CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ActivTrades is a CFD and Forex broker established in 2001. This platform initially specialized in Forex trading. However, they spread their wings over time to include other products such as spread betting and CDFs. ActivTrades provides its services to a range of institutional and retail traders through multiple platforms such as ActivTrader, MetaTrader 4, and MetaTrader 5. Their main client base is in Europe, mainly Germany and Italy. The rest of their clientele is spread across the Middle East, South America, and South East Asia.

ActivTrades Overview

See below for a brief overview of ActivTrades.

| Trading Platform: | ActivTrades |

| Headquarters: | London, UK |

| Founded: | 2001 |

| Regulation: | Financial Conduct Authority (FSA), Dubai Financial Services Authority (DFSA) of the United Arab Emirates, Securities Commission of the Bahamas |

| Minimum Deposit: | $500 |

| Deposit Methods: | Credit/Debit Card, Sofort, PayPal, Skrill, Bank Wire Transfer, Neteller |

| Platforms: | ActivTrader, MetaTrader 4, Metatrader 5 |

| Mobile App: | iOS, Android |

| Demo Account: | Yes |

| Spreads: | As low as 0.5 pips |

| Products Available: | Currencies, Commodities, Indices, ETFs, Stocks, Futures |

| Withdrawal Fee: | 9GBP for bank transfers |

ActivTrades Regulation

ActivTrades is regulated by top-tier authorities such as the Financial Conduct Authority (registration number 434413). They are also regulated by the Dubai Financial Services Authority (DFSA) and the Securities Commission of the Bahamas. ActivTrades is a member of the Financial Services Compensation Scheme.

ActivTrades Trading Platforms

| Platforms Available: | iOS, Android, Web, Desktop, Proprietary |

| Charts: | Yes |

| Order Types: | Market execution, pending order, buy limit, sell limit, buy stop, sell stop, buy stop limit, sell stop limit, stop loss |

| Alerts: | Yes |

| Watch Lists: | Yes |

| News Ticker: | Yes |

| Search function: | Yes |

| Research: | Yes |

| Copy Trading: | No |

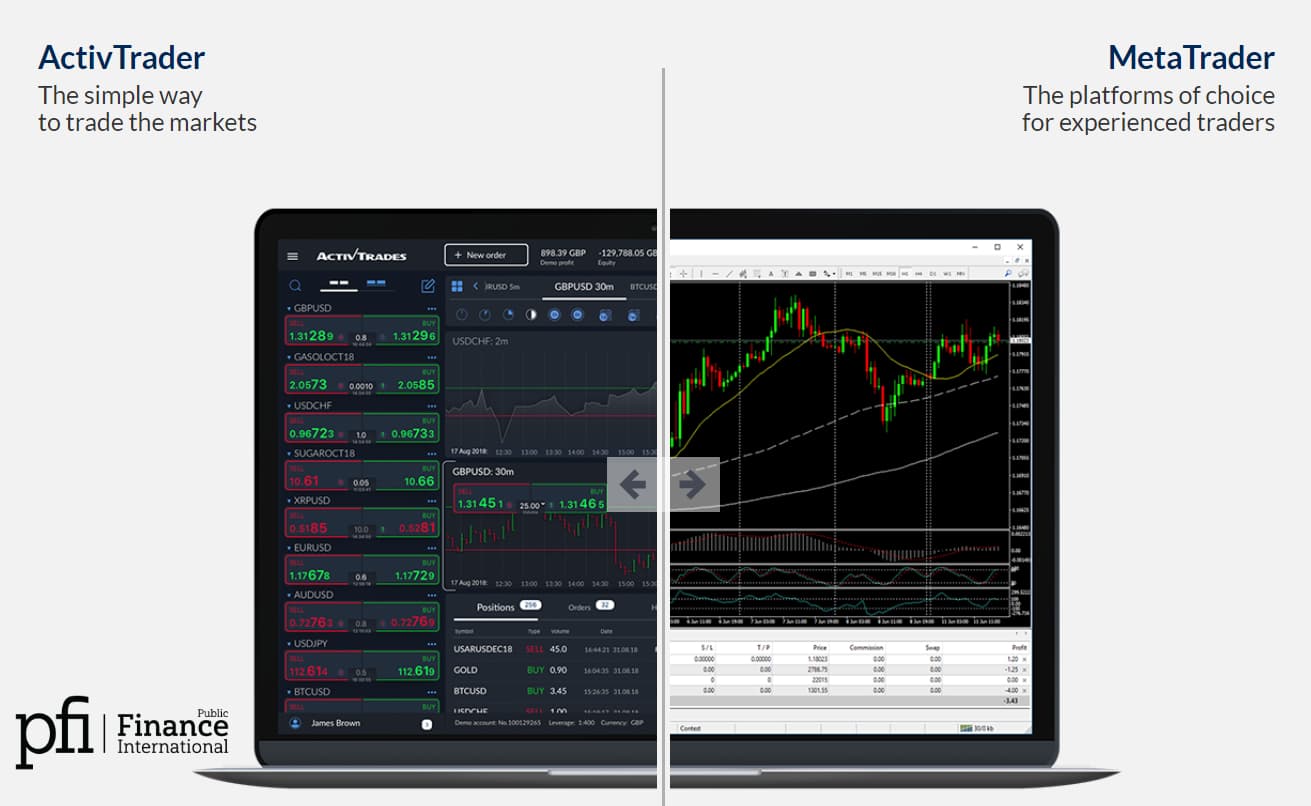

ActivTrades has platforms including MetaTrader 4 and MetaTrader 5, which can also be accessed on mobile devices. There are also swap-free accounts available. ActivTrades offers its proprietary platform ActivTrader. We explain more below:

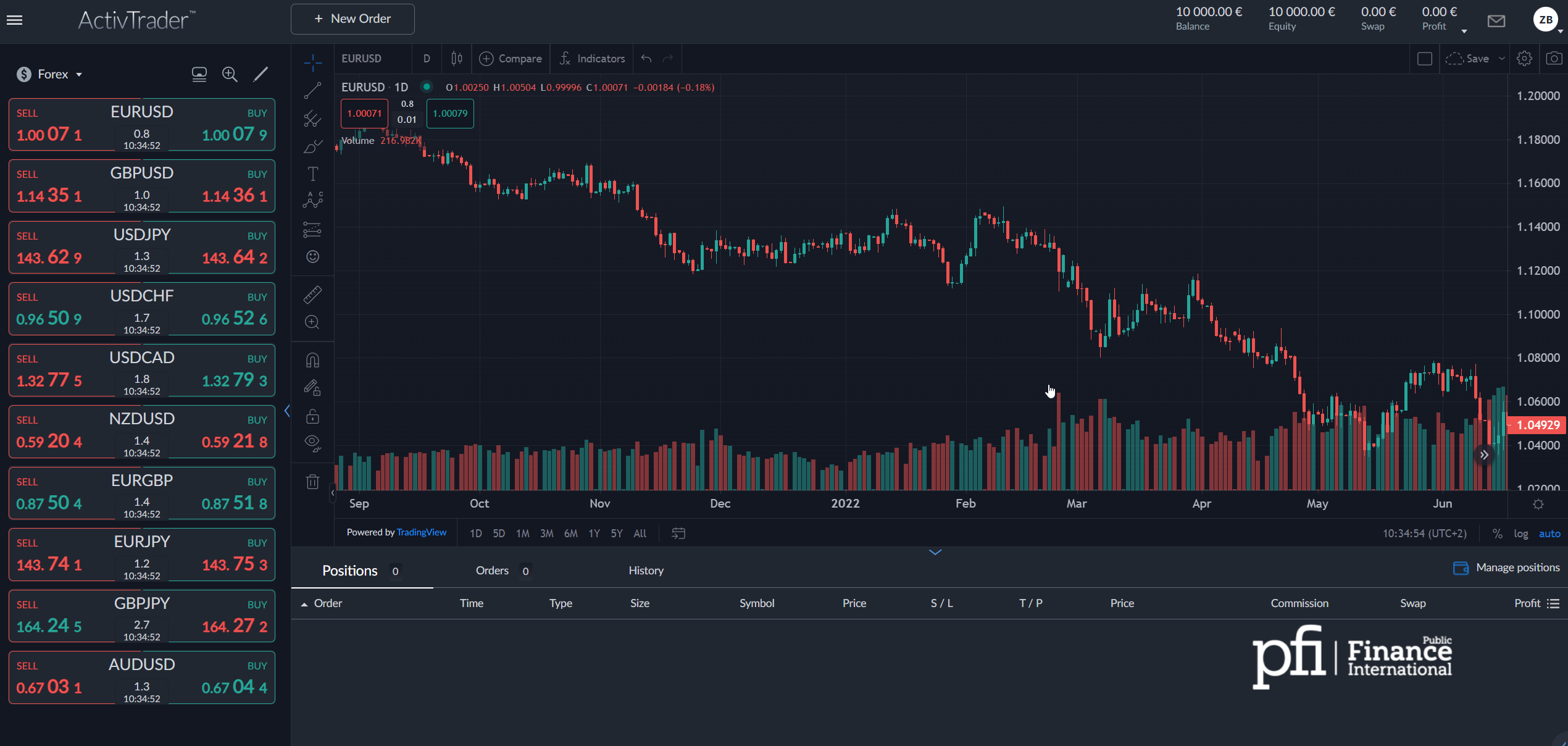

ActivTrader

ActivTrader is the proprietary trading platform of ActivTrades. This platform has a long history of providing customers with safe and reliable broker services. This platform allows you to trade up to 1000 CFDs, not limited to ETFs, financial and indices, forex, and commodities.

This platform comes in multiple languages and has a clear fee report. However, just like the mobile platform, it has no price alerts. ActivTrader is also user-friendly with a simple, easy-to-understand design and offers 2 step login.

The customizability of this platform can be described as average as some features are fixed on the platform.

It has a good search function; you can search for the asset's name or go by categories such as cash index or forex.

ActivTrader has the following features:

- Progressive Trailing Stop

ActivTrades itself developed this feature to protect the trader's profits. This feature allows the trader to protect their profit by allowing the setup of multiple tiers that are automatically modified as the market reaches specific trigger prices.

- Trailing Stop

This is a stop loss that trails the open position of a current price and then places the stop order upon the price reaching a specific distance from your stop order.

How is this different from normal stop orders? First, it differs because regular ones take effect when a specific price is attained. However, the trailing stop allows you to take more control in the markets because it safeguards your profits while simultaneously mitigating risks.

- Hedging

Hedging is a strategy that allows the trader to offset hostile price movements with a clever strategy. In case of adverse movements, this feature allows the investor to invest in the same product in a different direction.

- Market Sentiment

The market sentiment functionality allows the trader to monitor the market's direction. It enables you to understand the attitude of other traders towards a specific market investment. You can view the financial instrument's popularity and see the direction other investors are taking to make better decisions for yourself while trading.

- Charts

The platform employs real-time charts to give you a front-row seat from where you can view historical trends, forecasts, and current trends. In addition, you have the opportunity to view a variety of indicators and over four types of charts to strengthen your strategy.

MetaTrader4

If you are looking for a market-standard platform for your trading needs, the MetaTrader 4 is your go-to platform.

ActivTrades offers the MetaTrader4 platform. This user-friendly platform offers users enhanced security and features to trade forex, fixed income, indices, and commodities. In addition, you get access to a host of tools and expert advisors who are ready to help you develop your technical indicators.

This platform allows the use of up to 21 languages, allows trailing stops and price alerts, and provides historical data. In addition, you can access MetaTrader4 from multiple platforms, including desktop, mobile, and web.

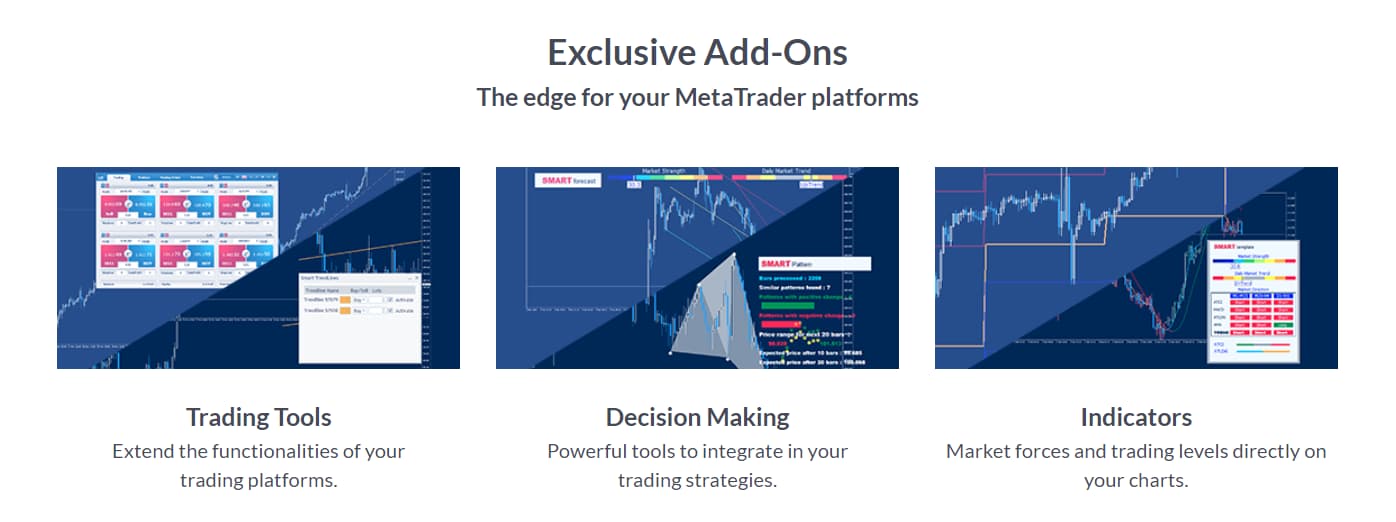

The SmartOrder2

ActivTrades developed SmartOrder2 to enhance MetaTrader 4 and 5. It has a simple and user-friendly interface and allows you to use different functions at the same time. In addition, this tool increases the trading speed. SmartOrder2 helps improve the position management process such that there is an improved integration between the platform and the app. The SmartOrder2 application is free of charge.

SmartLines

The SmartLines tool enables automation when it comes to the execution of charts based on Trendlines. You do not have to monitor every trend formation and price movement. This tool can help place an order with no time delay as long as you set the price of an instrument of choice and it crosses the trend line.

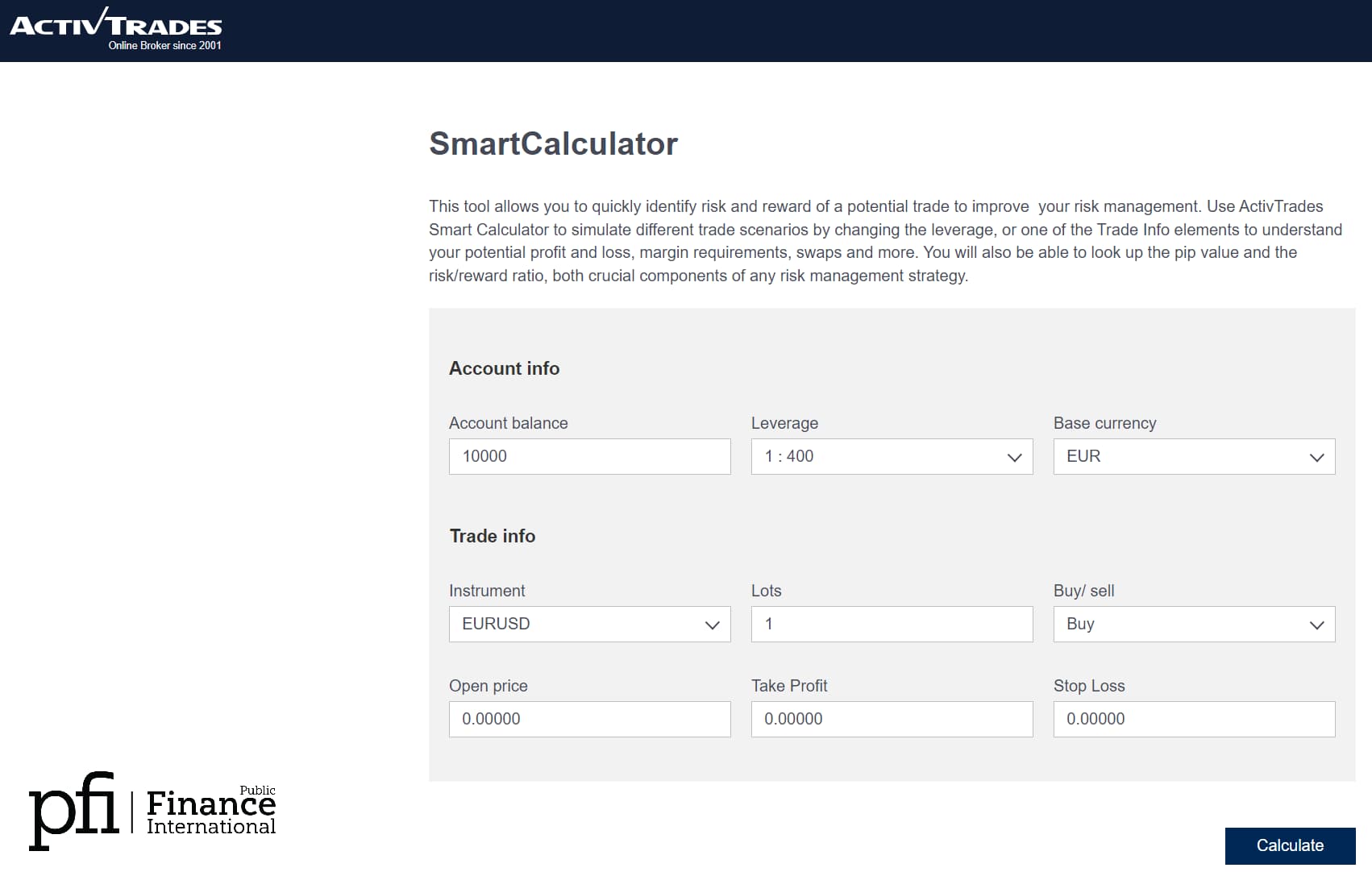

SmartCalculator

The SmartCalculator by ActivTrades allows you to promptly identify the rewards and risks associated with your trade to improve risk management.

With this tool, you can trade scenarios by switching up leverage. Therefore, you can understand whether you will make a profit or loss, the margin requirements, and what you need to do as part of your risk management strategy.

SmartTemplate

The SmartTemplate allows you to stop using complex math formulas by using chart signals to add long and short and long trading opportunities while providing clear timeframes to trade.

MetaTrader5

The MetaTrader5 is an advanced version of the MetaTrader. With this platform, you experience new characteristics and features that make trading online precise and professional.

This platform allows you to access more than 500CFDs, ETFs, and more. You can also reverse your current trade to net off positions. You can also open many positions in one contract and consolidate your positions, thus allowing first in, first out netting of positions.

Other strengths of the NMT5 include that they can show you economic news headlines, one-click trading, eight order types, and 21-time frames.

ActivTrades Mobile App

ActivTrades has a fast mobile trading platform that delivers functionality and performance at its best.

The order types available include; Market execution, pending order, buy limit, sell limit, buy stop, sell stop, buy stop limit, sell stop limit, and stop loss. You can also create alerts and easily search different CDFs.

With this platform, you can enjoy trading on the go as it allows you access to different financial instruments with the touch of a button, wherever you may be.

The mobile trading platform offers an intuitive user interface and has market-leading functionality. This is the right platform for you if you seek freedom and simplicity as you trade.

This platform also allows biometric authentication, making it as safe and secure as other platforms that need 2-step authentication. It also has three charts. Unfortunately, the user cannot set price alerts.

You can access the mobile trading platform on Android and iOS. The features of the two trading platforms, MetaTrader4 and 5, are similar on PC and mobile platforms. However, ActivTrades has enhanced the appearance of the mobile platform on iPad.

To download this application, you should go to the App Store or Playstore. You will not need any further configuration to trade.

ActivTrades Desktop Platform

ActivTrades has not developed any specific in-house desktop platform for trading. However, you can use the MetaTrader 4 and MetaTrader 5 platforms on the desktop. In addition, many traders use the MataTrader4 since it is available in multiple languages.

The user interface of this platform is friendly and highly customizable so that you can adjust the sizes and positions of different tabs. Unfortunately, some of the platform features are outdated and can be hard to find.

This platform features one-step login, which means it is not as secure as two-step authentication platforms.

The search function is okay; you can easily find assets in different categories. However, figuring out the forex trading categories may be a bit confusing.

The order types available here include market, limit, stop, and trailing stop. You can also use order time limits such as good 'til time and good 'til canceled.

You can set notifications and alerts for the desktop platform. This is different from the mobile and web-based platforms, where there is no alert platform. To set notifications successfully, you need your mobile MetaQuotes ID found in the MT4 platform settings and your email address.

This platform also allows you access to fee reports and portfolios. You can easily access your profit-loss and commission. You have to go to the account history tab, choose a position by right-clicking it, and then choose to save it as a detailed report.

Markets Available

The product portfolio at ActivTrades is limited to CFDs and Forex. The platform offers access to over 1200 CFD markets, a smaller collection than competitors. In addition, asset classes such as bonds, real stocks, funds and bonds are not available on the platform.

You can also trade cryptocurrency CDFs, but only those under the Bahamas-regulated entity.

Note that:

- ActivTrades has fewer currency pairs and bonds CFDs compared to its competitors.

- There are no futures CFDs

- Crypto CFDs are only available internationally in the Bahamas

- The platform offers an average range of commodity and stock index CFDs.

| Currency pairs: | 49 |

| Currency pairs: | 49 |

| Stock index CFDs: | 27 |

| Stock CFDs: | 660 |

| Stock index CFDs: | 27 |

| ETF CFDs: | 500 |

| Commodity CFDs: | 22 |

| Stock CFDs: | 660 |

ActivTrades allows you to change leverage levels if you want to lower the exposure with your positions.

Research

ActivTrades has an average selection of research tools available to users. There are technical tools such as APIs and charting that are useful. However, they could do more regarding fundamental data and trading ideas. Let's dive into more below:

Research tools

The platform offers sufficient research tools on the website. In addition, you can test these tools on the platform.

Newsfeed

The platform features an economic calendar conveniently found under the “Markets” tab. This calendar can help you monitor the most important and relevant events worldwide. Furthermore, it lets you filter the news based on parameters such as impact, countries, and even types.

The only downside of this platform is that there is no historical data based on events such as the inflation rates of specific countries.

Trading Ideas

Unfortunately, ActivTrades doesn't provide trading ideas. However, it provides some videos and short market analysis articles that may be relevant to you. Note that these are more commentary-type and do not provide much-needed insight into specific developments. As a result, you will not find trade recommendations or ideas.

Charting

Thankfully, this platform has excellent charting tools. These tools include a selection of up to 103 technical indicators.

Fundamental Data

There is no fundamental data provision on ActivTrades.

APIs and Other Research Tools

Apart from the tools mentioned above, you may enjoy other tools, including application programming interfaces. APIs help implement trading strategies once automated and allow you to connect to the platform's screening software directly with your broker account so you can place orders.

You can also see the number of long and short positions on your search bar. This acts as a sentiment indicator to help gauge the market's mood.

Education

ActivTrades offers a variety of educational tools to ensure that they stay in the know. Some educational materials you will find on the site include educational videos and educational manuals.

The manuals are handbooks with information about their platforms, including MetaTrader4 and 5 and ActivTrader. There are also handbooks with information regarding the tools you will find on the platform, including SmartPattern, SmartForecast, and SmartLine. The educational videos are great, especially for beginners, as they help the traders understand basics such as logging in, changing languages, how to use the MT4 for mobile trading on Android and iPad, finding the journal tab, and how to set up an alert for the platform.

Besides educational materials, ActivTrades also ensures that the trader has access to education events, including seminars, one-to-one training, webinars, and a much-needed webinar archive that they can refer to occasionally.

Lastly, you can get educated through the demo account and the platform's high-quality educational articles.

If you are starting as a trader on the platform, it would be best to try out the demo account. These accounts will allow you to become familiar with the platform without exposing you to risk. Additionally, you may benefit from the one-to-one training, which allows you to chat with an expert. The sessions are personalized to help a trader understand the ins and outs of trading on the platform. Remember, most other platforms do not invest in such training, so it's a plus if you choose ActivTrades based on this premise.

ActivTrades Fees

The platform has average non-trading fees and low trading fees. Additionally, you will not pay any fees when you deposit or withdraw in most cases. We go into details below.

If you want to understand the fees required by this platform, you can view them as low, average or high compared to competitors. You must also understand terms related to fees and commissions;

- Trading fees: These are fees that occur when you trade and may include spreads, conversion fees, commissions, and financing rates.

- Non-trading fees: These charges are not directly related to trading. They include withdrawal and inactivity fees.

Different fees apply to different asset classes. For instance, if you are in stock index trading, you may need to look at financing rates, spreads, and commissions, as these are most important in this case.

Compare ActivTrades Fees

| ActivTrades | eToro | IC Markets | Admiral Markets | Pepperstone |

|---|---|---|---|---|

| 0.87 | Varied Spread | Raw Spread account: 0.0 pips spread and $3.5 (per lot per side) commission Standard Account: 0.6 pips spread and $0.0 (per lot per side) commission | 0.00008 | Minimum from 0.0 and 0.17 average spread (Razor Account) Minimum from 0.6 and 0.77 average spread (Standard Account) |

| 1.14 | Varied Spread | Raw Spread account: 0.0 pips spread and $3.5 (per lot per side) commission Standard Account: 0.6 pips spread and $0.0 (per lot per side) commission | 0.0001 | Minimum from 0.0 and 0.59 average spread (Razor Account) Minimum from 0.6 and 1.19 average spread (Standard Account) |

| Spread: 84.48 (USD) | 1% | Spread | N/A | 0 + market spread |

| 0.05% - $0.02 per share | $0 | Spread | 0.02 USD (minimum $1) | 0 + market spread |

| 0.05% - $0.02 per share | $0 | Spread | 0.02 USD (minimum $1) | 0 + market spread |

| 0.05% - $0.02 per share | $0 | Spread | 0.02 USD (minimum $1) | min. 0.4 spread |

| Varied Spread | Varied Spread | N/A | N/A | N/A |

| N/A | N/A | N/A | N/A | N/A |

| N/A | N/A | N/A | N/A | N/A |

| 0.05% - $0.02 per share | $0 | 0.02 USD (minimum $1) |

Trading Fees

The trading fees for ActivTrades are low compared to other brokers. When comparing fees, we consider all the fees associated with the trade of a particular product. For example:

- Stock CFDs such as Apple

- Stock Index CFDs such as EUSTX50 and SPX

- Forex pairs such as EURGBP, EURUSD, AUDUSD, GBPUSD

Typically, when trading, you buy a leveraged position, hold it and then sell. The leverage is as follows:

- 30:1 for forex

- 2:1 for stock index CFDs

- 5:1 for stock CFDs

The fees include spreads, financing costs, and commissions.

This is for a $2000 position that is long and has been held for a week.

| S&P 500 index CFD fee | $0.9 |

| Apple CFD fee | $3.1 |

| Vodafone CFD fee | $5.5 |

Forex Fees

Forex fees at ActivTrades are low. For example, the table below shows the forex fees of a position.

| Trading Fee | ActivTrades |

|---|---|

| EURUSD | 0.87 |

| GBPUSD | 1.14 |

Non-Trading Fees

The non-trading fees at ActivTrades are average.

These non-trading fees include an inactivity fee. This fee is applied if the account has been inactive for over a year and there is a balance in the account. You will be charged £10 per month. There is also a currency conversion fee of 0.3%. This fee is for the conversion of a closed loss and profit if the quote currency differs from the base.

| Account Fee | $0 |

| Deposit Fee | $0 |

| Inactivity Fee | $10/month after 1 year of inactivity |

| Withdrawal Fee | $0 |

How to Open an ActivTrades Account?

The process of opening an account at ActivTrades is easy and digital. However, note that you will need a few minutes to finish opening your account on a business day. Below we outline the process of opening an account in steps.

- Step 1: The first step involves choosing your country of residence. In this step, you will be required to add personal information, including your email address and name. You will also choose a password at this stage.

- Step 2: Add the account holder's information. The information you fill in is tax residency and home address details.

- Step 3: Fill in your trading experience. Some information you will need to include your experience trading CFDs, the average size of each lot and the number of trades you have worked on.

- Step 4: The fourth step involves filling in accounts and financial information. The information you will fill in here includes your income and savings, the source of your funds, employment status and trading preferences.

- Step 5: You will choose a trading platform and base your currency on this step. Depending on your country, you will be required to change the entity you would like to register with. This step is vital because the entity you register with will determine investor protection and affect the fees charged.

- Step 6: Step 6 involves adding documents, including your identification, utility bills or banking statement and a photo so that ActivTrades can verify your identity.

Account Types

There are different account types at ActivTrades, as we outline below:

- Individual accounts: These accounts are owned by retail investors

- Islamic accounts: Islamic accounts are meant to cater to the Muslim community. This account has no rollover interest and commissions

- Institutional accounts: These are accounts owned by a legal entity.

- Demo Account: ActivTrades has a free demo account on which you can select a platform and practice. The account is risk-free and comes with £10, 000 in virtual funds.

Minimum Deposit

The minimum deposit at ActivTrades is $500. This is a bit higher compared to other CFD brokers. Most deposits at ActivTrades are free, and they offer most major currencies. In addition, there are various deposit options, including debit and credit cards, bank transfers, and e-wallets.

ActivTrades will not charge any fees for e-wallet and bank transfer deposits. Credit and debit card deposits are charged with a 0.5% fee if you are within the United Kingdom and the extended European Economic Area. The fee rises to 1.5% in the non-European Economic area.

Electronic wallets accepted on ActivTrades include:

- PayPal and Sofort for the UK and European Economic Area traders only

- Skrill

- Neteller

Credit card transfers are instant, and bank transfers can take several business days. You are only allowed to deposit money from accounts in your name.

Withdrawals

Like with deposits, there are no withdrawal fees for electronic wallets and credit and debit cards. Currencies within the European Economic Area have free bank withdrawals. However, banks in the US have a withdrawal fee of $12.50. The Bahamian entity bank transfers have a $9 fee.

| Credit/debit card | Yes |

| Bank transfer | Yes |

| Electronic wallets | Yes |

| Withdrawal fee | $0 |

How To Withdraw From ActivTrades?

The process to withdraw money from ActivTrades is straightforward. Here are the steps:

- Access the personal area of your ActivTrades profile.

- Choose “Make a withdrawal” under transactions

- Choose the amount and account

- Enter bank details as needed.

Base Currencies

There are four base currencies to choose from: USD, CHF, GBP, and EUR. This limited selection of base currencies could affect you because you will not pay a conversion fee if you want to trade assets or fund your account in the same currency as the bank account.

However, you can work around this issue by investing in a multi-currency account at a digital bank. Multi-currency banks offer several currencies with cheap international transfers and excellent exchange rates. Furthermore, opening an account at a digital bank will only take a few minutes on your mobile device.

ActivTrades Customer Support

ActivTrades offers phone support, email, and live chat. Their live chat works fast, making it heavily relevant on this platform.

The customer care team also answers emails within 24 hours. However, the customer care team is not available 24/7.

Their live chat option is fast, and the answers are relevant and satisfactory. However, note that you will have to give your contact details before they provide answers.

Conclusion

ActivTrades is an excellent CFDs and forex broker. The account opening process is quick and easy, the deposits and withdrawals are mostly free, and there are low trading fees.

However, it also has its downsides that are worth considering before you make a decision. For instance, there are a few products in the product portfolio. Furthermore, the research tools are too basic, and the platforms offer no fundamental data. Finally, you will also be charged for currency conversion and inactivity for a year.

All in all, it is an excellent platform to start your trading experience.

ActivTrades

- Award-Winning Broker

- Founded in 2001

- Regulated by FCA, SCB, CSSF

- Trusted in 170+ Countries

- Funds Protection For EU

- 1000+ CFDs Available

- Low Fees

Is ActivTrades legit or a scam?

ActivTrades is a legit platform by all means. After our assessment, it features all the critical aspects of a legit broker. As a result, it is one of the best forex brokers for beginners and even professional traders who want a trading account.

Does ActivTrades have a free account?

ActivTrades has a demo account with up to $10,000 in virtual money. You can explore this platform as you prepare to trade in a real individual account.

How does ActivTrades protect its clients?

ActivTrades has a negative balance protection policy that protects clients. They provide webinars that feature guest speakers who educate the audience on the latest trade news. F