CFD trading has gained immense popularity in Singapore, making it the fourth-largest global CFD market. To assist you in finding a suitable trading platform, we've evaluated some of the most reputable CFD brokers available in Singapore. If you have any lingering questions, our FAQ section at the end of this article addresses common concerns that arise when embarking on your trading journey.

Best CFD Trading Platforms in Singapore 2023

Below, you'll find our selection of the best CFD brokers in various categories for Singaporean traders:

- AvaTrade – Leading CFD Trading Platform in Singapore

- Pepperstone – Premier Low Spread CFD Broker in Singapore

- ActivTrades – Top-Performing Execution CFD Broker in Singapore

- CMC Markets – CFD Broker in Singapore with No Minimum Deposit

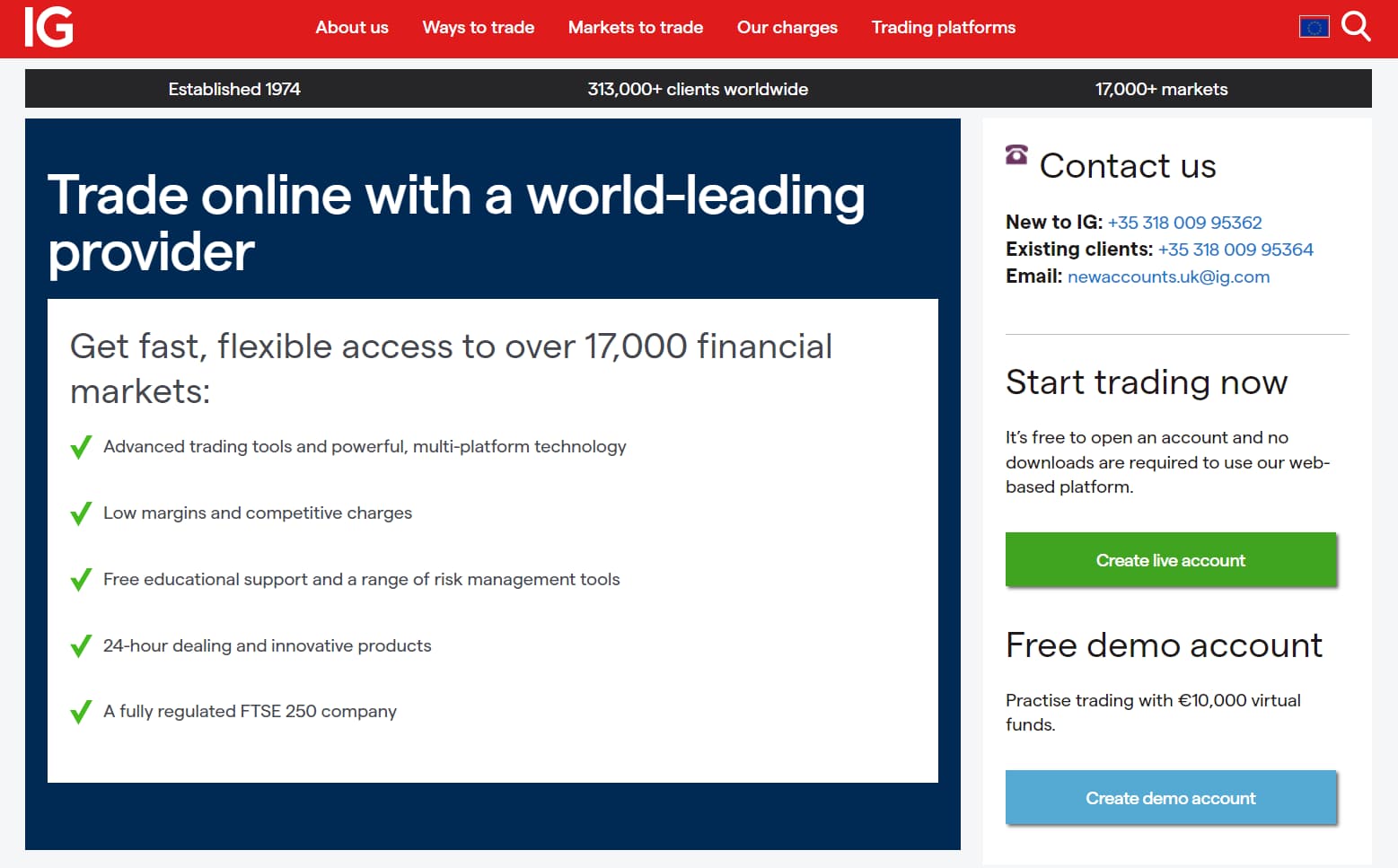

- IG – Well-regarded CFD Broker in Singapore

- City Index – Outstanding CFD Broker for Market Access in Singapore

- Trading 212 – Provider of Tight Spread CFDs in Singapore

In our assessment of CFD brokers in Singapore, we meticulously considered critical factors, including regulation, customer service, commissions, safety measures, available trading platforms, and competitive spreads.

1. AvaTrade

AvaTrade AvaTrade is an Irish-based online retail CFD broker, regulated by the Central Bank of Ireland. AvaTrade places a strong emphasis on financial security and dependability.

AvaTrade offers the AvaOptions proprietary CFD trading platform, specifically designed for CFD trading. Additionally, they provide support for both MT4 and MT5 platforms.

It's worth noting that the platform employs single-step authentication, which may pose a higher vulnerability to cyberattacks.

| Pros | Cons |

|---|---|

| AvaOptions provides access to a broad spectrum of markets | Limited demo account duration (21 days) |

| Swift and straightforward account setup process | High inactivity fees |

| Robust and exceptional research tools |

2. Pepperstone

PepperStone, headquartered in Australia, is under the regulation of the FCA. It is a privately held company and does not have an obligation to disclose its financial statements.

Pepperstone provides various account types to traders, including ECN and STP accounts. They also accommodate Islamic-friendly investment accounts upon request.

Trading options with Pepperstone encompass Forex, Cryptocurrencies, and stocks. They offer support for both MT4 and MT5 platforms, as well as a range of other trading options.

74-89 % of retail investor accounts lose money when trading CFDs

| Pros | Cons |

|---|---|

| Minimal charges for inactivity | Restricted research resources |

| Deposits and withdrawals are free of charge Commissions for CFDs | Commissions for CFDs |

| Advanced risk management and stop-loss mechanisms |

3. ActivTrades

ActivTrades is an international CFD and Forex Broker under the regulation of the UK's FCA and various other regulatory bodies.

They offer free deposits and withdrawals to trading accounts and accept payments from banks and credit cards. However, it's worth noting that they only accept four base currencies for account openings, which may result in a small conversion fee for users.

While the platform provides financial news updates, some users have found the flow of information to be inconsistent.

| Pros | Cons |

|---|---|

| Cost-effective trading platform | Research tools lack fundamental data |

| Strong support for CFD traders | Limited product selection |

| Outstanding customer support |

4. CMC Markets

CMC Markets is is a well-established publicly-traded CFD broker regulated by the Financial Conduct Authority (FCA). Being a publicly-listed company, they are required to provide financial statements to the public.

Their dedication to customer service is evident through their 24/7 customer support, a feature that sets them apart from many CFD brokers in Singapore.

Furthermore, their platform offers a wealth of valuable educational and research resources, catering to traders of all skill levels.

| Pros | Cons |

|---|---|

| Extensive range of research tools | High trading fees for CFDs |

| Strong global regulatory compliance | No social trading feature |

| Excellent customer support |

5. IG

IG is under the regulatory oversight of various global authorities, including the FCA and Germany's BaFin. As of now, IG stands as one of the largest online brokers on a global scale.

IG offers a proprietary CFD Trading Platform that sets it apart from the competition. The platform boasts a highly customizable and user-friendly interface. Moreover, IG provides free, succinct reports to all its users.

| Pros | Cons |

|---|---|

| A long and established track record of reliability | High fees associated with CFDs on stocks and Forex |

| One of the premier trading platforms available | Account opening process may have drawbacks |

| Consistently provides financial statements for transparency |

6. City Index

City Index, a subsidiary of GAIN Capital, is a global Forex and CFD broker with a history dating back to its launch in 1983. It operates under the regulatory oversight of high-level authorities across the globe.

City Index is committed to enhancing traders' skills and understanding of the financial markets through its extensive educational resources. These include regular webinars and a wealth of platform tutorials designed to simplify the trading process.

| Pros | Cons |

|---|---|

| Diverse research tools | The desktop platform is cluttered |

| Abundance of educational resources | High minimum deposit |

| User-friendly account opening process |

7. Trading 212

Trading 212 faced criticism due to delayed order executions, with reports of trades taking several minutes or even hours to resolve. Such delays can significantly impact the outcomes of CFD trading, potentially leading to substantial losses.

Notably, as of February 2021, Trading 212 suspended new account openings on their platform. Given this policy, it's challenging to recommend them to CFD traders at this time.

| Pros | Cons |

|---|---|

| User-friendly trading platform | Unable to open new accounts |

| No inactivity fees | Recent controversies raise concerns |

CFD Trading in Singapore

Singapore boasts one of the world's largest CFD markets, prompting the development of local regulations to meet the increasing demands.

Similar to all retail brokers, the top CFD brokers in Singapore must be registered with the Monetary Authority of Singapore (MAS).

Since 2019, there have been restrictions on leverage available to retail traders. Accredited investors can access leverage rates of up to 50:1, but MAS has limited retail traders to 20:1 leverage.

Furthermore, Singaporean regulations dictate that client funds must be held in segregated accounts, ensuring the financial security of traders in case the broker faces insolvency.

Singaporean tax laws regarding CFDs remain somewhat unclear. Long-term investors do not need to pay taxes on capital appreciation or dividends.

However, taxes for day trading are assessed on a case-by-case basis. It is advisable to consult with your local tax authority, disclose your trade volume and other income sources, and be prepared for potential taxation, which could be up to 22%, subject to their discretion.

Understanding CFDs

Originally used by hedge funds and asset managers on the London Stock Exchange, CFD trading has become accessible to casual traders thanks to online trading platforms.

Contracts for Difference (CFDs) involve agreements between traders and brokers. Traders establish contracts linked to underlying instruments like Forex, stocks, or commodities.

When opening positions, traders speculate whether the underlying instrument will increase or decrease in value during the contract period, referred to as "going long" and "going short," respectively.

Leverage is expressed as a ratio, for example, 100:1, allowing a marginal investment to secure a position 100 times larger than its base value.

Local regulations determine the maximum leverage ratios for margin. In areas with stringent regulations, like the EU, leverage can be limited to 30:1, depending on the underlying instrument.

Selecting a CFD Broker in Singapore

Regulation

The regulatory framework for CFD brokers in Singapore varies depending on the broker's location. CFD brokers in Singapore must adhere to the regulations set by Singapore's regulatory authority, MAS, which includes guidelines for maximum leverage amounts and rules regarding segregated client funds.

Education

Educational resources are essential for traders, especially newcomers. While seasoned traders may find some information redundant, it's crucial for newer traders to ensure the platform covers the basics of CFD trading.

Markets can be complex and volatile, particularly with CFDs. Proper preparation is key before committing funds to CFD trading, where losses can accumulate rapidly.

Research

Platforms like MetaTrader provide various market analyses and research tools, ranging from financial news feeds to charting and graphing software.

Many CFD trading platforms in Singapore offer their suite of tools to enhance the trading experience. Some of these tools may be beneficial, while others might be surpassed by better plugins.

For MetaTrader users, exploring the marketplace to discover popular scripts and plugins used by other traders can provide insights into platform deficiencies.

Fees & Commissions

Brokers charge users fees proportional to each trade.

Trading platforms typically levy small commission fees for each position a trader opens, while others may generate revenue through subscription fees.

Inactivity fees are common among brokers, imposing charges if an account remains inactive for an extended period. These fees can be substantial and deplete an account over time.

Trading Platforms Available

The most prevalent trading platforms used by brokers are the MetaTrader platforms, MT4 and MT5. Some brokers employ proprietary platforms for executing trades.

Brokers with their platforms often offer lower slippage and higher accuracy. However, smaller platforms might offer fewer security features.

The choice of trading platform significantly influences the trading experience, affecting asset accessibility, news availability, and charting tools.

Customer Support

When a broker manages your funds, reliable customer support is essential. Poor customer support is a major concern for many traders.

Many brokers offer telephone support during office hours, typically Monday to Friday. Accessibility depends on the broker's office location and your time zone, impacting communication.

AvaTrade, in particular, is recognized for its exceptional customer support and has received awards for its service quality.

How to Begin CFD Trading

The process of opening an account and commencing CFD trading may vary depending on your chosen broker. Nevertheless, the fundamental steps remain consistent across brokers:

- Open an account: Visit your broker's website and create an account, providing personal details and potentially funding the minimum deposit required to open an account.

- Install the trading platform: Choose the trading platform that suits you best and download and install it from the broker's website onto your desktop or mobile device.

- Choose your instrument: CFDs are associated with underlying instruments such as stocks or currencies. Select an instrument where you feel confident in identifying either an upward or downward trend.

- Open your trade: Depending on your market analysis, you can either "go short" (sell CFD contracts) if you anticipate a decline in the underlying instrument's value or "go long" (buy CFD contracts) if you expect an increase.

- Repeat and refine: It's unlikely to make substantial profits on your initial CFD trades. Begin with small amounts that you can afford to lose and refine your strategy as you gain experience.

Other Brokers to Consider

Maybank Kim Eng: Offers a wide range of tradable instruments but charges high commissions.

Phillip CFD: The first to introduce CFDs to Singapore, providing access to over 5,000 tradable assets.

Oanda: An American Forex and CFD broker with competitive spreads on CFD trades and advanced trading technology.

DBS Vickers: A subsidiary of DBS Bank offering access to various markets, including real estate and stock options.

Interactive Brokers: A highly regarded brokerage known for offering fractional share trading and top performance.

FAQ

Are CFDs Legal in Singapore?

Yes, CFD trading is legal in Singapore as long as the broker complies with local laws. Traders should also adhere to tax regulations related to their earnings.

Can You Get Rich Trading CFDs?

While it's possible to accumulate wealth through CFD trading, recent EU regulations have revealed that a significant percentage of CFD traders lose money. Leveraging can lead to losses exceeding the initial investment. Investing in long-term stock options with consistent year-over-year gains is a more reliable wealth-building strategy.

Is CFD Trading Considered Gambling?

Opinions on whether CFD trading is akin to gambling vary. Some Islamic authorities categorize it as a form of gambling, making it ineligible for Sharia-friendly accounts. CFD trading doesn't entail ownership of the underlying instrument, but it's influenced by real-world trends affecting that instrument.

How Much Capital Is Required to Start CFD Trading?

The initial deposit required to open a CFD trading account varies by broker. Some brokers have no minimum deposit requirement, but traders still need funds to open positions. Starting with around S$250 is a common suggestion. However, leveraging can increase position size, potentially leading to substantial gains or losses.

Which CFD Broker Is Best for Beginners in Singapore?

AvaTrade is recommended for CFD trading in Singapore due to its diverse range of instruments and options to invest in real stocks, beyond CFDs.

Conclusion

In summary, CFDs represent a sophisticated financial instrument characterized by significant volatility. Prior to engaging in CFD trading, it is imperative to gain a comprehensive comprehension of their mechanics and the accompanying risks. The market offers a plethora of brokers, each with its unique features and attributes. Given this extensive diversity, it is likely that you will find a suitable option. Additionally, it is worthwhile to explore other relevant brokers not covered in this article if none of those listed here align with your preferences.