CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

AvaTrade: A Secure Choice for CFD and Forex Trading

If you're considering trading Contracts for Difference (CFDs) and forex, it's crucial to choose a reputable broker. AvaTrade, also known as AVA Trade EU Ltd, has been in the industry since 2006 and stands out as a dependable option. In this review, we'll explore why AvaTrade is a top choice for traders

A Diverse Range of Financial Instruments

AvaTrade caters to a wide range of trading preferences by offering various financial instruments. Whether you're interested in commodities, bonds, cryptocurrencies, stocks, or stock indexes, AvaTrade has you covered. This diversity allows traders to build diversified portfolios and explore different markets.

Regulated by Top-Tier Authorities

One of the key factors that make AvaTrade a trustworthy broker is its regulation by top-tier authorities. This oversight ensures that the broker adheres to strict financial and ethical standards. For traders, this means a higher level of security and transparency when it comes to their investments.

Risk Disclosure

Before diving into trading, it's essential to understand the associated risks. CFDs are complex financial instruments that come with a high risk of losing money due to leverage. In fact, 71% of retail investor accounts lose money when trading CFDs with this provider. It's crucial to assess whether you comprehend how CFDs function and if you can afford the potential loss.

AvaTrade Overview

Here is a quick overview of Avatrade.

| Trading Platform | AvaTrade |

| Regulated | MiFID, KNF, ASIC, FSRA, FSCA, FFAJ, B.V.I. |

| Minimum Deposit | $100 – $500 |

| Mobile App | iOS, Android |

| Desktop | MT4, MT5, Proprietary |

| Deposit Methods | Credit Card, Debit Card, Bank Transfer, eWallets |

| Islamic Account | Yes |

| Automated Trading | Yes |

| Our Rating | 4.9/5 |

Here, we evaluate how AvaTrade measures up against other leading trading platforms in the industry.

| Trading Platform | AvaTrade | Pepperstone | eToro | Capital.com | IC Markets |

|---|---|---|---|---|---|

| Founded | 2006 | 2010 | 2007 | 2016 | 2007 |

| Regulation | FCA, ASIC, FSCA, FRSA, Israel Securities Authority, Financial Services Agency, Financial Futures Association of Japan | ASIC, CySEC, FCA, SCB, DFSA, BaFin, CMA | FCA, CySEC, ASIC, FSAS | FCA, CySec, ASIC, MiFID | ASIC, CySEC, FSA, SCB |

| Offering Of Investments | Forex, Stocks, Commodities, FXOptions, Cryptocurrencies, Indices, ETFs, Bonds | CFDs on Forex, Crypto, Shares, Indices, Crypto | Stocks, ETFs, Forex, Crypto, Indices, Commodities | Shares, Forex, Commodities, Indices, Crypto | CDFs on Forex, Commodities, Indices, Bonds, Cryptocurrency, Stocks, Futures |

| Minimum Deposit | $100 | $0 | $50 - $100 | $20 | $200 |

| Demo Account | Yes | Yes | Yes | Yes | Yes |

| Withdrawal Fee | $0 | $5 | $5 | $0 | $0 |

| Inactivity Fee | $50/month After 3 Months | $0 | $10/month | No | $0 |

| Deposit Methods | Credit and Debit Cards,Wire Transfer, e-payments | Credit/debit cards, Bank/Wire Transfer, PayPal, Neteller, Skrill, UnionPay | PayPal, Skrill, Neteller, Credit Card, Debit Card, Rapid Transfer,iDEAL, Klarna / Sofort Banking, Bank Transfer, Online Banking - Trustly, POLi | Credit Cards, Bank Transfer, Wire Transfer, Sofort, IDeal, MultiBanko, Trustly, WebMoney, Qiwi, Skrill, and Neteller | Credit Cards, Debit Cards, PayPayl, Neteller, Skrill, UnionPay, Wire Transfer, Bpay, Fasapay, Broker to Broker, Poli, Thai Internet banking, Klarna, Rapidpay, Vietnames Internet Banking |

Here's a summarized version of our key findings on AvaTrade:

AvaTrade in a Nutshell:

- AvaTrade is a secure online broker, subject to rigorous regulation by top-tier authorities, instilling trust as a Forex and CFD broker.

- Their impressive array of available markets caters to a broad spectrum of traders, offering diverse opportunities.

- AvaTrade stands out with its excellent selection of trading platforms, including their proprietary platform, MetaTrader, ZuluTrade, and DupliTrade.

- The educational resources they provide exceed industry standards, enhancing the trading experience for users.

AvaTrade Pros and Cons

While AvaTrade boasts numerous advantages, it's important to consider some potential drawbacks:

| PROS | CONS |

|---|---|

| Mobile App | CFD Only |

| Research and Education | Inactivity Fees |

| Deposits and Withdrawals |

AvaTrade's corporate structure and global presence are as follows:

The holding company of AvaTrade is registered in the British Virgin Islands as AVA Trade Ltd.

The company's headquarters are situated in Dublin, Ireland.

AvaTrade extends its services across the world, primarily operating through regional offices. They cater to various regions, including Australia, South Africa, Singapore, Japan, France, Italy, Spain, Mongolia, China, Abu Dhabi, and many more. Impressively, they have a customer base of over 200,000 active users and execute approximately 2 million trade orders each month.

- British Virgin Islands (holding company): AVA Trade Ltd

- Ireland: AVA Trade EU Ltd

- Australia: Ava Capital Markets Australia Pty Ltd

- South Africa: Ava Capital Markets Pty

- Japan: Ava Trade Japan K.K

- Abu Dhabi: AVA Trade Middle East Ltd

AvaTrade Trading Platform Overview

AvaTrade offers a comprehensive trading platform, providing access to a wide range of CFD products and a select number of currency pairs. This platform serves traders in more than 120 countries and encompasses two proprietary platforms, Webtrader and AvaOptions, in addition to third-party platforms like MetaTrader 4 and 5.

In addition to being regulated by top-tier authorities like the Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC), and the Japanese Financial Services Agency (FSA), AvaTrade also complies with regulations in tier-2 jurisdictions.

When compared to its competitors, AvaTrade's offering of stock, index, and forex CFDs is somewhat smaller. They do tend to have slightly higher fees for popular instruments and currency pairs, such as EUR/USD, compared to the industry average.

AvaTrade provides a commendable selection of trading platforms, including both their proprietary options and third-party solutions like MetaTrader 4 and 5. Notably, there are no charges for deposits and withdrawals.

Among AvaTrade's platforms, you'll find a web-based and mobile trading application known as Webtrader. WebTrader is the company's in-house trading platform, complemented by AvaOptions, designed specifically for forex CFD traders.

In addition to their proprietary platforms, AvaTrade also offers support for MetaTrader 4 and MetaTrader 5, both of which are third-party trading platforms

Web-based platform

AvaTrade's web-based platform, Webtrader, boasts a user-friendly interface that simplifies the process of browsing and selecting CFDs. Prices are conveniently displayed alongside ticker symbols, complete with buy and sell buttons. Traders can tag their preferred securities for quick access.

The search function on Webtrader allows users to search for assets by symbol or name. Additionally, the reporting feature offers comprehensive information for analyzing

historical transactions, including market prices, realized gains or losses, fees, and cost basis.

It's important to note that the Webtrader interface lacks customization options. Users cannot rearrange its elements to suit their preferences. Unfortunately, two-step logins and price alerts are not available, which may disappoint users accustomed to receiving notifications when security prices reach specific levels.

Desktop platform

AvaTrade's desktop platform bears resemblance to the MetaTrader 4 platform, offering the advantage of alerts and notifications. While not as aesthetically pleasing as the web-based version, the desktop platform allows for extensive customization of charts and the interface itself. The reports section mirrors the web-based version's quality, but similar to the web platform, two-step login functionality is absent.

AvaTrade supports both the MetaTrader 4 and MetaTrader 5 desktop platforms, available in a remarkable 41 different languages. Additionally, for forex options trading, the AvaOptions platform offers a desktop version.

Mobile trading app

The details regarding AvaTrade's mobile trading app are forthcoming.

The mobile version of AvaTrade boasts an aesthetically pleasing and user-friendly interface, optimized for the limited screen space of mobile phones. Despite this constraint, it offers a comprehensive set of features. The search function and reporting capabilities work seamlessly, enhancing the mobile trading experience.

A standout feature accessible through the mobile app is AvaProtect, designed to mitigate financial losses for an additional fee. Additionally, AvaOptions has its own mobile app version, catering to both iOS and Android users.

While these platforms primarily operate in English, it's worth noting that they offer a more limited range of languages compared to MetaTrader.

In terms of security, the mobile app allows for convenient fingerprint login, although a two-step login feature is not available for this version. Price alerts can be configured within the mobile platform and are conveyed to users through push notifications on their mobile device.

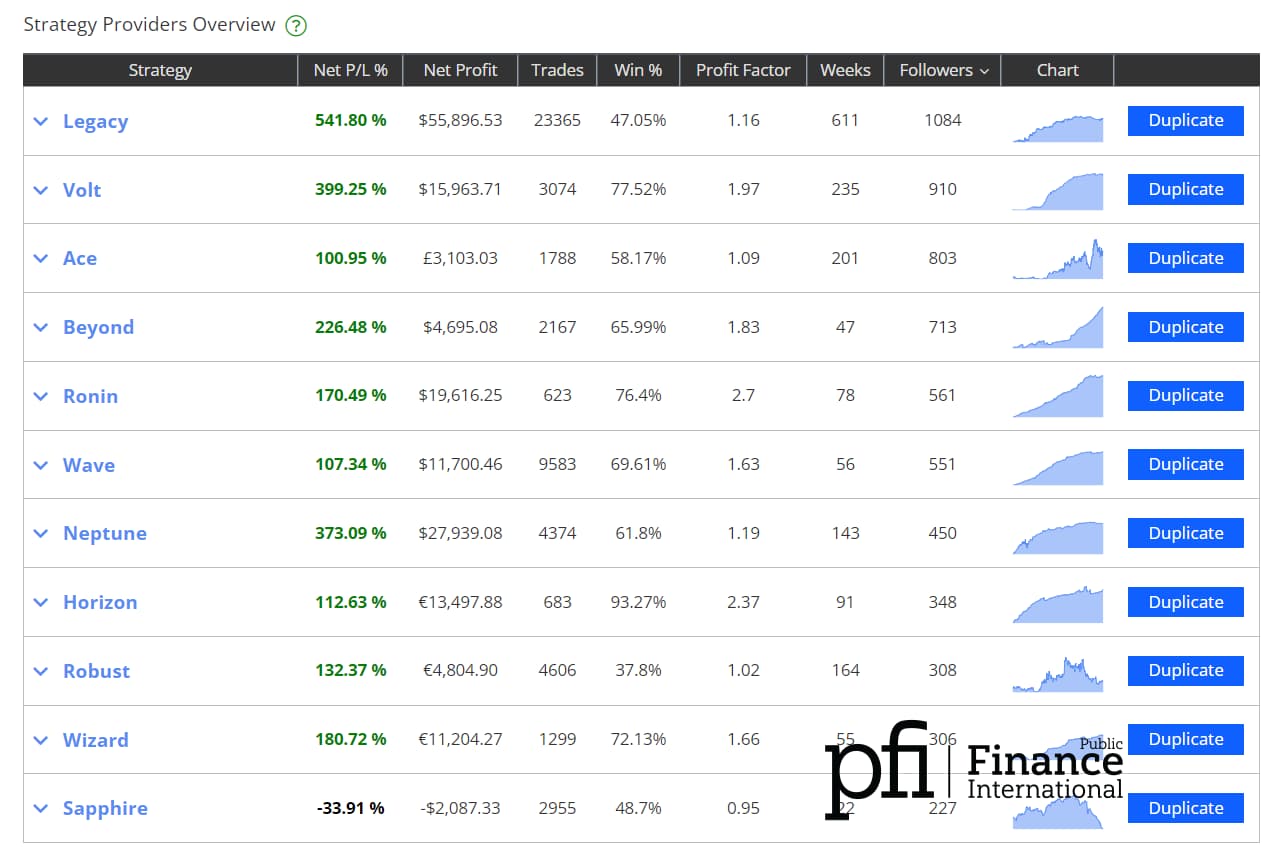

AvaSocial – Copy Trading

Avatrade copy trading integrates through DupliTrade and Zulutrade. This ranks them among the best copy trading brokers such as Pepperstone and eToro. Avatrade launched AvaSocial in the UK, with which traders can follow and copy the best traders.

Starting Copy Trading on AvaTrade:

- Begin by registering with AvaTrade.

- Complete the verification process.

- Fund your trading account.

- Choose between ZuluTrade or Duplitrade for your copy trading platform.

- Select your preferred signal provider(s) to follow.

- Begin copying the trading strategies of your chosen signal provider(s).

Order Types on AvaTrade:

AvaTrade's trading platform offers three primary order types:

- Market order – This order is executed at the prevailing market price of the security.

- Limit order – A limit order sets either a maximum buying price or a minimum selling price for securities. The order is executed only at the specified limit price or better.

- Stop order – A stop order is used to limit potential losses. It becomes a market order once the market price reaches the specified stop price

- AvaProtect: AvaProtect is a unique order type that acts as an insurance policy against losses resulting from trades made during a specified period. This order comes with an additional fee, and any losses incurred within the covered timeframe are reimbursed to the trader.

AvaTrade Trading Fees

AvaTrade's trading fees and spreads are competitive and align with industry averages. For instance, the average spread for trading the S&P 500 index CFD is 0.5, and for the Europe 50 index CFD, it's one pip. The EUR/USD pair carries a cost of 0.9 pips, which is consistent with industry norms.

To estimate the trading costs, a hypothetical scenario was considered, involving a $2,000 position held for one week with specific leverage ratios for different instruments. The fees for this scenario were:

- S&P 500 index CFD fees: $0.9

- Europe 50 index CFD fees: $0.6

- Apple stock CFD fees: $4.1

In general, trading with AvaTrade incurs lower costs compared to some other platforms like Plus500 or XM. For forex pairs, a similar hypothetical trade of $20,000 with a 30:1 leverage ratio held for one week results in costs as follows:

- EURUSD: $19.2

- GBPUSD: $15.7

- EURGBP: $10.5

While AvaTrade's fees for forex pairs are slightly higher compared to XM and Plus500, they remain competitive.

AvaTrade also imposes an inactivity fee if an account remains dormant for three months, amounting to $50 per quarter or approximately $13.33 per month, which is slightly higher than some competitors.

AvaTrade Research

AvaTrade offers robust research tools, including a news feed, an economic calendar, an idea hub, and various resources integrated into their platforms such as Webtrader, MetaTrader, and AvaOptions

For trading ideas, AvaTrade provides a section called 'Analysts View' or 'Forex Featured Ideas,' where traders can access insights into potential trading signals identified by other traders across a wide range of financial assets.

Their economic calendar covers global economic and corporate events, rating them based on their potential impact on financial markets.

AvaTrade's news feed, known as 'Market Buzz,' stands out with its excellent visual interface, tracking the number of daily publications, news sentiment (positive/negative), and the types of news covered.

The charting tools offered by AvaTrade are extensive, with 90 different technical indicators available for analysis. These charts can be customized to identify potential signals, price patterns, and trends.

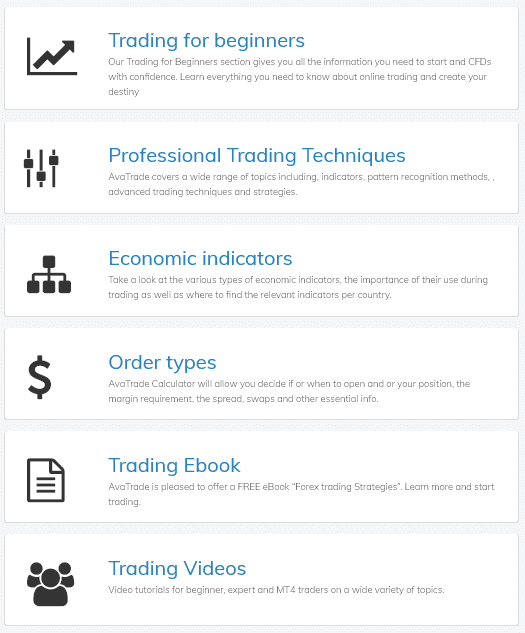

AvaTrade places significant emphasis on trader education to empower their clients further.

AvaTrade's educational offerings encompass:

This review found documented educational resources available for registered users. These go from basic platform tutorials to advanced materials, covering strategies and fundamental topics.

AvaTrade’s educational resources include:

- Trading for beginners

- Understanding Economic Indicators

- Forex Learning Resources (including an eBook)

- Professional Trading Strategies

- In-Depth Platform Tutorials

- Comprehensive Information on Types of Trade Orders

These resources cover key subjects that empower traders to expand their knowledge and enhance their portfolio performance.

AvaTrade also extends the opportunity for traders to hone their skills through a demo account before venturing into live trading with real capital.

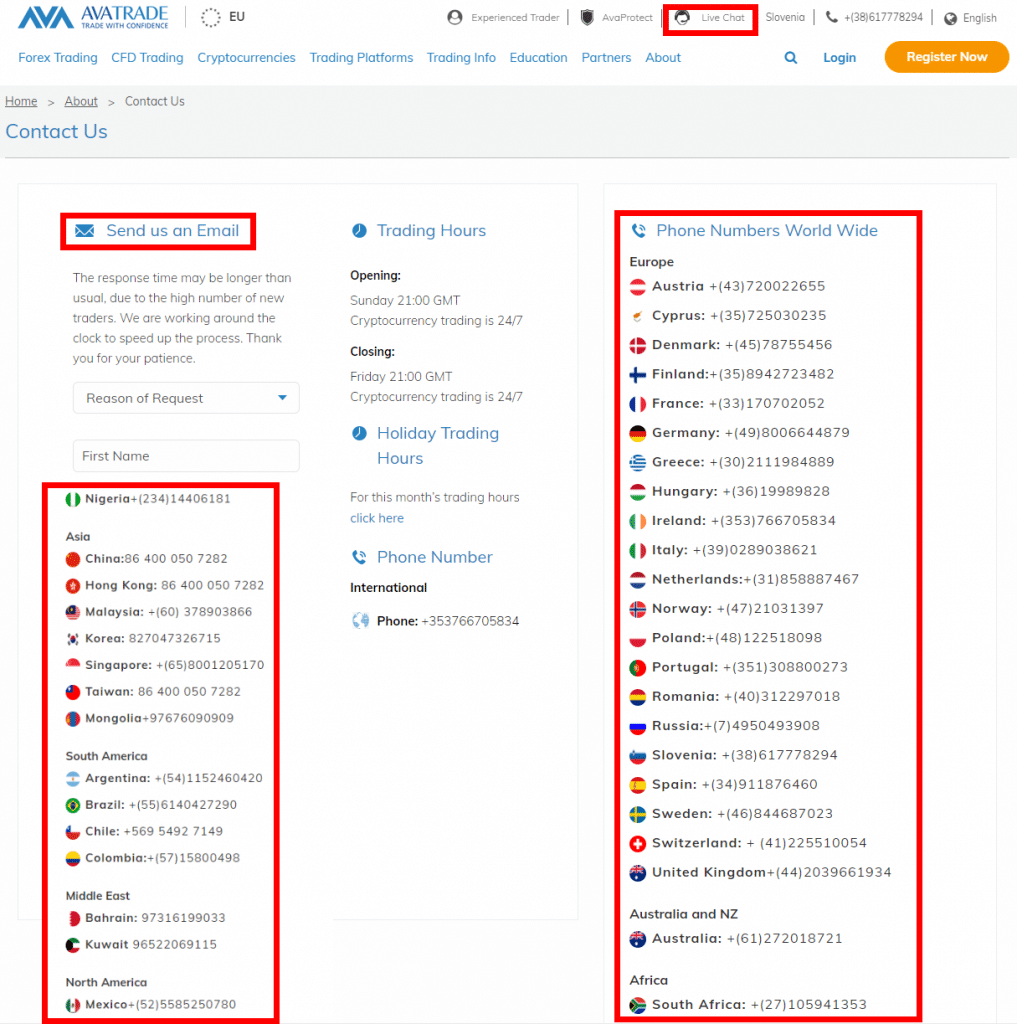

Customer Service

AvaTrade provides three communication channels for users to connect with their customer service team:

- Live chat

- Phone

The live chat feature stands out as efficient, with instant response times and well-trained customer representatives capable of delivering accurate information on various topics.

However, phone support has room for improvement, with longer wait times for call responses. While AvaTrade offers domestic phone numbers for various locations, some may be challenging to reach.

E-mail queries receive responses within 24 hours or less.

AvaTrade Minimum Deposit:

To open an account with AvaTrade, a minimum deposit of $100 is required for debit or credit card deposits. For bank transfers, the minimum deposit stands at $500. As is customary with many other trading platforms, AvaTrade will initiate an identity verification process. This process involves requesting specific documents to confirm your identity. However, it's noteworthy that AvaTrade's verification process tends to be quicker compared to most other brokers.

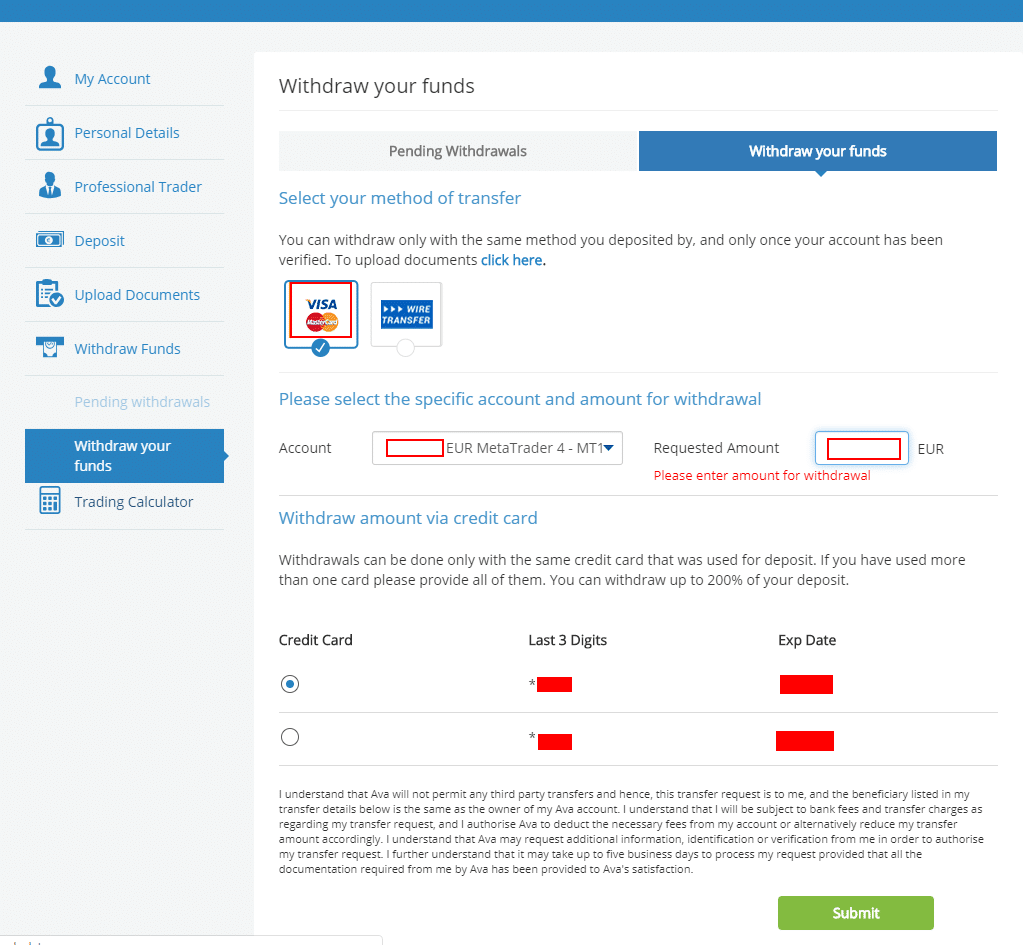

Withdrawals

AvaTrade offers free withdrawals for its users. There is a withdrawal limit for debit or credit card withdrawals, capped at up to 200% of the initial deposit made into the account before the withdrawal request. Importantly, this limit does not apply to withdrawals via bank transfers.

Withdrawals to electronic wallets are processed within one business day, and there is no minimum withdrawal limit in place. Meanwhile, withdrawals, including those for credit and debit cards, may take up to one business day. Bank transfers, on the other hand, may require a few business days for processing.

Is AvaTrade Safe?

AvaTrade is recognized as a safe and reliable platform, thanks to its regulation by tier-1 financial authorities. It offers a trustworthy environment for trading CFDs and Forex products.

The primary assurance of safety comes from the company and its subsidiaries being regulated by esteemed agencies in the countries where it operates. These regulators provide protections such as:

- €20,000 protection for EU clients from the Central Bank of Ireland.

- Negative balance protection for retail clients in the EU.

How to Open an AvaTrade Account?

Opening an account with AvaTrade is a streamlined, 100% online process that takes just a few minutes. Residents of many countries are eligible to open accounts, with a few exceptions like the United States, Belgium, Iran, and Israel.

AvaTrade offers four types of accounts:

- Standard Account: (for individuals)

- Corporate Account: Corporate Account (for companies)

- Islamic Account: Islamic Account (no swaps charged)

- Professional Account: Professional Account (higher leverage, but requires substantial financial experience)

Funding your Account

Traders can select from five base currencies for their accounts: GBP, EUR, USD, AUD, and CHF. This currency choice benefits clients in those regions by avoiding currency conversion fees.

Debit or credit card deposits are instant, though some users have reported a few hours' delay in reflecting the funds in their available balance. Bank transfers may take a few days and should originate from an account held by the verified AvaTrade account holder.

AvaTrade does not charge deposit fees for these payment methods.

Markets & Products Offered:

AvaTrade specializes in offering CFDs (Contract for Difference) for various financial assets, including stocks and forex.

Their CFD portfolio includes:

AvaTrade offers CFDs for various financial assets including stock and forex CFD.

This means that these financial assets are traded via CFDs.

The portfolio of CFDs available on AvaTrade include:

- 20 stock indexes

- 630 individual stocks

- 5 ETFs

- 17 Commodities

- 2 Bonds

However, when compared to competitors, AvaTrade has a relatively limited selection of ETFs, bonds, and individual stock CFDs.

Summary

AvaTrade, founded in 2006 and registered in the British Virgin Islands as AVA Trade EU Ltd, is headquartered in Dublin, Ireland. With over 200,000 clients spanning 120 countries, AvaTrade is regulated by top-tier institutions, including the Central Bank of Ireland and ASIC. Its robust regulatory framework ensures safety, offering EU clients a €20,000 protection and negative balance protection.

Conclusion

AvaTrade is a well-established broker that offers a diverse range of financial instruments and is regulated by top-tier authorities. While it provides ample opportunities for traders, it's essential to be aware of the risks associated with CFD trading. Before getting started, ensure you have a solid understanding of how CFDs work and carefully assess your risk tolerance.

Our Score: 4.9/5 Stars

- Regulated by top-tier financial authorities

- Serving a global client base of over 200,000 traders

- Multilingual customer support available

- Social Trading options

- Choice of five base currencies