We do our best to published unbiased reviews. Our opinions and analysis is our own and is based on hours of research. Learn more about our methodology here. Our reviews are not influenced by compensation we might receive from our partners.

Plus500, a global fintech firm established in 2008 with its headquarters in Israel, specializes in providing online CFD trading services. Their impressive portfolio boasts over 2,500 financial instruments, and in our testing, their trading platform and mobile app have proven to be among the finest in the industry. Plus500 offers a diverse range of CFDs, including forex, ETFs, cryptocurrencies, options, indices, shares, commodities, and more. What sets them apart is their stringent regulation by CySEC, MAS, FCA, and FSA, along with licenses from ASIC, FMA, and FSCA.

Summary

In summary, Plus500 is a reputable online brokerage, backed by top-tier regulatory authorities. Notably, their exceptional trading platform and mobile app make them stand out. We've found Plus500 to be an excellent choice for CFD traders, thanks to their robust customer support, user-friendly platform, and straightforward account opening process. The only drawback appears to be their exclusive focus on CFDs in their market offerings.

Retail investors worldwide place their trust in Plus500. Plus500 Ltd (PLUS.L) is publicly traded on the London Stock Exchange under the ticker symbol LON: PLUS, demonstrating its commitment to regulatory compliance. For a comprehensive review of Plus500 in the UK, we recommend reading our detailed analysis. The company was founded by Alon Gonen, Gal Haber, Elad Ben-Izhak, Omer Elazari, Shlomi Wizmann, and Shimon Sofer, and its current CEO is David Zruia.

| Feature | Plus500 |

|---|---|

| Founded: | 2008 |

| Publicly Traded: | Yes |

| Bank: | No |

| Regulation: | FCA, CySec, FSA, MAS |

| Licensed by: | ASIC, FSCA |

| Demo Account: | Yes |

| Minimum Deposit: | $100 |

| Copy Trading: | No |

| Minimum Trade: | Varies |

| Markets Available: | CFDs on more than 2000 instruments |

| Mobile Trading: | Yes |

| Countries Available: | 50+ |

| Withdrawals: | Free |

| Islamic Account: | Yes |

| Deposit Methods: | MasterCard, Visa, Skrill, PayPal, Bank Fund Transfers |

| Our Score: | 4.7/5 |

For active traders, this brokerage stands out, primarily because of its exceptional trade execution, platform quality, and its competitive fee structure and commissions at Plus500.

Pros and Cons

| PROS | CONS |

|---|---|

| User-Friendly Platform | Limited Offering to CFDs |

| Suitable for Intermediate to Experienced Traders | Average Research Tools |

| Fully Digital Account Opening | Lack of Fundamental Data |

| CFD Fees (Relatively Low, but a Consideration) |

We recommend it for advanced experienced traders, looking for a reliable and trustworthy broker.

Read more about it on Wikipedia.

Why should you consider reading this review?

Selecting the correct trading platform is pivotal for those aspiring to become active traders. This comprehensive review delves into various aspects, including the platform's strengths and weaknesses, fee structure, security measures, regulatory compliance, and more. By perusing this review, you can make an informed decision to determine if it aligns with your specific requirements. Additionally, if you're exploring alternatives to Plus500, consider platforms like eToro, Pepperstone or Avatrade as viable options.

What's Outstanding About Plus500?

The primary advantage of Plus500 lies in its user-friendly platform and competitive pricing.

Key Highlights include:

- Quick and easy demo account setup, with real-money accounts subject to verification, which may take a few business days based on workload.

- Below-average fees compared to industry standards.

- Strong regulatory oversight enhancing the broker's credibility.

- Publicly listed on the London Stock Exchange.

- A platform well-suited for both novice and experienced traders.

Comparison with Similar Trading Platforms

Here, we provide an overview of how Plus500 stacks up against similar trading platforms.

| Broker | Plus500 | XTB | eToro | Trading 212 | Interactive Brokers |

|---|---|---|---|---|---|

| Founded | 2008 | 2002 | 2007 | 2004 | 1993 |

| Headquarters | Israel | Poland | Tel Aviv, Israel | London, United Kingdom | Greenwich, Connecticut, United States |

| Regulation | CySEC, FMA, MAS, SFSA, FSCA, ASIC, FCA | FCA, Cyprus Securities and Exchange Commission (CySEC), Belize International Financial Services Commission (IFSC) | FCA, CySEC, ASIC | FCA, FSC, CySEC | MAS, FCA, CFTC, SEC, CBI, IIROC, ASIC, CSSF |

| Minimum Deposit | $100 | $0 | $50 - $10,000 | $0 | $0 |

| Withdrawal Fees | $0 | Yes (varies with withdrawal method) | $5 withdrawal fee | No | 1 Free Withdrawal/month |

| Inactivity Fees | $10/month (after 3 months of no login activity) | Yes | $10/month (after 12 months of no login activity) | Yes | $0 |

| Instruments Available | CFDs on: Indices, Forex, Commodities, Crypto, Shares, Options, ETFs | 4000+ (FX, Commodity CFDs, Indices, Stocks, Cryptocurrency) | 2000+ | Over 7000 Global Stocks & ETFs and CFDs on Forex, Commodities, Indices, Stocks | Access to 150 Exchanges (CFDs, Funds, Crypto, Futures, Options, Bonds, Stocks, ETFs, Forex) |

Regulation of Plus500

Plus500 and its subsidiaries are under the supervision of the following regulatory authorities:

- Plus500UK Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under license number #509909.

- Plus500CY Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number #250/14.

- Plus500SG Pte Ltd is licensed by the Monetary Authority of Singapore (MAS) under license number #CMS100648-1 and by IE Singapore under license number #PLUS/CBL/2018.

- Plus500SEY Ltd is authorized and regulated by the Seychelles Financial Services Authority under License No. SD039.

- Plus500AU Pty Ltd (ACN 153301681) is licensed by:

- ASIC in Australia under AFSL #417727

- FMA in New Zealand under FSP #486026.

- It is an Authorised Financial Services Provider in South Africa under FSP #47546.

Please note that when trading CFDs with Plus500, you do not have ownership or rights to the underlying assets. Refer to the disclosure documents available on their website for more details.

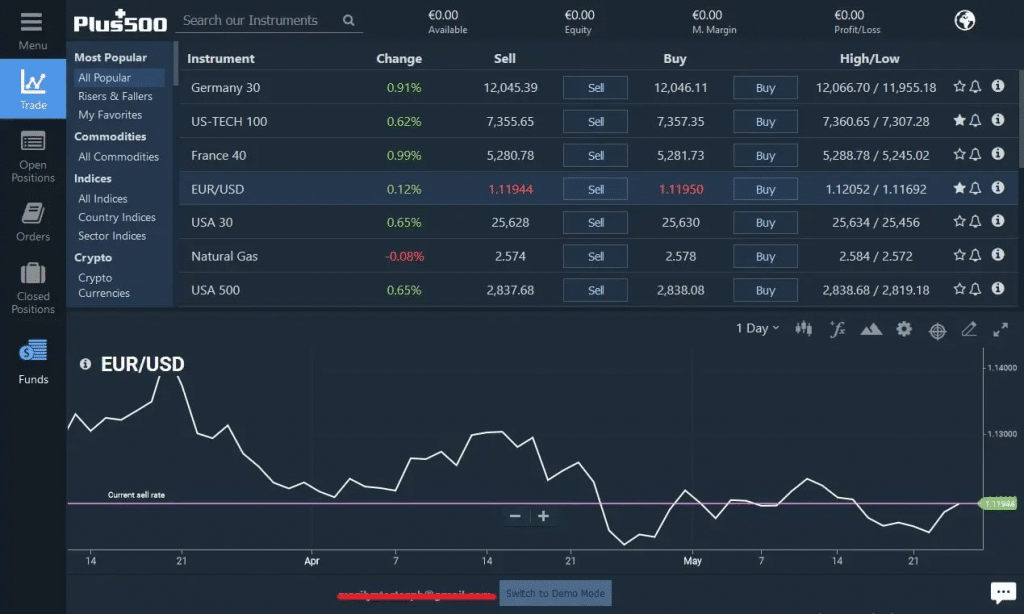

Platform Overview

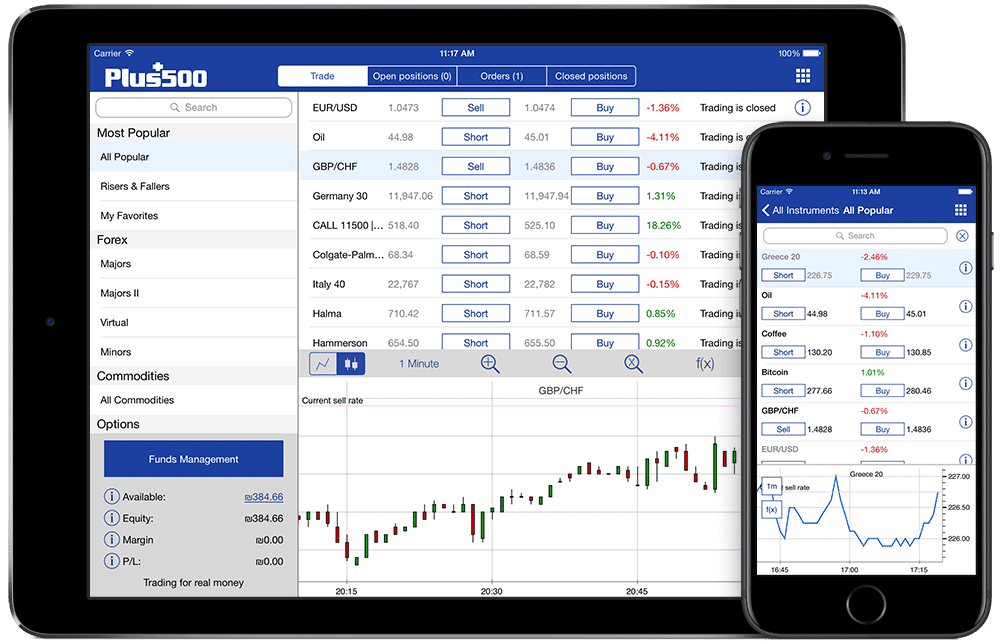

Plus500 offers its proprietary trading platform known as WebTrader. This platform is user-friendly and provides a seamless experience across various devices, including Windows PCs, tablets, smartphones, and web browsers. Notably, Plus500 does not offer the MetaTrader 4 (MT4) platform, which is popular for its additional functionality and customization options.

How Trading Works at Plus500

Trading at Plus500 involves opening and closing CFD positions with just a few clicks. Users can access the mobile app, select an instrument, and choose to "Buy" or "Sell." They can also specify the amount they want to use for the position and execute the trade. It's important to note that all the financial instruments offered on Plus500 are traded as CFDs, making it a suitable platform for active traders rather than long-term investors. Holding CFDs for extended periods may incur additional costs.

See the video below and learn how Plus 500 works:

WebTrader

The WebTrader platform provided by Plus500 features a user-friendly interface, earning positive ratings from most users. It enhances security through two-step logins and offers detailed reports on fees, historical transactions, positions, and other essential client activity information. However, it lacks built-in tools for in-depth analysis of trading activity. While Plus500's platform caters to most traders effectively, it has limitations. Notable limitations include the inability to use functions like automated trading via expert advisors, back-testing, trading algorithms, or managing third-party funds with PAMM or MAM trading platforms.

The platform's downside lies in its lack of customization options and the absence of advanced charting tools. Additionally, it has limitations when it comes to screen layout flexibility. While it adequately serves basic charting needs, advanced traders may find it lacking in functionality.

On a positive note, the search function within the platform is effective, allowing traders to easily locate the securities they intend to trade. Plus500 offers traders the convenience of receiving notifications through email, SMS, and push notifications, particularly when the price of a specific asset experiences movements.

Plus500 Mobile App

The Plus500 mobile app mirrors most, if not all, of the tools and features available in the web-based version. This includes comprehensive charting tools, a functional search module, and access to reports.

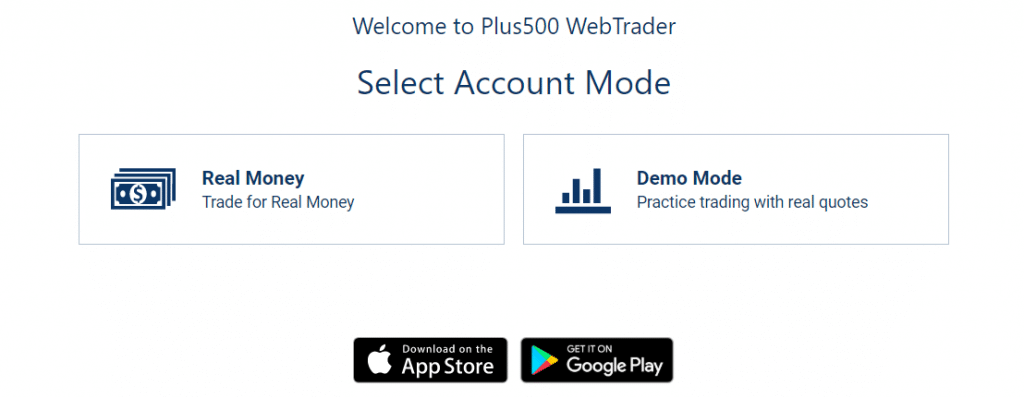

Opening a demo account is a straightforward process, taking only a few minutes to complete the registration. In contrast, real money accounts require verification, which typically takes a few days, contingent on the current workload.

How to Open a Plus500 Account?

Opening a demo account is easy. It takes a few minutes to register and complete the registration. Real money accounts need to be verified. It takes a few days, depending on the workload.

Is Plus500 Good For Beginners?

While the Plus500 platform boasts user-friendliness, intuitive design, and accessibility, it's essential to note that CFDs are intricate financial instruments. Therefore, we highly recommend utilizing the demo account as a starting point, particularly for beginners.

Who Is Eligible to Open an Account?

Plus500 extends its services to investors globally, with a few exceptions. Certain regions, such as Cuba, Iran, and Syria, are prohibited from registering on the platform. Additionally, residents of the United States and Canada are ineligible to open accounts, as these countries have enacted restrictions on the sale of CFDs to retail investors.

Step-by-Step Account Opening Process:

- Complete the online registration.

- Provide necessary proof of residency and identity verification documents (e.g., national ID, passport, utility bill, etc.).

- Await approval

- Deposit funds to initiate your trading journey.

Minimum Deposit Amount

The minimum deposit requirement at Plus500 stands at $100

Multiple payment options are available, including debit cards, credit cards, and electronic wallets. For bank transfers, a minimum deposit of $500 is applicable.

| Minimum Deposit | Plus500 | eToro | Trading212 |

|---|---|---|---|

| Amount | $100 | $200 | $1 |

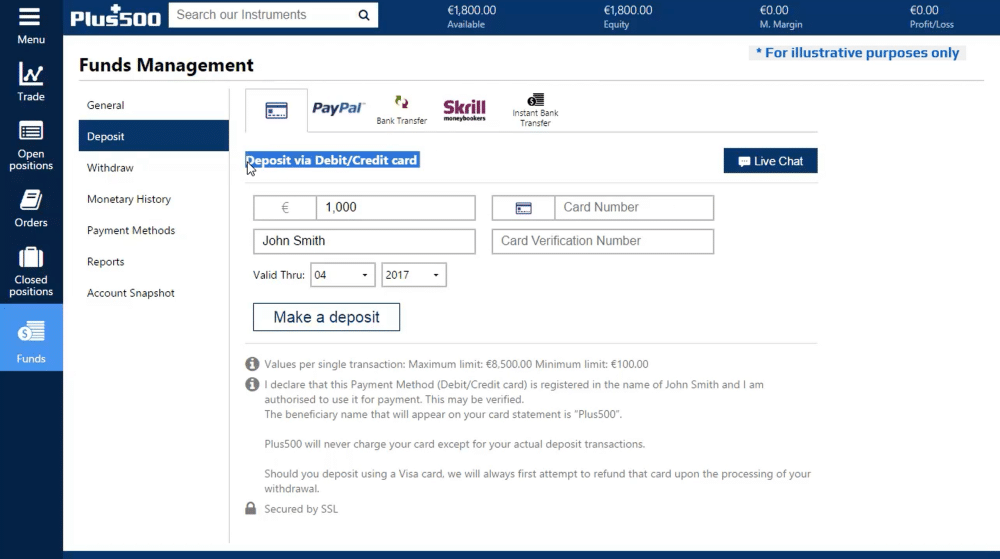

Withdrawal and Funding Options

At Plus500, you have several options for depositing and withdrawing funds, each with its own characteristics:

- Bank Fund Transfers: Bank transfers may take several days to be cleared.

- Visa or MasterCard Credit/Debit Cards: Deposits made with these cards are instant.

- Electronic Wallets: Electronic wallets like PayPal and Skrill offer quick and convenient transactions.

You can find detailed instructions for these transactions in the Funds Management section of the Plus500 platform. Notably, Plus500 does not charge fees for deposits.

Plus500 supports 10 different base currencies for their accounts, providing flexibility for traders.

Types of Accounts

There are two types of accounts available:

Both Retail and Professional accounts share many similarities. The primary difference lies in the leverage ratios offered, with Retail accounts having lower leverage than Professional accounts. It's important to note that Professional clients do not have Investor Compensation Fund (ICF) rights.

To qualify for a Professional account, traders typically need to meet certain minimum net asset or income requirements. Additionally, traders must answer specific questions to confirm their understanding of the risks associated with higher leverage ratios.

Markets & Products Offered

Plus500 offers an extensive range of CFDs (Contracts for Difference) on various financial markets and forex pairs, making it a competitive choice. The available markets include:

- 1,800 Stock CFDs

- 33 Stock Index CFDs

- 92 ETF CFDs

- 22 Commodity CFDs

- 14 Cryptocurrency CFDs

- CFDs on 70 Currency Pairs

Plus500 Forex

Plus500 provides access to over 60 popular forex pairs, such as EUR/USD, GBP/USD, and EUR/GBP, with leverage. It's important to note that all Forex trading on Plus500 is conducted through CFDs. They offer advanced tools to help you protect your profits and manage potential losses.

Cryptocurrencies offered

Yes, Plus500 allows trading in cryptocurrencies. Here is a list of the available cryptocurrencies:

- Bitcoin (BTC)

- Ethereum (ETH)

- NEM

- Litecoin

- Bitcoin Cash

- EOS

- IOTA

- NEO

- Cardano (ADA)

- Stellar (XLM)

Plus500 was one of the first brokers to offer Bitcoin CFDs back in 2013.

Order Types

- Market order – Executed at the current market price of the security.

- Limit order – Sets a maximum or minimum price for buying or selling securities, executed only at the specified limit price or better.

- Stop order – Limits losses if the market price falls below a certain level, turning into a market order when that price is reached.

- Trailing-stop order – Allows traders to benefit from favorable price movements until a specified percentage or price decrease occurs.

- Guaranteed Stop Loss Orders - Availability depends on market conditions and may come with wider spreads

It's important to note that while limit, stop, and trailing-stop orders are executed at or better than the specified price, the company cannot guarantee execution at the exact price due to slippage. Slippage may occur during periods of market volatility.

Fees

Plus500 boasts low trading costs compared to many of its competitors. They do not charge a withdrawal fee for the first five withdrawals per month, which benefits traders with smaller capital amounts. Plus500's revenue primarily comes from customer trades and the bid/ask spread. The spread is dynamic and changes based on market conditions. High-volume traders may qualify for discounts.

The average varied spreads can provide an indication of costs:

- S&P500 – average varied spread cost 0.02%.

- Europe 50 – average varied spread cost 0.05%.

- Forex(e.g., EUR/USD): – Varied cost of 0.01%.

Exact fees per trade may vary depending on the instrument being traded.

Inactivity Fee

Plus500 imposes an inactivity fee on accounts that have not been logged into for more than three months. This fee amounts to $10 per quarter after the initial three-month period. Unlike some brokers that charge fees for inactivity, Plus500's fee is triggered by account login, which can be beneficial for traders.

Overnight Funding Fee

If you hold positions overnight, an overnight funding fee may apply. The specific percentage depends on the amount of leverage associated with the position, and this percentage is indicated next to the price of the financial asset. If the trade involves a different currency than the account base currency, currency conversion charges may also apply

Leverage

Leverage levels at Plus500 vary based on the trader's location and applicable laws. Maximum leverage levels for retail accounts are as follows:

- Stock index – 20:1 leverage

- Stocks – 5:1 leverage

- Forex – 30:1

For instance, a 30:1 leverage means you can borrow $30 for every $1 you invest. It's important to note that leverage levels are fixed and cannot be adjusted, limiting a trader's ability to reduce market risk associated with their positions.

Research

Plus500 provides limited research tools. Its technical analysis tools are suitable for basic analysis, offering 107 technical indicators that can be applied to different time frames, from tick charts to weekly charts for various instruments. Both the WebTrader and the mobile app offer charting tools, although the mobile app's charts may be less visually appealing due to space constraints.

Customizable charts are saved after applying indicators, which is convenient for traders analyzing numerous securities during a single session. The platform includes a news feed featuring an economic calendar and a corporate events calendar. However, it lacks real-time news from major outlets like Reuters or CNN Money.

A "Traders' Sentiment" tool within the platform's overview section indicates the percentage of traders trading CFDs on a given security during a session (e.g., 41% sellers vs. 59% buyers). Another valuable indicator is "Live Statistics," displaying performance for 5-minute, 60-minute, and 1-day time frames.

Notably, Plus500 lacks fundamental data for stocks, necessitating the use of third-party tools for in-depth research.

Plus500 Education Resources

While Plus500 offers a demo account for practice, its educational resources are limited. The platform provides clients with Key Information Documents (KID) outlining instrument information and associated risks for various asset classes, including commodities, ETFs, Forex, indexes, options, equities, and cryptocurrencies.

The "Trader's Guide" section on their website features six short videos covering topics like slippage when opening a position, trading basics, popular strategies, rollovers, and options. These videos serve as tutorials on platform functionality and are geared more towards beginners.

- Slippage when opening a position

- How to trade?

- Popular strategies

- What is a Rollover?

- What are options?

Plus500 also offers a Risk Management section that explains various conditional order types and their role in risk mitigation.

A comprehensive FAQ section covers topics such as account verification, deposits, fees and charges, financial instruments, account opening, regulations, identification document submission, trading, and withdrawals. These materials are informative for navigating the platform but do not necessarily aid in skill improvement.

- Account verification process

- Deposits

- Fees & Charges

- Financial instruments

- Opening an account

- Regulators

- Submitting identification documents

- Trading

- Withdrawals

Some materials guide the trader through the platform. None of the educational resources help traders improving their skills.

Portfolio Analysis Tools

Plus500 provides basic portfolio analysis tools, including profit/loss breakdowns, balances, and transaction histories. However, the platform lacks advanced tax accounting tools or trading journals.

Customer Support

Plus500's customer support has received positive feedback from users within the platform. They offer live online chat support and email customer support, with representatives available 24/7. Live chat responses are typically quick and relevant, while email response times may vary based on the complexity of the inquiry.

Users appreciate the broker's transparency in disclosing rates and fees. However, it's worth noting that Plus500 does not offer phone customer service.

Withdrawal Options and Fees

Please note that withdrawal options and fees were not explicitly mentioned in the provided text. If you have specific questions about withdrawal methods and associated fees, it is recommended to consult the official Plus500 website or contact their customer support for up-to-date information on this topic.

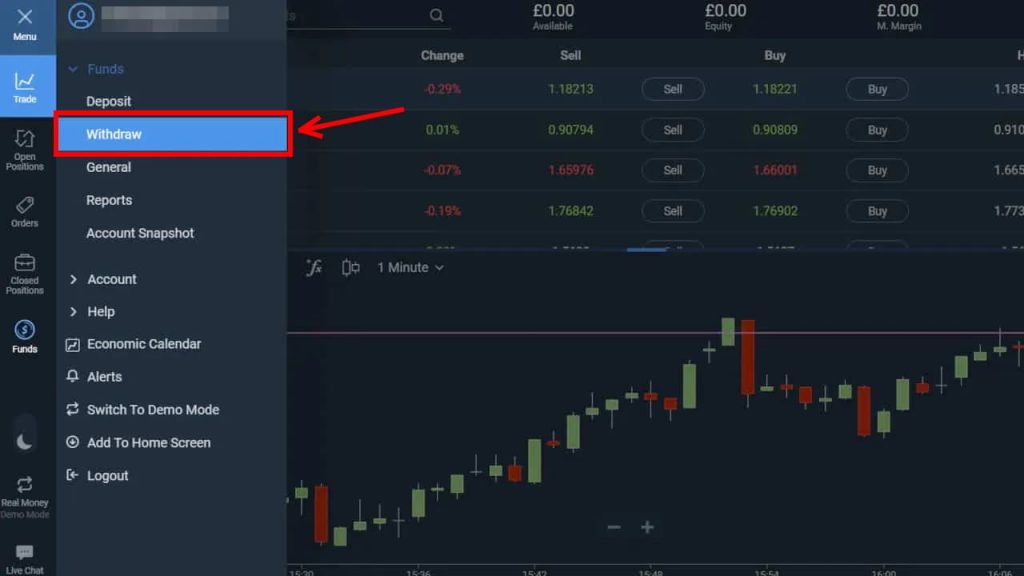

How to Withdraw Funds from Plus500:

Withdrawing money from Plus500 is a straightforward process:

- Click on the Menu Button located in the top-left corner of the platform.

- Select 'Withdraw.'

- Choose your preferred Withdrawal Method.

- Enter the amount you wish to Withdraw.

- Click 'Open a Withdrawal' to finalize the withdrawal.

Plus500's withdrawal procedure is user-friendly and hassle-free. Notably, they do not charge a fee for the first 5 withdrawals. However, after the initial 5 withdrawals, a fee of $10 is applied.

There are minimum withdrawal amounts of $50 for PayPal and $100 for bank transfers. If your withdrawal amount falls below these minimums, a $10 fee will be incurred.

It's important to emphasize that you can initiate a withdrawal from Plus500 once you have completed the verification process. Verification is a standard procedure required by all legitimate brokers before permitting trading. Therefore, identity verification is essential before you can make withdrawals.

Withdrawal Methods

Plus500 offers a variety of withdrawal options:

- Credit or Debit Card

- Wire/Bank Transfer

- e-Wallets (PayPal or Skrill)

Withdrawal Timeframe

Withdrawals from Plus500 typically take 5-7 business days after withdrawal verification. Funds are expected to arrive in your bank account within this timeframe. However, please be aware that withdrawals to a bank account may take longer, depending on your bank and jurisdiction.

IIs Plus500 Legitimate?

Plus500's legitimacy is underscored by several key factors:

- CySEC Authorization: Plus500CY Ltd. is authorized and regulated by CySEC (#250/14), further demonstrating their commitment to compliance and transparency.

- Plus500CY Ltd. is authorized & regulated by CySEC (#250/14).

- Publicly-Traded Company: Plus500 is a publicly-traded company, listed on the London Stock Exchange (LSE) under the ticker symbol LSE: PLUS. Additionally, it is included in the FTSE 250 Index. This public listing adds transparency and provides insights into the company's financial health, solvency, and liquidity, offering an extra layer of protection for investors.

- Financial Services Compensation Scheme (FSCS): Traders utilizing Plus500 are safeguarded under the Financial Services Compensation Scheme (FSCS), providing a safety net in case of unforeseen financial issues.

- Segregation of Funds: In accordance with the client money rules established by the Financial Conduct Authority (FCA), Plus500 is required to maintain corporate funds and client funds in segregated accounts at regulated banks. This separation ensures the security of client funds.

In summary, Plus500's legitimacy is grounded in its stringent adherence to regulatory standards, public listing, and financial safeguards, contributing to a high level of trustworthiness and reliability in the brokerage industry.

Balance Protection

The company hedges its exposure with their parent company and acts as a principal. Plus500 is registered across Europe and the Asia-Pacific Region with trusted regulatory authorities. In the U.K. and the FCA's client money rules, Plus 500 has to keep corporate funds and client funds in segregated accounts at regulated banks.

| Residence | Amount | Regulated by | Subsidiaries |

|---|---|---|---|

| UK | £85,000 | Regulated by the Financial Conduct Authority (FRN 509909) | Plus500UK Ltd |

| South Africa, New Zealand and South Africa | No balance protection | ASIC (AFSL #417727), Financial Markets Authority (FSP #486026), and FSCA (FSP #47546) | Plus500AU Pty Ltd |

| EU, Norway, Switzerland (EEA) | €20,000 | Cyprus Securities and Exchange Commission (#250/14) | Plus500CY Ltd |

| Israel | No balance protection | Israel Securities Authority (#515233914) | Plus500IL Ltd |

| Singapore | No balance protection | Monetary Authority of Singapore (#CMS100648-1) and the IE Singapore (#PLUS/CBL/2018) | Plus500SG Pte Ltd |

According to the Financial Conduct Authority (FCA), the regulatory body in the UK, and the European Securities and Markets Authority (ESMA), trading Contracts for Difference (CFDs) carries substantial risks due to its involvement in short-term positions within volatile instruments. Research indicates that over 79% of CFD traders experience financial losses. These losses are often attributed to the high transaction costs, extensive leverage utilization, and market volatility, which can erode account balances rapidly.

In March 2019, ESMA introduced renewed restrictions that prohibit the marketing, distribution, and sale of CFD products to retail clients in Europe for a three-month period beginning on May 1, 2019. These restrictions encompassed limitations on leverage levels for different CFD types, the minimum margin requirement triggering margin calls, and restrictions on incentives offered for CFD trading. Additionally, ESMA mandated the inclusion of risk warnings to inform investors about the potential for financial losses.

Before considering trading with this provider, it is crucial to thoroughly comprehend the intricacies of CFDs. Investors are strongly advised to allocate funds that they can afford to risk.

In conclusion, Plus500 stands out as an exceptional online broker, particularly suited for advanced traders seeking to engage in CFD trading. The platform is rigorously regulated by top-tier authorities and is publicly listed on a stock exchange. Plus500 boasts competitive fee structures, user-friendly interfaces for both web-based and mobile platforms, and low minimum deposit requirements. Professional accounts offer substantial leverage options for Forex traders.

Conclusion

Overall, Plus500 is among the top platforms available, and this article provides comprehensive insights to help you make an informed decision when considering their platform for your trading needs.

86% of retail investor accounts lose money when trading CFDs with this provider.