Pepperstone: Your Trusted Forex and CFD Broker

Pepperstone founded in 2010 and headquartered in Australia, has established itself as a safe and reliable forex and CFD broker. Boasting exceptional customer support and catering to algorithmic traders, Pepperstone has earned its reputation in the financial industry. The broker is subject to rigorous regulation by top-tier authorities, including the FCA (Financial Conduct Authority), BaFin, DSFA, SCB, CySEC, CMA, and ASIC (Australian Securities and Investments Commission). With a global presence, Pepperstone maintains offices around the world, ensuring accessibility to its services.

Notably, Pepperstone stands out as one of the largest MetaTrader brokers in the industry. As of today, over 80,000 traders place their trust in Pepperstone for their trading needs.

Between 74-89 % of retail investor accounts lose money when trading CFDs.

Summary

★★★★★ 4.9/5 (Best for Active Forex Traders)

Pepperstone proves to be an exceptional choice, particularly appealing to algorithmic traders. Offering competitive pricing for forex trading, this broker stands as a safe and reliable option in the forex and CFD space. Regulated by esteemed authorities, Pepperstone is well-suited for high-volume traders and provides access to a diverse selection of third-party trading platforms, all while maintaining competitive pricing.

| Pepperstone | |

|---|---|

| Demo Account: | Yes |

| Regulated by: | ASIC, FCA, BaFin, DSFA, SCB, CySEC, CMA |

| Minimum Deposit: | $0 |

| Min. Trade: | 0.01 lots |

| Mobile App: | iOS, Android |

| Desktop: | MT4, MT5, cTrader, TradingView |

| Countries Not Available: | Full List |

| Deposit Methods: | Visa, Mastercard, Bank Transfer, POLi, MPESA, BPay, Union Pay, Neteller, Skrill, PayPal |

| Islamic Account: | Yes |

| Our Rating: | ★★★★★ 4.9/5 |

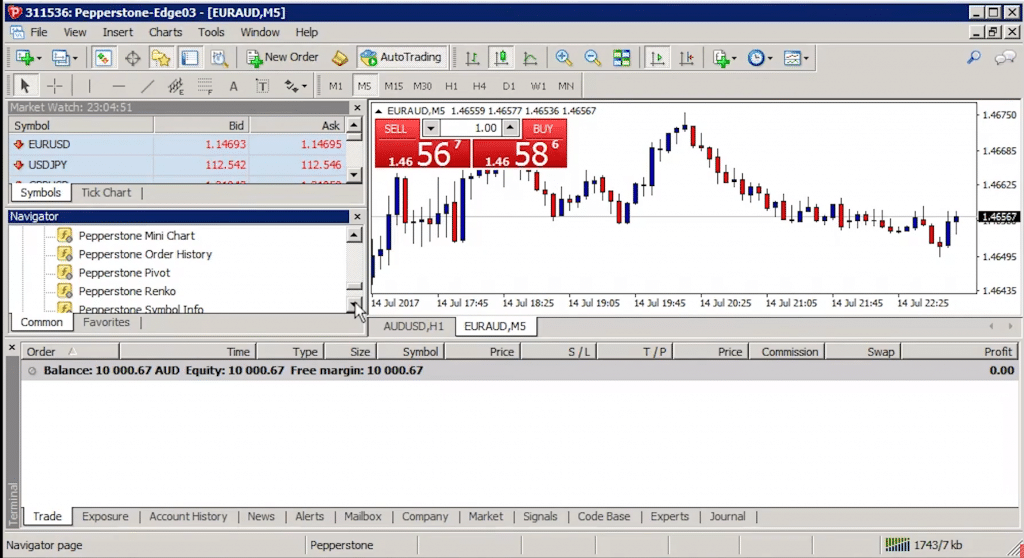

Pepperstone Trading Platform

★★★★★ 4.8/5

Pepperstone distinguishes itself by offering an array of third-party trading platforms, providing traders with diverse options for their trading needs. While Pepperstone does not have its proprietary platform, it compensates with a comprehensive selection of platforms. Notable platforms include the full suite of cTrader for Windows and MetaTrader for both Windows and Mac OS.

For those interested in social copy trading, Pepperstone offers a choice of platforms, including cTrader, DupliTrade, MyFXBook, and Trading View. Both cTrader and MetaTrader support algorithmic trading, catering to traders who employ automated strategies. It's worth noting that eToro is another highly regarded platform for copy trading.

Web Platform

Pepperstone's web-based platform is built on MetaTrader and impresses with its robust customization options and extensive language support. While the design may appear somewhat dated, the platform makes up for it with its rich feature set. Pepperstone provides thorough tutorials to assist users in mastering its platforms, making navigation and arrangement of tabs on the screen a straightforward process. MT4 and MT5 web traders come equipped with indicators, expert advisors, DDE protocols, order management tools, and more.

Now, let's explore each trading platform in detail:

MetaTrader 4

MetaTrader 4, developed by MetaQuotes Software Corp, has stood the test of time since its 2005 release. Widely used for forex trading, it extends its versatility to various markets, including commodities, indices, and cryptocurrencies via CFDs. Key features encompass advanced charting, backtesting capabilities, mobile trading, algorithmic trading support, and an extensive library of technical indicators. MT4 also accommodates Expert Advisors (EAs), allowing users to create personalized trading strategies.

MetaTrader 5

Released in 2010 as an upgrade from MT4, MetaTrader 5 offers enhanced functionality. Distinguishing features include an expanded array of charting tools, a broader set of indicators and technical analysis resources, faster trade execution speeds, diverse order types, and improved market data streaming.

cTrader

Developed by Spotware Systems Ltd and introduced in 2010, cTrader is an alternative to MT4 and MT5. It excels in security and speed, delivering rapid order execution times. cTrader offers a balance of user-friendliness and advanced capabilities, appealing to both novice and experienced traders. Its WebTrader version serves as a reliable no-download backup solution for trading on different computers.

Capitalise.ai

Capitalise.ai offers code-free trading automation, empowering traders to convert their ideas into automated strategies using plain English, without any coding. It facilitates backtesting with historical data and simulating strategies with real-time data, making it accessible and convenient.

TradingView

TradingView stands out as an ultimate platform for advanced charting functions. Its user-friendly interface provides access to streaming quotes, real-time news feeds, market analysis tools, interactive charts, and more. Moreover, its extensive social network with over 15.5 million active users transforms it into more than just a charting tool. Traders can post their trades, engage in discussions, and share strategies, creating a valuable resource for traders of all levels.

Pepperstone's diverse range of third-party trading platforms ensures that traders have access to the tools and features that best suit their trading preferences and strategies

74-89 % of retail investor accounts lose money when trading CFDs

Smart Trader Trading Tools

Smart Trader Tools is a valuable suite of resources designed to refine your trading strategy. It encompasses current market data, advanced functionalities, broadcasting capabilities, and intricate alerts, all aimed at enhancing your trading experience.

Expert Advisors

| Alarm manager | Trade-related events notification, price action moves, and more |

| Correlation Matrix | Insights to view the correlation between trading instruments |

| Connect | Analysis and news in one place |

| Correlation Trader | In-depth correlation analysis through time-frames |

| Market Manager | Market prices, pending and open orders |

| Sentiment Trader | Market sentiment ratings |

| Session Map | Real-time global map of market sessions and overlaps |

| Excell RTD | Analyze and report real-time market data in Excell |

| Mini Terminal | Single market trade terminal |

| Trade Terminal | Professional robust analysis and trade execution |

| Trade simulator | Simulate trades with real market data |

| Tick Chart Trader | Create charts for specific timeframes with Generator EA |

Indicators

| Candle Countdown | Time left in a candle bar |

| Chart Group | Adjust charts through multiple timeframes |

| Bar Changer | Offline Charts available on MT4 |

| Freehand | Draw on your chart |

| Chart-in-Chart | Compare price action on different symbols |

| Donchian | Identify range of trading opportunities and gain insight into trends |

| Gravity | Identify support and resistance areas |

| High-Low | See the high-low for a period on the chart |

| Keltner | Channel size based on ATR |

| Mini Chart | The price action of other time-frames and instruments |

| Magnifier | Resizable and draggable sub-window inside the main chart |

| Order history | Previous trades history set open and close of particular trades |

| Pivot Point | Spot market levels based on previous day |

| Renko | Renko blocks on MT4 time-based charts |

| Symbol Info | Dragable window showing symbol data |

Pepperstone Mobile Trading

★★★★★ 4.8/5

Pepperstone provides mobile trading options through dedicated apps for MT4, MT5, and cTrader. These mobile trading apps are accessible on both iOS and Android platforms, supporting 22 different languages. The MetaTrader 4 mobile app stands out with its user-friendly interface, robust functionality, efficient search features, and price alert capabilities. Notably, these mobile platforms seamlessly synchronize with your online trading account and vice versa, ensuring a cohesive trading experience across devices.

Traders enjoy access to both forex and CFD trading within the MetaTrader app. This comprehensive app incorporates 30 indicators, watch lists, alerts, trendlines, and charts spanning various time frames. In essence, it caters to the needs of a wide range of traders, from novices to advanced practitioners.

74-89 % of retail investor accounts lose money when trading CFDs

Pepperstone Fees

★★★★★ 4.9/5

Pepperstone boasts competitive fee structures, particularly suitable for active traders who engage in frequent trading activities throughout the week or day. While their standard account features trading fees that align with industry averages, the Razor account presents significantly improved fee structures tailored to the needs of active traders. Pepperstone's utilization of multiple liquidity providers ensures that traders benefit from competitive quotes and narrow spreads across a wide array of instruments and assets.

The spreads offered are variable and contingent upon prevailing market conditions. Drawing from various providers, Pepperstone's spreads can be as tight as 0 pips on the EURUSD pair during periods of high liquidity, especially in the Razor account.

Pepperstone commissions on Razor accounts

Below, you'll find the commissions applicable to both MT4 and MT5 Razor accounts, denominated in USD and EUR.

MT5 Razor Account

| Account currency | Commission per 0.01 lots | Commission per 1 lot |

|---|---|---|

| USD | USD 0.04 (USD 0.08 round turn) | USD 3.50 (USD 7 round turn) |

| EUR | EUR 0.03 (EUR 0.06 round turn) | EUR 2.60 (EUR 5.20 round turn) |

MT4 Razor Account

| Account currency | Commission per 0.01 lots | Commission per 1 lot |

|---|---|---|

| USD | USD 0.04 (USD 0.08 round turn) | USD 3.50 (USD 7.0 round turn) |

| EUR | EUR 0.03 (EUR 0.06 round turn) | EUR 2.60 (EUR 5.20 round turn) |

cTrader Commissions

Below, you'll find the commissions applicable to both MT4 and MT5 Razor accounts, denominated in USD and EUR.

Overnight Funding Fees:

Should you decide to keep a position open overnight, an overnight funding charge will be applied to your account. These rates adhere to the regional benchmark rates for Equity CFDs, Share CFDs, and commodities. Pepperstone applies a fixed rate of 2.5% for these overnight funding fees.

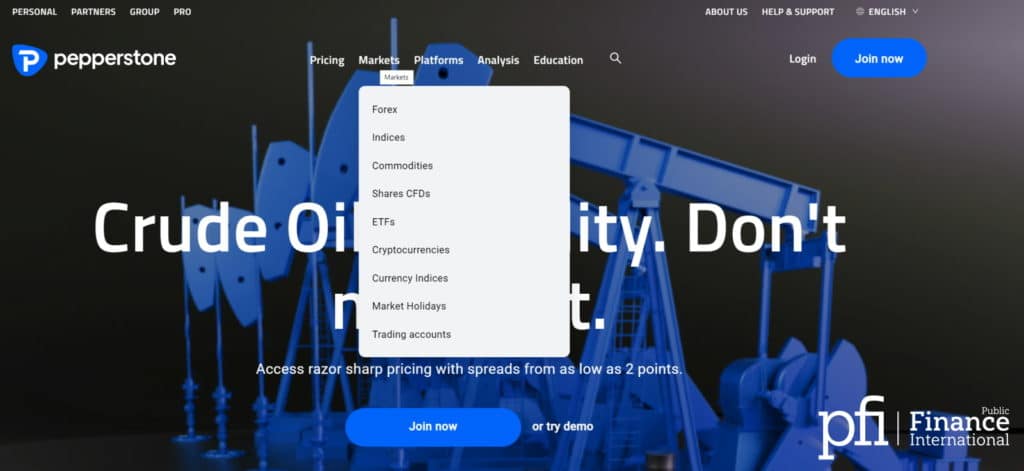

Pepperstone Markets Available

★★★★★ 4.5/5

Pepperstone impresses with its extensive offering of over 1200 instruments spanning various markets. While they provide CFDs across Forex, Indexes, Shares, ETFs, Commodities, and Cryptocurrencies, Pepperstone truly excels in its core competency – forex trading. They offer a diverse range of currency pairs, including majors, minors, crosses, and exotics, featuring low commissions and tight spreads.

The financial instruments available at Pepperstone encompass:

- Forex – Pepperstone provides access to approximately 70 currency pairs, encompassing major, minor, cross, and exotic pairs.

- Indices – Trade a broad selection of over 20 global indices on Pepperstone's platform, including NASDAQ, FTSE100, All Australian 200, and the Hang Seng.

- Share CFDs – With a catalog exceeding 1,000 global shares, primarily sourced from the US market, Pepperstone's share CFDs offer leveraged trading opportunities on some of the world's most prominent companies.

- ETFs – Pepperstone offers over 100 Exchange Traded Funds (ETFs) hailing from 35 countries.

- Metals – The platform includes several metal pairs, such as gold, silver, copper, and platinum.

- Commodities – Gain access to popular commodities such as crude oil and natural gas or engage in trading soft commodities like corn, wheat, coffee, and sugar.

- Cryptocurrency – : Stay at the forefront of the cryptocurrency movement with a selection of cryptocurrency CFDs, allowing you to participate in the cryptocurrency market's dynamics.

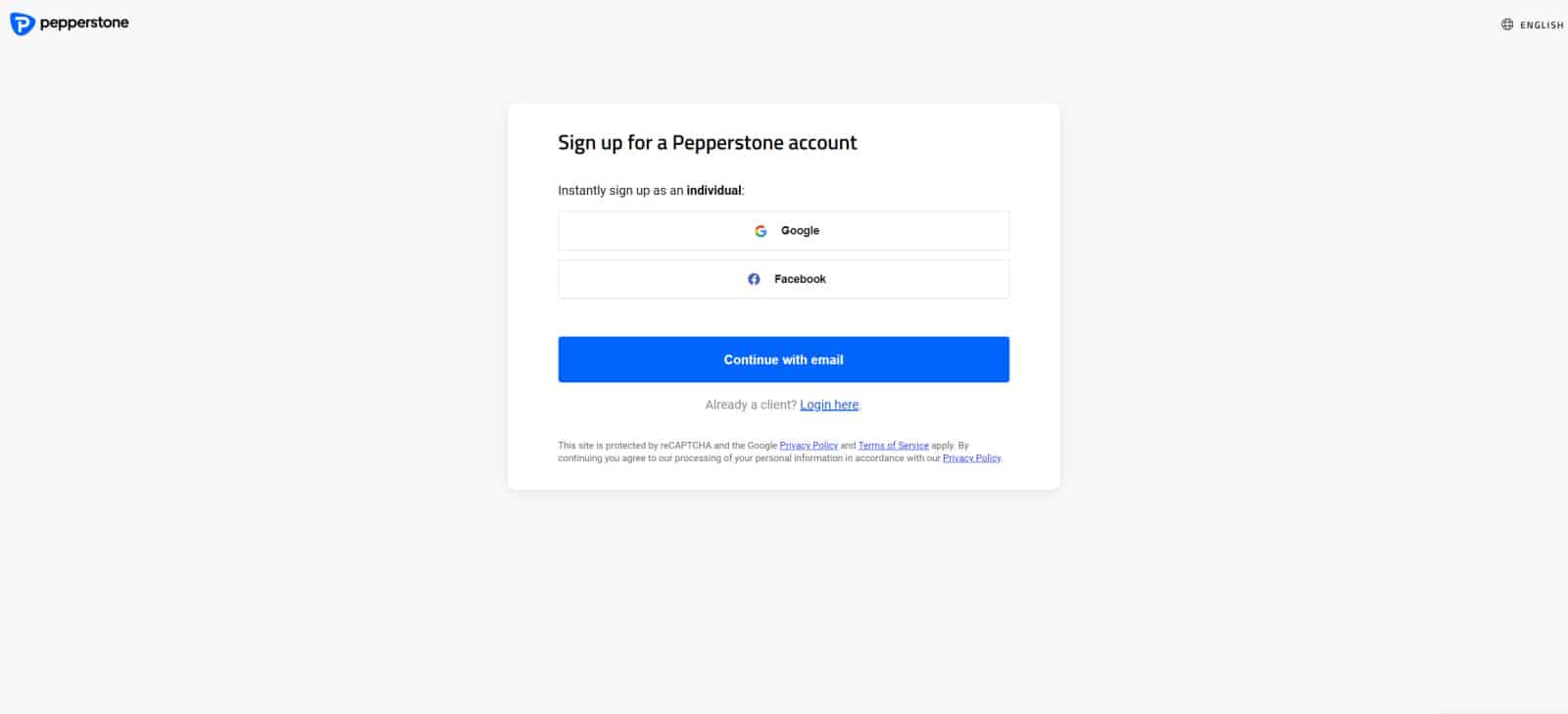

Opening an account

★★★★★ 5/5

The process of opening a Pepperstone account is remarkably straightforward and efficient, typically requiring just 10 to 15 minutes if you have your identification documents readily available. Notably, there is no minimum deposit requirement for the standard account, making it accessible to a wide range of traders. In my personal experience, the process of establishing a Pepperstone account was seamless and user-friendly. Pepperstone extends its services to traders across the globe, with only a few exceptions, including Canada, New Zealand, Japan, and the United States.

Pepperstone provides traders with two distinct account types to choose from – the Razor and Standard accounts. Once your application is approved, you'll be well-equipped to commence your trading journey with Pepperstone, benefiting from their competitive pricing and swift execution speeds.

Standard account

The standard account operates without any commissions, but its spreads are slightly higher compared to the razor account. It presents a spread ranging from 1.0 to 1.3 pips on the raw spread, making it particularly appealing to newcomers in search of a straightforward account.

Razor account

The razor account, on the other hand, is commission-based, offering raw spreads starting from 0.0 pips. This account type is favored by scalpers, algorithmic traders, and clients who wish to utilize Expert Advisors. For EURUSD, the average spread typically ranges from 0.0 to 0.3 pips, with a commission starting at AUD$7 round turn for every 100,000 traded.

Pepperstone Minimum deposit

Pepperstone sets its minimum deposit for a standard account at a remarkable $0, surpassing the industry average, which typically spans from $10 to $10,000.

Swap-free Account

For Islamic traders seeking to participate in financial markets while adhering to Islamic law, Pepperstone offers swap-free accounts. These accounts eliminate interest-based fees associated with trades, aligning with the prohibition of "riba" or interest payments in Islamic banking.

Swap-free accounts provide Muslim traders with access to the same financial markets as their counterparts without compromising their religious principles. These accounts function similarly to standard accounts but do not incur swap fees. Instead, an administration fee is applied every 11 days if a position remains open.

It's worth noting that swap-free accounts are available only in countries with a Muslim-majority population. If you're a Muslim trader in a non-Muslim country, you may not have access to Pepperstone's swap-free trading account for online Forex Trading.

74-89 % of retail investor accounts lose money when trading CFDs

Funding Your Account

★★★★ 4/5

Once you've successfully opened and verified your Pepperstone account, you'll find it convenient to fund it using a range of payment methods. Pepperstone accepts various base currencies, including AUD, GBP, CAD, USD, SGD, EUR, HKD, NZD, CHF, and JPY.

If you fund your Pepperstone account in the same currency as your intended asset trading, you won't incur any conversion fees. To optimize your savings on currency conversion fees, consider opening an online multi-currency bank account.

It's important to note that while Pepperstone offers a diverse selection of deposit and withdrawal methods with no fees, international bank transfers are subject to a $20 USD fee.

Additionally, if you choose to withdraw funds using Neteller or Skrill, each withdrawal will be accompanied by a $1 charge.

Payment methods available will depend on your region but include

- Bank Transfer

- Visa & Mastercard

- BPay

- Poli

- PayPal

- Neteller

- Skrill

With the exception of bank transfers, these payment options facilitate instant deposits, while withdrawals typically require 3-5 days for processing.

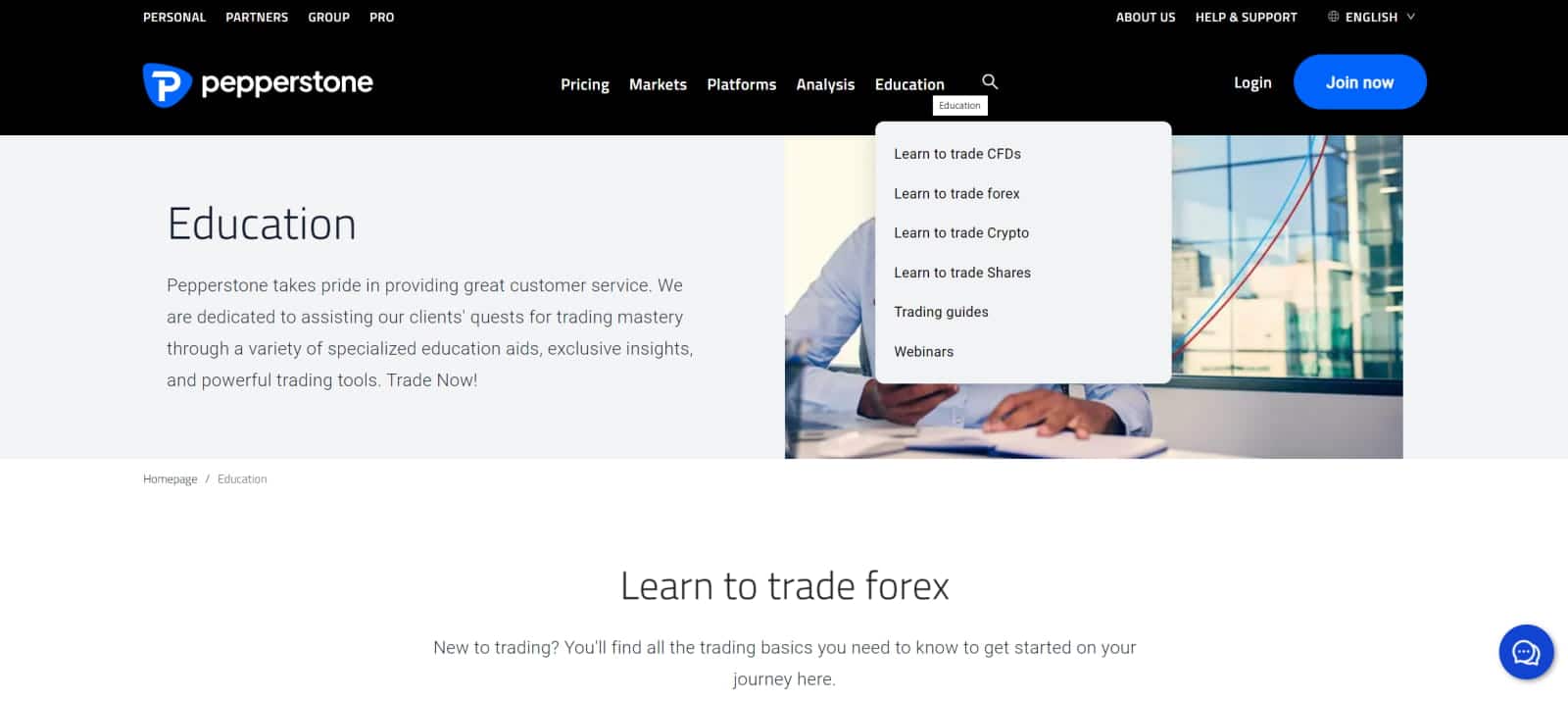

Research and Education

★★★★★ 5/5

Pepperstone's research and educational offerings surpass industry standards. Their website dedicates an entire section to education and analysis, providing a wealth of resources. They host webinars featuring professional analysts, offer guides, deliver market news, furnish market analysis, and maintain an economic calendar. For novice traders, there is a dedicated section that guides you through the essentials of trading forex and CFDs.

Customer Service

★★★★ 4/5

Pepperstone boasts a commendable customer service setup, earning it a solid 4/5 rating. They provide 24/5 phone support, live chat, and email assistance.

Australian account holders with Pepperstone can reach out via phone at 1-300-033-375, while international account holders have the option to dial +613 9020 0155. For email support, inquiries can be sent to [email protected].

In my testing, I found that all three channels of communication delivered impressive response times. The live chat, in particular, stood out as a valuable resource, with support agents who were not only friendly but also well-informed. Pepperstone's website also includes a support page featuring frequently asked questions that prove to be quite helpful.

Support is available in multiple languages, including English, Vietnamese, Thai, Chinese, Polish, and Arabic.

Pepperstone Leverage

Pepperstone offers leverage of up to 400:1, although the specific leverage level varies depending on the jurisdiction. For forex trading, the leverage is set at 30:1 under ASIC regulation, 30:1 under DFSA regulation, and 30:1 under FCA jurisdiction. This means that with every $1 in your account, you can trade up to $30 in the forex market under these respective regulations.

| Regulation | Leverage |

|---|---|

| ASIC | 30:1 |

| CySEC | 30:1 |

| FCA | 30:1 |

| DFSA | 30:1 |

| BaFIN | 30:1 |

| SCB | 200:1 |

| CMA | 400:1 |

Leverage Explained

Leverage is a double-edged sword that can amplify both profits and losses. The size of your position has a direct impact on your profit/loss (P/L) because leverage magnifies it. Margin, on the other hand, represents the funds required in your trading account to initiate or maintain a position. Margin requirements are typically expressed as a percentage of the full position size (e.g., 0.5%, 1%, 2%). The specific leverage ratio depends on regulatory guidelines, the financial instrument, and the asset class. Forex trading often offers higher leverage compared to cryptocurrency trading, where leverage tends to be lower.

Bonus Information

Pepperstone does not provide deposit bonuses. This decision is in compliance with European regulations, which prohibit deposit bonuses. Instead, Pepperstone focuses on delivering a cost-effective trading platform and exceptional service to its clients. In 2018, the European Securities and Markets Authority (ESMA) banned all forex deposit bonuses within the European Union.

Pepperstone does offer a "refer a friend" program, allowing traders to invite friends or family to trade with the platform. The bonus amount for referring a trader varies based on the jurisdiction, with specific requirements such as funding the referred account and executing a certain volume of trades.

Pepperstone also features an Active Trader Program, where traders can earn cash rebates and reduce their commissions based on their monthly forex trading volume. The rebate amount is determined by the number of standard lots traded.

For high-volume traders, the Active Trader Program offers additional benefits such as priority customer support and free Virtual Private Server (VPS) services.

Regulation Overview:

Pepperstone Group Limited is regulated by multiple reputable authorities, enhancing its credibility and safety for traders. These regulatory bodies include the Financial Conduct Authority (FCA #684312) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, the Dubai Financial Services Authority (DFSA), the Seychelles Financial Services Authority (SCB), the Capital Markets Authority of Kenya (CMA), the Cyprus Securities and Exchange Commission (CYSEC), and the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFIN).

This multi-regulatory approach ensures that Pepperstone adheres to high standards of financial regulation and customer protection. Client funds are held in segregated accounts with tier-1 banks, and the compensation schemes offered by both the FCA and ASIC further safeguard client assets.

Pepperstone undergoes regular independent audits to maintain its commitment to regulatory compliance, establishing itself as a trustworthy Forex broker in the industry.

Pepperstone Awards

While awards may not be the sole determinant for choosing a broker, they serve as a testament to a broker's reputation and excellence in the industry. Pepperstone has received numerous awards over the years, including:

- TradingView Broker of the Year 2022

- FX Scouts Global Forex Broker of the Year 2022

- InvestinGoal Best Broker in the World and Best Broker in Australia 2021

- Best Forex Trading Support – Europe (Global Forex Awards) 2019

These awards reinforce Pepperstone's standing as a top-tier broker with a commitment to trading excellence and customer support.

Pepperstone Pros and Cons

In conclusion, let's summarize the key advantages and disadvantages of Pepperstone as a broker to provide a well-rounded view for potential traders.

| Pros | Cons |

|---|---|

| Regulated by multiple regulatory bodies, including the Australian Securities and Investments Commission (ASIC) and the UK's Financial Conduct Authority. | No US-based clients due to regulatory restrictions. |

| Offers a wide range of trading instruments, including forex, indices, commodities, and cryptocurrencies. | They are a relatively new company compared to some established brokerages. |

| Low fees, with competitive spreads and no deposit or withdrawal fees. | CFDs are the only options available for those looking to purchase bonds, stocks or mutual funds. There is no opportunity for direct purchasing. |

| Fast and reliable execution with multiple trading platforms available, including MetaTrader 4 and 5, as well as cTrader. | |

| Safety features, including negative balance protection, to safeguard your account. | |

| No fees are incurred for inactive accounts. | |

| Strong customer support, with 24/5 availability and multiple languages supported. |

Conclusion: Pepperstone Review

Navigating the world of forex trading can be a daunting task, especially when searching for a reputable and secure platform. After a thorough evaluation of Pepperstone's services, it's evident why this platform has garnered such a strong reputation in the industry.

Pepperstone's Razor account and Active Traders program offer exceptional pricing, setting it apart as an ideal choice for experienced traders seeking competitive advantages.

What truly distinguishes Pepperstone, however, is its commitment to ensuring accessibility for all, including novice investors. Their user-friendly standard package is equipped with essential tools, making it an excellent starting point for those beginning their forex trading journey. As someone who once grappled with the complexities of trading as a beginner, I can confidently assert that Pepperstone provides an excellent entry point.

In conclusion, Pepperstone stands as a trustworthy broker that checks all the right boxes. Its competitive pricing, narrow spreads, minimal commissions, and top-notch customer service make it an appealing choice for traders of all levels.In conclusion, Pepperstone stands as a trustworthy broker that checks all the right boxes. Its competitive pricing, narrow spreads, minimal commissions, and top-notch customer service make it an appealing choice for traders of all levels.

I trust that my Pepperstone review has provided valuable insights to assist you in making an informed decision regarding whether to choose this platform for forex or other financial instrument trading.

74-89 % of retail investor accounts lose money when trading CFDs

FAQs

Does Pepperstone offer a Demo Account?

Yes, Pepperstone provides a free demo account, making it an ideal choice for beginners looking to practice real-world forex trading without any financial risk. This platform offers a secure and risk-free environment to explore different trading strategies and become familiar with the trading platform. The demo accounts are available for up to 30 days, providing ample time to build confidence in your trading abilities before transitioning to live trading.

Which countries are restricted from using Pepperstone's trading platforms?

While Pepperstone caters to clients worldwide, there are specific countries where its services are not available. These countries include the United States and its territories, Canada, Japan, New Zealand, and Zimbabwe.

Is Scalping allowed on Pepperstone's platforms?

Yes, Pepperstone permits scalping and hedging on its Razor trading account. Scalping is supported on the MetaTrader 4, MetaTrader 5, and cTrader forex trading platforms.

Does Pepperstone operate under a Market Maker Model?

No, Pepperstone is not a market maker. It operates as a no-dealing desk (NDD) forex broker, acting as an intermediary between traders and liquidity providers. This means that all client orders are directly routed to the market through Pepperstone's execution venues without any interference from Pepperstone or other market-making entities.

How does Pepperstone ensure the security of client funds?

Pepperstone prioritizes the security of client funds by maintaining segregated accounts for client funds and implementing SSL encryption for its website and client area. These measures are in place to safeguard the integrity and security of client funds and sensitive information.