Most of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FP Markets, also known as First Prudential Markets, has been in operation since 2005, earning a solid reputation for its exceptional customer service, client satisfaction, and swift trade execution. As an Australian CFD and Forex broker under First Prudential Markets Pty Ltd, they offer users access to a vast array of over 10,000 financial instruments. One notable feature is the ability to automate position opening and closing. FP Markets also provides valuable resources such as news updates and economic calendars to help users stay informed about market trends. Additionally, technical analysis indicators and charts are available for deeper insights.

Regulated by the Australian ASIC (Australian Securities and Investments Commission) and monitored by the Cypriot CySEC (Cyprus Securities and Exchange Commission), FP Markets operates under the scrutiny of two esteemed regulatory bodies, instilling confidence in both the platform and its financial products.

In this comprehensive review, we will delve into the intricate details of what FP Markets offers. We'll examine its strengths and areas for improvement within the context of this global forex broker and how it stacks up against other platforms.

| PROS | CONS |

|---|---|

| Low forex trading fees | No support for ETfs, mutual funds, bonds, futures, and options |

| Easy access to funds | Relatively high CFD broker fees |

| Multiple base currencies supported | User interface on the desktop trading platform |

| Various payment methods | Additional fees for deposits made in currencies other than AUD |

| Low minimum deposits for forex trading | |

| Access to a demo account | |

| No withdrawal fees | |

| There are no withdrawal fees |

FP Markets Trading Platform Overview

As of the current date, FP Markets provides access to its platform through three main avenues: desktop, web, and mobile. Most users tend to utilize all three options for a seamless trading experience.

Desktop Trading Platform

FP Markets provides access to the well-known MetaTrader 4 and MetaTrader 5 (MT4 and MT5) on their desktop platform. Seasoned traders will find this platform familiar, as it shares significant functionality with the web application. This consistency ensures a similar trading experience across both platforms.

One notable feature of FP Markets' desktop platform is its ability to send alerts for price changes on instruments you're interested in trading. You can set up email and mobile notifications for this purpose.

Through FP Markets' desktop trading platform, you can trade forex, stocks, or CFDs. Stocks are traded on the Australian Securities Exchange. However, like other FP Markets platforms, ETFs, mutual funds, bonds, options, and futures are not available.

Web trading platform

The web trading platform, referred to as WebTrader by FP Markets, offers users a browser-based trading experience without the need for additional software installation. It's accessible on both Mac OS and Windows, but it's recommended to use the latest browser version for security reasons. There are no limitations on what you can trade via the web platform compared to other access points. You can trade Forex, Share CFDs, Indices, Commodities, and Cryptocurrencies.

Mobile trading platform

The web trading platform, referred to as WebTrader by FP Markets, offers users a browser-based trading experience without the need for additional software installation. It's accessible on both Mac OS and Windows, but it's recommended to use the latest browser version for security reasons. There are no limitations on what you can trade via the web platform compared to other access points. You can trade Forex, Share CFDs, Indices, Commodities, and Cryptocurrencies.

To access it, you'll need to download MetaTrader 4 from the App Store. Users benefit from real-time quotes and the ability to execute trades with a single click. In 2019, FP Markets' iOS app received recognition for the quality of trade execution by Investment Trends.

The Android version of MetaTrader 4 is available via the Google Play Store, offering customizable trading layouts and interactive chart features that make data easy to read on a small screen. It also provides the option to track your trading history.

FP Markets – Account opening

Opening an FP Markets account is a straightforward online process, eliminating the need to visit a physical location. However, it's important to note that customers from the US, Belgium, Japan, New Zealand, and some other countries do not have access to FP Markets accounts due to regulatory restrictions.

For forex trading accounts, there is no minimum balance requirement, making it accessible to those starting with limited capital or beginners looking to test the platform and their skills before making larger deposits. However, opening an Iress trading account requires an initial deposit of at least $1,000.

Account types

FP Markets offers different account types, including Forex trading accounts (Standard or Raw) and Iress trading accounts (Standard, Platinum, or Premier). The choice of account type depends on your trading preferences and objectives, with varying minimum deposits, commissions, and leverage options.

Islamic Accounts

FP Markets offers Islamic Accounts for traders with religious restrictions on overnight rollover charges or profits on positions. Metatrader accounts can be converted into Islamic accounts upon request.

Deposit and withdrawal

FP Markets supports various currencies for deposits, including CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, and USD. Deposits can be made using credit or debit cards, bank transfers, online payment systems, or PayPal. Fees and waiting times vary depending on the chosen deposit method and account type.

Please verify the most up-to-date information on FP Markets' website before making any financial decisions.

| Deposit Method | Deposit Fees | Deposit Times |

|---|---|---|

| Neteller | 4% for Iress accounts | MT4/5 done instantly Iress in 1 business day |

| Skrill | 4% for IRESS accounts | MT4/5 done instantly IRESS in 1 business day |

|

PayTrust (PayTrust deposits can only be made in the following currencies: MYR, IDR, TBH, VN) |

There are no deposit fees | MT4/5 done instantly IRESS in 1 business day |

|

NganLuong.vn (Deposits can only be made in VND) |

There are no deposit fees | MT4/5 done instantly IRESS in 1 business day |

|

FasaPay (Deposits can only be made in USD or IDR) |

There are no deposit fees | MT4/5 done instantly IRESS in 1 business day |

| Broker to

Broker (deposits can be made in the following currencies: AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD or USD.) |

There are no deposit fees on deposits made in AUD. Other currencies attract an international charge of 25 AUD. | All transactions take up to 1 business day to clear |

Minimum deposit

When opening an FP Markets forex trading account, you'll need to make a minimum deposit of $100. For Iress accounts, the minimum deposit requirement is $1,000.

Base currencies

FP Markets offers flexibility in choosing base currencies for deposits. While AUD is preferred due to certain advantages, several other currencies are accepted. You can make deposits in the following base currencies: CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, or USD. Keep in mind that using currencies other than AUD may incur additional fees.

Available Markets and Financial Products

FP Markets provides access to six key financial products

- Forex

- shares

- metals

- commodities

- indices

- cryptocurrencies

Forex

With over 60 currency pairs available, the forex market is open throughout the week, offering major currency pairs at all times. Users can take advantage of up to 500:1 leverage for maximizing spreads, and trade spreads start from as low as 0.0 pips.

Shares

FP Markets offers access to over 10,000 Australian and international shares across four continents. Trading shares can be done through two options: Iress with access to over 10,000 CFDs or MT4 & MT5 for trading up to 54 shares on global exchanges.

There are two options through which you can trade shares with FP Markets. Through Iress, you have access to upwards of 10 000 CFDs to trade on exchanges across the world. MT4 & 5 allows you to trade up to 54 shares on global exchanges.

Metals

Precious metals are available for trading through FP Markets. The market operates five days a week, and metals can be traded against currencies, with USD and AUD being commonly used for trading against gold and silver.

Commodities

FP Markets provides access to various commodities with fast execution speeds and leverage of up to 500:1. Trades can be executed using the MT4 platform.

Indices

For trading indices, FP Markets recommends using MT4, which offers technical analysis indicators and a customizable user interface. Margins on indices start from as low as 1%, and overseas stock options include NASDAQ 100, S&P 500, EUREX, and more.

Cryptocurrencies

FP Markets allows trading in five of the most sought-after cryptocurrencies: Bitcoin, Ethereum, XRP (Ripple), Bitcoin Cash, and Litecoin. Notably, you don't need a crypto wallet to trade these currencies, and they offer low spreads.

Research tools available

FP Markets offers a range of research tools for investors, including:

Mini Terminal: Designed to streamline your workflow and focus on specific markets.

Sentiment Trader: Uses live and historical data to provide insights for trading decisions.

Trade Terminal: Provides an overview of all open positions.

Fundamental Analysis: Daily fundamental analysis available on the website's blog section.

Session Map: Presents key indicators for decision-making.

Tick Chart: Ideal for traders entering and exiting multiple positions throughout the day.

Customer Service

FP Markets provides efficient customer support accessible 24 hours a day on weekdays. You can contact customer service via live chat, phone, or email. However, customer support services are reduced on weekends. Staff members are trained to handle technical questions related to trading.

Regulation

FP Markets is regulated by the Australian Securities and Investments Commission (ASIC), one of the industry's respected regulatory bodies. Client funds are segregated, ensuring investor protection. FP Markets also operates under the Australian Financial Services License (ASFL) #286354.

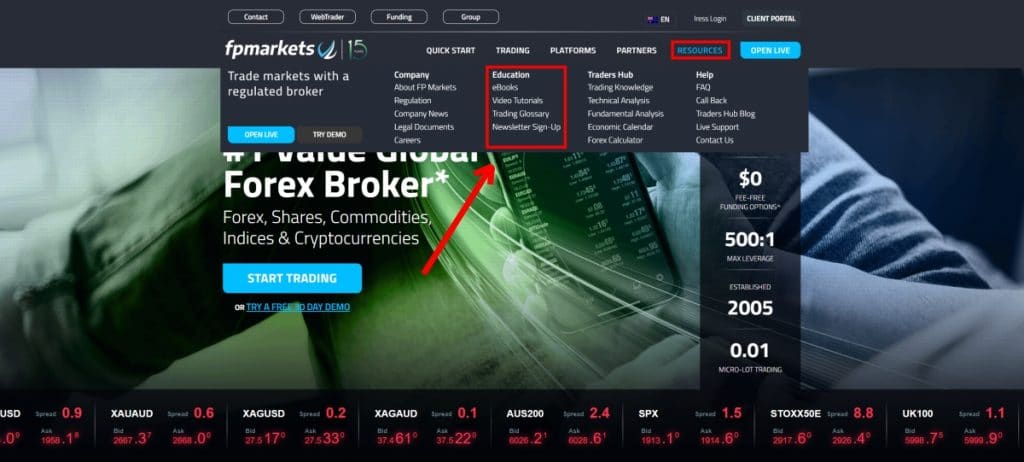

Education

FP Markets offers a robust educational package, including access to a demo account for beginners to practice and improve their trading skills without risking capital. The platform's educational resources are considered among the best in the industry.

For those who are still getting accustomed to the trading platform, FP Markets offers helpful tutorials. These tutorials are designed to simplify the process of finding options and functionality within the platform, catering to both beginners and experienced traders.

FP Markets goes a step further by providing daily fundamental analysis authored by their experts from First Prudential Markets.

If you're eager to dive deeper into trading knowledge, FP Markets offers a comprehensive trading course suitable for beginners looking to elevate their skills, with valuable insights even for experienced traders. To tackle any confusing terminology, there's a detailed trading glossary readily available.

For those who prefer written resources, high-quality eBooks are accessible through the platform's resource tab on the website.

Conclusion

In conclusion, FP Markets ensures peace of mind by offering top-tier liquidity through partnerships with financial giants like JP Morgan, Barclays, HSBC, and Goldman Sachs. This multi-bank liquidity setup provides an additional layer of safety for investors.

To sum up, some of our favorite features offered by FP Markets include an exceptionally low entry barrier for forex trading, quick and straightforward account setup, a reasonable $100 deposit requirement, support for various currencies and payment methods, and the absence of withdrawal fees.

On the flip side, CFD trading on FP Markets carries relatively higher fees and a higher minimum deposit, setting a more substantial entry threshold. However, given the increased risk associated with CFD trading, this higher barrier may serve as a prudent deterrent for less experienced traders.

Taking all aspects into consideration, we confidently recommend FP Markets.

Our Score: 4.5/5

- Established in 2006

- Relatively low minimum deposit

- Low Forex Trading Fees

- Easy account opening

- Excellent customer service

- Seamless Deposits and Withdrawals

Most of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.