XM was founded in 2009. It comprises several entities that use the brand and are regulated in various jurisdictions. Trading Point of Financial Instruments Ltd, XM's first entity, was established in 2009 in Cyprus and is regulated by CySEC. In 2015, XM opened an ASIC-regulated entity in Sydney, Australia. Trading Point of Financial Instruments UK Ltd, XM's parent company in the United Kingdom, is regulated for its Trading.com brand in London. Finally, XM Global Limited is regulated by the IFSC in Belize.

While XM falls short of industry leaders when it comes to platform offerings, market coverage, and pricing, the company excels in providing great educational material and market analysis. XM's 1.5 million traders and investors can pick from a wide choice of XM products and services, including advanced trading solutions that are also suitable for novice traders.

It’s definitely a broker that has gained the liking of many and put a few others off. And this is where the question arises: does XM meet your trading needs? This is exactly what we’re here to answer in this review. So, if you want to figure out whether XM is really the perfect broker for you, keep reading as we break down each and every aspect of XM through our full, honest XM review.

Summary

On the positive side, there are plenty of things to like about XM. Fees are reasonable for deposits of a few hundred dollars. The Zero account option appears to be reasonable for Forex traders with deposits as low as $5. Trading is available in a range of assets, including 1,200+ individual stocks and shares. With a long track record and solid regulatory standing in Belize, Cyprus, and Australia, XM has a reputation that is on the higher end of the business average.

However, it lags behind in certain aspects like not being available to US-based clients, not offering a competitive number of tradable symbols, and having pretty high spreads for the Standard account.

Overview

| Trading Platform | XM |

|---|---|

| Founded | 2009 |

| Headquarters | Limassol, Cyprus |

| Minimum Deposit | $5 |

| Financial instruments | CFDs on Stocks, Forex, Commodities, Equity Indices, Precious Metals, Shares, Energies |

| Regulation | CySEC, FCA, ASIC |

| Demo Account | Yes |

| Islamic Account | Yes |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| Mobile App | Yes |

| US-Accepted | No |

| Our Score | 4.3/5 |

Pros and Cons

As we mentioned before, XM has both great sides and drawbacks, and the first step to decide whether you want to invest in XM is to know exactly where it stands out and where it lags behind.

|

|

|

|---|---|

| Great trading tools and loyalty program |

Not available for US-based clients |

| Competitive trading cost | No fixed spread accounts |

| Low minimum deposit |

Inactivity fee |

| High leverage |

|

| Comprehensive research and education | |

| Robust regulation |

|

| Negative balance protection | |

| Prompt customer support with over 25 languages |

XM Compared

The below table shows how XM compares to its biggest competitors in the industry:

| Platform | XM | eToro | OctaFX | Plus500 | IC Markets |

|---|---|---|---|---|---|

| Regulation | CySEC, ASIC, IFSC | ASIC, FCA, CySEC, MiFID | CySEC | CySEC, FMA, MAS, SFSA, FSCA, ASIC, FCA | CySEC, FSA, ASIC, SCB |

| Founded | 2004 | 2007 | 2017 | 2008 | 2007 |

| Inactivity Fees | $15 one-off +$5/month | $10/month (after 12 months of no login activity) | $0 | $10/month (after 3 months of no login activity) | $0 |

| Minimum Deposit | $5 | $10 - $10,000 | $100 | $100 | $200 |

Offering of Investments

XM provides its clients with 1,230 CFDs across numerous classes of assets, as well as 100 exchange-traded securities , all through its many brands. The table below outlines the many products offered by XM:

| Forex | Yes |

|---|---|

| CFDs | Yes |

| US Stock Trading (Non CFD) | Yes |

| Int'l Stock Trading (Non CFD) | Yes |

| Social Trading/ Copy Trading | Yes |

| Cryptocurrency (CFD) | Yes |

| Cryptocurrency (Physical) | No |

| Forex Pairs | 57 |

| Tradable Symbols | 1,327 |

Account Opening

Opening an XM account is easy and straightforward. It is done completely online and you might be able to get your account live in one business day.

Account Types

Traders have access to a competitive and cost-effective trading environment in terms of trading and non-trading fees, which is all thanks to the wide variety of account types offered by the broker. Regardless of their degree of skill, education, or experience, XM traders are provided the advantage they require to facilitate their trading activity. Below is a list of the account types offered by XM:

| Account Name | Benefits |

|---|---|

| Micro Account |

|

| Standard Account |

|

| Ultra-Low Account |

|

| Shares Account |

|

XM offers a demo account that is great for beginners who wish to brush up on their skills using virtual funds. It’s perfect if you want to compare brokers and put their trading strategies to the test in a real live environment with simulated risk, and without losing your cash.

Signing up for an XM demo account is hassle-free and completely digital. It takes a few minutes and your demo trading can start as soon as you register.

XM offers an Islamic Account, which serve traders who adhere to Sharia law that prohibits its adherents from paying any interest, like overnight fees.

XM gives Muslim traders the option of creating an Islamic Account on all of the available live trading accounts, with no additional commissions or administration costs on some financial instruments.

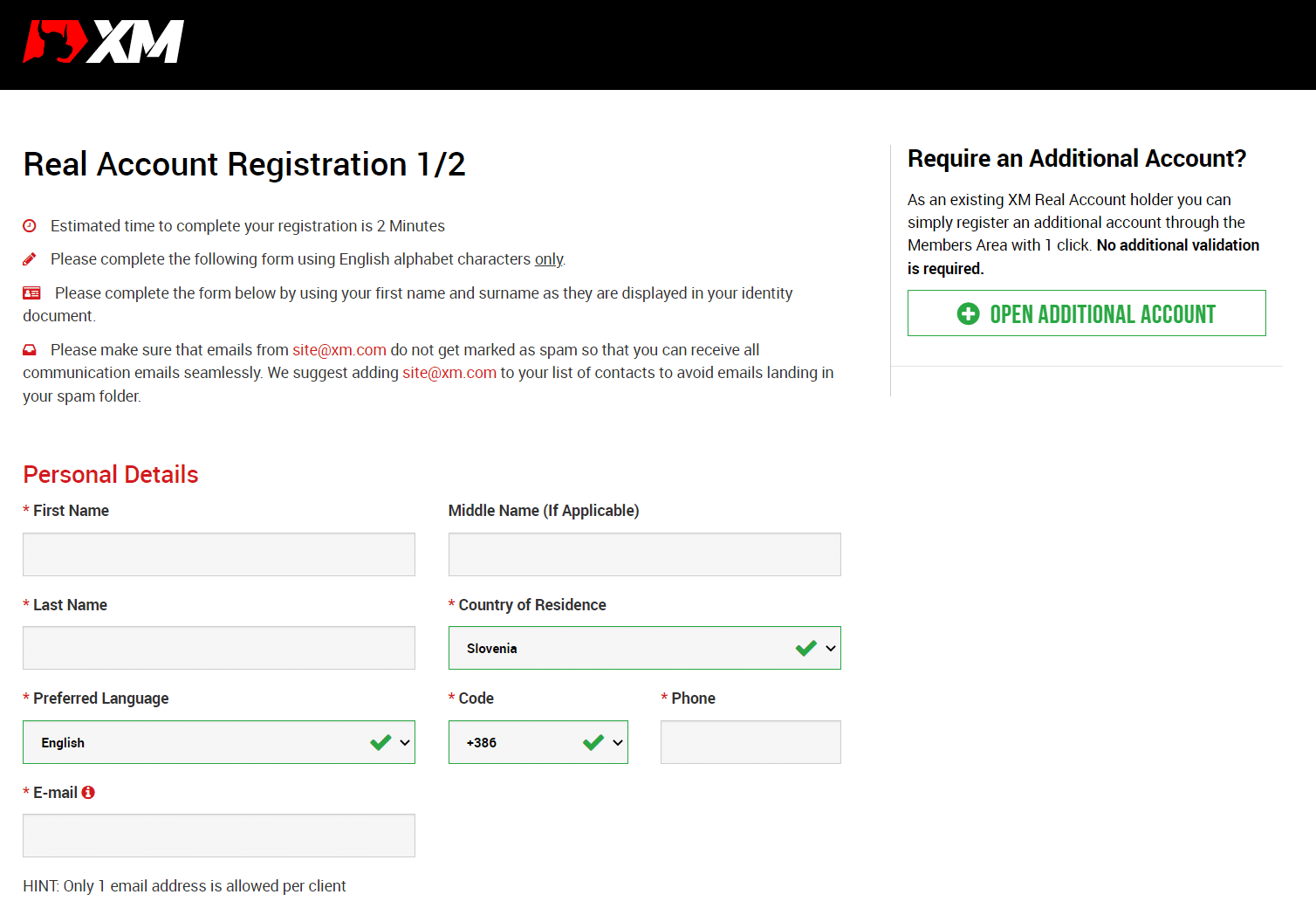

How to open an account

XM account opening process is digital and fast. Just fill out the form on their website. During our testing, our account was opened and verified on the same day.

XM offers the following languages:

- Arabic

- Bengali

- Chinese

- Czech

- Dutch

- English

- Filipino

- French

- German

- Greek

- Hungarian

- Indonesian

- Italian

- Korean

- Malay

- Polish

- Portuguese

- Russian

- Spanish

- Swedish

- Thai

- Vietnamese

To open an XM account, follow these steps:

- Fill in your first and last name, your country of residence, email and phone number.

- Select your account type, and MT4 or MT5 as your preferred trading platform.

- Fill in your personal information (birth date, address…)

- Select the leverage level and base currency.

- Fill in the questionnaire about your trading knowledge.

- Verify your account by providing your ID, passport or drivers license. Utility bills and bank statements are accepted as proof of residency.

Commission and Fees

XM clients can enjoy instant execution through XM's Zero account, which does not have any rejections or requotes. However, when it comes to price, XM still lags behind the leading forex brokers in terms of pricing.

There are 4 main accounts to choose from on XM, and commissions and fees are determined by the account type and the chosen global entity. The commission-based Zero and the Ultra Low account are cost-effective. However, the commission-free Standard and Micro accounts are rather costly. It's worth noting that the Zero and Ultra Low accounts aren't available in every XM entity.

Average spreads on the USD/EUR pair are 0.1 pips in the commission-based XM Zero account, which, after you include the $7 round-trip commission, makes the spread 0.8 pips. Both the Micro and Standard accounts have spreads of 1.6-1.7 pips, making them much less appealing options in terms of price.

XM is the only dealer in every trade it executes. This mechanism makes the broker execute for almost $50 m at a time and 200 open positions at the same time. Plus, XM offers a Shares account (not available at all the XM entities), which takes a deposit of $10,000 and is designed for clients who wish to trade shares without any leverage.

XM Fees Compared

XM CFD trading fees are low and there is no withdrawal and deposit fees. Forex and stock index fees are in line with the industry average.

| Platform | XM | eToro | Plus500 |

|---|---|---|---|

| Stock Fees ($1000 trade AAPL) | $5.4 | 0% (spot), $0.9 (CFD) | Varied Spread: $10,5 (CFD) |

| Cryptocurrency Fees ($1000 BTC Trade) | N/A | $7,5 | Varied Spread: $5,08 |

| Options Fee | N/A | N/A | Varied Spread |

| Forex Fees (EURUSD) | 1.7 pips (Standard, Micro, and Ultra-low accounts), $3.5 commission per lot + spread (Zero Accounts) | 1 Pips | Varied Spread |

Spreads

If you open a Micro or Standard account with XM, the costs and pricing are based on a spread. Furthermore, the XM spread is a fractional pip price that is derived by the multiple liquidity providers of XM's. Adding a 5th digit, known as a fraction, to regular 4-digit quoting prices allows you to benefit from the tiniest price swings.

For the most popular assets, average spread references calculated during the day on a Standard account are shown below:

| Instrument | Spread |

|---|---|

| USD/EUR | 1.7 pips |

| Gold | 35 |

| Crude Oil WTI | 5 pips |

| BTC/USD | 60 |

Minimum Deposit

XM's minimum deposit is $5 for a Micro Account or a Standard Account. But, if you want to trade with a Zero Account, the minimum deposit is $100. However, the amount changes depending on the payment method selected and the status of the trading account's validation.

XM's financial transactions are handled in a customer-centric manner, with clients having access to a variety of payment methods that are accepted in all countries. XM provides a variety of payment alternatives, including the most regularly used, as well as a local bank transfer option, which allows clients to fund their accounts using local banks and currencies without incurring conversion fees.

XM’s deposit options are:

- Credit cards

- E-wallets like Moneybookers Skrill, Neteller, and Western Union

- Bank wire and Local Bank Transfer

Minimum Deposit Compared

| Platform | Minimum Deposit | Deposit Fee | Withdrawal Fee |

|---|---|---|---|

| XM | $5 -$100 | $0 | $0 |

| Plus500 | $100 | $0 | $0 |

| eToro | $10 - $10,000 | $0 | $5 |

| OctaFx | $25 | $0 | $0 |

Base Currencies

At XM you can open an account with 11 base currencies. Here is a list of base currency options: EUR, USD, GBP, CHF, JPY, AUD, RUB, PLN, HUF, ZAR, SGD. If you open an account in EUR and then transfer your funds in EUR, your funds are converted into USD at the inter-bank price.

Withdrawal

Withdrawal options at XM are the same as its deposit options. These include bank wire transfers, credit/debit cards, and e-wallets. XM does not charge withdrawal fees or deposit fees. The company has covered all transfer fees, including major credit cards, instant account funding, e-wallets, and wire transfers, with no hidden fees.

Furthermore, the majority of brokers in the industry charge for wire withdrawals, deposits and withdrawals. On XM withdrawals above $200 USD and conducted by wire transfer are covered under their zero fees policy. This is a big plus for traders who want to cut their costs on withdrawal and deposit fees.

Leverage

XM offers leverage up to 1:888 depending on your account type and the entity under which XM follows regulatory restrictions. As a result, always refer to the rules of your residency to determine the leverage level you are permitted to use, because different XM entities apply different conditions due to regulatory reasons. Leverage is also dependent on the financial instrument.

XM Europe provides up to 30:1 leverage, which applies to XM's EU-regulated entity. XM Australian-based entity offers up to 500:1. And finally, the international entity allows a pretty high leverage of 1:888.

Note: Always choose your leverage wisely, as well as the XM entity under which you want to trade. You can learn more about this at the XM education center.

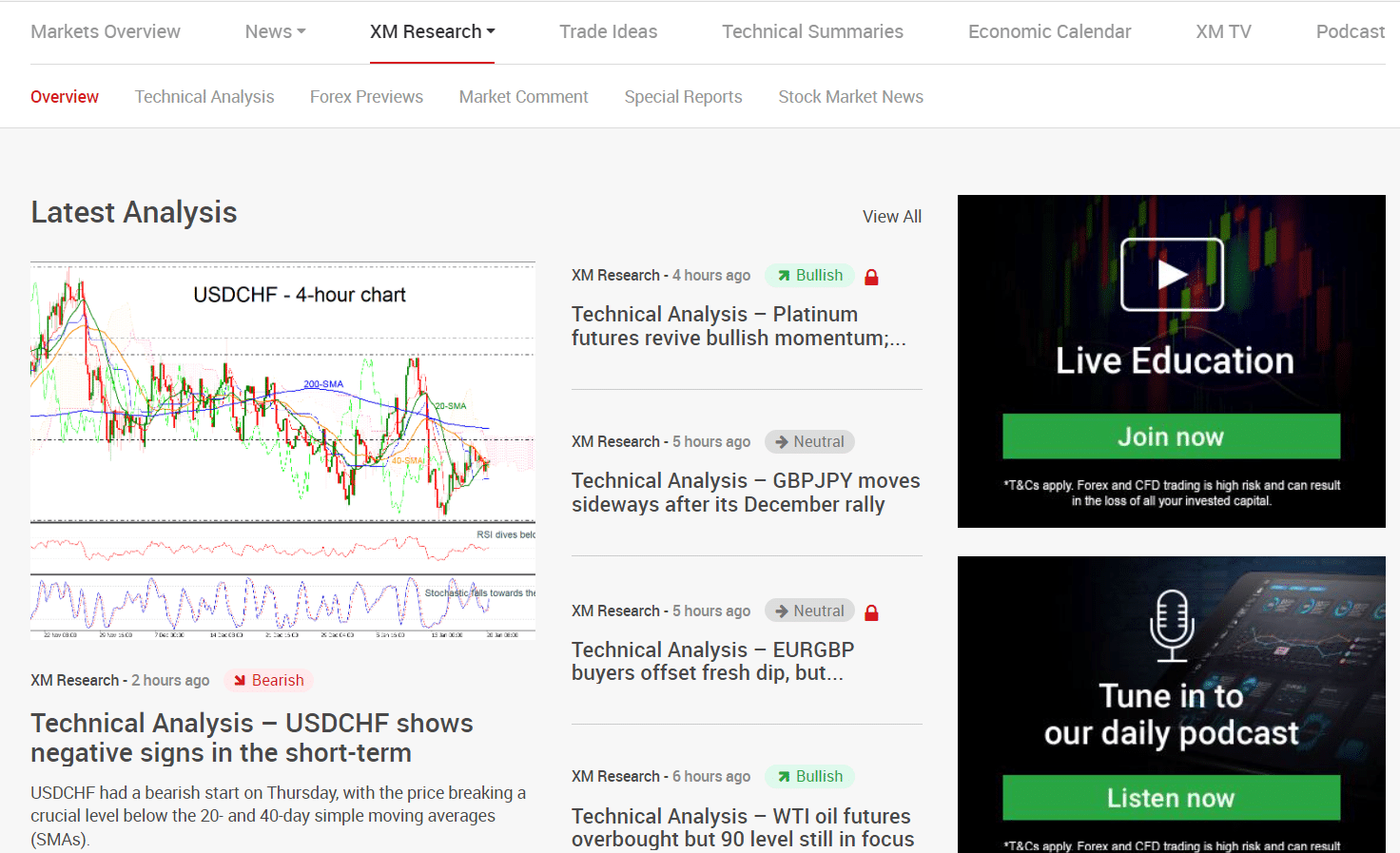

Research

XM research is one of the world's most trusted and Filtering material by asset classes is possible in the XM’s News section, making it easy to access articles about forex, stocks, indices, and cryptocurrencies. We do appreciate XM’s scope of research material, owing to its high-quality daily market recaps as well as fundamental and technical analysis articles.

XM TV, a product of XM, is an absolute gem, providing outstanding daily in-house market commentary that strongly competes with leaders in video, such as Saxo Bank, IG, and CMC Markets. It’s true that the market research is mostly outside of MT4, but XM provides clients with a comprehensive and high-quality package that suits most.

Clients with live accounts can access XM's Trade Ideas and Technical Summaries hub, with signals that stream from both Analyzzer and Autochartist. Trading Central also offers trading ideas. XM provides social copy trading from compatible expert advisors built by Analyzzer as well as the MetaTrader signals market that supports automated trade copying.

Compared to the research of leaders in the industry, XM has one disadvantage: the trading platforms are separated from the research.

Education

The XM provides a wide range of high-quality educational material that competes with industry titans like IG, Saxo Bank, and FXCM.

For example, Tradepedia, the company's in-house video course, is an excellent collection to reference for newcomers. It delivers educational Forex and CFD material. With 39 videos spread throughout 7 chapters and high-quality coverage for both beginner and advanced videos, the series is undoubtedly helpful. The course instructor shows how to use some of the company's own indicators, like the Avramis River indicator.

There are a total of 53 written articles grouped in a progressive fashion throughout 6 chapters, covering 13 lessons in forex, beginning with the fundamentals and progressing to more advanced topics.

Plus, XM offers comprehensive coverage of time zones and a detailed timetable arranged by experience level for clients to subscribe to, with 49 webinar instructors who cover 19 languages every week.

Trading Platforms

XM clients have access to the well-known MetaTrader4 and MetaTrader5 platforms, which are what allows them to conduct their trades. XM bases their technology on the most widely used industry platforms (MT4 and MT5) for the benefit of traders, as the platforms are well-developed and provide access to countless extensions as well as full training on how to use tools. The platforms have received high ratings as a result of their good reputation and are always a plus for brokers.

All platforms are integrated with a site full of stop or trailing orders, indicators, technical analysis, and other comprehensive tools, and these are all directly accessible from only one account and available to clients in several versions. You can always access XM simply by using a browser and logging into Web Trading.

XM has a software that is powerful and suitable for any device, including web, mobile, and multi-account trading. If you choose the Desktop platform or other versions, you’ll have complete account capability and the trading process will be a breeze.

Because XM employs MT4 and MT5, you can take advantage of its advanced features, such as automated trading and trading bots. And for those who favor technology trading, they can always use EAs with unlimited chart usage and manual trading tools.

To put it simply, almost all of your trading needs in this area will be met!

Mobile Trading Experience

XM is a MetaTrader-only broker, so the iOS and Android versions of the MT4 and MT5 mobile apps are available and you can download them from the Apple iTunes and Google Play stores. These apps allow access to your account with complete account functionality from a tablet or smartphone. With three chart types, more than 30 technical indicators, and a trading history journal, the MT4 and MT5 apps provide excellent charting.

Is Your Money Safe on XM?

When it comes to safety, XM is considered average risk. It’s not publicly-traded and doesn’t operate a bank. Two tier-1 authorities, one tier-2 authority, and one tier-3 authority regulate XM. It's regulated by the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities & Investment Commission (ASIC) and the Financial Conduct Authority (FCA).

XM operates under different entities, and which one you will use, depends on your residency.

| Client Residency | Investor Protection | Regulation | Entity |

|---|---|---|---|

| EEA | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | Trading Point of Financial Instruments Ltd. |

| Australia | N/A | Australian Securities and Investments Commission (ASIC) | Trading Point of Financial Instruments Pty Ltd. |

| Middle-East | N/A | Dubai Financial Services Authority (DFSA) | Trading Point MENA Limited |

| International | N/A | International Financial Services Commission of Belize (IFSC) | XM Global Limited |

Customer Support

It's always nice to know that if you do need assistance at any time, you'll get it quickly and efficiently. Customer service at XM is fast and reliable. Support is available in a wide range of languages, with native speakers providing assistance to clients in over 25 languages.

XM support representatives speaks: English, Japanese, Chinese, Greek, Bahasa Malay, Bahasa Indonesia, French, Spanish, Italian, Hungarian, Russian, Dutch, German, Polish, Portuguese, Czech, Slovakian, Bulgarian, Hindi, Arabic, Korean, and Romanian. You can reach out to representatives in several departments across the globe.

You can contact XM by:

- Phone

- Live Chat

Support is available 24/5 via live chat, email, and phone, during the same time period as when the markets are open.

We found their response time is quick and representatives provide relevant answers. Live chat response was quick, phone support was great and we got the answers to our questions. We received replies to our email withing one business day.

Phone number: +501 223-6696

Email: [email protected]

Accepted Countries

XM allows clients from most countries, including Malaysia, Netherlands, Singapore, South Africa, United Arab Emirates, United Kingdom, Germany, Hong Kong, India, Ireland, and Australia. However, clients from the United States, Canada, China, and Japan, are not accepted by XM.

In addition to giving personal information, new users on XM must provide proof of ID. An official national identity card, passport, or driver's license can be used to verify identification. Response times are very fast for verification after you upload images.

The Bottom Line

XM Group offers around 1300 instruments, including 57 currency pairs, but it lags behind the leading forex brokers who provide their clients with thousands of tradable symbols. While XM Group's commission-based account pricing is competitive, its Standard account spreads are pretty high.

XM Group, despite its drawbacks, provides traders with exceptional research and education, making it a good pick for novice and seasoned traders who value quality market research. It also offers a good variety of account types to suit the different needs of its clients. Plus, it’s a well-regulated, standard MT4 broker, which is a relief for clients who want to minimize the risk of suddenly losing their money on a broker.

It’s your decision at the end of the day, whether you’re willing to accept XM’s flaws and take advantage of its many good sides or you just can’t deal with its drawbacks and want to skip it!

FAQ

What is the minimum withdrawal on XM?

The minimum withdrawal is $5 for Standard, Micro and Zero accounts.

How long does it take to withdraw from my XM account?

While the withdrawal requests process takes little time to be approved (between 1-3 business days), the speed with which the money is sent depends on the country that the money is being transferred to, as different restrictions and policies apply. The money will be available on your account in 3 business days if you use a standard EU bank, although some methods or institutions may take longer or even process instantly.