Founded in 1978 and listed on the NASDAQ, Interactive Brokers Singapore is a reputable online broker that is based in the United States and has a presence in Singapore. It’s now one of the largest and best-known trading platforms in the US with a substantial presence in Asia. It's also one of the most affordable trading platforms available in Singapore, offering 133+ markets in 33 countries.

With offices in Singapore, the United States, Canada, Switzerland, Hong Kong, Australia, Hungary, Russia, the United Kingdom, Japan, China, Luxembourg, Estonia, Ireland, and India, Interactive Brokers accepts clients from numerous countries and territories.

It’s one of the biggest names in the industry, with a very strong reputation. In this review, we’ll be putting Interactive Brokers SG to the test. We will go over the pros and cons, as well as their main features.

So, before creating a trading account with this broker, have a look at our unbiased Interactive Brokers review to make the most informed decision you can about it.

Summary

When we look at Interactive Brokers SG, we see more positive things than negative ones, and that’s what makes it stand out in the market as a strong, reliable online broker. On the one hand, IBKR has one of the most competitive fee structures in the market, a thorough educational section, a wide selection of products, technology-driven trading tools, and many account base currency. It also doesn’t have minimum account deposit or inactivity fees.

On the other hand, despite all of these attractive features, it falls behind when it comes to certain features. For example, you might find its desktop trading platform a bit complicated, or the fact that It doesn’t offer the most user-friendly account opening process or credit/debit card payment.

Interactive Brokers Singapore Overview

| Feature | Interactive Brokers Singapore |

|---|---|

| Founded | 1978 |

| Headquarters | Greenwich, Connecticut, United States |

| Products | Stocks, bonds, options, ETFs, futures, FX, mutual funds, and metals |

| Minimum Deposit | $0 |

| Withdrawal Fees | $0 |

| Trading Fees | Low |

| Stock Holding Type | Custodian |

| Platforms | Proprietary |

| Base Currencies | 23 |

| Demo Account | Yes |

| Inactivity Fee | No |

| Mobile Apps | Yes |

| US accepted | Yes |

| Customer Service | Phone and live chat |

| Our Score | 4.9/5 |

Pros and Cons

If you’re considering trading with IBKR in Singapore, we recommend that you first have a basic understanding of what it offers and what it doesn’t. The following table of IBKR’s pros and cons may be useful in this regard:

| PROS | CONS |

|---|---|

|

|

IBKR Singapore Compared

IBKR has many strong competitors in the market, including Tiger Brokers, Moomo, TD Ameritrade, and eToro. In order to get a bigger understanding of how IBKR compares to its rivals, check the following table that breaks down the features of each of these brokers.

| Broker | Interactive Brokers Singapore | Moomoo | TD Ameritrade | Tiger Brokers | eToro |

|---|---|---|---|---|---|

| Founded | 1978 | 2018 | 1975 | 2014 | 2007 |

| Minimum Deposit | $0 | $0 | $0 | $0 | $200 |

| Singapore-Accepted |

Yes | Yes | Yes | Yes | Yes |

| Inactivity fee | $0 | $0 | $0 | $0 | $10/month |

| Regulated | Yes | Yes | Yes | Yes | Yes |

Why it’s a Good Idea to Invest with Interactive Brokers SG

From a very attractive fee structure to a large product selection, there are tons of reasons to love IBKR:

- Highly Competitive Trading Costs

When it comes to providing clients with low, affordable trading costs, IBKR reigns supreme. IBKR offers competitive rates that are among the lowest in the industry. Furthermore, these low trading costs aren’t just applicable to equities, but also to other asset classes like forex.

IBKR’s commissions start at 0.08 percent of trade value for Singapore-listed stocks and Hong Kong-listed stocks, US$0.005 per share for US-listed stocks, 0.11 percent of trade value for Singapore and Hong Kong share CFDs, and 0.005 percent per share for US share CFDs. Other rivals that provide similar custodian accounts charge far higher trading costs and a minimum of S$10. But with IBKR, a US stock, for example, costs US$0.005 per share, with a minimum order value of US$1.

- No Account Minimum

The minimum cash deposit necessary to get started with an online broker is a typical issue that faces many new traders. You don’t have to worry about that when getting started with IBKR. The broker (whether in IBKR Pro or IBKR Lite) doesn’t have any required minimum balance to start trading.

IBKR no longer charges its US$10 maintenance fee on a monthly basis, which was a big drawback of this broker in the past. So, you may still use IBKR to execute low-cost trades even if you don't expect to make several trades per month.

- Technology-driven Trading Tools

In order to enhance your trading strategy, Interactive Brokers offers you 100+ order types and algorithms to select from, as well as a variety of trading tools. The broker also provides trading APIs, which enable you to automate your trading strategies, create custom trading apps, and construct commercial trading softwares.

- Wide Range of Products

Investors all over the world seek online brokers with a large selection of offerings. If you’re one of them, we recommend that you invest with Interactive Brokers. You get to trade stocks, funds, bonds, futures, options, and currencies anywhere around the world with just one IBKR account.

IBKR offers the worldwide reach that today's economy requires, with 135 markets, 23 currencies, and 33 countries.

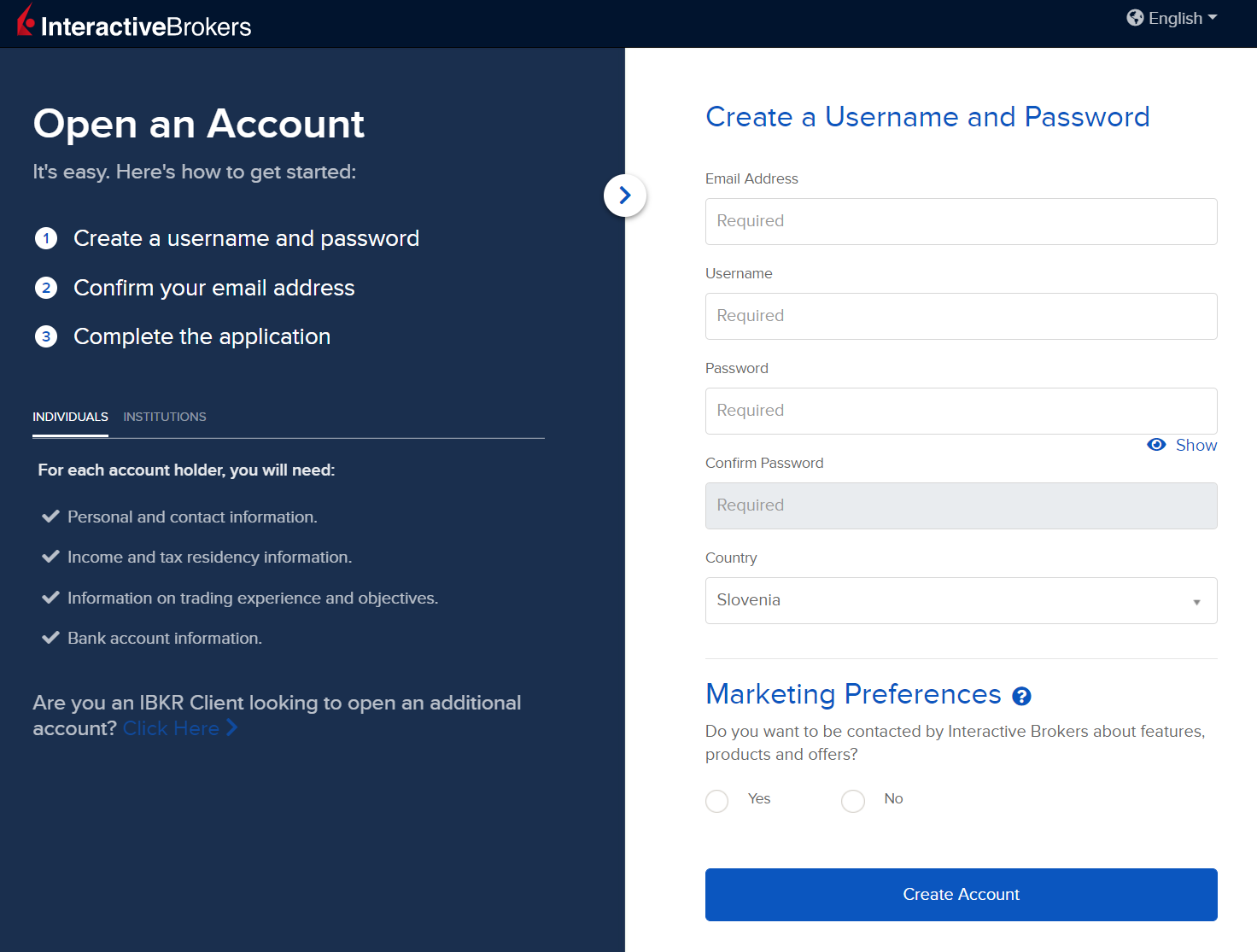

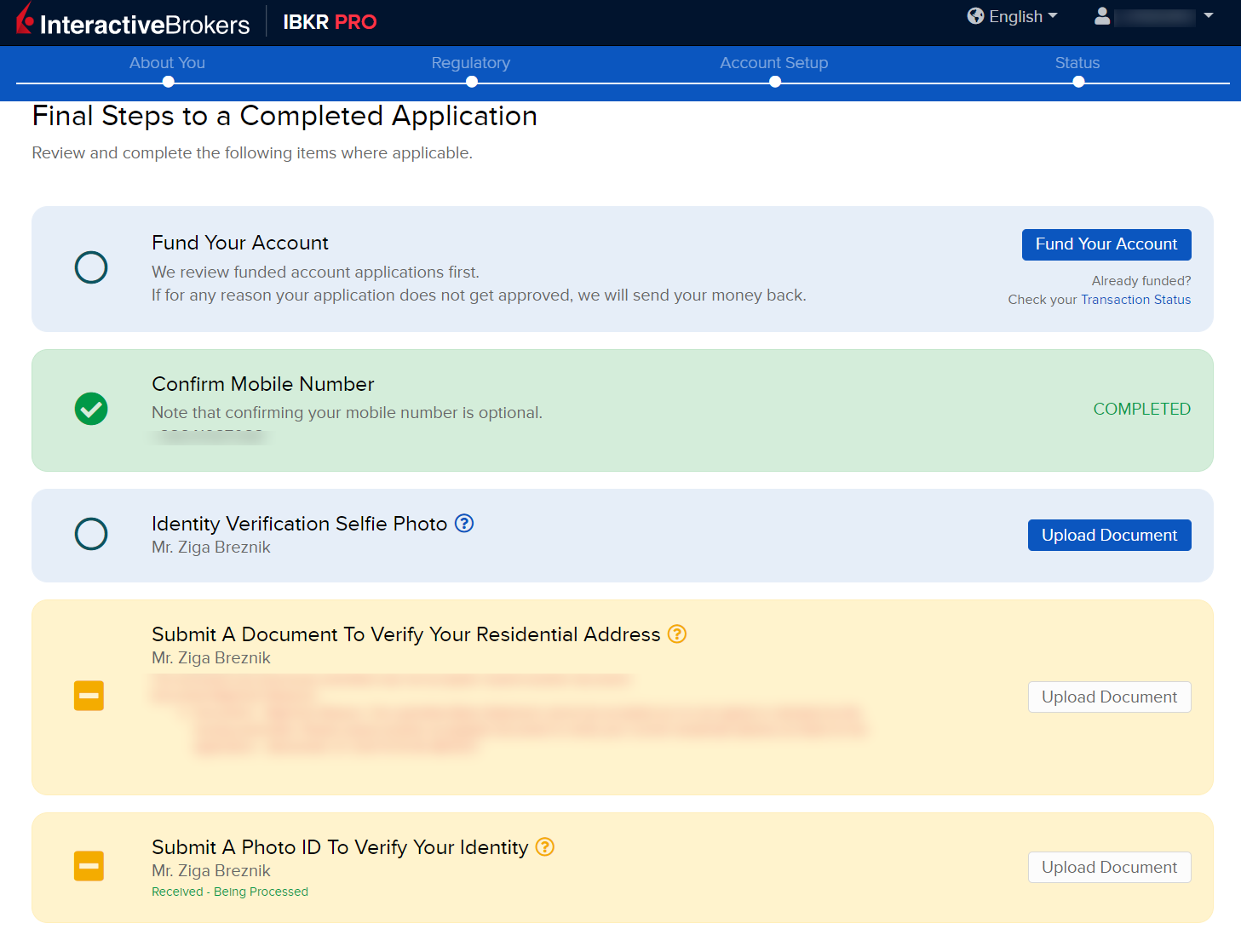

Account Opening Process

Although the account opening process is not the most user-friendly in the industry, it doesn’t take a genius to create a trading account with IBKR, you’ll only need to follow the steps below:

- Write a username and create a password

- Confirm your email address

- Select your region

- Complete the application by providing some additional personal information

- To begin trading, fund your account. It's worth noting that some products like leveraged ones have specific eligibility requirements

Your account will usually take 1-3 business days to get accepted. You'll need to use a method like bank wire to fund your trading account. You can do this using different currencies, like SGD, USD, CNH, GBP, and HKD.

Account Types

Interactive Brokers offers a variety of account types, each with its unique ownership structure and service offered. When it comes to account ownership, the account types on IBKR are divided into accounts geared towards individual traders and investors on one side and accounts designed for institutions on the other side. However, a number of these are exclusively available to residents of the United States and cannot be opened by Singapore-based traders.

The below list shows all account types offered by IBKR:

- Individuals (owned by one person)

- Joint (owned by two person)

- Friends and Family (owned by up to 15 persons)

- Trust

- UGMA/UTMA (available only to US-based clients)

- IRA (available only to US-based clients)

- Family Office

- Advisor

- Small Business (for small businesses)

- Money Manager

After selecting your account type, you can choose between Cash, Reg T Margin, or Portfolio Margin accounts. If you're a newbie and aren't aware of the technicalities of managing a margin account, a cash account at IBKR is the way to go.

IBKR Lite

With no inactivity fees or account minimum, IBKR Lite offers S$0 commissions on US shares and Exchange Traded Funds (ETFs) trades. It’s geared towards citizens of the United States and traders under the Employee Track. With IBKR Lite, you get to trade in a simple, convenient trading environment, as well as free market data from key exchanges.

IBKR Lite is currently only available to direct US-based traders. If you work for a company that uses Employee Track, you can sign up for an IBKR Lite account no matter which country you’re located in. So you won't be allowed to have an IBKR Lite account if you're a regular trader who isn't located in the US or works for a firm that uses IBKR.

IBKR Pro

Despite its name and its branding as a sophisticated account for active investors and traders, IBKR Pro is just a regular account for trading with IBKR. IBKR Pro, like IBKR Lite, doesn’t require a minimum account balance, and clients who have IBKR Pro accounts have access to all of IBKR's features, including technology-driven features like IBKR algorithms and APIs, as well as tools that IBKR Lite users don’t have access to.

Fees

Interactive Brokers charges you a 0.08 percent commission on Singapore stocks, with a minimum commission of $2.50.

This minimum commission is among the lowest in the industry, compared to bank brokers such as OCBC Securities and DBS Vickers who charge up to $25 per trade.

The broker charges $0.005 per share for US stocks, with a minimum of $1, which is among the lowest minimum commissions in the industry. So, you can make even the smallest trades without fear of losing your money due to high commission fees.

There are other types of pricing on IBKR that you should look out for. The first one is tiered pricing, where your commission fee is determined by your trading volume. Regulatory, exchange, and clearing fees might also have an impact. Tiered pricing may be more suitable for people who trade more frequently and in bigger amounts, thanks to the lower set price rates.

The second one is fixed pricing, which entails paying a set rate per share that includes all regulatory and exchange expenses. This could be a percentage of the transaction value, such as 0.08 percent for Singapore-listed stocks, or fixed amount per share, such as US$0.005 for US-listed stocks. Fees for Singapore-listed stocks are set at 0.08 percent of trade value, with a minimum order value of S$2.50.

Inactivity Fees

Interactive Brokers used to charge an inactivity fee, unless you met a certain threshold. If you didn't generate at least 10 to 20 USD in commissions in a calendar month, you were subject to inactivity fees.

As of 9 July 2021, Interactive Brokers waived their inactivity fees. This is great, as you are not forced to trade in order to avoid inactivity fees.

Deposit

Although IBKR does not charge any fees on deposits, their deposit methods are very limited. Using e-wallets or credit/debit cards to make a deposit is not allowed on the broker, which is a shame since this can put some investors off and make them seek an alternative broker that does allow that.

You can only make deposits from accounts that are registered in your name, and it can take up to three business days for a bank transfer to be completed.

Withdrawal

You may be happy to hear that the first withdrawal with Interactive Brokers each month is free, but bear in mind that future withdrawals are subject to fees. After the initial free withdrawal, the charge for subsequent withdrawals is determined by the currency and withdrawal used.

Outgoing transfers, like deposits, can only be made by bank wire. It can take up to two business days to withdraw your funds from IBKR.

Research

Interactive Brokers has a lot to offer in terms of research. You may also choose from a variety of third-party providers. You can use the Client Portal to subscribe to third-party research and recommendations, such as Morningstar's. Choose ‘Menu>Settings>User Settings' and ‘Research Subscriptions' to do so, but don’t expect them to be all free.

On all of its platforms, Interactive Brokers offers a wide range of fundamental data. For example, you get to benefit from their income statements for the previous 6 years, peer group companies, and a dividend calendar. Refinitiv's environmental, social, and governance (ESG) scores are also offered by IBKR.

At IBKR, the charting options are numerous, with 120 technical indicators. However, the charting tool is not the most user-friendly among competitors.

IBKR GlobalAnalyst is excellent for stock screening. It generates searchable and sortable tables that allow you to compare companies by country, location, or industry at current rates in a certain currency.

You also have access to multiple economic calendars, news, and summaries. The Economic Calendar does a great job at keeping you informed about impending events that will have an influence on the economy. This feature may be accessed from the menu at any time, albeit the broker can improve the design a bit more.

IB has established the Mutual Fund Search Tool on its website as of June 2020. With this tool, you can search for and select international mutual funds based on country, fund family, and whether or not the fund charges additional commissions. You can also search for funds according to their structure using the ‘Fund Type' filter. This makes Interactive Broker Singapore a great fund platform.

Education

IBKR Campus is a great opportunity for new users to learn about financial markets and IBKR’s trading tools, as well as improving their understanding of markets and keeping on top of current events.

Through their Trading Academy, you can learn more about the assets and markets available through Interactive Broker’s Trader Workstation and TWS API applications.

IBKR Webinars are handy when you want to watch and learn about the latest market topics, as well as IBKR tools. It’s as easy as participating in the broker’s webinars or browsing their extensive library of webinars.

And if you’re keen on watching or reading market analysis and commentary from 70+ industry experts, including the broker’s Chief Strategist Steve Sosnick, then go for Trader’s Insight. Interactive Brokers also offers IBKR Quant, a blog for experts who have an interest in deep learning, programming, AI, Blockchain, IBKR API, and other technologies that have an influence on the market Today.

And finally, their Student Trading Lab is a free online opportunity for computer science and finance educators interested in blending classwork with trading experiences from the real world. So, Interactive Brokers offers pretty much everything a new client would like to see in the educational section of a broker.

Regulation

Interactive Brokers (UK) Limited is authorized and regulated by the UK Financial Conduct Authority (FCA) and the UK FSCS covers regulated products. Interactive Brokers LLC is a member of the SIPC compensation scheme and is regulated by the US Securities and Exchange Commission (SEC) and CFTC.

Check the below table to learn more about Interactive Brokers Regulation in Singapore:

| Country | Regulator | Legal entity | Protection Amount |

|---|---|---|---|

| Singapore | Monetary Authority of Singapore (MAS) | Interactive Brokers Singapore Pte. Ltd. | No protection |

Is it Interactive Brokers Safe?

Interactive Brokers Group is a multi-national brokerage firm with offices all over the world. IBKR offers negative balance protection, although the extent of investor protection and the governing authority vary by entity. Negative balance protection is available for FX spot and CFD trading at Interactive Brokers, but only for retail clients from the European Union. Negative balance protection is not available to professional or non-EU clients.

IBKR is a safe broker as it has licenses from several reputable regulators. Interactive Brokers has a long track record and publicly reported financials and is listed on the NASDAQ stock exchange.

Singapore's central bank and financial regulatory authority is the Monetary Authority of Singapore. It’s responsible for enforcing several laws governing money, insurance, banking, securities, and the whole industry in general, so you should be safe trading with IBKR in Singapore.

Base Currencies

IBKR excels in providing a wide array of base currencies, including:

- US Dollar

- Canadian Dollar

- Czech Koruna

- Danish Krone

- Euro

- Australian Dollar

- British Pound

- Hong Kong Dollar

- Russian Ruble

- Singapore Dollar

- Hungarian Forint

- South African Rand

- Chinese Yuan

- Israeli Shekel

- Japanese Yen

- Swiss Franc

- Mexican Peso

- New Zealand Dollar

- Norwegian Krone

- Indian Rupee (only in India)

- Polish Zloty

- South Korean won (KRW)

- Swedish Krona

It’s worth noting that the available currencies may vary depending on the legal entity with which you open an account with.

Accepted Countries

One of the biggest perks of Interactive Brokers is that you can use it in most countries and territories across the globe, including Singapore. These countries and territories are listed on the broker’s website.

The Final Verdict: Is Interactive Brokers a Good Option in Singapore?

Interactive Brokers is a great option for most traders who seek to trade many products at the lowest costs, using diverse, advanced research tools. Of course, all of this is available with no annoying inactivity fees, as IBKR has dropped its minimum US$10 maintenance fee. So, it’s an excellent option not only for traders who make many trades each month, but also traders searching for a low-cost broker to trade with. There’s little reason to worry about losing your funds, since the broker is well-regulated by top-tier authorities.

So, if you can turn a blind eye on IB’s flaws, it’s an excellent option to make your way as a successful trader in Singapore.

How to know whether I'm an IBKR Pro or IBKR Lite user?

Simply log in to see if you're an IBKR Pro or IBKR Lite user, and the IBKR Pro or IBKR Lite logo will appear in the browser. If you're a retail investor in Singapore, you're probably already using IBKR Pro.

How can I withdraw my funds from IBKR?

Follow the steps below in order to successfully withdraw money from your IBKR trading account:

1. Log into the Client Portal and choose ‘Transfer & Pay' then

‘Transfer funds.'

2. Choose the account you wish to

withdraw from.

3. Select ‘Withdraw Funds' at the top of the

page.

4. Choose the withdrawal currency and withdrawal

method.

5. Provide the information required from you.

6.

Submit the request.

7. Select ‘View Transaction History'

to see the status of your withdrawal request.

Does Interactive Brokers charge inactivity fees?

No, Interactive Brokers does not charge its clients any inactivity fees. Although the broker was known for having hefty inactivity fees in the past unless certain criteria were met (clients had to make a minimum of $10-$20 in commissions in a calendar month to avoid fees), the broker has finally eliminated the inactivity fee on July 9, 2019.