Founded in 2013, Titan FX is a technology-driven ECN Forex Broker and commodities broker. It provides its clients with next-generation and technology-driven trading conditions, as well as institutional-grade spreads and quick trade execution. The broker provides trading services through both MetaTrader 4 and MetaTrader 5, two of the greatest trading platforms out there and are available on the web, desktop, iOS and Android.

Titan FX is the owner of the Zero Point Infrastructure, which allows it to provide clients of different levels of experience and investment sizes with competitive prices. Its seasoned support and management team comprises highly experienced forex professionals with years of experience, offering the finest possible customer service and trading conditions to retail and institutional clients.

While it might seem like a perfect broker, it isn’t. We put Titan FX to the test to see if it really does what it says and whether it offers the best possible trading experience. Join us in this unbiased review to find out everything you need to know about Titan FX in 2022.

Summary

On the good side, Titan FX has attractive fees, user-friendly platforms, a wide array of trading tools, good customer service, and a thorough FAQs section. But since no broker is perfect, Titan FX has some downsides, including an offshore regulation from the Vanuatu Financial Services Commission (VFSC), a high minimum deposit of $200, Limited non-FX assets, and it does not accept clients from the US.

TitanFX Overview

| Trading Platform | Titan FX |

|---|---|

| Founded | 2013 |

| Headquarters | Kumul Highway, Port Vila, Republic of Vanuatu |

| Regulation | Titan FX is a regulated broker under the laws of the Republic of Vanuatu. It has a financial dealer license by the Vanuatu Financial Services Commission (VFSC) |

| Demo Account | Yes |

| Minimum Deposit | $200 |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| Inactivity Fee | No |

| Spread | Varies |

| Deposit Methods | Visa, Mastercard, Skrill, STICPAY, AMEX, Neteller, bitwallet, and Local Japanese Bank Transfer |

| Withdrawal Methods | Visa, Mastercard, STICPAY, Neteller, Skrill, bitwallet, and Local Japanese Bank Transfer |

| Asset Classes | Forex, Commodities, Metals, Energies, Indices, CFDs |

| Mobile App | Android and iOS |

| US accepted | No |

| Customer Service | Live chat, phone, and email |

| Our Score | 2.5/5 |

TitanFX Pros and Cons

There are a lot of things to like about Titan FX. However, it falls short in other crucial aspects that may well put you off from opening an account with this broker.

| Pros | Cons |

|---|---|

| Low fees | High minimum deposit of $200 |

| Great, user-friendly MT platforms | Does not accept clients from the US |

| Great, user-friendly mobile app |

Poor regulation, so your money may be at high risk |

| A wide range of trading tools | Limited non-FX assets |

| Good customer service and thorough FAQs section | |

| It has a long history in the industry |

Titan FX Compared to Similar Trading Platforms

There are a lot of brokers in the industry that we can compare to Titan FX. However, we picked the most competitive ones and set a brief comparison between them and Titan FX so you could better understand the offerings and features of this broker, and whether you wish to trade with it or skip it and find a better option.

| Trading Platform | Titan FX | FxPro | RoboForex | XM |

|---|---|---|---|---|

| Founded | 2013 | 2006 | 2009 | 2009 |

| Minimum Deposit | $200 | $100 | $10 | $5 |

| Inactivity Fee | No | $5 monthly fee after 6 months of inactivity | No | $5 per month |

| US-Accepted | No | No | No | No |

| Regulated | Yes | Yes | Yes | Yes |

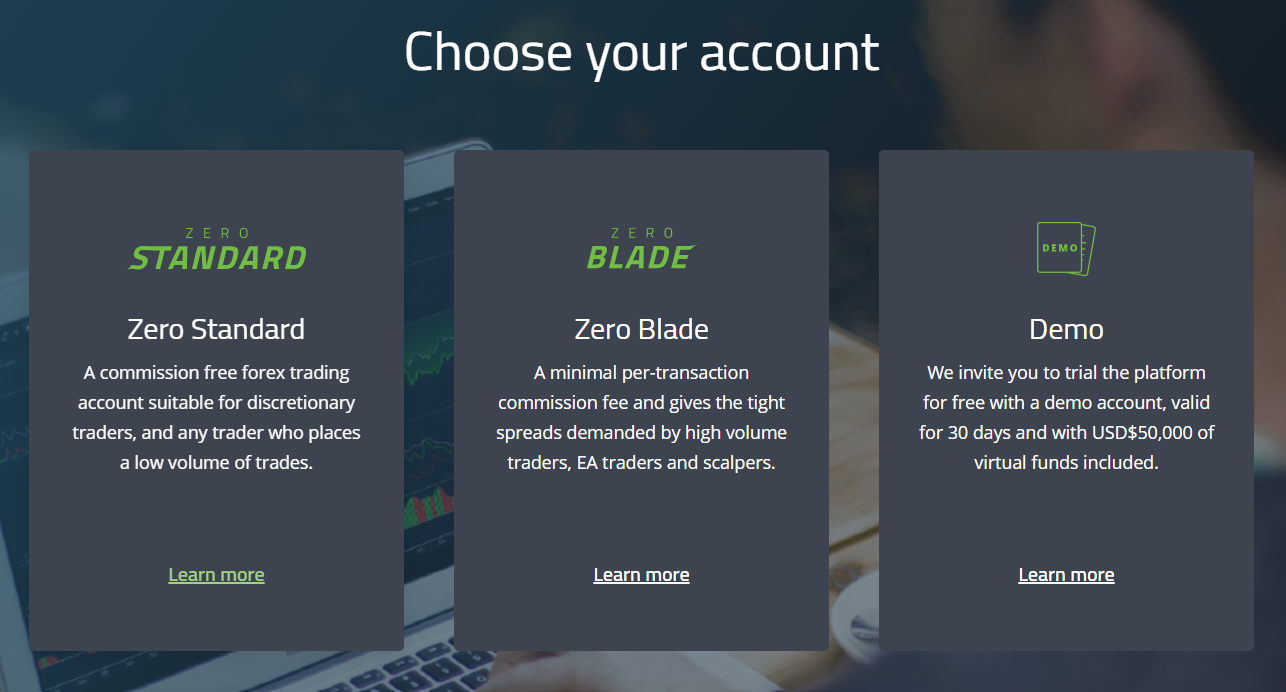

Account Opening

Titan FX offers more than one account type. If you wish to trade without paying a commission, you can open a Zero Standard STP account. On MT4 and MT5, the Zero Standard STP Account is a commission-free Institutional Grade STP account with access to interbank spreads. With Titan FX Zero Point technology and spreads as low as 1 pip and, this account type features fast execution and high reliability.

The Zero Blade ECN account has the tightest available spreads offered by Titan FX, as well as the fastest connectivity and high execution speed. Due to Zero Point Dynamic Liquidity Aggregation, there are spreads as low as 0 pips available on the ECN platform.

Both accounts are great for different purposes. Clients that employ manual trading strategies, for example, may benefit from the standard account. For more skilled clients, on the other hand, the blade account may be the best option.

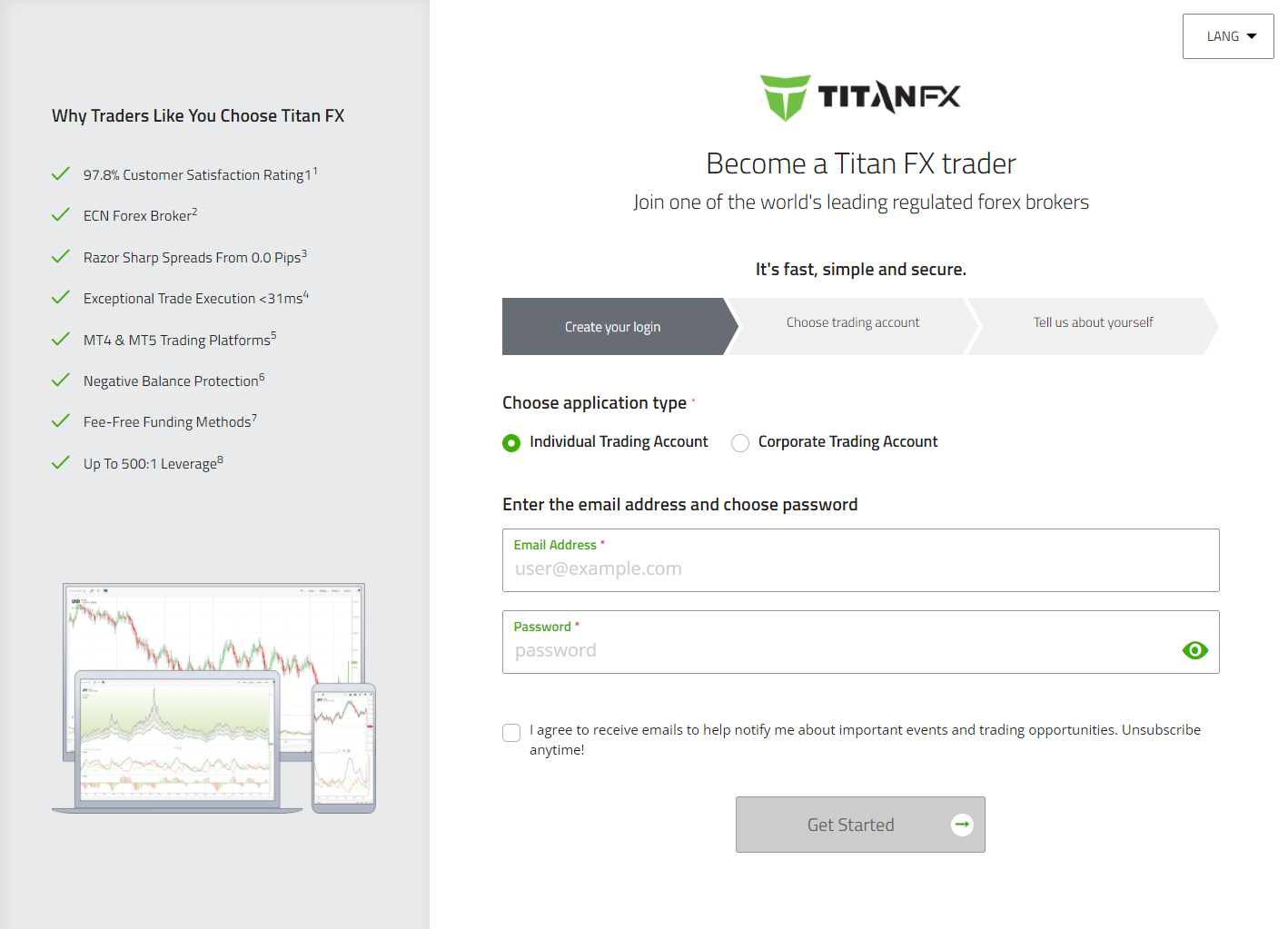

Titan FX makes it simple and hassle-free to open a trading account. The process for opening any of the account types is the same, and new account applications are promptly approved. So, you can start trading immediately with them in only a few minutes.

You'll have to pick between a Corporate Trading Account and an Individual Trading Account. Then you'll be asked to provide answers to basic questions of your personal and account type information, and your account will be activated.

Titan FX also offers its potential clients a demo account to allow them to test the waters before deciding to trade with real cash. You get to test the platform for free for 30 days using their demo account which has $50,000 in virtual funds. Also, you can contact their customer support if you want more or fewer funds in the account.

TitanFX Fees

Titan FX offers 2 different types of trading accounts to its customers. There is a commission-free Standard account and a commission-based blade account. As a result, trades on the standard account have fee-free institution-grade STP spreads.

On the other hand, trades on the blade account, which is designed for skilled and seasoned clients, have both a commission and variable spreads. Spreads on the blade account type are also as low as 0.0 pips.

Note: there may be extra fees that are not stated in our Titan FX review because broker fees can vary and change quickly. Before you open a Titan FX trading account, make sure you review and understand all of the latest fees updates.

Commission Fees

A commission fee may be charged by a broker as a service fee for enabling the purchase and sale of financial assets through your trading account. The majority of brokers’ revenue may come from commission fees charged to registered traders on their transactions.

If the broker fulfills or cancels an order on your behalf, you will be charged a commission fee. If your broker fails to fulfill a market order, you will normally not be charged a commission.

Titan FX charges a commission on CFD instruments. Commission rates vary depending on the style of trade, the type of financial instrument, and the size of your trading account.

Inactivity Fees

There is no inactivity fee on Titan FX. Inactive accounts are not charged any account maintenance fees. Clients may be required to meet particular trading activity requirements by brokers as part of the account's terms and conditions. So, the registered clients might be charged an account inactivity fee. If your trading account is inactive for a specific period of time as determined by the broker, an inactivity fee may be charged. We recommend that you always review the broker's website to ensure that you are aware of and satisfied with all of the services and fees that may be charged to you.

Deposit and Withdrawal

For all offered account types, the minimum deposit to start an account with Titan FX is $200. Funding trading accounts can be done via their Secure Client Cabinet and payment methods like Visa, Mastercard, Skrill, STICPAY, AMEX, Neteller, bitwallet, and Local Japanese Bank Transfer.

Don’t be put off by the high minimum deposit of Titan FX, as brokers with larger minimum deposits often provide extra premium services that can’t be found elsewhere for free. Brokers with smaller minimum deposits cater to more mainstream traders who aren't interested in some of the more advanced technical features. Other brokers that don’t require a minimum deposit usually do so trying to win new clients quickly.

Withdrawals are usually handled automatically within one business day. However, the time it takes for funds to arrive in your account depends on the selected withdrawal method and how the payment provider processes your payment. You can withdraw funds from your trading account via multiple payment methods like Visa, Mastercard, STICPAY, Neteller, Skrill, bitwallet, and Local Japanese Bank Transfer.

Trading Platform

Titan FX provides its clients with both the MetaTrader 4 and MetaTrader 5 platforms. Both include desktop versions that you can use on a PC or a Mac. You can also use tablet apps and mobile trading apps for iPads, Android tablets, Apple iPhones and Android phones.

WebTrader, a web-based app that you can use without any installation, is also supported by Titan FX. The app connects clients to their trading accounts directly through their web browsers.

Titan FX uses SSL encryption in its PC and mobile platforms to protect its clients' personal information. The broker also advises its users to always seek for the SSL security sign on their browser while using Titan FX via its web platform.

Trading Tools

Titan FX provides its clients with a wide range of trading tools through the platforms, such as a varied selection of systems for algorithmic trading and technical indicators for charting. The broker’s Virtual Private Server (VPS) product can be advantageous to you if you employ automated trading systems.

You can also engage in social and copy trading via Titan FX's ongoing collaborations with SignalTrader and ZuluTrade. You get to provide and copy trading signals from other traders via ZuluTrade.

Also, try out their Multi-Account Manager (MAM) if you’re a money manager or investor, it will most probably gain your liking!

Education

One of Titan FX's goals is to provide the most effective forex education to its clients in order to prepare them for trading. To trade effectively with this broker, you must first have a thorough understanding of the trading markets and tools. We recommend you check Titan FX’s educational resources available, as well as external educational material.

Titan FX offers its clients educational sections on the platform, which are Forex Monthly, Market Analysis, Economic News, and Learn Forex. The broker has a wide range of educational content. You should really take your time and become familiar with how the financial markets operate and the platform in general.

Mobile Trading Experience

Titan FX offers a user-friendly mobile trading app, through which you can be in control of your account, trade in financial markets, benefit from 30 technical indicators for market analysis, and receive financial news and emails with the Titan FX Metatrader application. The mobile app is available for Android, iPhone, and iPad.

The broker managed to create a mobile trading app that meets the expectations of many traders out there; it features real-time quotes of financial instruments, support of all kinds of trade execution modes, full trading history with the ability search, and trading directly on chart in the iPad version.

Titan FX offers you the 30 best-known technical indicators in the industry, including Accelerator Oscillator, Alligator, Accumulation/Distribution, Average Directional Movement Index, Awesome Oscillator, and Average True Range.

There’s also an offline mode for charts and quotes, as well as a toolbox window to show orders, emails, trade history, news, and trading journal.

Unaccepted Countries

TitanFX does not accept clients from New Zealand, the United States, or Vanuatu. Due to legal constraints, some of its features and products may not be available to clients from specific countries.

Is Titan FX Safe?

Clients of Titan FX have their funds held in segregated accounts with tier-1 banks. The broker does not use clients’ cash for operational activities. They also don’t make payments to or accept payments from third parties. Funds are transferred to and from a Titan FX trading account in the Titan FX trading account's name. This protocol is applicable to all forms of transfers made on Titan FX.

Trading with Titan FX has a high level of risk because it is an offshore brokerage. It’s owned by Titan FX Limited, a Vanuatu-based offshore company that claims to be licensed by the Vanuatu Financial Services Commission (VFSC). Vanuatu is the shortcut jurisdiction to open a broker since it simply requires the company to file an online registration, pay a fee, prove initial established capital of $2,000, and the broker will be ready and registered within two to three months. As a result, it became a haven for suspicious forex brokers.

Therefore, the cost of forming the broker becomes extremely inexpensive when compared to industry-leading licensing. The company registered with VFSC can start operations without having to maintain a physical presence. Thus, investing and trading with VFSC brokers doesn’t provide any guarantees of the company's long-term viability. Most importantly, they don’t implement any protection against scams or fraud. Overall, the VFSC legislation, as well as Vanuatu itself, may be an appealing place to start a broker, but it is an unappealing regulation for traders and investors.

To make their situation even worse, Titan FX was once licensed and regulated in New Zealand, but its license was later suspended. Also, The Financial Services Agency (FSA) of Japan has previously blacklisted Titan FX. FSA put this broker on a warning list of companies that target Japan-based clients without having the necessary authorization from local regulatory authorities.

You should thoroughly investigate any broker before entrusting your funds to them. Don’t forget that not every broker that claims to be regulated is actually regulated, since many brokers claim to be regulated but merely have an offshore license. We don’t suggest whatsoever that you deal with offshore brokers that don’t have an authentic regulation from top-tier authorities.

Customer Support

Titan FX has all the means it needs to help its clients: live chat, phone, and email support. Their multilingual support team is available via live chat or phone 24 hours a day, Monday through Friday. They also offer a thorough FAQ section to answer most of the clients’ inquiries.

English, Czech, Chinese, German, Spanish, Italian, French, Polish, Portuguese, Slovenian, Hindi, Hebrew, Arabic, Russian, and Romanian, are among the languages supported by Titan FX.

Some complain that their responses are sometimes slow or that they don’t fully answer your questions.

Phone number: +678 27 502 or +1 (206) 745-5058

Email: [email protected]

The Final Verdict: Should You Invest Your Money With Titan FX?

The short answer is: probably not. Titan FX is a Forex and CFD broker with license number 40313 by the Vanuatu Financial Services Commission (VFSC). Many industry analysts, however, believe that Vanuatu's regulatory system does not provide traders with the same level of protection as other regulators do.

While they have great MetaTrader interfaces and a smooth mobile app, they have fewer non-FX trading instruments than other forex brokers do. Also, Titan FX is unable to deliver its services to clients in the United States, Australia, New Zealand, and Vanuatu due to regulatory restrictions.

Titan FX is not the best online broker in the industry in terms of its regulation and what it offers, so before you start to invest money with it, you need to ask yourself first whether working with that broker is worth putting your money at risk of being lost at any time.

Does TitanFX Accept US Clients?

No. The United States is one of the countries Titan FX does not accept. According to US law, the only brokers allowed for US-based traders are those registered by the Commodity Futures Trading Commission (CFTC). You can only trade with US-regulated platforms.

The United States is not the only restricted country by Titan FX, they also don’t allow clients from Aland Islands, Austria, Bulgaria, Belgium, Czech Republic, Croatia, Cyprus, Denmark, Estonia, France, Finland, United Kingdom, Greece, Germany, Hungary, Italy, Ireland, Japan, Latvia, Lithuania, Luxembourg, Liechtenstein, Malta, Norway, Netherlands, Poland, Portugal, Romania, Slovenia, Spain, Sweden, Slovakia, Singapore, China, Hong Kong, Macao, Israel, United Arab Emirates, and Turkey.

Does Titan FX accept clients from India?

India-based traders can open accounts and trade with Titan FX. The broker, however, does not mention any compliance with Indian-based regulators on its website. Plus, foreign exchange trading is illegal in India. Money safety may be an issue to you as an india-based trader because the broker is not licensed by any regulatory authority in India.

Is it possible to trade Crypto CFDs with a demo account?

Yes, you can use a demo account to practice trading Crypto CFDs.

Is Negative Balance Protection applied while trading Crypto CFDs?

Yes, negative protection is applied, but only after a scrutiny by the Trade Operations Department.

Is it possible for me to trade on weekends?

Weekend trades are not offered at Titan FX. They did that in order to safeguard clients from the unstable price supply from liquidity providers. If you're carrying a trade over the weekend, make sure your account is well-funded and keep an eye on your stop-losses, pending orders, and take-profits.

Are there any transaction fees for Blade accounts?

There are no extra transaction fees while trading Crypto CFD products, regardless of account type.

What leverage does Crypto CFDs have?

For all Crypto CFD pairs, Titan FX offers a margin of up to 5% (20:1 leverage). Each product's leverage is fixed, and each account's leverage cannot be adjusted.

What are the trading hours on Titan FX?

Except for the rollover period, the majority of forex trading is open 24 hours a day, Monday through Friday.