Selecting a Forex broker with either zero spreads or low spread accounts is vital, especially if you're into Forex trading and scalping. Reducing trading costs can have a significant impact on your overall profitability, especially if you're an active trader. However, the multitude of options available can be overwhelming, and not all of them can be relied upon.

In reality, many Forex brokers market so-called "zero spread" accounts that often turn out to be nothing more than enticing marketing gimmicks aimed at attracting novice traders.

To ease your burden, I've taken the initiative to thoroughly investigate what the industry has to offer and compiled a list of the best Forex brokers with low-cost options for 2023.

Who Are the Top Low Spread Forex Brokers in 2023?

After extensive research, here are the top brokers with the lowest spreads and competitive offerings:

- Pepperstone – Leading the Pack as the Lowest Spread Forex Broker Overall

- FP Markets – An Ultra-Competitive Broker with Exceptionally Low Spreads

- AvaTrade – A Reliable Choice for Fixed Low Spread Forex Trading

- IC Markets – Delivering Raw Low Spreads Accounts Starting from 0.0 Pips

- Forex.com – Your Go-To Broker for Best Execution and Low Spreads

- FXTM – Offering High Leverage and Low Spreads for Traders

- eToro – A Stellar Option for Copy Trading Alongside Low Spreads

- IG – A Commission-Free Broker with Attractive Low Spreads

- FxPro – Your Destination for a Zero Spread Forex Experience

- Fusion Markets – Combining Low Spreads and Competitive Commissions for Forex Trading

My Top 3 Picks

An Exhaustive Compilation of the Top 7 Forex Brokers with Zero Spreads

1. Pepperstone

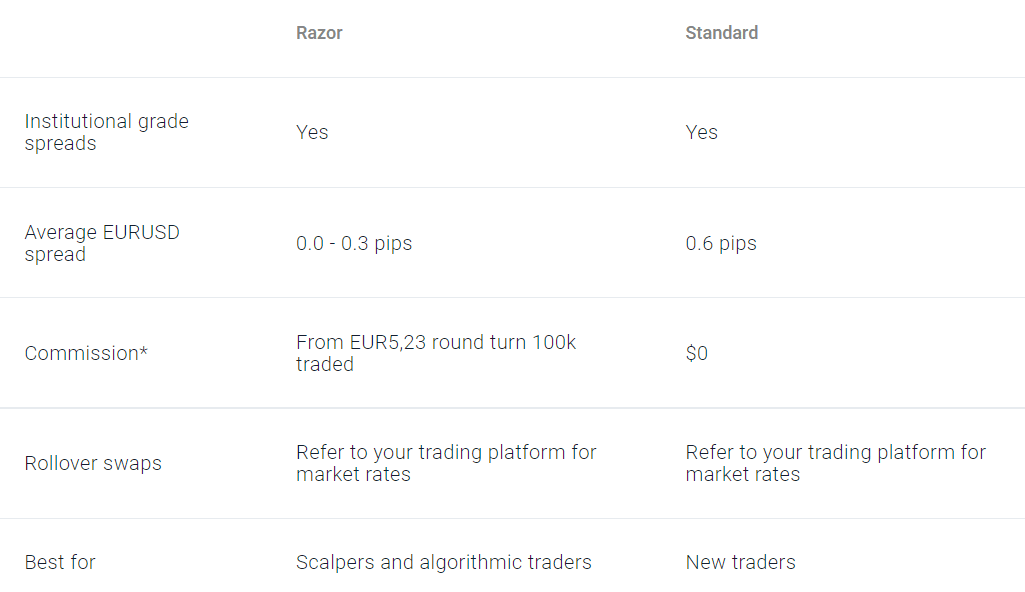

When evaluating all factors, Pepperstone emerges as our top choice for the finest brokerage with exceptionally narrow Forex spreads and zero commission charges. With their Standard Account, traders can access impressively low average spreads starting at 0.6 pips for the EUR/USD pair, all without incurring any trading commissions. Furthermore, their Razor account offers spreads ranging from an astonishing 0.0 to 0.3 pips, with a round-turn fee of EUR 5.23 per 100,000 traded.

Pepperstone stands out for its minimal trading fees and overall affordability, especially when compared to other brokers that impose higher spreads.

81.2% of retail investor accounts lose money when trading CFDs with this provider

2. FP Markets

FP Markets, short for First Prudential Markets, presents itself as a remarkable option for those seeking affordability and substantial leverage. As a regulated and dependable Forex broker with zero spreads, FP Markets stands out. They provide spreads that commence at 0 pips and typically hover around 0.45 pips. Additionally, they grant access to a variety of third-party trading platforms, allowing you to select the one that best suits your needs. Moreover, FP Markets offers a diverse array of educational resources.

It's worth noting that FP Markets, unfortunately, does not extend its services to residents of the United States.

On FP Markets Official Website

FP Markets Quick Overview

Established in 2005, FP Markets stands as one of the venerable institutions in the Forex market. Over the years, this experienced brokerage has built a strong reputation and continues to be one of the most esteemed platforms in the industry.

FP Markets distinguishes itself primarily through its commitment to exceptional customer service. Their dedication to enhancing the user experience and ensuring client satisfaction ranks among the finest I've encountered in the brokerage world. Moreover, FP Markets boasts rapid trade execution and an extensive array of available trading markets.

FP Markets Account Options and Fee Structure

FP Markets offers its users two types of accounts – Raw and Iress. The Raw trading account is compatible with MT4 and MT5 trading platforms and offers spreads as low as 0.0 pips. However, there’s a commission of 3.00 AUD per transaction and a minimum of 100 AUD.

On the other hand, the Iress trading account is tiered into three categories: Standard, Platinum, and Premier. The Standard and Platinum tiers come with respective minimum commission fees of 10 AUD and 9 AUD. The Premier account, while having no minimum commission fees, requires a significantly higher minimum deposit of 50,000 AUD.

Pros and Cons

| Advantages | Disadvantages |

|---|---|

| Commencing spreads at 0 pips | Unavailability in the United States |

| Extensive range of trading platforms | |

| Abundance of educational materials | |

| Swift order execution |

3. AvaTrade

For traders who are actively engaged in the market, AvaTrade presents itself as an attractive option. They provide a competitive fixed spread of 0.9 pips without any commission charges. Opening an account with AvaTrade requires a minimum deposit of $100. Traders can access AvaTrade's proprietary trading platforms as well as both MT4 and MT5. However, it's worth noting that they impose inactivity fees that are slightly above the industry average.

AvaTrade is subject to regulatory oversight by several reputable authorities, including the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority (FSCA), the Financial Conduct Authority (FCA), and CySEC.

76% of retail investor accounts lose money when trading CFDs with this provider.

Quick Overview of AvaTrade

Founded in 2006, AvaTrade stands as one of the more established Forex and CFD brokers listed here. AvaTrade's standout feature lies in its wide array of available financial instruments, encompassing commodities, bonds, cryptocurrencies, stocks, and stock indexes.

What truly sets AvaTrade apart is its exceptional research tools, which simplify Forex trading, even for traders with limited experience. Additionally, the broker offers highly competitive rates, user-friendly mobile apps, and the convenience of 100% fee-free deposits and withdrawals.

AvaTrade Account Options and Fee Structure

AvaTrade extends the option of selecting from standard, corporate, or professional accounts to its users. The standard and professional accounts cater to individual traders, while the professional account is designed for more seasoned traders who possess documented prior investment experience.

Regarding trading fees and spreads, AvaTrade remains highly competitive. The average spread hovers around 0.5 pips, aligning closely with industry standards. While the fees are generally low, their precise amount varies depending on the specific financial instrument being traded. It's essential to note that AvaTrade also levies an inactivity fee as part of its fee structure.

Pros and Cons

| Advantages | Disadvantages |

|---|---|

| Highly competitive rates of 0.9 pips | Inactivity fees |

| Wide range of currency pairs | |

| Easy account opening process | |

| Free deposits and withdrawals | |

| Great research tools |

4. IC Markets

IC Markets stands out with its remarkable average spread of just 0.1 pips, securing a prominent position among the tightest spreads on this list. The rapid order execution provided by IC Markets makes it a preferred selection for scalpers and algorithmic traders alike. Notably, IC Markets refrains from imposing any commission fees on deposits or withdrawals. Additionally, clients can benefit from the availability of robust trading platforms, including cTrader and MetaTrader. For those seeking the utmost in spread transparency, IC Markets' Raw Spread Account offers zero spreads coupled with commissions.

However, it's essential to note that IC Markets does come with a relatively high minimum deposit requirement for opening an account.

74-89% of retail investor accounts lose money

Quick Overview of IC Markets

Although IC Markets may not be my top choice, it certainly ranks among the finest Forex brokers. I primarily recommend it to Forex traders who heavily rely on algorithmic strategies for their trades. IC Markets impresses with its comprehensive research tools and advanced functionalities, solidifying its position as one of the most potent platforms in the industry.

Furthermore, IC Markets boasts highly competitive pricing and swift order execution. While their range of available markets isn't overly extensive, it proved to be more than sufficient to maintain my engagement. However, it's important to be aware that the relatively high minimum deposit requirement can deter some traders.

IC Markets Account Options and Fee Structure

IC Markets provides traders with the flexibility to choose from three distinct trading accounts: Raw Spread (cTrader), Raw Spread, and Standard. The first two offer spreads starting from 0.0 pips but entail commission fees of 3 AUD and 3.5 AUD, respectively. In contrast, the Standard Account does not impose commission fees but features spreads commencing at 1.0 pips.

Pros and Cons

| Pros | Cons |

|---|---|

| Low average spreads of 0.1 pips | High Minimum account deposit |

| Fast order execution speed | |

| No withdrawal or deposit fees | |

| Powerful platform |

5. Forex.com

Forex.com stands as one of the top-rated brokerage firms in the United States, offering a secure and dependable choice for traders. It provides access to a broad spectrum of 80 currency pairs. While the spreads are attractively low, it's important to note that there is a fixed commission fee of $5 per standard lot. Forex.com boasts three premium trading platforms in addition to the widely popular MT4 platform.

However, it's worth considering some drawbacks. Passive traders may encounter inactivity fees, and there exists a lengthy waiting period for account verification.

On Forex.com Official Website

Forex.com Quick Facts

If you're in search of an online brokerage platform specializing in currency trading, Forex.com stands as a top-tier choice. Established in 2001, it holds a distinguished reputation in the Forex industry, offering a wide range of major currency pairs, competitive pricing, and remarkably low fees and spreads.

Forex.com Accounts & Fees

In terms of spreads, Forex.com is among the most cost-effective Forex brokers, with spreads dipping as low as 0.1 pips. Nevertheless, considering the presence of a flat commission rate of 5 AUD per standard lot and additional non-trading fees, such as the inactivity fee, traders may find more economical options. It's important to note that Forex.com offers a single account type, and the application and verification process can be relatively lengthy and intricate compared to some of its peers.

Pros and Cons

| Pros | Cons |

|---|---|

| Highly regarded brokerage | Inactivity fees |

| Cost-effective fee structure | Lengthy waiting period for account verification |

| Extensive range of research tools | |

| Wide variety of currency pairs | |

| Access to premium educational materials |

PFI Rating: 4.8/5

6. FXTM

ForexTime (FXTM) is a dependable choice suitable for both novice and seasoned traders. FXTM offers competitive spreads, starting as low as 0.1 pips, and provides a diverse range of account types.

Clients of FXTM gain access to a vast market selection, encompassing over 200 markets, including 48 currency pairs. It distinguishes itself through its exceptional customer support and a wealth of educational resources.

However, there are certain drawbacks to consider. FXTM imposes high fees for CFD trading, and there are also inactivity and withdrawal fees to be aware of.

On FXTM Official Website

FXTM Quick Facts

Established in 2011, FXTM has earned a solid reputation as a top Forex and CFD broker, particularly for its user-friendly interface and strong customer support. The trading platforms are remarkably straightforward, and the registration process is swift, with rapid access to customer service. Furthermore, FXTM stands out as an excellent choice for beginners due to its extensive array of educational and research tools.

FXTM Accounts & Fees

While FXTM may not be the absolute cheapest Forex broker, its spreads, commencing at 0.1 pips, and modest commission rates position it below the industry average. Opening an account is straightforward, especially if you opt for the Micro Account, requiring only a minimal deposit of 50 AUD. The Advantage Plus Account, with a 500 AUD minimum deposit, offers more advanced features and attractive trading conditions for experienced Forex traders. Nevertheless, it's important to note that FXTM's non-trading, withdrawal, and inactivity fees are relatively high.

Pros and Cons

| Pros | Cons |

|---|---|

| Competitive spreads starting from 0.1 pips | High CFD trading fees |

| Responsive customer service | Inactivity and withdrawal fees |

| Abundance of educational tools | |

| Quick and hassle-free account opening process |

What Is a Low Spread or Zero-Spread Forex Broker?

Below is a comparison of brokers based on information such as foundation year, regulation, offering of investments, and more.

| Trading Platform | Pepperstone | FP Markets | AvaTrade | IC Markets | Forex.com | FXTM | eToro |

|---|---|---|---|---|---|---|---|

| Founded | 2010 | 2005 | 2006 | 2007 | 2001 | 2011 | 2007 |

| Regulation | ASIC, CySEC, FCA, SCB, DFSA, BaFin, CMA | ASIC, CySEC | FCA, ASIC, FSCA, FRSA, Israel Securities Authority, Financial Services Agency, Financial Futures Association of Japan | ASIC, CySEC, FSA, SCB | CFTC | FCA, CySEC, FSCA, MiFID, FSA, BaFin, AMF, FCMC, AFM | FCA, CySEC, ASIC, FSAS |

| Offering Of Investments | CFDs on Forex, Crypto, Shares, Indices, Crypto | Forex, Shares, Metals, Commodities, Indices, Cryptocurrency, Bonds, ETFs | Forex, Stocks, Commodities, FXOptions, Cryptocurrencies, Indices, ETFs, Bonds | CDFs on Forex, Commodities, Indices, Bonds, Cryptocurrency, Stocks, Futures | Forex, Shares, Commodities, Cryptocurrencies, Gold and Silver, Indices | Forex, Indices, Forex Indices, Commodities, Metals, Stocks | Stocks, ETFs, Forex, Crypto, Indices, Commodities |

| Minimum Deposit | $0 | $100 | $100 | $200 | $100 | $50 | $50 - $100 |

| Demo Account | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Withdrawal Fee | $5 | $0 | $0 | $0 | $25 in the US, and $40 for international | $3 for Credit Cards, $20 - $40 bank transfer, $0 for Skrill / Neteller | $5 |

| Inactivity Fee | $0 | $0 | $50/month After 3 Months | $0 | $15/month after 12 months | $5/month after 6 months | $10/month |

| Deposit Methods | Credit/debit cards, Bank/Wire Transfer, PayPal, Neteller, Skrill, UnionPay | Credit Cards. Debit Cards, Bank Transfer, Ngan Luong, FasaPay, Online Pay, Broker to Broker, Neteller, Skrill, PayTrust, PayPal, Bpay, Poli | Credit and Debit Cards, Wire Transfer, e-payments | Credit Cards, Debit Cards, PayPayl, Neteller, Skrill, UnionPay, Wire Transfer, Bpay, Fasapay, Broker to Broker, Poli, Thai Internet banking, Klarna, Rapidpay, Vietnames Internet Banking | Credit Cards, Debit Cards, Wire Transfer | Credit Cards, Debit Cards, e-Wallets, Bank Wire, Local Payment Solutions | PayPal, Skrill, Neteller, Credit Card, Debit Card, Rapid Transfer, iDEAL, Klarna / Sofort Banking, Bank Transfer, Online Banking - Trustly, POLi |

How do Low Spread Forex Costs Compare per $100,000 Traded?

| # | Forex Broker | Spread | Pips on Major Forex Pairs * | Established |

|---|---|---|---|---|

| 1 | Pepperstone | Variable | from 0.7 | 2010 |

| 2 | AvaTrade | Variable | from 0.9 | 2006 |

| 3 | FP Markets | Variable | from 1.4 | 2005 |

| 4 | IC Markets | Variable | from 1.0 | 2007 |

| 5 | Forex.com | Variable | from 1.0 | 2006 |

| 6 | FXTM | Variable | from 0.4 | 2011 |

Fees Compared

While it is hard to compare fees as spreads vary, we compared fees below to give you a basic understanding. When comparing fees, you should look for all fees combined, not just the spreads.

| Trading Fee | Pepperstone | FP Markets | AvaTrade | IC Markets | Forex.com | FXTM |

|---|---|---|---|---|---|---|

| EURUSD | Minimum from 0.0 and 0.17 average spread (Razor Account) Minimum from 0.6 and 0.77 average spread (Standard Account) | from 0.0 - 1.3 (average 0.2 pips) | Spread: 0.9 | Raw Spread account: 0.0 pips spread and $3.5 (per lot per side) commission Standard Account: 0.6 pips spread and $0.0 (per lot per side) commission | average 1.15 | Commissions +Minimum 1.6 pips - Typical 1.9 (Standard Account) Minimum 1.9 pips - Typical 1.9 (Micro Account)Minimum 0 pips - Typical 0 (AdvantageAccount) |

| GBPUSD | Minimum from 0.0 and 0.59 average spread (Razor Account) Minimum from 0.6 and 1.19 average spread (Standard Account) | from 0.0 - 1.8 (average 0.7 pips) | Spread: 1.5 | Raw Spread account: 0.0 pips spread and $3.5 (per lot per side) commission Standard Account: 0.6 pips spread and $0.0 (per lot per side) commission | average 1.7 | Commissions+Minimum 1.8 pips - Typical 2 (Standard Account)Minimum 2.2 pips - Typical 2 (Micro Account)Minimum 0.1 pips - Typical 0.2 (AdvantageAccount) |

| Apple Fees | 0 + market spread | Spread | 0.13% | Spread | N/A | Spread + Commission |

| Tesla Fees | 0 + market spread | Spread | 0.13% | Spread | N/A | Spread + Commission |

| Amazon Fees | 0 + market spread | Spread | 0.13% | Spread | N/A | Spread + Commission |

| S&P 500 Fees | min. 0.4 spread | Spread | 0.25 over market | Spread | N/A | Spread + Commission |

| Options Fee | N/A | N/A | N/A | N/A | N/A | N/A |

| Mutal Fund Fees | N/A | N/A | N/A | N/A | N/A | N/A |

| ETF Fee | N/A | N/A | 0.13% - 0.15% | N/A | N/A | N/A |

What is a Low Spread or Zero-Spread Forex Broker?

Low spread or zero-spread forex brokers, as the name suggests, provide traders with the smallest possible forex spreads. In recent years, trading costs have decreased as forex brokers vie for more clients. Many brokers now offer zero spreads as an added incentive, but it's crucial to thoroughly understand the terms and conditions before selecting a broker.

The lowest spread for the EURUSD pair typically ranges from 0.1 to 0.9 pips with no commission charges. However, it's essential to review all fees, including overnight fees, commissions, non-trading fees, deposit or withdrawal fees, and inactivity charges.

How to Choose a Low-Spread Forex Broker?

Before you begin trading, it's important to research the brokers on your shortlist. While some forex brokers may advertise low spreads, they may not be the best fit for your trading strategy. Here are some things to watch out for:

You should watch out for these situations:

- Beware of fixed spreads, which can indicate wider spreads than the market average. Brokers with fixed spreads might also be trading against your positions as market makers.

- Ensure that the broker is regulated by a top-tier regulatory authority. This adds an extra layer of confidence in the ethical business practices of your broker.

- Check that the minimum deposit requirement is not too high for your budget.

- Examine spreads on different currency pairs and account types. Some low-spread brokers may advertise low costs, but spreads can vary based on currency pairs or account types.

What Is Spread in Forex?

The spread represents the difference between the ask and bid prices in a trade. A low spread indicates a small difference between the bid and ask prices of a currency pair, while an increase in the spread usually signifies volatile market conditions or reduced market liquidity. Spreads often widen during less active trading hours, times of market volatility, or ahead of significant news events.

Most major brokers derive their price quotes from the interbank market. Spreads are typically quoted in fractions of a pip (fractional pips).

The spread serves as the profit mechanism for no-commission brokers. The cost is embedded in the bid-ask prices for each currency pair you trade, rather than charging a per-trade commission fee. While some brokers advertise lower spreads, they may be more expensive overall due to higher commissions. To avoid higher average spreads, it's advisable to calculate the Average Spread data over an extended period (monthly spread data) and consider both spreads and commissions (spread + commission).

How Does Spread Work in Forex?

The bid price represents the exchange rate at which you are willing to sell a currency, while the ask price is the price at which you buy the same currency. The bid price is typically lower than the ask price. When you buy a currency pair, you are essentially buying the base currency and selling the quote currency. Conversely, when you sell the currency pair, you are selling the base currency and receiving the quote currency. Currency pairs are quoted based on their bid and ask prices.

A currency quote expresses the value of one currency in relation to another foreign currency. These two currencies are known as the base currency and the quote currency, with the base currency always listed first.

How Are Spreads Calculated?

Spreads are a critical factor in calculating trading costs. They involve two components:

First, Interbank Spread: This represents the difference between the price at which a bank wants to buy a currency at a specific rate and the offer price at which they are willing to sell it.

SecondBroker's Spread: Retail traders execute orders through brokers, and brokers often add a markup spread above the raw interbank spread. The way forex and CFD brokers make money depends on their available execution methods and business models.

To calculate the spread, you need to determine the difference between the bid and ask prices in pips. This calculation simply involves subtracting the bid price of a currency pair from the ask price. Typically, 1 pip equals 0.0001 for most currency pairs and is based on the fourth decimal place of the currency pair's price.

For instance, an example of a 1 pip spread for USD/EUR would be quoted as 1.1061/1.1062.

How to Spread Bet in Forex?

Spread betting is available in specific countries, such as the United Kingdom. In spread betting, traders speculate on the price's direction, whether it will rise or fall. Spread betting brokers offer a way for traders to potentially reduce tax liabilities.

What Is Considered a Good Spread?

Spreads are considered good when they are as close to zero as possible. Typically, good spreads average below 1 pip. An example of a good spread would be 0.5 pips for a currency pair. It's also important to base your calculations on average price data over an extended period.

What Is the Lowest Spread in Forex?

The lowest spread occurs when the difference between the bid and ask price is minimal. It's ideal to trade when spreads are low, particularly during major forex trading sessions when liquidity is high and volatility is low.

Zero pips (zero spread) is the lowest possible spread in forex. ECN-STP brokers often offer zero spreads. To determine which broker offers the lowest spreads, it's crucial to calculate all trading costs comprehensively. Some brokers may offer zero spreads but charge commissions per trade, potentially making them more expensive overall.

What Is a Zero-Spread Account?

A zero-spread trading account is a forex trading account where there is either no spread (the bid and ask prices are the same) or the spread is exceptionally narrow. The actual spread may still vary depending on trading conditions, account types, and whether the broker charges commissions.

How to Compare Low Spread Accounts?

To compare low-spread forex accounts effectively, you should consider factors like commissions per trade, spreads, available trading platforms, regulatory status, security measures, and the range of currency pairs offered.

Raw Spread Account vs. Standard Account

In forex trading, a standard account typically involves a standard lot size of 100,000 units of currency. A raw spreads account, on the other hand, refers to trading costs where the broker does not add a price markup but provides pricing directly from liquidity providers.

Do Spreads Matter When Trading Forex?

Yes, spreads matter significantly when trading forex. A lower spread means lower trading costs, making it cheaper to place trade orders. Tight spreads are particularly important for strategies that aim to profit from small price movements. However, it's essential to consider other commissions that your broker may charge, as some brokers with low spreads may offset their earnings through higher commissions.

Scalping and Spreads

Finding a broker with zero spreads is essential for scalping strategies. Scalping involves profiting from small price changes and often requires executing a high volume of trades. Traders who employ scalping need rapid order execution and a well-defined exit strategy, as a single significant loss could wipe out the gains from many small trades.

The Lowest Spread Forex Brokers: Key Takeaways

Numerous forex brokers now offer competitive and zero spreads. While any of the brokers mentioned can meet your trading needs, Pepperstone stands out as a top recommendation. It not only offers some of the lowest spreads in the forex market but is also an excellent choice for both experienced and novice forex traders.