Advertiser Disclosure: Some of the links in this post are from our partners. We might receive a compensation (at no additional cost to you).

This content is not intended for US users. eToro USA LLC does not offer CFDs, only real Crypto assets available.

eToro , a renowned multi-asset brokerage firm and cryptocurrency exchange, is celebrated for its copy and social trading features. Founded in 2007 by Ronen Assia, Yoni Assia, and David Ring, eToro offers a diverse range of trading options, including eToro CFD trading, cryptocurrencies, stocks, and ETFs. The company operates globally, serving customers in over 140 countries, and boasts millions of registered eToro users.

Headquartered in Tel Aviv-Yafo, Israel, eToro also maintains registered offices in Cyprus, the United Kingdom, the United States, and Australia. Notably, between 2018 and 2020, the company's valuation soared from $800 million to $2.5 billion. eToro stands out as a secure broker, subject to regulation by top-tier financial authorities.

Summary:

For those considering eToro, it's an excellent choice for both copy social trading and cryptocurrency trading, catering to beginners and experienced traders alike. Notably, it offers commission-free trading of US stocks. However, it's worth noting that eToro's forex and CFD trading fees are slightly higher compared to some of its competitors.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Is eToro Safe?

When it comes to safety, eToro has established itself as a trusted platform with millions of users. It takes rigorous security measures to protect user funds and personal information, including:

- Safeguarding funds in secured tier 1 banks.

- Implementing SSL encryption to secure personal data.

- Adherence to stringent regulation by top financial authorities, including FCA, ASIC, CySEC, and FinCen.

UK investors benefit from protection through the Financial Services Compensation Scheme (FSCS), while European investors under eToro Europe are covered by the Investor Compensation Fund for Customers of Cypriot Investment Firms, offering protection up to €20,000.

Though eToro is not publicly traded at the moment, the company has plans to go public soon, with a potential listing on the stock exchange. Additionally, users can enhance their account security by enabling Two Factor Authentication (2FA).

In summary, eToro presents a robust trading platform for a wide range of assets, with a focus on safety and user protection, making it a compelling choice for traders of various levels of experience.

| Trading Platform | eToro |

|---|---|

| Demo account: | Yes |

| Minimum Deposit: | $50 - $200 |

| Minimum Trade: | $50 - $1000 (less with leverage) |

| Copy Trading: | Yes |

| Mobile App: | iOS, Android |

| Desktop: | N/A |

| Web Platform: | Proprietary |

| Countries not available: | Canada, Japan, Cuba, Iran, North Korea, Sudan, Syria and Venezuela (full list) |

| Deposit Methods: | Bank Transfer, Maestro, Visa, MasterCard, Diners Club, PayPal, Skrill, Neteller |

| Withdrawals: | 3 - 8 days |

| Islamic Account: | Yes |

| Regulated by: | FCA, CySec, FinCen, ASIC |

| Our Score: | 4.9/5 |

The eToro trading platform has a general main appeal for social trading. This allows users who don't want to trade to copy the trades of successful investors. eToro allows this by providing a messaging feature, a social media feed, and other similar add-ons that we will explain in further detail. Fully automated trading systems are not permitted.

List of eToro Subsidiaries by Location:

- United Kingdom:eToro U.K. Ltd., which is regulated by the Financial Conduct Authority (FCA) (FCA)

- Australia: eToro AUS Capital Pty Ltd., regulated by the Australian Securities and Investments Commission (ASIC)

- Cyprus: eToro (Europe) Ltd. regulated by Cyprus Securities and Exchange Commission (CySEC)

- United States: eToro (Europe) Ltd., under the regulation of the Cyprus Securities and Exchange Commission (CySEC).

| PROS | CONS |

|---|---|

| Easy Account Opening. | CFD and Forex Fees. |

| User-Friendly Website and Mobile App. | Withdrawals may take longer than usual. |

| Recognized as the Best Social Trading Platform. | |

| Ideal for Crypto Trading. |

Comparison of eToro to Similar Trading Platforms:

Now, let's provide an overview of how eToro stacks up against other trading platforms.

| Trading Platform | eToro | Plus500 | XTB | Trading 212 | Interactive Brokers |

|---|---|---|---|---|---|

| Founded | 2007 | 2008 | 2002 | 2004 | 1993 |

| Headquarters | Tel Aviv, Israel | Israel | Poland | London, United Kingdom | Greenwich, Connecticut, United States |

| Regulation | FCA, CySEC, ASIC | CySEC, FCA, MAS, ASIC, FMA, and FSCA | FCA, Cyprus Securities and Exchange Commission (CySEC), Belize International Financial Services Commission (IFSC) | FCA, FSC, CySEC | MAS, FCA, CFTC, SEC, CBI, IIROC, ASIC, CSSF |

| Minimum Deposit | $50 - $10,000 | $100 | $0 | $0 | $0 |

| Withdrawal Fees | $5 withdrawal fee | $0 | Yes (varies with withdrawal method) | No | 1 Free Withdrawal/month |

| Inactivity Fees | $10/month (after 12 months of no login activity) | $10/month (after 3 months of no login activity) | Yes | Yes | $0 |

| Instruments Available | 2000+ | CFDs on: Indices, Forex, Commodities, Crypto, Shares, Options, ETFs | 4000+ (FX, Commodity CFDs, Indices, Stocks, Cryptocurrency) | Over 7000 Global Stocks & ETFs and CFDs on Forex, Commodities, Indices, Stocks | Access to 150 Exchanges (CFDs, Funds, Crypto, Futures, Options, Bonds, Stocks, ETFs, Forex) eToro stocks and shares isa. |

Overview

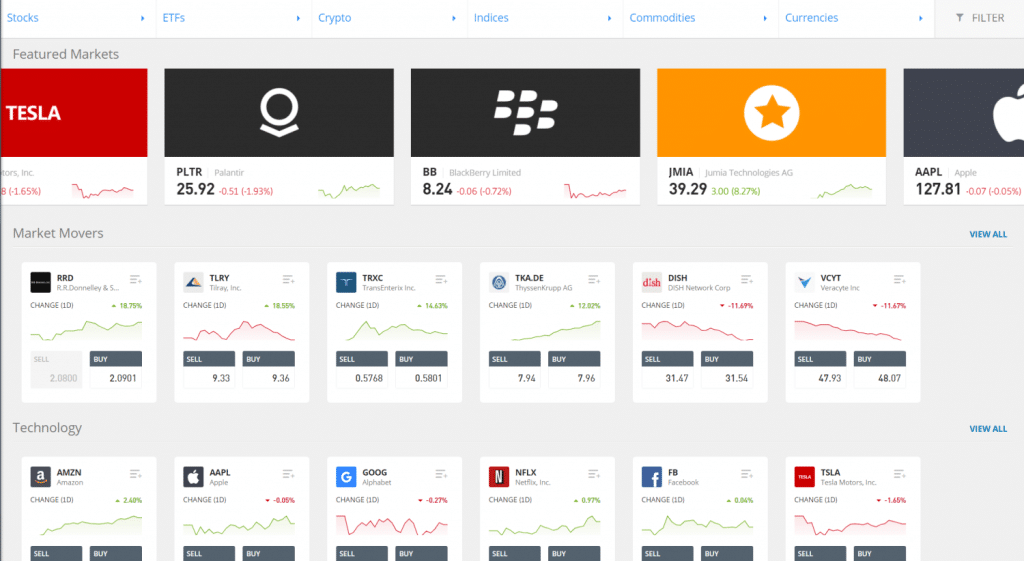

eToro presents a wide array of investment products, encompassing stocks, fiat currencies, commodities, exchange-traded funds, and a selection of 15 cryptocurrencies.

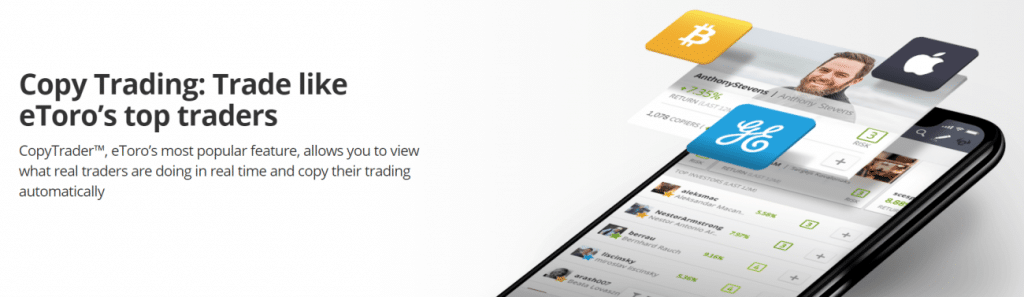

Notably, eToro stood at the forefront of online brokers by introducing the concept of social trading, effectively pioneering this trend. While numerous competitors have since followed suit, eToro remains at the forefront of this field, offering a unique blend of social interaction reminiscent of social media platforms. Here, users connect, chat, and engage in following other traders, examining their performance and preferred trading instruments. Within this innovative environment, eToro has unveiled two groundbreaking products: CopyTrader™ and CopyPortfolios™.

eToro has earned a solid reputation as a secure and appealing brokerage for both seasoned and novice day traders. This reputation is further enhanced by eToro's competitive fee structure and user-friendly interface, making it a valuable addition to any trader's toolkit. For those seeking alternatives, Interactive Brokers and Plus500 are notable choices, while individuals interested in Forex trading may want to explore Pepperstone and AvaTrade, as highlighted in our reviews.

In 2019, eToro expanded its offerings by launching eToroX, a cryptocurrency exchange. This exchange is subject to regulation by the Gibraltar Financial Services Commission (Gibraltar FSC) and is registered with FinCEN as a Money Service Business, bolstering eToro's presence in the crypto market.

Web-Based Platform

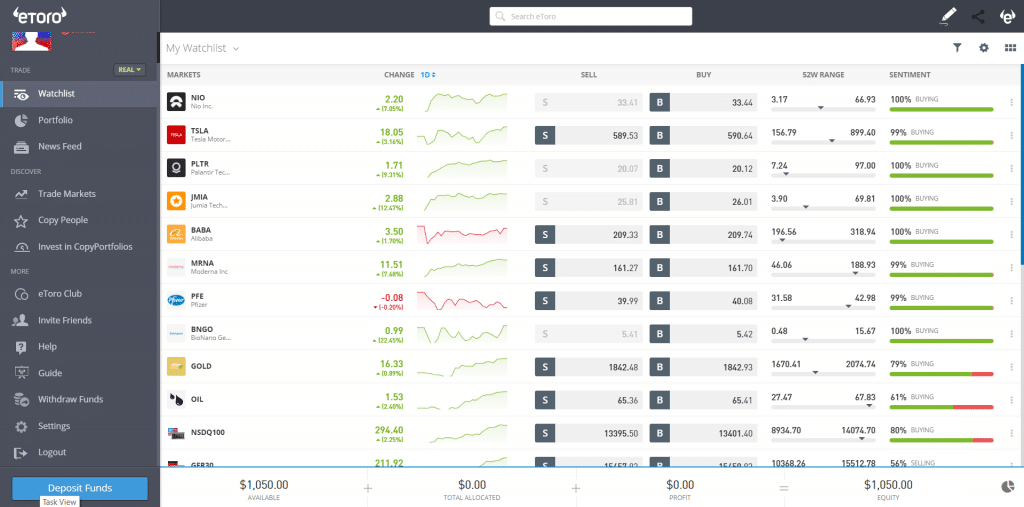

All of these features are accessible through eToro's web-based platform.

They offer both a web-based and mobile platform, but they do not provide a desktop platform.

Their interface supports 26 different languages, presenting a polished and contemporary design that particularly appeals to a younger audience. This stands in contrast to the more traditional and occasionally outdated platforms offered by other brokerage firms.

However, one drawback is that the eToro workspace lacks customization options; users need to adapt to the interface as it comes.

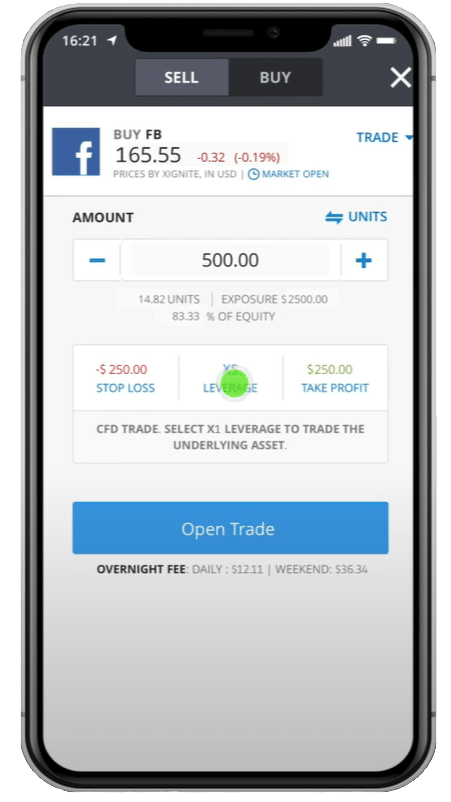

Mobile App

The web platform and eToro's mobile app both feature a two-step login process, enhancing security for users. Additionally, they offer predictive search functions, making it convenient to navigate through a vast array of available securities directly on your mobile device.

Both versions also provide real-time market price alerts and notifications, which can be delivered via push notifications for your convenience.

Under the portfolio tab, users can access reports that include a summary of their trades, market values, and the fees incurred. Furthermore, an account statement is available, offering a comprehensive overview of all transactions conducted during a specific period.

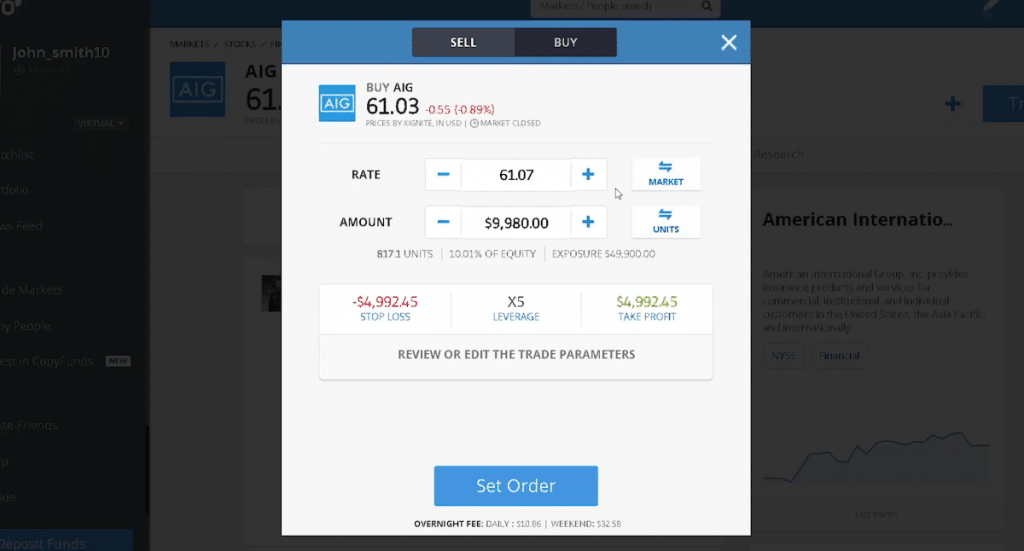

Minimum Trade Size

As of December 6th, 2020

| Market | Minimum Trade Size |

|---|---|

| Crypto | $10 |

| Stocks and ETFs | $10 |

| Currencies | $1,000 |

| Commodities | $1,000 |

| Indices | $1,000 |

| Copy Trading | $1 |

Minimum Trade Size:

The minimum trade size takes leverage into account. For example, if a user wishes to initiate a position in oil (a commodity with a $1000 minimum requirement), they can do so with just $100, leveraging at 10x. In the realm of eToro copy trading, the minimum initial investment is $200, with a minimum requirement of $1 for each copied trade.

However, it's important to note that individuals engaged in active or high-volume trading may find eToro's small maximum trade sizes limiting and may need to explore alternative options.

eToro Fees

eToro's fee structure is positioned at the lower end of the industry spectrum. Notably, they do not impose fees for US-listed stocks. CFD fees are kept low and are factored into the spread. For instance, the S&P 500 CFD incurs a fee of 0.75, while the Europe 50 CFD carries a fee of 3. When trading cryptocurrencies, a 1% fee is added to the spread during both buying and selling, and this fee is integrated into the displayed price unless trading under ASIC (Australian Securities & Exchange Commission).

However, it's worth mentioning that currency pairs come with relatively high trading costs, exemplified by the EUR USD currency pair incurring a 3-pip fee, whereas many other brokers charge between 0.6 and 1 pip per trade. For forex traders, there are more favorable options elsewhere, particularly for active or high-volume traders. We recommend considering Pepperstone or Avatrade for better spreads.

Deposit fee

eToro does not impose any deposit fees. It aligns with the standard practice of most brokers, which typically do not charge fees for depositing funds.

Withdrawal fee

When it comes to withdrawals, eToro applies a $5 fee for bank transfers, consistent with industry norms.

Inactivity Fee

eToro has an inactivity fee of $10 per month if the user fails to log into their account for a continuous 12-month period. The specific overnight rollover fees vary depending on prevailing market conditions.

Comparing Trading Fees

To assess trading fees, it's essential to consider these factors when comparing eToro with other platforms

| Platoform | eToro | Interactive Brokers | Plus500 | Gemini | Binance | Robinhood | Coinbase |

|---|---|---|---|---|---|---|---|

| EURUSD | Varied Spread | Spreads | Spread: 0.01% | N/A | N/A | N/A | N/A |

| GBPUSD | Varied Spread | Spreads | Spread: 0.02% | N/A | N/A | N/A | N/A |

| Bitcoin | 1% | 0.12% - 0.18% of trade value | Spread: 0.30% | $0.99 up to 1.49% of Order Value | 0.02% - 0.1% of Order Value | 0% | 0.6% of Order Value |

| Apple Fees | $0 | $0 commissions | Spread: 0.74% | N/A | N/A | $0.000130 per share | N/A |

| Tesla Fees | $0 | $0 commissions | Spread: 0.75% | N/A | N/A | $0.000130 per share | N/A |

| Amazon Fees | $0 | $0 commissions | Spread: 0.75% | N/A | N/A | $0.000130 per share | N/A |

| S&P 500 Fees | Varied Spread | N/A | Spread: 0.02% | N/A | N/A | 0% | N/A |

| Options Fee | N/A | $0.25/contract - $0.65/contract | Spread | N/A | N/A | $0.00218 per contract | N/A |

| Mutal Fund Fees | N/A | No Transction Fee Funds - 0.00 USD and Lesser of 3% or 14.95 for Transaciton Fees | N/A | N/A | N/A | N/A | N/A |

| ETF Fee | $0 | $0 commissions | Spread | N/A | N/A | 0% | N/A |

Order Types

eToro offers a selection of four distinct order types:

- Market: A market order is promptly executed at the prevailing quoted price at the moment the order is placed.

- Limit: This order type establishes a predetermined maximum or minimum price at which the financial asset should be either purchased or sold.

- Stop-loss: Executed when the security's price reaches a specific predetermined level, a stop-loss order is designed to minimize potential losses.

- Trailing stop-loss: This order empowers traders to secure their gains by initiating the sale of the asset only when the price reaches a certain point, moving in the opposite direction (or in favor of a short position), while remaining inactive as long as the price continues to move favorably for the trade.

eToro Markets & Products

In the course of this review, we find it prudent to explore the extensive range of investment opportunities offered by eToro, which encompasses a multitude of options. These encompass currencies, indices, Exchange-Traded Funds (ETFs), and a selection of 15 cryptocurrencies. Each of these asset classes is amenable to various investment strategies, catering to diverse trading preferences.

It's important to note that eToro does not facilitate equity trading. However, their array of investment choices is more than satisfactory, providing a diverse selection that should meet the needs of most traders.

eToro allows direct trading of stocks and cryptocurrencies, bypassing the need for Contracts for Difference (CFDs). Furthermore, they support an extensive range of Exchange-Traded Securities (ETS), offering the advantage of $0 commission fees for US stocks and the option to engage in fractional share trading, which includes trading based on the eToro stock price.

Is eToro a Suitable Choice for Cryptocurrency Trading?

Maintaining objectivity and impartiality in our review is of utmost importance to us. In light of this commitment, it is with sincerity that we acknowledge eToro as one of the top choices for cryptocurrency traders. eToro offers a robust portfolio of major cryptocurrencies, making it an excellent platform for individuals who wish to focus on this specific market. It's important to note that trading crypto assets on eToro is not overseen by any EU regulatory framework.

Some of the popular cryptocurrencies available on eToro include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Bitcoin Cash (BCH)

- Ripple (XRP)

- Dash

- LiteCoin (LTC)

- Ethereum Classic (ETC)

- Cardano (ADA)

- Stellar Lumens

- plus 85 more…

CopyPortfolios

eToro caters to CFD trading across various financial markets, encompassing commodities and stock indexes. Additionally, the platform provides access to specific asset management solutions, notably Copy Portfolios™ and Copy Traders™ solutions. eToro's CFD trading features innovative elements that consolidate different traders into a single fund. These options are particularly appealing to eToro clients seeking a passive approach to engage in CFD trading.

It's important to be aware that cryptocurrency trading on eToro involves CFD trading on the actual underlying asset, rather than physically owning the cryptocurrency. Please note that Crypto CFDs are not available to UK clients due to the FCA's ban on cryptocurrency CFD derivatives.

Copy Trading

The copy trading feature enables traders to replicate the actions of other individuals on the platform. In this process, the platform assumes control of the user's account and adjusts their portfolio in accordance with the modifications made by the copied portfolio over time.

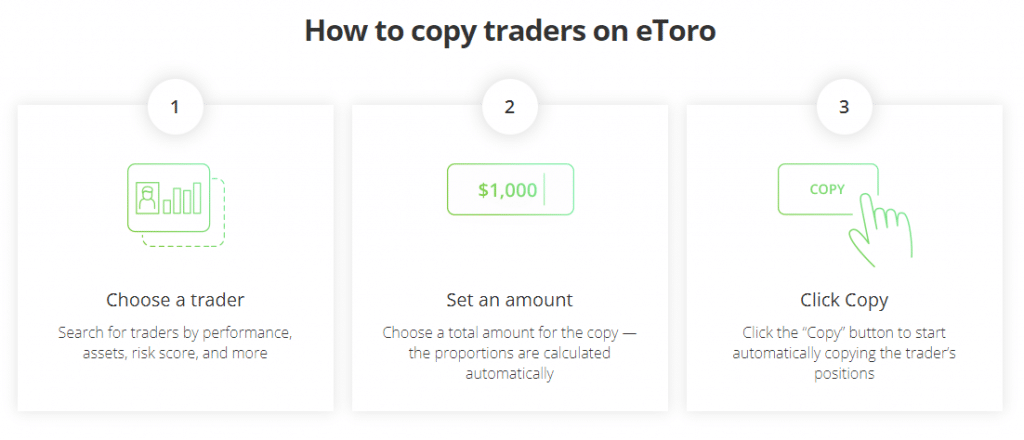

To initiate copy trading on eToro, simply follow these straightforward steps:

- Select a trader based on their performance, choice of assets, risk score, and other relevant criteria.

- Specify the amount you intend to copy with.

- Click the "Copy" button, and you're all set.

The Copy Trader feature empowers users to peruse a list of traders and select the top-performing ones to replicate their portfolios. This functionality is particularly appealing to passive traders and those who may be less experienced, as it allows them to seamlessly blend self-directed trading with copy trading. For individuals just embarking on their trading journey, this serves as an excellent resource for gaining valuable insights.

It's essential to note that the copy trading system on eToro is entirely manual, in contrast to fully automated trading systems found on platforms like MetaTrader, which are not permissible. This distinction provides the assurance that when you copy a trader on eToro, they are executing those trades manually. It's worth mentioning that many other social trading platforms accommodate both manual and automated trading strategies.

Wallet

eToro's mobile wallet app is a secure digital wallet boasting compatibility with over 120 cryptocurrencies. This multi-crypto wallet offers a secure environment for purchasing, receiving, and storing cryptocurrencies. The eToro Wallet's user interface closely resembles that of the mobile app, ensuring a seamless transition for users.

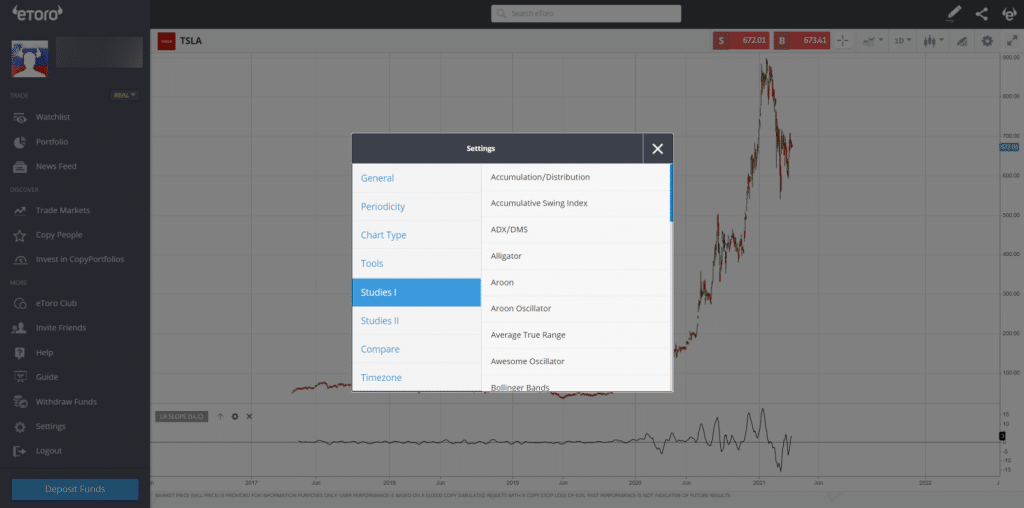

eToro Research and Technical Analysis Tools:

eToro offers a range of technical analysis tools, complemented by analyst recommendations, yet it falls short on fundamental data. The charting tools are robust, boasting over 70 technical indicators and charts for in-depth price analysis. However, it's important to note that the charting tool's maximum time span is limited to 6 months, making it suitable for shorter-term analyses.

Within eToro's research toolkit, you'll find valuable resources, including an economic calendar, daily market analysis, podcasts, and earnings reports.

Market Sentiment Data: Each financial asset on eToro features its own market sentiment data, revealing the percentage of traders inclined to buy or sell that particular security. This sentiment data is calculated based on the trading activities of top users, providing a more reliable gauge. Additionally, you can access analyst comments for select popular assets.

The news feed, while informative, is primarily composed of tweets and comments from users within the eToro community. This constitutes a public news feed generated by eToro users themselves. In-house content typically maintains higher quality standards. However, it's worth noting that major external media outlets such as Reuters or Bloomberg are not integrated into the platform.

As for fundamental data, eToro provides basic financial ratios, but it lacks historical records of balance sheets, income statements, price targets, or earnings estimates.

In the realm of cryptocurrency tools, users have access to crypto trading ideas and the option to replicate the strategies of individual traders or groups across 94 supported cryptocurrency pairs.

eToro's notable strength lies in its hands-off trading approach and the vibrant community for idea sharing. However, it does not offer substantial third-party analysis resources.

Educational Resources

eToro's educational offerings are decent, encompassing a variety of resources to assist traders in their learning journey. These resources include weekly webinars, video tutorials covering the platform's features, and an extensive FAQ section. The tutorials range from basic platform guides to beginner-oriented content and more advanced lessons.

Platform Educational Content

eToro's educational offerings are decent, encompassing a variety of resources to assist traders in their learning journey. These resources include weekly webinars, video tutorials covering the platform's features, and an extensive FAQ section. The tutorials range from basic platform guides to beginner-oriented content and more advanced lessons.

Trading School

On the platform itself, you'll find a comprehensive "Details" section located next to the various financial instruments. These details extend beyond the fundamentals, providing additional valuable insights. For instance, this section offers information about the instrument itself and considerations to ponder before making an investment decision.

Trading School

eToro presents a "Trading School" section where you can access a series of fundamental video lessons. While these videos serve as a solid starting point, they do not delve deeply into specific topics and may not be overly comprehensive. Additionally, eToro maintains a YouTube channel containing past webinars and diverse educational content, such as analysis videos and additional tutorials.

eToro demo account For beginners, eToro offers a demo account, which proves instrumental in the learning process, allowing individuals to practice trading without risking real capital.

Trading Knowledge Assessment:

Opening a new trading account on eToro requires completing a relatively basic test known as the "eToro trading knowledge assessment." This assessment shouldn't pose significant challenges for those with a reasonable grasp of trading fundamentals.

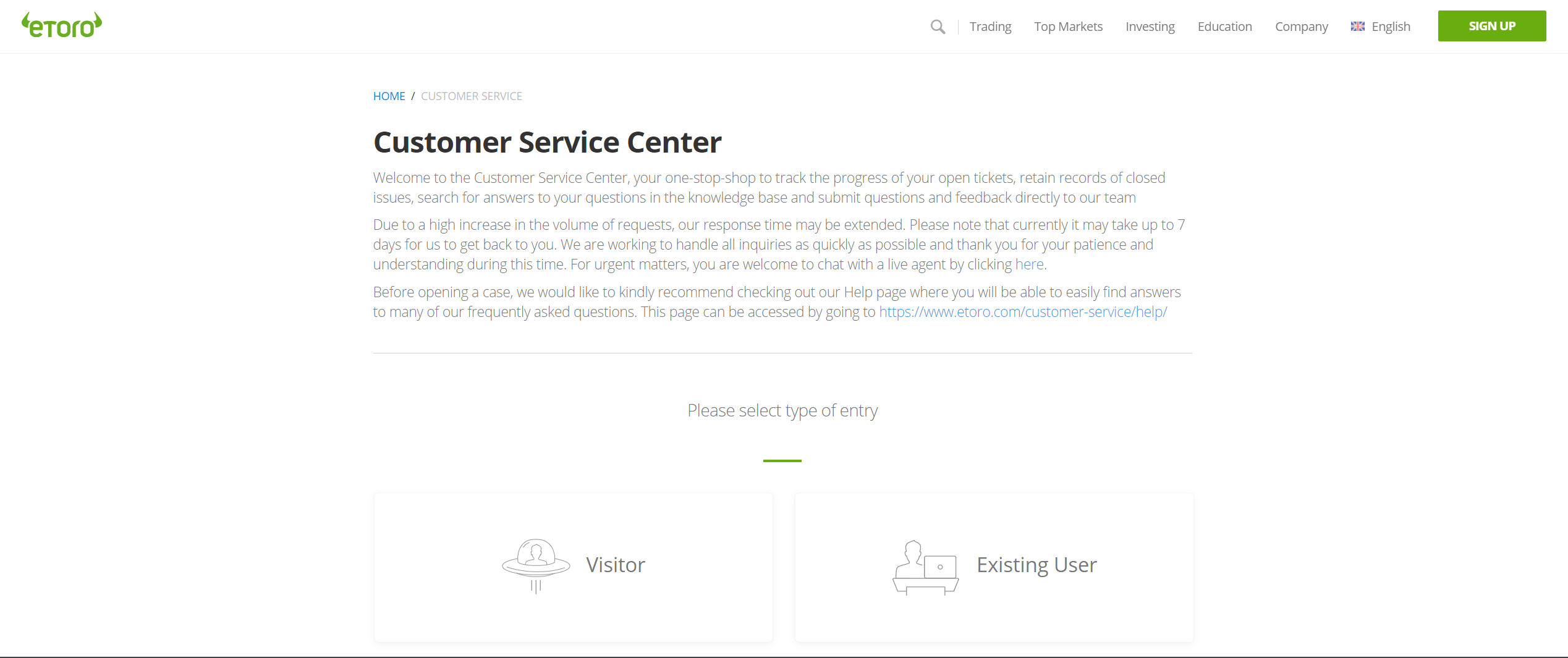

Customer Support

eToro's customer support is satisfactory, although it does have some limitations. The eToro help center offers a live chat feature, but it may not be immediately evident as it's somewhat concealed within the FAQ section. Some traders have reported that customer service representatives are occupied, particularly over the weekends, when attention may be scarce.

Notably, eToro does not provide email or phone support. Instead, they rely on support tickets submitted through their platform interface. The response to these tickets is promptly delivered to the user's email inbox. The response time is generally swift, typically within 24 hours or less.

While eToro's customer service may not be considered the best in the industry, it adequately addresses basic issues and concerns.

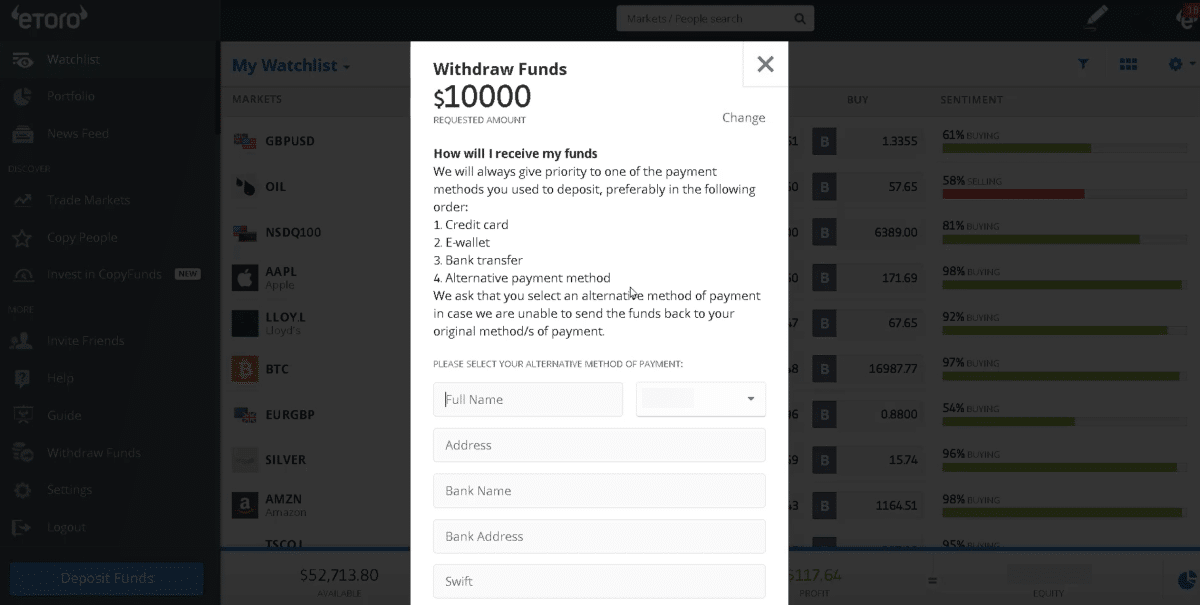

Withdrawals

Withdrawing funds from eToro is a straightforward process. eToro imposes a $5 withdrawal fee and requires a minimum withdrawal amount of $30 per transaction. Clients have the option to withdraw funds to a bank card, electronic wallet, or bank account. However, it's important to note that withdrawing funds to an account with a base currency different from the US dollar may incur additional currency conversion fees.

Withdrawals via credit cards, debit cards, and electronic wallets are processed instantly, while bank account transfers may take up to 2 business days for completion. During the pending phase, withdrawals are displayed as 'eToro withdrawal under review.' Importantly, there are no specific withdrawal limits imposed by eToro.

How to Open an eToro Account

The process of opening a new eToro account is quick and entirely online. Registration typically takes only a few minutes to complete. You can explore the web platform even before registering.

eToro accounts are accessible in most countries, but there are certain countries where account registration is prohibited. These countries include Albania, Canada, Cuba, Iran, Iraq, Jamaica, Japan, Nicaragua, Pakistan, Syria, and Serbia. Additionally, U.S. customers located outside of US territories are unable to open eToro accounts.

Account types

Types of eToro Accounts

Retail Accounts

Retail traders have access to all available assets and can engage in both copy and manual trading. Leverage is limited, but these accounts benefit from investor compensation fund coverage and negative balance protection.

Professional Accounts

To qualify for a professional account, clients must pass an assessment test. Professional accounts do not have access to ESMA investor protection measures like the Investor Compensation Fund and the Financial Ombudsman Service. However, they gain access to higher leverage ratios.

Demo Account

eToro provides a demo account with a balance of $100,000, allowing traders to practice using virtual funds on the platform. This account offers real-time prices, making it an excellent way to hone trading skills without real financial risk.

Popular Investor Program

Successful traders can participate in the Popular Investor Program, which allows others to replicate their trading strategies. This program features four different levels of participation.

Verification Process

Before depositing funds, users must undergo an identity verification process. This process requires proof of identity and proof of residency documentation. Typically, verification is completed within a day once all necessary documents are provided. Additionally, users may need to complete a brief survey to assess their trading knowledge and experience.

eToro Tiers

eToro features a membership program with various benefits available. There are multiple eToro membership levels, ranging from silver to diamond, depending on the trading activity.

Funding

Depositing funds into an eToro account is a hassle-free process, and there are no deposit fees.

Deposit Methods

Depositing funds into your eToro account can be done using debit or credit cards, or electronic wallets like PayPal or Skrill. Deposits made via these methods are credited instantly. However, bank transfers may take up to 7 days to clear. It's worth noting that eToro is actively working on expanding its range of funding options, with additional options expected in the near future.

Minimum Deposit

The minimum deposit requirement at eToro is typically $50. However, it's important to highlight that the minimum first deposit has been reduced for clients in the United Kingdom, Switzerland, Italy, Sweden, Ireland, Spain, Netherlands, Germany, Austria, Norway, France, and Australia.

There are certain exceptions to this minimum deposit requirement:

- For clients in Israel, the minimum deposit is set at $10,000.

- For deposits made via bank transfers, the minimum amount is $500.

Professional accounts entail the same minimum investment amount as regular accounts. These accounts grant users the ability to utilize higher leverage ratios for their transactions. However, to qualify as a professional client, traders must meet specific criteria. In some instances, eToro may require the first deposit to be made using a debit or credit card, while subsequent deposits can be made using other accepted methods.

It's noteworthy that eToro provides accounts denominated in a single currency, the US dollar. In contrast, some other brokers offer a broader selection of five or more base currencies for their accounts.

Conversion Fees:

eToro traders should be aware of conversion fees if they deposit funds using a payment method with a currency different from the US dollar. These conversion costs start at 50 pips, which equates to approximately 0.46% of the deposited amount. Additionally, eToro stipulates that deposits must originate from accounts in the account holder's name.

| Regulation | eToro |

|---|---|

| CySEC | Yes |

| ASIC | Yes |

| FinCEN | Yes |

| FCA | Yes |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

They offer zero-fee stocks for US-listed securities. This is a great advantage and puts them on top of many of its rivals.

Their fees for CFDs are below the market average, even though its forex broker fees are higher compared to other brokers.

Their social trading interface has an incredible design and it is a captivating alternative for those who are starting out their journey. Traders can connect with more experienced peers or seek potential ideas to start off by using the social feed.

Conclusion

eToro, as a zero-fee stock broker for US-listed securities, stands out as a top choice in the market. Their fee structure for CFDs is below the industry average, although their forex broker fees are somewhat higher compared to competitors.

One of eToro's standout features is its engaging and well-designed social trading interface. It's particularly appealing for beginners who want to connect with more experienced traders, seek trading ideas, and leverage the social feed.

In summary, eToro is a legitimate and secure platform offering zero-commission stock trading. Their user-friendly platform and excellent mobile trading app make it accessible to a wide range of investors. eToro provides opportunities for investing in stocks, forex pairs, ETFs, and is especially strong in copy and cryptocurrency trading. Account opening is a straightforward process, and customer support is reliable.

Operating in over 140 countries with a vast client base, eToro is a prominent broker. However, it's essential to note that it is restricted in 30 countries.

In the United States, users from eligible states can register and trade cryptocurrencies. The demo account provides $100,000 in virtual funds but requires completion of ID verification before depositing real money.

eToro offers a diverse range of assets, including US-listed stocks, currency pairs, cryptocurrencies, and more. The platform is accessible in 26 different languages, and its charting tools encompass over 70 technical indicators.

Overall, eToro is an excellent choice for less experienced traders seeking guidance. However, it may not be the optimal choice for active or high-volume traders due to higher spreads and limited maximum trade sizes.

This comprehensive overview provides a detailed understanding of eToro, addressing key aspects relevant to typical investors.

- Best For Social Copy Trading

- 0% Commissions on Stocks

- Regulated by top-tier Authorities

- Easy to Use

- Great Variety of Investments

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Frequently Asked Questions (FAQ) about eToro

How does eToro make money?

eToro generates revenue through three primary avenues. They operate as market maker brokers, employing a NDD-STP hybrid model. Profits come from traders' losses, and the platform undergoes audits to ensure market fairness. Additionally, eToro earns income from CFD fees and commissions, as well as non-trading fees such as withdrawal and inactivity fees.

Is eToro trustworthy?

Yes, eToro, established in 2007, holds licenses in numerous top-tier jurisdictions. As a regulated financial services company, it undergoes regular audits and monitoring. Trusted by over 15 million users across 170 countries, eToro recently merged with FinTech Acquisition Corp. V, positioning itself as a publicly traded company listed on the NASDAQ stock exchange. This indicates a high level of trustworthiness, comparable to other established platforms.

What type Of broker is eToro?

eToro operates as a market maker broker, employing a hybrid model combining aspects of STP (Straight-Through Processing) and NDD (Non Dealing Desk) practices. This approach ensures high-quality execution for traders, depending on the specific entity they are trading with.

Is eToro suitable for beginners?

eToro is an excellent choice for beginners. Their user-friendly trading platform is intuitive, with transparent fees and secure login procedures. Some instruments can be traded with zero fees. eToro offers a demo account, a low minimum deposit requirement, and an exceptional mobile trading platform, making it ideal for newcomers. The platform's interface is user-friendly and less intimidating compared to platforms designed for experienced investors.

Does eToro offer an ISA (Individual Savings Account)?

No, eToro does not currently offer an eToro ISA account, which means trading in a more tax-efficient manner is not possible on their platform. However, it's worth keeping an eye on future developments in case eToro introduces an ISA account option.

Can you make money on eToro?

Yes, it is possible to make money on eToro, but like any other broker, success depends on informed trading decisions. Achieving profitability involves managing losses and aiming for consistent profits. eToro stands out with its copy trading feature, which can be particularly beneficial for inexperienced traders. While eToro offers a user-friendly platform and free stock investing, traders should remain aware of the potential for losses. It's essential to approach trading with care, especially for new investors.

eToro provides a range of investment opportunities, including real stocks and cryptocurrencies, making it suitable for various trading strategies. However, traders should be mindful of withdrawal fees and currency conversion costs, as eToro primarily offers USD-denominated accounts.

Disclosures

eToro is a versatile platform offering opportunities for stock and crypto asset investments, as well as CFD trading. It's important to be aware that trading CFDs involves a high risk of rapid capital loss due to leverage. A significant proportion, 81%, of retail accounts have experienced losses when trading CFDs with this provider. Before engaging in such trading, it's crucial to evaluate your understanding of CFDs and your capacity to bear the associated risk, particularly considering the notable percentage of accounts incurring losses.

Please note that past performance does not serve as a reliable indicator of future results. The trading history presented encompasses less than five full years and may not provide an adequate foundation for making investment decisions.

Copy trading is a portfolio management service offered by eToro (Europe) Ltd., an entity authorized and regulated by the Cyprus Securities and Exchange Commission.

Investing in crypto assets is characterized by high volatility and a lack of regulation in certain EU countries, resulting in a lack of consumer protection. Additionally, tax implications on profits may apply.

It's important to emphasize that eToro USA LLC does not provide CFDs and disclaims any responsibility for the accuracy or completeness of the content in this publication. The content has been prepared by our partner using publicly available non-entity specific information about eToro.