Interactive Brokers, founded in 1978 in New York City and headquartered in Greenwich, Connecticut, stands as one of the world's largest brokerage firms. With a presence in 14 different countries through over 24 offices, it caters to more than 1.3 million brokerage accounts, serving clients globally.

One of the standout features of IBKR is its low trading fees, coupled with a robust trading platform and an extensive selection of securities. Notably, Interactive Brokers boasts industry-leading low margin rates and provides access to over 150 different markets and numerous exchanges, making it a preferred choice for many investors. A key factor contributing to its popularity is its stringent regulation by some of the world's most reputable regulatory agencies.

Interactive Brokers in a Nutshell:

Summary

Interactive Brokers is not only licensed by top-tier regulators but also listed on the stock exchange, boasting a long and reputable track record. Its user-friendly trading platform is complemented by a wealth of tools, making it an excellent choice for traders, whether they are beginners or experienced, especially for those interested in options, stocks, and margin trading.

Platform Overview

Interactive Brokers caters to a diverse audience, from beginners to experienced traders worldwide. While its core clientele consists of institutional investors and professional traders, it also appeals to active day traders due to its competitive commissions and fees. Moreover, the broker is subject to rigorous regulation by multiple top-tier jurisdictions, including the United States Securities and Exchange Commission (SEC), Securities Futures Commission, the UK's Financial Conduct Authority (FCA), among others.

| Interactive Brokers | |

|---|---|

| Minimum Deposit | $0 |

| ETFs Fees | $0.005 |

| US Stock Trading Fee | min. $1 or max. 1% of trade value (Free for US IBKR Lite Plan) |

| UK Stock Trading Fee | 0,05% for trades above £50,000, fixed 6£ for trades below £50,000 |

| German Stock | 0,1% of trade value (max. €99) |

| Forex Fees | Low |

| Mutual Funds | $0 |

| Options | $0.65 up to $2.22 per contract |

| Futures Fees | $0.25 up to $2.22 per contract |

| CFD Fees | $0.005 ($1 min.) up to $3.92 per order |

| Bonds | $2.35 up to $5 (IBKR Lite – free for US treasury bond) |

Selecting the right brokerage firm from the multitude of options available can be a daunting and time-consuming task, diverting your precious time away from potentially more profitable and fulfilling pursuits

Given the intricacies involved in evaluating brokers and weighing their pros and cons comprehensively, we have undertaken the effort of distilling the essential attributes of this broker for your convenience. Our aim is to streamline the process of identifying top contenders, thus saving you valuable time.

Leverage my review in conjunction with our assessments of other brokers featured on Public Finance International to facilitate a comparative analysis of key features and characteristics. This approach will empower you to make a well-informed choice, allowing you to confidently select the broker that best aligns with your needs and preferences.

| PROS | CONS |

| An extensive array of products is readily accessible. | The trading platform may pose a challenge for novice users due to its advanced features. |

| Endorsed and overseen by esteemed top-tier regulatory bodies. | |

| Exceptional research resources. |

Account Opening Process

Initiating your account is a seamless online procedure that typically requires just a few minutes. Upon registration, you'll need to undergo identity verification, which should be completed within 24 hours, provided all requisite information is supplied.

Interactive Brokers extends a variety of account types to cater to diverse needs, including individual and joint accounts, trust accounts, retirement accounts, friends and family managed accounts, and institutional accounts suitable for businesses, hedge funds, and family offices. Additionally, there's a specialized money manager account tailored for professional investment managers. Please note that the availability of these account types may vary based on your country of residence.

Broadly speaking, Interactive Brokers offers two main types of accounts:

- IBKR Lite: Designed for retail investors, this account imposes no minimum deposit requirement. However, a minimum balance of $2,000 is needed for margin trading. IBKR Lite offers commission-free trading for U.S.-listed stocks and ETFs, as well as fixed pricing for options, futures, and mutual funds, with no maintenance fees.

- IBKR Pro: Primarily targeted at institutional investors, high-net-worth individuals, and professional traders, the IBKR Pro account provides unlimited commission-free trading for U.S. stocks, ETFs, and select mutual funds. It offers both fixed and tiered pricing, with costs varying based on trade volume. There are no maintenance fees associated with this account.

For those looking to familiarize themselves with Interactive Brokers' services before committing, a demo account with $1,000,000 in virtual funds is available.

Please note that active users on the platform have access to a comprehensive suite of tools, even though data for most instruments is subject to a 10 to 15-minute delay.

Interactive Brokers Margin Rates

Here's a comparison of USD margin rates offered by Interactive Brokers:

| $25K | $300K | $1.5M | $3.5M | |

| Interactive Brokers | 6.08% | 5.75% | 5.53% | 5.42% |

| Fidelity | 12.33% | 11.075% | 8.50% | 8.50% |

| Schwab | 12.33% | 11.08% | N/A | N/A |

| E-Trade | 12.95% | 6.95% | N/A | N/A |

| TD Ameritrade | 13.50% | 12.00% | N/A | N/A |

Deposits

Interactive Brokers does not charge deposit fees. They provide more than 24 different base currencies for its accounts. These include the most popular ones – US Dollar, Australian Dollar, and Euro – and some exotic ones like the Israeli Shekel, and the Mexican Peso.

Interactive Brokers Minimum Deposit

To open an account with Interactive Brokers there is no minimum deposit at Interactive Brokers.

If you plan to invest with several securities and trade heavily, they recommend you deposit $25,000. This ensures you don't get your account locked by the SEC and the pattern day trader rule.

The following is a list of the available deposit methods:

- ACH deposits

- Checks

- Online bill payment

- IRA rollovers

For Wire Transfers, Interactive Brokers routing number is 021000089.

Bank transfers typically take between 2 and 3 days to be cleared.

Withdrawals

Interactive Brokers does not charge a fee for the first withdrawal of each month. Withdrawal methods are limited to bank transfers as withdrawals cannot be made to debit cards, credit cards, or electronic wallets. Withdrawals typically take 1 to 2 business days to be cleared.

Furthermore, they offer multiple base currencies for its accounts. This could help traders in saving conversion fees when withdrawing money.

Interactive Brokers Withdrawal Fees

Subsequent withdrawal fees after the first free one – vary depending on the account's base currency. In general, they can be estimated as $10 per withdrawal. Additionally, check payments for US clients generate an additional $4 fee.

Interactive Brokers Markets Available

Interactive Brokers offers one of the industry's most extensive portfolios of financial products. A wide range of products are available for both active traders and buy-and-hold investors.

Their platform offers access to 140 different exchanges worldwide. This includes 78 stock markets, 33 options markets, 32 futures markets.

Interactive Brokers provide access to the following number of investment products:

- Thousands of individual stocks

- Fractional Shares Trading For U.S. and European Stocks

- OTCBB (over-the-counter bulletin board) – Penny Stocks

- 13,000 exchange-traded funds (ETFs)

- 105 currency pairs

- 250 mutual fund providers

- More than 62,000 individual bonds

- Thousands of options

- Dozens of commodity, stock index, and other futures

- 13 stock index CFDs

- 7,100 individual stock CFDs

- Cryptocurrency Trading through Paxos Trust (Bitcoin, Ethereum via Bitcoin Index, Bitcoin futures, and ETN products)

They offer a robo-advisory service called Interactive Advisors. It provides investment advice for clients depending on their financial goals. For that particular service, there's a minimum $100 investment required and certain fees apply.

Mutual Funds include a neat Mutual Fund Search Toll to search by categories such as fund type, fund family, and country.

Interactive Brokers is probably one of the few that provides access to a selection of hedge funds. Even though customers must meet certain criteria to be granted access to this type of investment vehicle. The minimum investment typically starts at $200,000 even though some funds may require a minimum investment of $1 million.

Interactive Brokers Trading Platform

Interactive Brokers offers multiple trading platforms and systems. These include a web-based client's portal, a desktop version, Mobile Trading Apps, a messaging-based trading system, and advanced API features for sophisticated active traders. The IB Trader Workstation includes investment tools like Options Strategy Lab, Volatility Lab, Markets Scanners, and Portfolio Builder.

Take a look at this short tutorial on how to use Interactive Brokers platform

All these variations are accessible to IBKR Pro account holders. Retail investors using an IBKR Lite account can access the Client Portal, IBKR Trader Workstation, and the mobile trading app, known as IBKR TWS Mobile. Additionally, there is a web-based platform available as well.

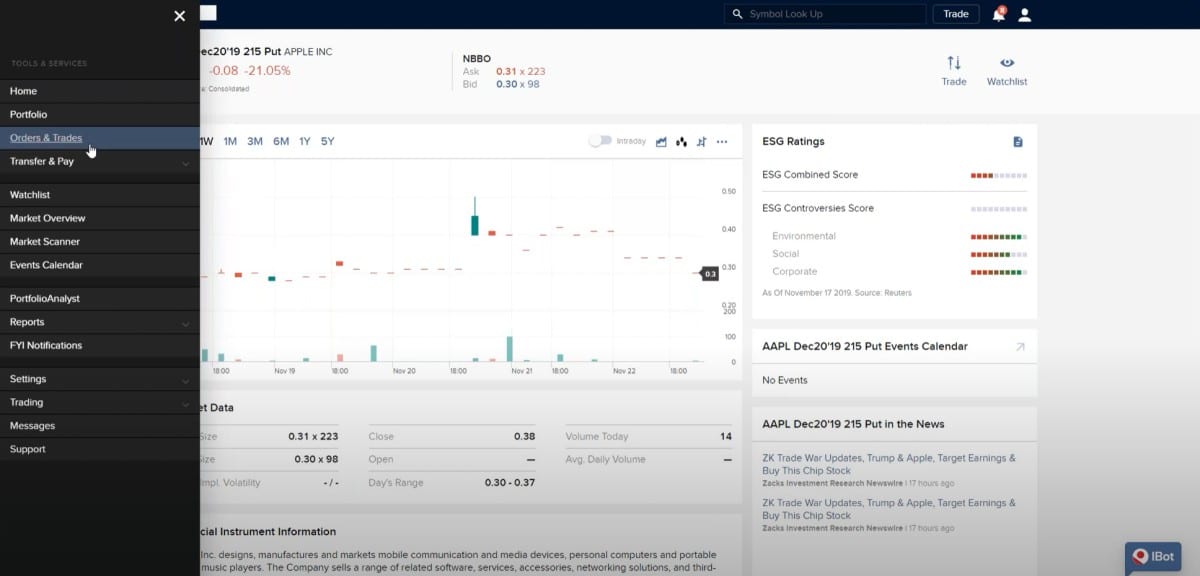

Web-based platform

Interactive Brokers' Client Portal stands out as a user-friendly, cloud-based trading interface boasting a modern design, an intuitive menu, and a user-friendly search function. It eliminates the overwhelming sensation often associated with crowded desktop versions that demand extensive customization for smooth navigation.

This Client Portal appears tailored for retail traders, simplifying tasks such as placing trades, exploring various securities, reviewing reports, and handling daily trading activities. Furthermore, it offers customization in multiple languages, including Dutch, English, Chinese, and Spanish.

To enhance account security, traders can opt for two-step authentication, receiving verification codes via SMS.

The web-based platform empowers traders with a wide array of order types, including Market, Stop, Stop-Limit, Limit, and Trailing-Stop orders. Interactive Brokers also offers less common options like Limit-on-Close and Market-on-Close orders. Various time-bound order alternatives, such as Day, Good-til-Canceled (GTC), Immediate or Cancel, and more, are available.

Alerts and notifications can be configured, delivering push notifications when asset prices hit predefined levels.

The Client Portal's charting tool impresses with a rich selection of indicators and drawing tools, covering both traditional and advanced charting patterns. A news feed accompanies the ticker summary, and essential asset fundamentals are easily accessible. Since 2021, they've provided technical opinions directly from Trading Central.

According to their website, the Client Portal was designed to offer a user-friendly trading interface, making it particularly valuable for new clients seeking real-time portfolio performance insights without grappling with a more complex tool like the TWS.

Desktop Platform

Their desktop trading platform goes by the name TWS and is geared towards advanced users. It offers a robust set of tools and supports sophisticated strategies and systems like algo trading.

TWS was primarily crafted for experienced investors and traders who seek to leverage a broader range of securities and in-depth analytics. These tools become particularly valuable as a portfolio gains complexity.

This platform encompasses everything, catering to both basic and advanced strategies and investment approaches. Consequently, the TWS interface is not as user-friendly and can be challenging for novice traders to navigate.

Traders with prior experience in handling complex trading systems will find this platform intriguing. It offers extensive customization options, which can help streamline navigation through its multifaceted features.

In terms of security features, it offers the same alternatives as the web-based platform, including two-step login with SMS verification code.

Moreover, the desktop version boasts a wider array of complex order types compared to the Client Portal. These include mid-price orders, snap-to-midpoint, snap-to-primary, IBALGO, Hedge, relative, and snap market orders. It also provides various time-bound trade order alternatives.

For those who want to trade on the go, there's a mobile trading app available as well.

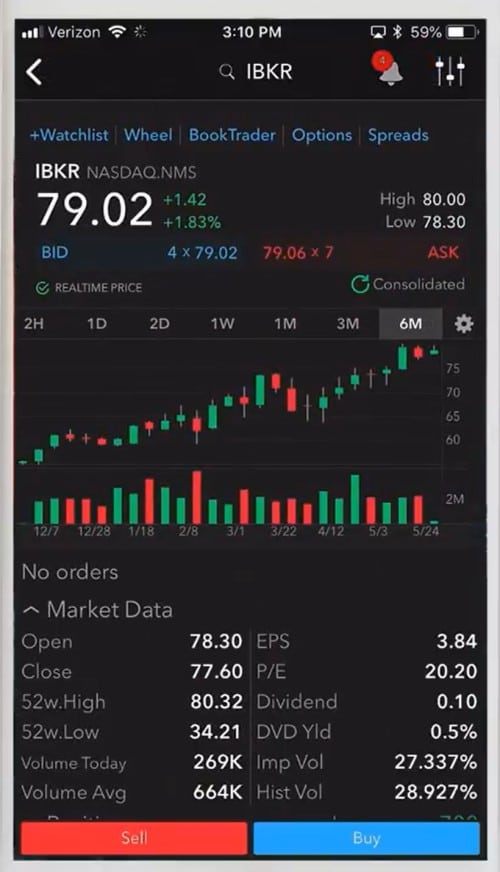

Mobile Trading App

The mobile version of the platform boasts a contemporary and user-friendly design, catering to traders on the move. It shares more similarities with the web-based version than with the desktop iteration.

This app is accessible on both Android and iOS devices and maintains the same robust security features found in the other versions.

Navigating the app is a breeze, thanks to its user-friendly search function, which neatly organizes asset classes under the same ticker or those with similar letters.

Furthermore, the mobile app provides access to a range of research materials, including analyst recommendations, fundamental data, news updates, and an economic calendar.

The types of orders available in the mobile app mirror those in the web-based version.

IBot Function

Interactive Brokers introduces the innovative IBot chatbot feature, allowing users to place orders and retrieve information via text or voice commands.

The IBot feature offers an extensive array of commands, such as displaying charts for specific securities or fetching key fundamental data for stocks.

This feature can be accessed through the TWS mobile app, via SMS on a mobile phone, through the FB Messenger app, via Amazon's Alexa system, or within the Desktop TWS platform.

Advanced APIs

Interactive Brokers has developed various APIs tailored for institutional and seasoned traders, enabling them to access their database and systems using commonly used programming languages such as Python, C++, and .Net.

Interactive Brokers Fees

In general, trading fees are low, with either no fee or only minimal charges. So, how does Interactive Brokers generate revenue?

Interactive Brokers derives income from four sources: commissions, Net Interest Income, Trading gains, and various other income. Interest-earning assets have seen a 15% increase in recent years.

To understand the cost of trading with Interactive Brokers, it's essential to analyze three key expenses: trading fees and commissions, applicable margin and interest rates, and other non-trading fees. Here's a breakdown of the cost for trading various asset classes and different plans:

Stocks, ETFs, and Warrants

IBKR Lite clients enjoy commission-free trading for US exchange-listed stocks and ETFs.

IBKR Pro accounts have a fixed or tiered rate for trading both US-listed and non-US-listed shares.

Non-US shares can be traded at a fixed commission starting at 0.1% of the trade value, with varying minimums.

Tiered plans for IBKR Pro accounts reduce the cost per trade as the monthly volume increases.

Options

Fixed pricing for both account types for US-listed options at $0.65 per contract, with a $1 minimum per order.

Certain surcharges apply to specific instruments.

Higher fees for European exchanges starting at EUR 1.5 per contract.

Futures

US-listed futures and future options can be traded for as little as $0.85 per contract

E-mini FX futures can be traded for $0.50 per contract.

Lower trading costs for volumes exceeding 1,000 contracts per month.

Spot Currency Pairs

Fees calculated at 0.20 basis points times the trade value for volumes under $1 billion per month, with a minimum of $2 per order.

Tiered pricing for higher volumes, going as low as 0.08 basis points for volumes over $5 billion monthly.

Fixed Income Securities

US-listed fixed income securities have a commission fee starting at 0.1% of the bond's face value, with a minimum of $1 per order and a maximum of $250 or 1% of the trade value, whichever is lower

Similar commission fees for European bonds and Hong Kong government bonds.

Precious Metals

Commission fees for gold and silver start at 0.15 basis points times the trade value, with a minimum of $2 per order.

Storage costs calculated as 0.10% of the value of the metals per year.

Mutual Funds

A wide selection of commission-free mutual funds with no transaction fee

Some funds offered at a fixed low commission rate outside the US and within the US.

Margin Rates & Interest Rates

Different rates for Lite and Pro accounts.

Rates vary based on currency and can change.

Non-Trading Fees

No inactivity fees for trading accounts.

Research Tools

Comprehensive research tools, including third-party research in Trader Workstation (TWS) and the web-based Client Portal.

Traders' Insight blog offers valuable content published during the trading week.

Charting

The trading workstation provides a comprehensive suite of charting tools, encompassing more than 120 diverse technical indicators.

Charts serve as just one avenue for generating trading insights. Interactive Brokers offers additional features like Validea and The Leading Edge, two real-time, in-depth analytics tools that furnish valuable information to traders. The charts provided by IBKR are fully customizable, allowing you to tailor them to your preferences using the Edit menu and save your layouts as personalized templates.

For technical traders, Interactive Brokers offers an extensive selection of over 120 technical indicators, coupled with user-friendly drawing tools. This enables you to select:

You can choose:

- The desired time period

- Various Bar Types (including bar, candle, line, historical volatility, implied volatility, hollow candles, option volume, option open interest, and heikin-ashi)

- Vertical Scale preferences

- The number of bars to display

- Dividend information

- Volume Plot Height

- Along with numerous other chart parameters

Furthermore, the platform provides access to fundamental company data, including financial statements, dividend calendars, and tools for peer group analysis.

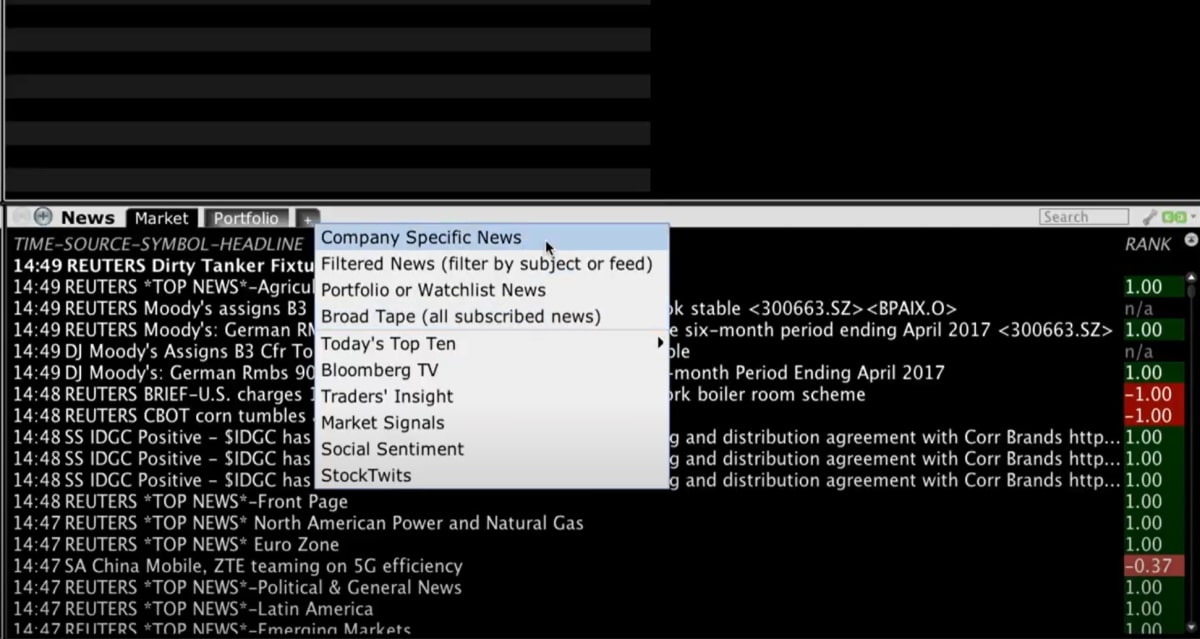

News Feed

The platform's news feed incorporates real-time news sources seamlessly integrated within the interface. These sources encompass a diverse array, including Benzinga Crypto News, Benzinga Pro News, Thomson Reuters Global Financial Market News, IBKR Traders' Insight, IBKR Market Signals, IBKR Quant Blog, Insider Insights, Dow Jones North American Briefing, Market Realist, Morning Star Insider Trade Log, China Investment Insight, TipRanks Market News, SeekingAlpha, The Motley Fool, StreetInsider.com, TipRanks Market News, Zacks Investment Research, and many more. Additionally, some premium features may require a subscription.

Moreover, the platform offers a comprehensive economic calendar covering global events, daily market summaries, and various other tools to stimulate trading ideas during moments of inspiration.

While certain features may come at an extra cost, users can evaluate their value on an individual basis. Notably, some features are exclusive to IKBR Pro clients.

Trading Ideas

Interactive Brokers furnishes traders with trading ideas tailored to their specific preferences. By customizing parameters within the platform, you can discover new trades aligned with your chosen asset class. Available sources for trading ideas include Benzinga, IBKR Market Signals, Capitalise, and Refinitiv Significant Developments. Additionally, the research portal provides a "Top Lists" section, highlighting the most intriguing assets across different regions and asset classes.

Educational Tools

Interactive Brokers offers a diverse range of educational tools, accessible through the "IBKR Campus." These resources include:

- Traders' Insight

- Webinars

- Traders' Academy portal

- Podcast Series (Traders' Insight Radio)

- Traders' Glossary

- IBKR Quant Blog

One notable educational offering is the Traders Academy program, consisting of 48 courses that span from fundamental investing topics, including platform basics, to in-depth explanations of complex products like leveraged and inverse ETFs. Importantly, this program is available to both clients and non-clients alike.

Interactive Brokers regularly organizes webinars and similar events conducted by experienced financial professionals within their team, providing valuable market insights. These events are free and open to the public.

Is Interactive Brokers Safe?

Interactive Brokers is widely regarded as a safe online broker. They implement robust security protocols to safeguard personal information and account data. Accounts opened with Interactive Brokers LLC benefit from protection under the Securities Investor Protection Corporation (SIPC), covering up to $500,000, with a cash sublimit of $250,000.

The level of security may vary based on the client's country of residence and the regulatory framework applicable to the Interactive Brokers entity serving them. Additionally, the mobile app offers biometric login, enhancing security. Accounts holding over $1 million can also request a digital security card.

Customer Service

Interactive Brokers provides multiple channels for client support in the event of platform or account-related issues. Clients can access customer service representatives through live chat within the platform, and phone and email support are also available in various languages, with toll-free numbers offered in many regions.

Overall, users have reported positive experiences with IBKR's customer service, though some have noted that their availability is limited to 24/6, which can pose challenges for traders operating outside regular business hours.

Conclusion

Interactive Brokers, a publicly-traded brokerage firm established in 1978 and headquartered in the United States, boasts a solid reputation. Regulated by top-tier financial agencies like the SEC (US), the FCA (UK), and the ASIC (Australia), this broker offers an extensive portfolio of securities across more than 135 global markets. A demo account with $1,000,000 is available for testing the platform before making a deposit. Interactive Brokers stands out with its low trading fees, including zero-commission trading for US-listed stocks and ETFs. Educational resources are abundant, with the Traders' Academy program covering a wide range of basic and complex financial topics. The quality of customer service is generally favorable, although availability is limited to 24/6.

Our Rating: 4.9/5

Interactive Brokers, with its strong regulatory standing, diverse product offerings, stock exchange listing, and long-standing history, proves to be an excellent choice for both experienced and casual traders. Its low fees and robust trading environment enhance its appeal.