Robinhood is an American trading platform for beginners, founded in 2013 and headquartered in Menlo Park, California. Robinhood is best known for offering $0 stock, ETF, options, and cryptocurrency transactions, as well as an easy-to-use website and a mobile trading app that appeals mostly to young investors.

Summary

Robinhood is a broker that is great for beginners and younger investors. It is mostly free and easy to use. It offers a wide variety of assets to trade with, but it does not offer a demo account and is only limited to US clients. It is great for $0 stocks, ETFs, options, and cryptocurrencies.

Overview

Here is a quick overview of Robinhood.

| Feature | Robinhood |

|---|---|

| Founded | 2013 |

| Minimum Deposit | $0 |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

| Inactivity Fee | $0 |

| Demo Account | No |

| Minimum Trade | Varies |

| Maximum Trade | Varies |

| Payment Method | Credit cards, Debit cards, PayPal, Bank Transfer |

| Funding Method | Bank Transfer |

| Available Cryptocurrencies | BTC, ETC, ETH, DOGE, BCH, BTG, OMG, XMR, LSK, QTUM, LTC, NEO, DASH, XRP, XLM, ZEC, |

| Islamic Account | No |

| Products | Stocks, ETF, Options, Crypto |

| Platforms | Web Trader, Android, iOS, Tablet |

| Share Dealing | Yes |

| Number of shares | 5,000 |

| Country of Regulation | USA |

| Regulation | Securities and Exchange Commission (SEC) & Financial Industry Regulation Authority (FINRA) |

| Customer Support | Email and social media |

| Our Score | 4/5 |

Best alternative: Interactive Brokers

Interactive Brokers is best for low costs, superior execution and wide range of markets. Investors can trade stocks, forex, options, futures, bonds, and funds across 135 markets from a single account.

If you are looking for a great alternative, make sure you also check our review of eToro and AvaTrade. For active day traders, we analyzed the best mobile day trading apps.

Robinhood Pros and Cons

Robinhood has many great features that make it a good broker, and being “free” and easy to use are major ones. However, it has some downsides that make clients skeptical about it. Below, we've listed the main advantages and disadvantages that you should consider before starting trading on Robinhood.

| Pros | Cons |

|---|---|

| Low trading costs | Absence of retirement accounts |

| Cryptocurrency trading | No mutual bonds or funds |

| Possible to trade a little amount of cryptocurrency | Little available resources |

| Easy to use | Can be used only by US clients |

| Efficient web and mobile trading platforms | Limited customer service |

| Instant access to deposited cash | Limited products |

| No account minimum | Little educational material |

| Free ETF trading and US stock | |

| Account creation is fast and completely digital. | |

| Fee structure is transparent | |

| No minimum deposit |

Compare Robinhood to Similar Brokers

| Broker | Robinhood | eToro | Webull | Trading 212 |

|---|---|---|---|---|

| Founded | 2013 | 2007 | 2017 | 2006 |

| Minimum Deposit | $0 | $50 | $0 | $1 |

| Commission | Varies | Varies | Varies | Varies |

| Inactivity Fee | No | Yes | No | No |

| Platforms | Web, iOS, Android | Web, Windows, iOS, Android | Web, Windows, iOS, Android | Web, Windows, iOS, Android |

| Languages | 16 | 5 | 2 | 16 |

Regulation

Robinhood is regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulation Authority (FINRA).

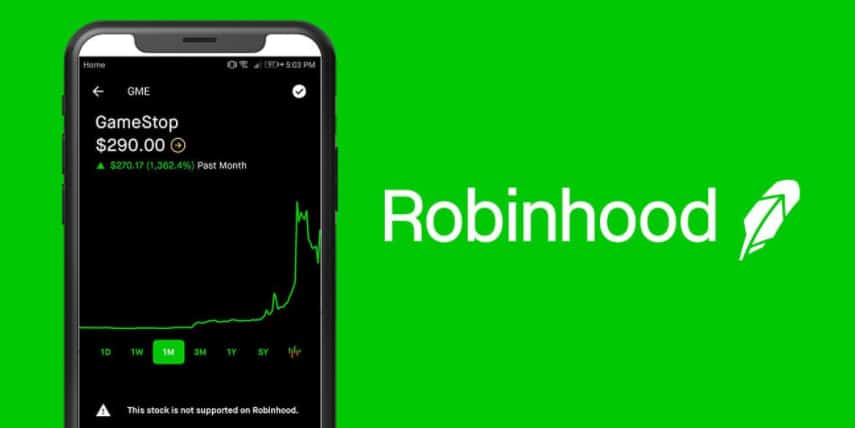

Robinhood Trading Platform

We listed below all the platforms offered by Robinhood.

| Trading Platform | Robinhood |

|---|---|

| MT4 | No |

| MT5 | No |

| cTrader | No |

| Web Platform | Yes |

| Android | Yes |

| iOS | Yes |

| Microsoft | No |

| Price Alerts | Yes |

Web Trading Platform

The web trading platform is easy to use and provides clients with a great user experience. Although the platform cannot be customized, the default workspace is well-designed, straightforward, and logically arranged.

Robinhood offers a two-step login, which is more secure than simply entering a username and password. The search tools are excellent in that you will always be able to find what you are looking for. You can use the search bar to perform a basic search or use tags to narrow down your results.

Under the ‘Collections' tab, you can view some linked tags if you click on a stock. When you click on a tag, you'll get a list of all stocks with that tag. If you want to compare two things side by side, this is a useful tool.

If you're only interested in Apple, for example, you can simply click on that tag to see the whole list. For a wide range of events, you are able to push notifications and set alerts, like for price movements, dividend payments, money transfers, orders, corporate actions, and earning announcements.

The portfolio and fee report functions on Robinhood's web trading platform are simple to grasp. You can see the average cost of your stock portfolio as well as its returns. There's also a pie chart that shows how well-diversified your portfolio is.

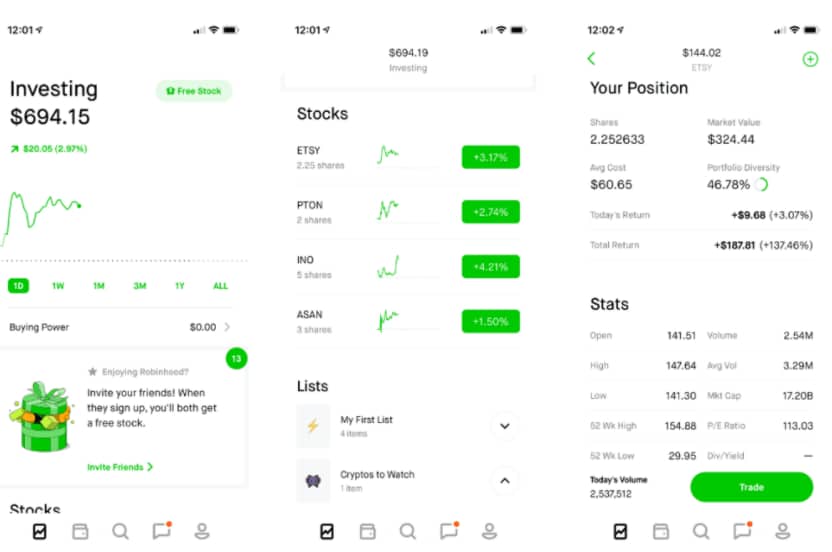

Mobile Trading Platform

The Robinhood mobile trading platform has a similar design and experience as the Robinhood web trading platform. Because the detailed stock screener isn’t available on iOS and Android, the research capabilities differ a little bit from those on the web platform.

The mobile trading platform of Robinhood offers a secure login. It uses two-step authentication, with the possibility of employing biometric authentication as well.

Markets and Products

Although Robinhood offers a solid range of cryptocurrencies, its stock and exchange-traded funds (ETFs) products fall behind those of competitors.

Robinhood gives access to over 5,000 stocks and ETFs. Most of them are traded on major stock exchanges in the United States. There are also some non-US stocks available, which are offered through ADRs instead of foreign exchanges.

Options

As for options, you can only trade stock and stock index options. Only bigger stocks are eligible for these choices.

Cryptocurrencies

With Robinhood, you can trade big cryptocurrencies like Bitcoin and Ethereum, as well as smaller ones like Stellar and Monero. There are the available cryptocurrencies on Robinhood:

- BTC

- ETC

- ETH

- DOGE

- BCH

- BTG

- OMG

- XMR

- LSK QTUM

- LTC NEO

- DASH

- XRP

- XLM

- ZEC

Robinhood Commissions and Fees

For trading stocks, ETFs, options, or cryptocurrency, Robinhood charges no commission. Facebook (FB) is a free social media platform. It makes money by gathering your user data and selling ads to compensate for not charging a membership fee. In the case of Robinhood, it is also a free service. It sells your order flow to wholesale market makers rather than selling advertisements.

As a result, Robinhood is not entirely free. However, in today's world of $0 transactions, virtually all brokers, with the exception of Interactive Brokers and Fidelity, charge money for order flow (PFOF).

For US stock, crypto trading, and options, Robinhood charges no commission. However, Robinhood offers other services that are not free.

| Feature | Robinhood |

|---|---|

| Minimum Deposit | $0 |

| Stock Trades | $0 |

| Options (Base Fee) | $0 |

| ETF Trade Fee | $0 |

| Account Fee | $0 |

| Options Per Contract | $0 |

| Mutual Fund Trade Fee | N/A |

| Futures Per Contract | N/A |

| Broker Assisted Trade Fee | N/A |

| US Stock Index Option | $0 |

| USD Margin Rate | 2.5% |

Deposit And Withdrawal

Robinhood offers a great cash management service, including free and quick deposits and withdrawals. However, you can only make deposits through bank transfer, and deposits exceeding your ‘Instant' limit can take a number of working days. It takes longer to deposit greater sums on Robinhood Gold.

Robinhood Minimum Deposit

The Robinhood minimum deposit is $0 for the standard accounts, and a $2,000 minimum deposit for margin accounts, on the Robinhood gold account.

Research

Robinhood's research tools are easy to use. However, there are some minor variations in the tools available on its mobile and web trading platforms. On the mobile trading platform, for example, the screener is not available.

Robinhood Gold gives you access to additional research tools like live market data and research reports provided by Morningstar.

Trading Ideas

Expert analyst ratings of multiple products are available, which may help you make smarter decisions. The percentage of analysts that rank the stock as sell, hold, or buy is shown in these ratings. You can also find products that are related to the one you're looking at in the ‘People also bought' section.

Robinhood announced a feature called Profiles in late February 2020, which allows you to customize your public profiles and search other users' investments.

Basic Data

Users can find some basic fundamental statistics, such as the P/E ratio, the number of workers, and the market capitalization of each company.

Charts

At Robinhood, the charts are rather basic. If you select ‘Expand,' you may see the previous price movements of the stock you wish to trade, as well as a few technical indicators. You can use a different tool if you want a more comprehensive chart analysis.

News Feed

When you click on a product, you will get a corresponding news stream. The news feed is one of excellent quality, as it comes from reputable third-party sources like Yahoo! Finance and Seeking Alpha.

Education

Under the ‘Learn' option on Robinhood, you can learn from educational publications. They are easy to comprehend, well-organised, and great for beginners.

Account Types

When you sign up, a Robinhood creates an Instant account for you. You can upgrade to Robinhood Gold or convert your account to a Cash Account. Robinhood does not offer Individual Retirement Accounts (IRA).

Account Types In Robinhood

Robinhood offers different account types: Instant Account, Cash Account, and Robinhood Gold account.

Robinhood Instant Account

| Pros | Cons |

|---|---|

| Instant deposit is available up to $1,000 | Pattern Day Trading rules apply to day trading |

| Instant access to stock sale profits |

Cash Account

| Pros | Cons |

|---|---|

| Pattern Day Trading rules do not apply to day trading | No instant deposit |

| Transferring money takes 4-5 days | |

| To use the proceeds from a sale, you must wait several days. |

Robinhood Gold

| Pros | Cons |

|---|---|

| Instant deposit is available up to $50,000 | Pattern Day Trading rules apply to day trading |

| Live market data | A monthly fee of $5 |

| More research tools | |

| More buying power | |

| First $1,000 of margin debt are interest-free |

The Pattern Day Trading regulations limit day trading, which is one of the primary differences between the various accounts. This is crucial when you have a balance of $25,000 or less and sell and buy stocks during the same day.

You can only make three day trades each week with the Robinhood Gold and Robinhood Instant accounts. If you do perform more trades, your account will be banned for 90 days unless your balance is $25,000 or more.

Even though the Cash Account has no such restrictions, day trading is nearly impossible since you have to wait three days for settlement after selling to spend the proceeds.

Is Robinhood Safe To Use?

Robinhood is safe and secure. Robinhood is a member of the SIPC and is regulated by the Securities and Exchange Commission (SEC). Client funds are protected for up to $250,000 for cash claims and up to $500,000 for securities.

Despite the platform's easy user interface, which has helped many investors understand trading, other investors wondered if Robinhood was too good to be true. Robinhood is regulated by the Securities and Exchange Commission (SEC), whose job is to oversee the securities market to guarantee openness and fair trading.

Their compliance mechanism is to prosecute companies and individuals who commit fraud or spread false information. The SEC does not provide individual investor protections—it does not insure against loss or safeguard your money against actions taken by your brokerage company.

Robinhood is also a member of the Financial Industry Regulatory Authority (FINRA), a self-regulatory organisation (SRO) that most brokerage companies join voluntarily. The SEC regulates SROs, although they are not government entities. FINRA members must follow the organization's rules and regulations, which include agent and broker testing and licensure, as well as a comprehensive disclosure structure that protects investors.

Robinhood includes two key entities: Robinhood Financial LLC and Robinhood Crypto LLC. The former is in charge of stock and options trading, while the latter is in charge of cryptocurrency trading. Robinhood Financial LLC is a FINRA member and is covered by the SIPC, a US investor protection system. SIPC protection has a ceiling of $500,000, with a cash limit of $250,000.

SIPC does not cover all investments. It protects registered securities such as stocks, bonds, bonds, and mutual funds. Currency, unregistered limited partnerships, Unregistered investment contracts, fixed annuity contracts, and interests in gold and silver are not covered by it. Robinhood Crypto LLC is not a member of the Financial Industry Regulatory Authority (FINRA) or the Securities Investor Protection Corporation (SIPC). This means that there is no investor protection system in place for cryptocurrency trading.

Customer Support

Unlike most brokers, Robinhood does not offer an inbound telephone number, so if you have any urgent questions, you cannot call them for assistance. You can input your own phone number for a callback after working your way through an extensive menu meant to narrow down your support issue. Other than that, customer service is handled entirely through the app or the website.

Email: [email protected]

Final Thoughts

The most appealing part of Robinhood is that it’s almost entirely free, there are no inactivity or withdrawal fees, and clients can trade on convenient web and mobile trading platforms.

But the drawbacks of the broker can certainly make it a deal breaker, as it's only limited to clients from the US, it has poor customer support, and offers little guidance in the trading world. Robinhood is a good choice if you seek an easy-to-use broker and wish to trade US without fees.

FAQ

Is Robinhood 100% Free?

Robinhood is theoretically free and does not charge for stock, option, or cryptocurrency transactions. Certain services, however, require a $5/month Robinhood Gold membership, and Robinhood does take money for order flow (PFOF).

How can I withdraw my funds from Robinhood without paying fees?

To begin, sell all of your stocks and other investments. Then, using ACH, send all of your funds to your bank account (ACH transfers are free). Finally, email Robinhood to request that your account be closed. Robinhood will charge you a $75 ACAT fee if you move your stock holdings to another broker.

Is it possible to day trade stocks using Robinhood?

To day trade with Robinhood, you must have at least $25,000 in your account (all brokers are required by law to have at least $25,000). Otherwise, your account is limited to three day trades every rolling five working days.

Is it possible to trade penny stocks using Robinhood?

No. Robinhood does not support over-the-counter (OTC) securities. Customers of Robinhood, on the other hand, can trade business shares listed on the NASDAQ and NYSE with a current stock price of less than $1.00.

Can I trade international stocks using Robinhood?

Yes. You can purchase and sell over 250 popular American Depositary Receipts (ADRs) using Robinhood, including shares in businesses like Nintendo (NTDOY), Adidas (ADDYY), and Tencent (TCEHY).

Can I start trading Immediately after I sign up for a Robinhood account?

Once you fund a Robinhood account, you are allowed to immediately access up to $1,000 in funds. The typical processing period for ACH transfers is two to three days.