IG was launched in 1974 and it’s now a worldwide leader in the trading industry as a pioneer in CFDs and spread betting. IG is a public company located in London that is on the FTSE 250 index of the London Stock Exchange (LON: IGG). IG has 1921 employees and a market valuation of £2.8 billion, according to its annual report for the financial year ending, 2020. It serves roughly 239,600 clients globally through its regulated firms in the UK and elsewhere.

But is it a suitable broker for you? In this article, we’re going to give an in-depth answer to this question with an honest review of IG.

Summary

IG Group is a publicly traded company and regulated in 6 tier-1 jurisdictions, it’s a low-risk FX and CFDs broker. IG is undoubtedly one of the most trustworthy forex and CFDs brokers in the industry. It excels when it comes to the quantity of offerings, trading experience (both web-based and mobile trading), research, education. So, overall, it is a great broker to trade with. However, if you’re a US-based client, you may not find it as suitable for you since IG doesn’t provide you with the same advantages it provides other clients with.

Overview

| Broker | IG Group |

|---|---|

| Founded | 1974 |

| Headquarters | London, United Kingdom |

| Minimum Deposit | $250 |

| Fees | Varies (low) |

| Inactivity Fees | $18 per month if the account is inactive for 24 consecutive months |

| Tradable Assets | 19537 |

| Forex Trading | Yes |

| Forex Pairs | 100 |

| Cryptocurrency (Spot) | No |

| Copy Trading/Social Trading | Yes |

| CFD Trading | Yes |

| Regulation | FCA,CFTC, NFA |

| Mobile App | Yes |

| Customer Support | live chat, phone, email, and social media |

| US-Accepted | Yes |

| Our Score | 4.7/5 |

IG Compared

To get a better view of IG broker, we set a brief comparison between IG and other competitors in the industry below:

| Broker | IG | Forex.com | Oanda | OctaFX | EXNESS | FXTM |

|---|---|---|---|---|---|---|

| Founded | 1974 | 2001 | 1955 | 2011 | 2011 | 2008 |

| Minimum Deposit | $250 | $100 | $0 | $25 | $50 | $10 |

| Inactivity fee | Yes | Yes | Yes | No | No | No |

| US Accepted | Yes | Yes | Yes | No | No | No |

Pros and Cons

IG is undoubtedly a great broker in so many aspects, but not all traders are willing to accept its drawbacks. Check the pros and cons of IG below to find out if this is a broker that you might consider:

| PROS | CONS |

|---|---|

| Wide Range of Investments | High share-CFD fees |

| Well Regulated (Multiple Tier-1 Authorities) | No back-testing integration or copy trading |

| Provides protection for EU-/UK-based clients | Doesn’t offer protection for US-based clients |

| Accepts US-based Clients | It doesn’t offer guarantee stop loss for US-based clients |

| Focuses on research and education |

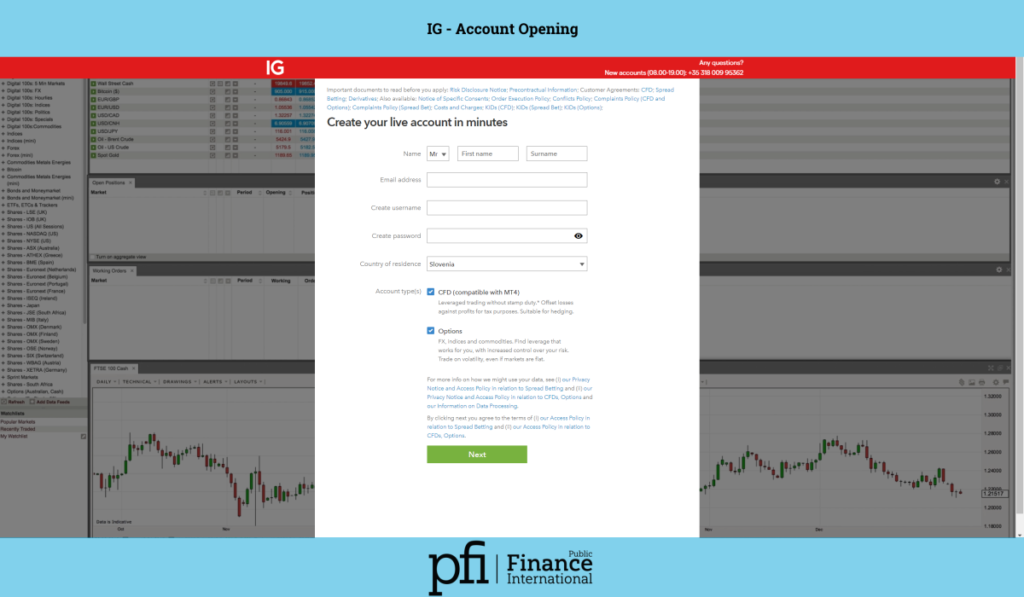

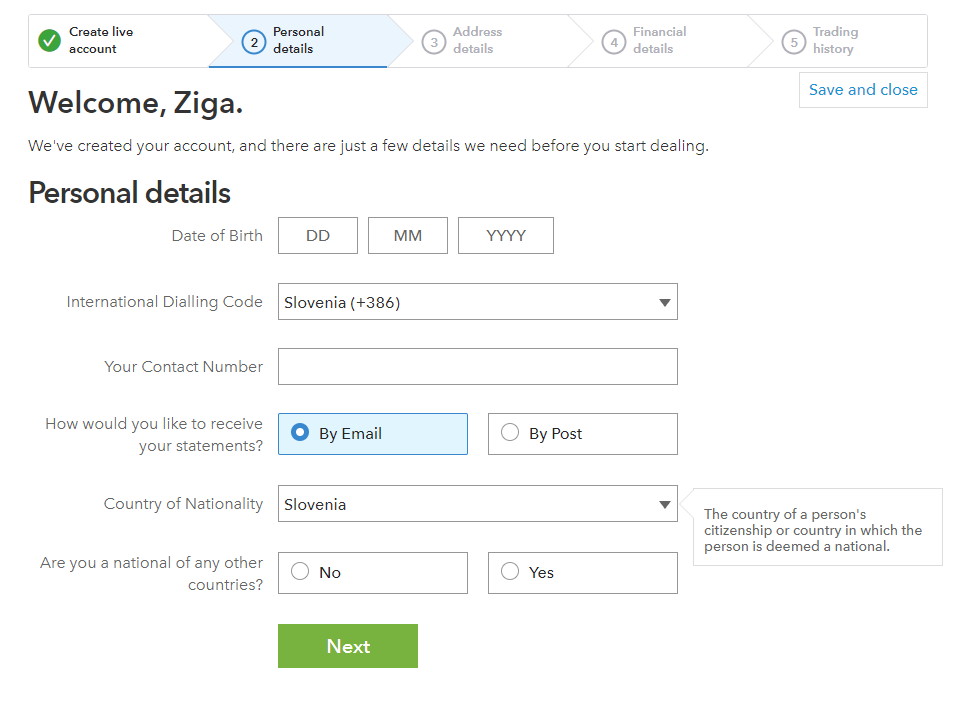

Account Opening

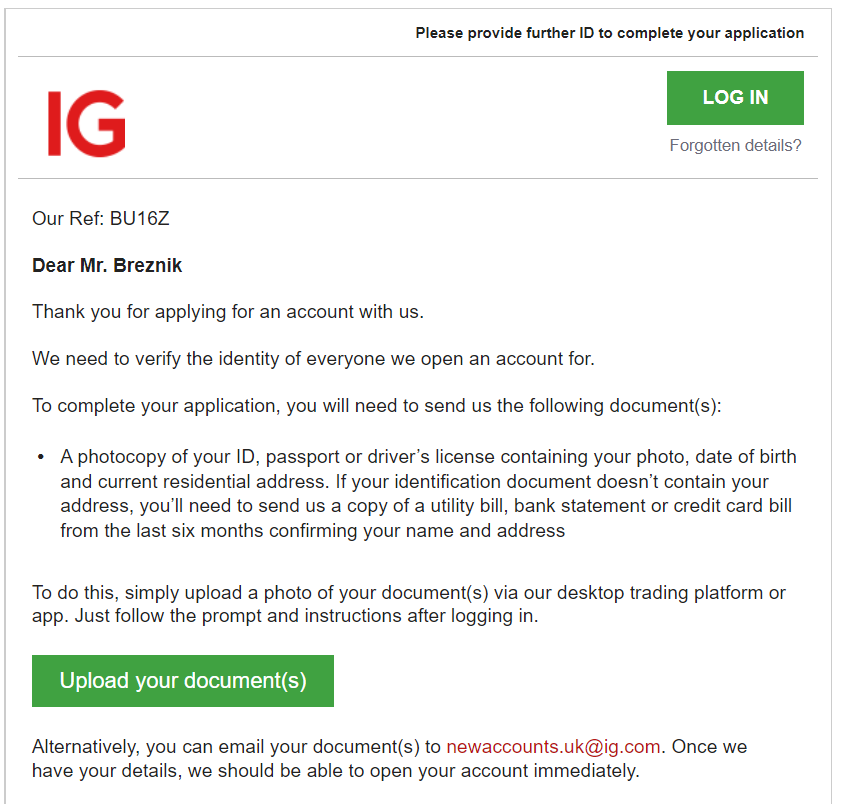

Signing up for an account at IG is easy and straight-forward. When I signed up for an account it took just a few minutes to fill in the data. After signing up, I received a call from a IG representative in matter of minutes of singing up. The only thing left to do is to verify my identity by uploading my ID documents and complete a quiz that demonstrates my knowledge of CFD. Overall, the account opening process experience is great.

Offerings of Investments

Residents of the United States, the United Kingdom, New Zealand, and Japan must select their local IG entity. Depending on which IG entity you choose, you may have access to a different set of markets.

IG has amassed a comprehensive portfolio of over 17,000 marketplaces around the world. Futures and options are accessible on a wide range of instruments, ensuring that you always have something to trade. IG (UK) provides the following products:

- Forex

- Shares

- Indices

- Cryptocurrencies

- Commodities

- ETFs

- Bonds

- Options

- Interest rates

- Industry sectors

IG (UK) provides a wide range of professional and institutional services, which is significantly more than the industry average. IG Smart Portfolios (an account basket that combines retirement and savings programs) and low-fee ETFs allow accounts of all levels to invest for longer terms.

In addition to approximately 20,000 CFDs, IG also provides access to international stock markets through exchange-traded securities (non-CFDs) for UK-based, Australia-based, and Germany-based clients.

CFDs allow you to trade cryptocurrency, but you can't trade the underlying asset directly (like buying Bitcoin). In the United Kingdom, IG doesn’t sell crypto derivatives to retail traders.

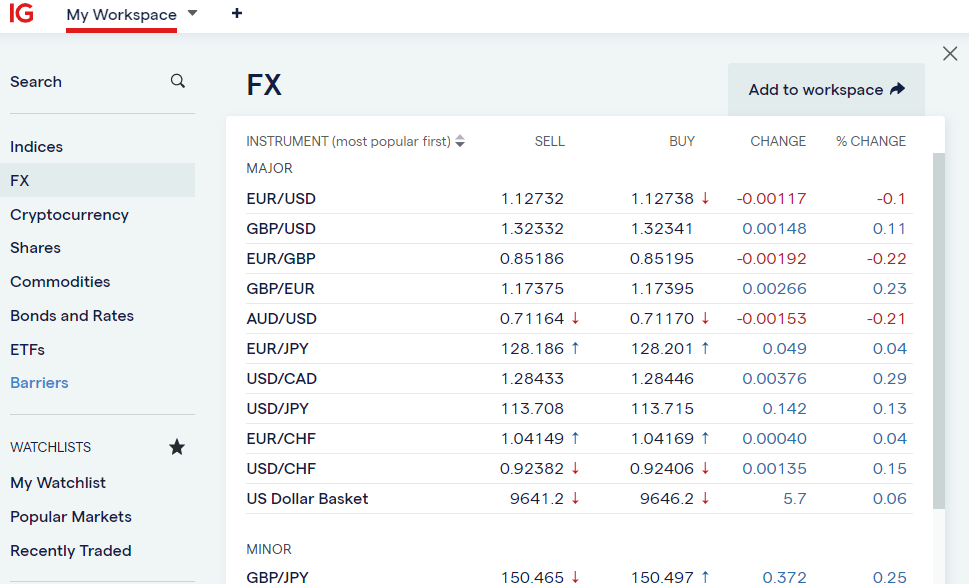

In the United States, IG’s product line is limited to spot forex trading of more than 80 pairs organized into the following categories:

- Majors

- Minors

- Exotic

- Australasian

- Scandinavian

- Emerging Markets

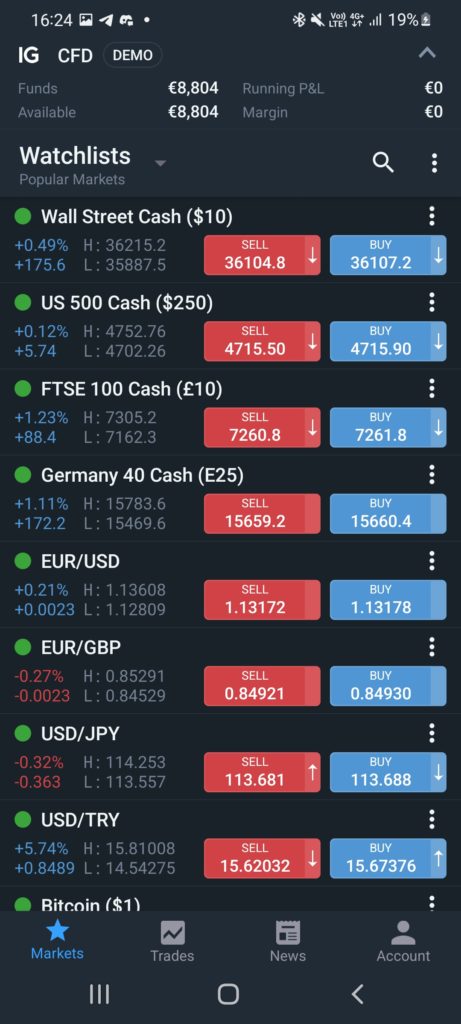

Platform and Tools

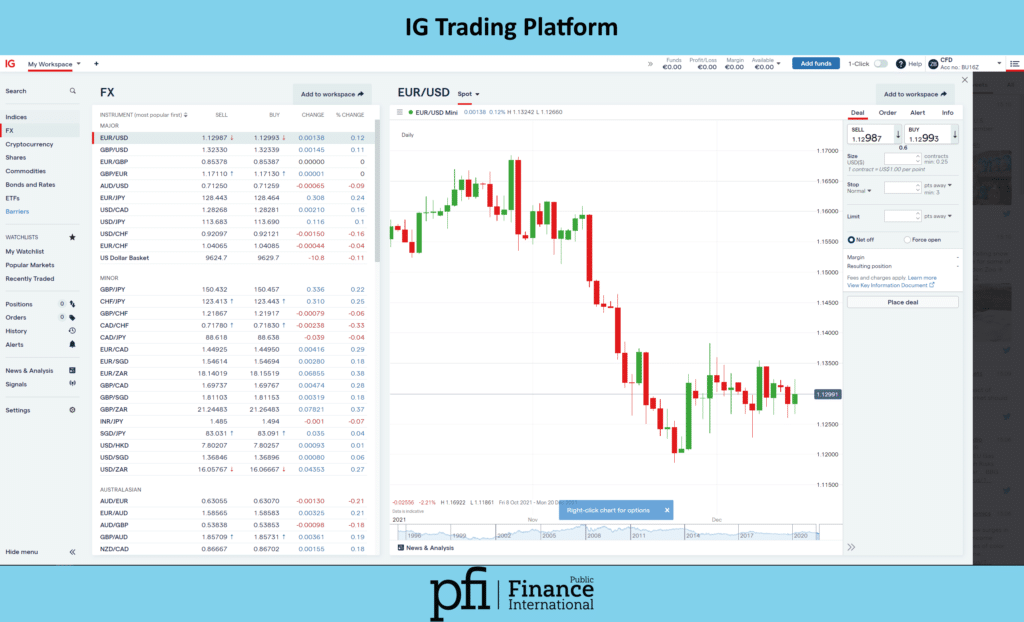

IG offers a great range of trading platforms and tools. Its functionality is widely used and caters to traders of all levels of experience. For share trading, IG offers the MetaTrader4 (MT4) and L2 Dealer platforms, which include both Forex Direct and Direct Market Access (DMA). L2 Dealer is a good option due to its discounts and support for complex algorithmic order types.

The unique web-based platform from IG is jam-packed with features. Charts, for example, can be accessed from almost every view that displays streaming bid rates or live market prices. There are also numerous trading and research tools, as well as risk-management modules that are directly integrated. The only minor snag is that you'll need to build up the layout yourself, as the default view is empty. It’s also possible to save many custom layouts.

IG's default charts include 30 optional studies and sophisticated features, such as the ability to create up to 4 alerts on any of the 11 indicators. A tick chart, which is not available from all brokers, is also available in addition to the 5 chart types. Finally, trading from a chart with an integrated trade ticket displays reward/risk ratios and allows traders to precisely drag any limits/spots.

The ProRealTime platform is a third-party platform that provides more sophisticated charting with automated strategies and around 100 indicators. Unless traders make 4 trades or more throughout each calendar period, it costs £30 per month to use ProRealTime. Despite the fact that it offers flexible layout and great charting, it may require an update. Floating windows, for example, can become cluttered and are not as good as advanced snap grid layouts.

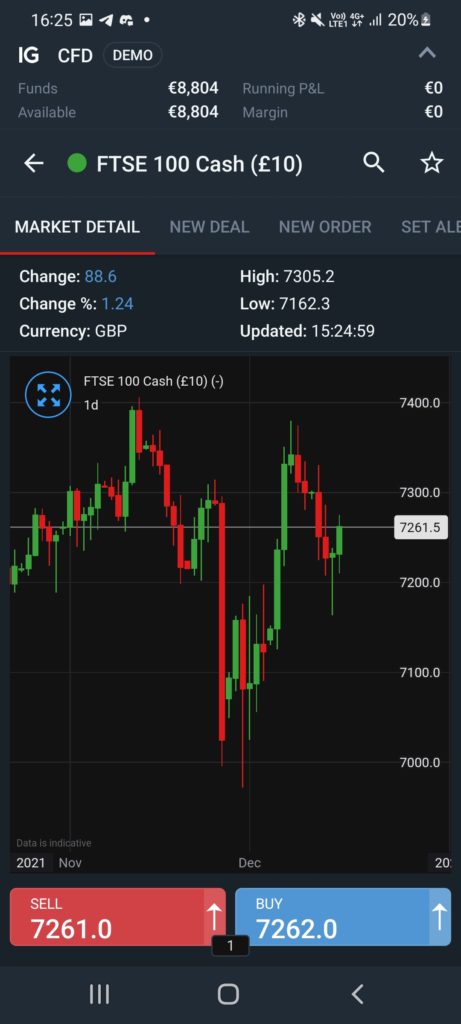

Mobile App

The IG mobile app stands out among competitors, as it’s jam-packed with features that will appeal to both novice and experienced traders. It features sentiment readings, alerts, an economic calendar, and watch lists, as well as market information for each instrument, all in a perfectly-designed layout. The app has a 4.1 rating on the Google Play Store and 4.5 rating on the App Store for an aggregated rating of 4.3. The web platform automatically syncs watch lists.

There are also 16 time periods, 20 drawing tools, and 30 technical indicators to choose from across 5 chart types, including tick charts. Setting up charts is simple if you take the time to look through the menu.

However, one disadvantage is that chart indications created via the web don’t instantly sync to mobile, despite the fact that you can save them as presets. Other than that, IG Mobile charts are fast and precise when zooming in and out within timeframes.

The IG Mobile app's research is limited to Reuters news headlines, PIA First, and Autochartist signals.

Commissions and Fees

Regardless of what they trade, IG offers attractive pricing to its traders.

- IG provides discounts to any volume traders who qualify as a professional under EU regulations through its active trader rebate program. There are three tiers to this program. Tier one rebates 10% of the spread if you transact more than £50 million in forex volume each month. On the other hand, if you trade more than £300 million per month, you can get a 20% rebate.

- The DMA account is a better alternative than the active trader rebates on the platform's spread-only pricing for shrewd traders wanting more discounts than what is available in the CFD account. Forex Direct, a commission-based option, is available through the DMA account and gives you access to the L2 Dealer platform. There’s a low minimum deposit of £1,000 for the DMA accounts and a tiered pricing structure dependent on your past month's trading volume.

- Average CFD account spreads: In August 2020, regular spreads for mini and standard size contracts during the main trading session from Midnight to 9 p.m. averaged 0.745 pips. Spreads during low-liquid times are larger than usual, as they are with other brokers, averaging 1.39 pips at IG in August 2020, during the 2100 – 0000 session.

- Average DMA account spreads: The all-in spread is 1.3 pips utilising the base tier of $60 per million for traders who handle less than $100 million per month, based on average spreads of 0.165 on the USD/EUR for the 12 weeks ending 19 March, 2019. Clients who conduct more than 1.5 yards have their per-side commission reduced to $10 per million, resulting in a spread of 0.365 pips, according to 2019 statistics.

- Forex Direct receives its liquidity from interbank liquidity sources where IG operates as an agency broker, adding no further spread. IG charges a commission on each trade you make. Traders are able to switch between execution methods in their CFD account by using the order types at hand, depending on whether or not they’d like to force open a trade with potential slippage, as opposed to orders which may be rejected if the price is not available anymore.

Research

IG offers traders a diverse range of high-quality market research. Standard research tools such as economic calendar and live news from Reuters are available on the platform. A customized screener for many asset classes, like CFDs on global equities and currency, is one of the most advanced features offered by IG.

Reuters and IGTV also have a lot of streaming videos, including videos every day that cover global financial markets. Content is even tailored in the section of “Recommended News”, which tailors headlines according to your account attributes.

DailyFX — a blog-style news website offering IG traders with news and research tools — is powered by IG. Moreover, IG offers what it’s called IG Community, a newly created social network that resembles a sophisticated forum and has over 80,000 users. Despite the fact that the information is crowdsourced, it’s still useful since IG selects the top research articles.

IG's platform now includes Autochartist and PIA First, allowing you to see trade signals created by technical analysis and automated pattern recognition. Traders can easily copy these trading ideas with no more than one click. For the best copy trading platform, make sure you check out eToro (#1 copy trading platform). IG offers free Real Vision TV premium research to clients who deposit $500 or more, and Real Vision research is offered to clients who deposit $5,000 or more.

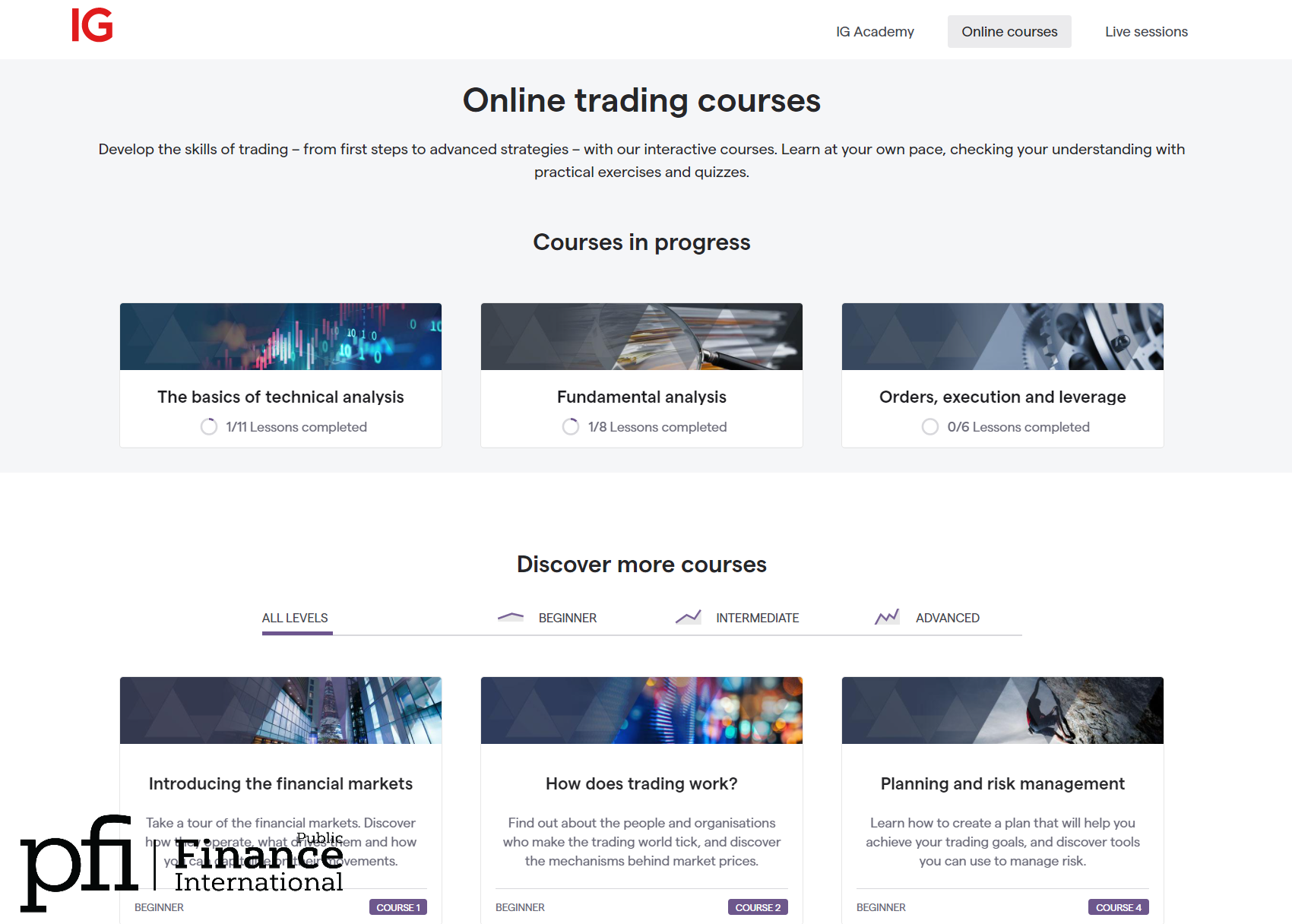

Education

IG excels when it comes to providing the best educational material, with articles, videos, quizzes, and even progress tracking. Not only that, but it also offers courses on IG Academy, guides offered by DailyFX, multiple weekly webinars, and mobile app for education. The content is divided in 3 levels: beginner, intermediate, and advanced.

- With IG Academy, you get to access 8 courses, each categorized by experience level, with many chapters and quizzes for a more participatory experience.

- The IG Community provides content that’s curated by IG, including educational articles. Traders, for example, provide their personal experiences and opinion, like on their past successes as traders or even mistakes.

- DailyFX features a great selection of educational material, including 8 beginner trading guides, 5 advanced trading guides, and materials in a course with progress tracking. There are 7 articles regarding risk management with Bollinger Bands. There are also 17 starter articles in addition to educational content, and support is provided in multiple languages.

- IG offers multiple webinars each week as well as archived content and playlists on its multiple YouTube Channels. The Technical Analysis Masterclass, for example, is covered live by its in-house staff. You’ll also find archived webinars sorted by skill level, making it simple to find exactly what you're looking for.

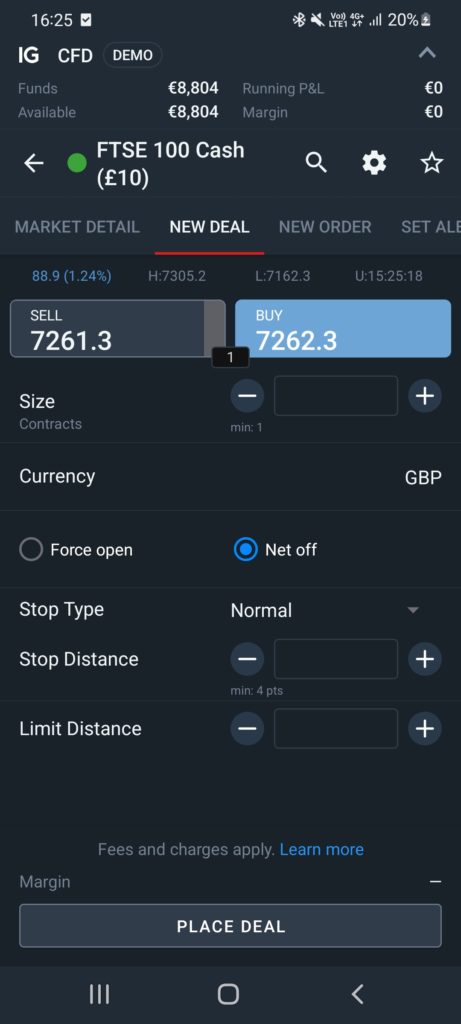

Portfolio Analysis

Despite being straightforward and intuitive, the order interface on IG's web-based US platform is mediocre at best. The order ticket can only be used to place basic market and pending orders. There are no guaranteed stop loss or trailing stop loss orders available.

You select the trade size, which is denominated in 100,000-unit increments of the base currency (commonly referred to as a standard lot in retail FX.) The default currency for IG's American order ticket is the US dollar, but the U.K. order ticket offers a choice of euro, British pound, US dollar, and Japanese yen.

The assured stop loss order is also available on the UK site. However, there’s no trailing stop loss order, which might be disappointing to some traders.

IG’s “My IG” page provides basic real-time information regarding your activity on the platform, including transaction activity, balances, and profit/loss breakdown. IG (US) is also experimenting with a built-in tool called “Trade Analytics”, which is designed for the analysis of trading behavior, although it's just for live accounts.

This feature is great since it allows clients to look deeper into their trading activity than just the basic metrics. IG doesn't provide tax accounting tools or a trading journal.

Overall Trading Experience

Starting with its own web-based product that is easy to use and customizable, IG offers a variety of platform options and API interfaces. This simple trading interface is reliable and doesn’t take a seasoned trader to use. It has a simple appearance (particularly in the US version) that conceals its complexity.

There are not as many bells and whistles as some competitor interfaces, but what IG lacks in quantity, it makes up for in quality.

Clients in the United Kingdom have access to the same features as their counterparts in the United States, as well as the option to upgrade to the fee-based ProRealTime charting platform, which is free if you meet a few trading activity requirements. Plus, technologically adept traders are able to attach their own software or a Bloomberg terminal through a great API interface.

UK-based clients with bigger accounts can also trade CFD shares through L2 Dealer, which allows direct market access (DMA) without going through IG's dealing desk. According to ESMA guidelines, clients using the Forex Direct service on that platform must have a professional designation. Apart from exchange fees, there are no additional fees for this service.

Is Your Money Safe on IG? Regulation and Security

IG is considered to be a safe broker. IG is a publicly traded company that runs a regulated bank and is governed by 6 tier-1 (high trust), 3 tier-2 (medium trust), and 1 tier-3 regulator (low trust). The following tier-1 regulators have given IG their approval:

- Australian Securities & Investment Commission (ASIC)

- Monetary Authority of Singapore (MAS)

- Japanese Financial Services Authority (JFSA)

- Financial Conduct Authority (FCA)

- Swiss Financial Market Supervisory Authority (FINMA)

- The Commodity Futures Trading Commission (CFTC)

In accordance with the FCA's client money regulations, IG (UK) takes precautions to ensure that their clients’ funds aren’t mixed with corporate funds. Client assets are safeguarded in the unlikely event that it becomes insolvent, as the money is held in separate accounts at licensed institutions.

The Financial Services Compensation Scheme (FSCS) provides further asset protection for IG clients (up to £85,000.)

The negative balance protection rules established by ESMA that came into effect in 2018 give IG (UK) clients a guarantee that they’ll never lose more money than they have in their IG accounts. Guaranteed stop loss orders are also available, reducing the risk of huge losses in extreme, unexpected market conditions.

On the other hand, negative balance protection and guaranteed stop loss orders aren’t offered by IG (US). The SIPC or FDIC don’t insure client funds.

IG has a counterparty dealing desk that is advantageous for traders who wish to trade with the interbank system, especially those with big accounts.

The software security provided by IG is on par with the best in the industry. Clients will be logged out of IG’s web-based platform for inactivity, as well as the mobile applications. There’s also biometric and two-factor authentication.

Customer Support

You can contact an IG representative via live chat, which is available whenever the platform is operational. There are also the usual methods like phone, email, social media, and a well-organized, informative FAQs section. If nothing works, a well-documented customer complaint system should be able to help resolve the issue.

Their Customer support is available 24 hours a day from 8am Saturday to 10pm Friday .

Online customer support is provided in a variety of languages, allowing IG appeal to a wider range of traders.

Phone Number: +61 3 9860 1799, +61 (3) 9860 1799, 0800 195 3100

Email: [email protected]

The Bottom Line

With numerous trading instruments, reasonable spreads, cutting-edge news, advanced research and educational material, IG is a great fit for many traders, especially for seasoned traders. IG is regulated by many reputable tier-1 authorities, which is a big plus if you are worried about losing your money on online brokers.

However, IG doesn’t offer as many benefits to US-based clients as it does to other clients, so if this is not a major issue for you as a US-based trader, IG could be a great option for you.

What is the IG minimum deposit?

The minimum varies depending on which IG entity you open a trading account with as well as where you’re based, ranging from $250 USD or 300 EUR to as high as 2,500 CHF. For example, IG South Africa requires a minimum deposit of 4,000 ZAR, whereas IG Japan requires a deposit of 35,000 JPY. The minimum deposit for a live account with IG Australia is 450 AUD, in Singapore, it is 400 SGD.

What leverage Does IG provide?

On its website, IG provides a clear and complete explanation of forex trading costs. The minimum account deposit is 250 units in the base currency, which converts to $250 for US accounts, and the largest leverage available to US-based clients is 50:1, according to CFTC regulations.

Is IG a perfect choice for beginners?

IG is a CFD (contract for difference) broker. Unless you wish to trade currencies, it’s usually not highly recommended for novices. We recommend opting for a broker where you can acquire genuine shares of a company rather than a CFD contract for novices who want to trade stocks.