Founded in 2011, OctaFX has amassed more than 6 million users all over the world. With its swap-free offering and attractive incentives and bonuses, it keeps gaining more and more market share. OctaFX claims to assist Forex traders to make more money. We looked into this broker to see if the commission-free and swap-free MT5 trading environment lives up to its boasts.

So, at the end of this review, you should be able to answer this question clearly: Should you open an OctaFX trading account right now?

Summary

OctaFX is considered a higher than average risk. It is not a publicly-traded company and is not regulated by top-tier authorities. OctaFX offers a smooth registration process, quick deposit and withdrawal processes, a great layout, mobile trading, Islamic accounts, attractive bonuses, and a good user experience. However, it’s not available for US-based users, it lacks some assets and currency pairs, and it has low trust since it’s not regulated by any top-tier authorities.

Best Alternative to OctaFX is eToro

- #1 Best Rated Copy Trading Platform

- Regulated by Top Tier Regulations

- Safe & Secure

- 0% Commission on Stocks*

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Read Full eToro Review

*on selected US stocks

| Broker | OctaFX |

|---|---|

| Founded | 2011 |

| Headquarters | St. Vincent and the Grenadines |

| Minimum Deposit | $25 |

| Inactivity Fees | $0 |

| Forex | Yes |

| CFDs | Yes |

| Cryptocurrencies | Yes |

| Copy Trading/Social Trading | Yes |

| Forex Pairs | 28 |

| Regulation | CySEC |

| Mobile App | Yes |

| Customer Support | live chat, phone, email, regular mail, WhatsApp, and Telegram |

| US-Accepted | No |

| Our Score | 3.5/5 |

OctaFX: Pros and Cons

While OctaFX has some pretty impressive features, it also has some major disadvantages you want to be aware of if you’re considering trading with it.

| Pros | Cons |

|---|---|

| Account Opening | Not Available in the USA |

| Hedging and scalping are available | Limited Instruments Available |

| All account types offer Shariah-compliant options | Low trust since it’s not regulated by top-tier authorities |

OctaFX Compared

In order to put things into perspective and for you to understand the broker’s features better, we set a brief comparison between OctaFX and its major competitors in the industry.

| Broker | OctaFX | FXTM | EXNESS |

|---|---|---|---|

| Founded | 2011 | 2011 | 2008 |

| Minimum Deposit | $25 | $50 | $10 |

| Inactivity Fees | $0 | $5/month | $0 |

| US-Accepted | No | No | No |

Account Types

OctaFX provides traders with two trading accounts: one MT4 and one MT5. Both have a maximum leverage of 1:500. The US dollar and the Euro are the account's basic currencies. The first of the two key differences are that MT5 traders don’t have to pay a finance fee for leveraged trading, whereas MT4 traders do. The second difference is that MT4 doesn’t have index CFDs.

With OctaFX, users can open MT4 or MT5 demo accounts with no time limits. The MT4 demo account expires after 8 days of inactivity, while the MT5 demo account will expire after 30 days of inactivity.

The flexibility of MT4 and MT5 accounts allows traders to choose their deposit amount and leverage, resulting in a more realistic demo experience. They're perfect for testing EAs and fixing bugs for algorithmic traders.

Commissions and Fees

The commissions and costs charged by OctaFX vary based on which of the 3 account types you choose (MT4 Micro, MT5 Pro, cTrader ECN.) Overall, OctaFX finds it difficult to compete with the lowest-cost MetaTrader brokers when it comes to pricing.

The MT4 Micro account has the lowest spreads, with only 39 tradable instruments, the USD/EUR spread is 0.7 pips. On the other hand, the MT5 Pro account has a collection of 45 tradable instruments with a bit higher spreads (at 1.1 pips.)

The OctaFX cTrader ECN account has a smaller product selection than its other account types, with 28 forex pairs and 2 metals available.

The MT5 Pro account is great as it has a price similar to the cTrader ECN account with almost double the tradable instruments.

Minimum Deposit

OctaFX’s minimum deposit ranges from $25 when funding with Mastercard/Visa or €50 when using Neteller/Skrill, depending on the chosen payment method, to as much as 500,000 NR. Any applicable minimums are determined by your country of residence and the OctaFX entity with whom you open a trading account.

OctaFX offers over 50 payment methods, including Visa, Fasapay, Neteller, bitcoin, and a wide range of local bank transfers. Note that some of these may not be available in your country.

Offerings

OctaFX has a limited number of tradable instruments. Many industry leaders, for example, have more than 10,000 tradable instruments.

OctaFX offers forex trading, CFD trading, 52 trading symbols, 28 forex pairs, cryptocurrency (CFD), and social trading. On the other hand, it doesn’t offer cryptocurrency (physical) US stock trading (non-CFD), or Int'l stock trading (non-CFD).

CFDs allow you to trade cryptocurrency, but you can't trade the underlying asset directly (like buying Bitcoin). Note that crypto CFDs aren’t available to retail traders from any broker's UK residents, nor to UK entities.

Leverage

For Forex traders, the maximum leverage is 1:500, while for cryptocurrency traders, it is 1:25. It's ideal for scalpers and traders that need high leverage in their trading accounts.

Spreads

OctaFX has floating spreads that fluctuate with market conditions. The one good thing about a floating spread over a fixed spread is that a floating spread is smaller than average most of the time. However, it can widen at market opening, during important news releases, during rollover, or periods of extreme volatility.

Platforms and Tools

OctaFX is a MetaTrader broker that offers MetaQuotes Software Corporation's range of platforms, including MT4 and MT5. There's also the cTrader, which includes the cAlgo platform.

OctaFX provides a web interface for copy trading that connects to its MT4 platform. However, OctaFX's copy trading experience lacks a sense of community, a feature shared by all of the most popular copy trading brokers.

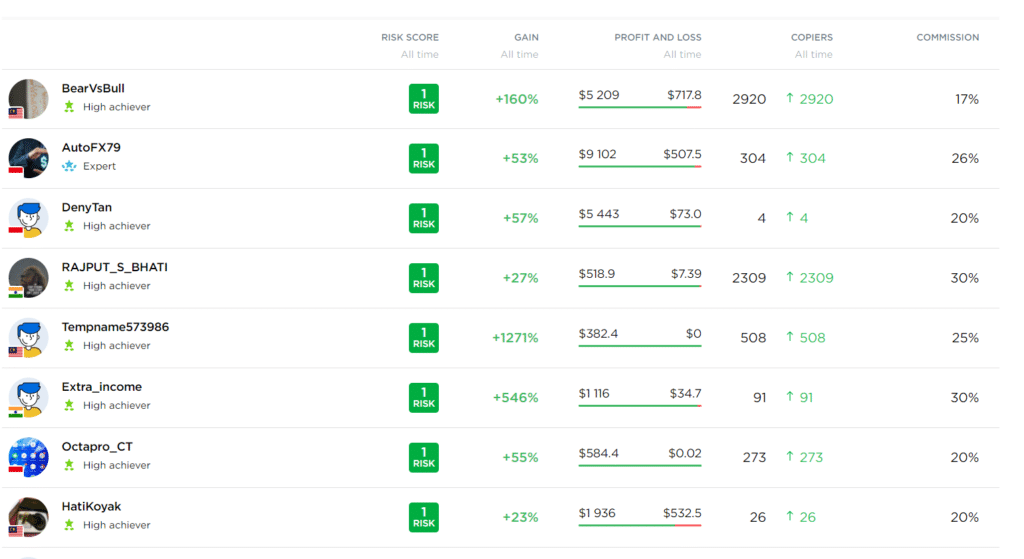

Between August and October this year, 630 of the 3340 systems featured on OctaFX's copy trading platform were profitable, accounting for around 18 percent of all strategies. All in all, the layout is good, though there can be more performance statistics included.

The MT4 and MT5 trading platforms come in three forms: a full-featured desktop client, a lightweight web trading interface for manual users, and a mobile app.

OctaFX Copy Trading

OctaFX's investment in establishing a proprietary copy trading service, which it also introduced as a mobile app, is a plus for OctaFX traders. Traders can also follow signal providers, which are called Master Traders by OctaFX.

OctaFX offers revenue share, in which copiers pay a fee on profitable trades and fixed revenue per lot only, where a trading fee is applied regardless of the outcome. They can also use the filter to find the most suited Master Traders based on the structure of commission.

OctaFX offers a ranking system, which evaluates the Master Trader's trading history with OctaFX. In-depth information on each Master Trader's trading strategy and results are also available. Copiers are able to evaluate trades separately, and the variety of trading metrics OctaFX offers helps copiers make better decisions about the Master Traders they want to follow.

Before copy traders get to follow Master Traders, they must first fund their copy trading account. OctaFX shows you how much money you should provide each Master Trader. Traders can either make a direct deposit or transfer funds from their trading account.

An adjustable risk management tool known as the drawdown percentage (DDP) is also available. The DDP will close the copiers’ position if the Master Trader loses money. Copiers have the ability to manually close open positions, allowing them to be in control over their own portfolios.

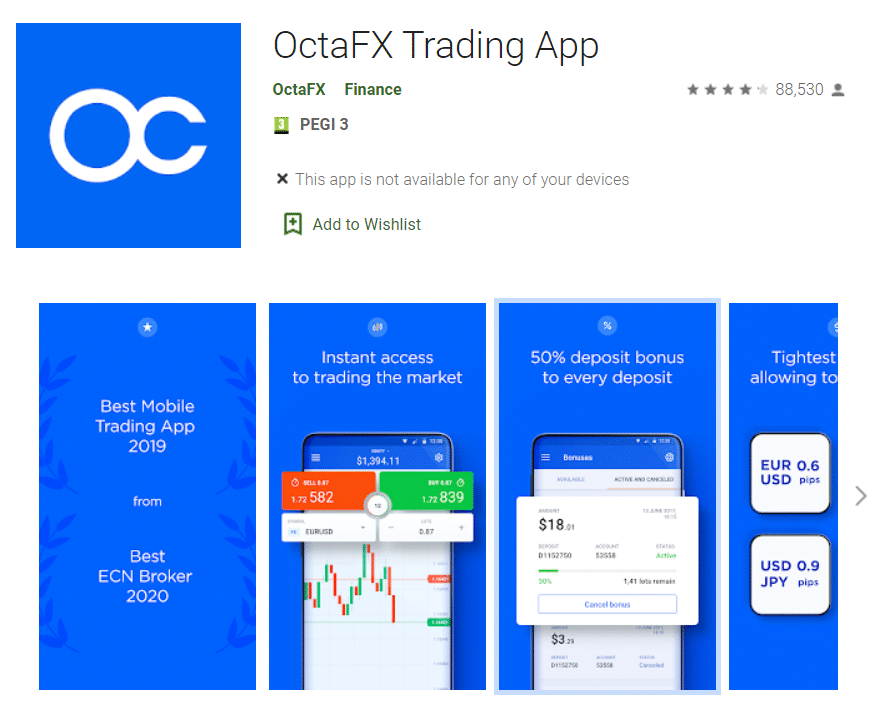

Mobile App

Traders can now manage their OctaFX portfolios using a customized mobile trading app. It has been downloaded over 10 million times on Android smartphones. The success of OctaFX's proprietary copy trading service prompted the development of a mobile app.

Research

OctaFX's research offering has a solid foundation since it includes a little bit of every basic type of content. OctaFX, however, has some room to improve its research offering when compared to research heavyweights Saxo Bank, IG, and CMC Markets.

Under OctaFX’s Traders' Tools section, the broker offers a variety of research content, including an economic calendar, and daily analysis reports, market insights, and trading signals from AutoChartist.

The broker also creates video content, likeits weekly Market in a Minute video on YouTube, as well as various archived educational materials and webinars.

Education

OctaFX has a section dedicated only to forex education on its website, including key articles. There isn't much educational content, however, about how to trade and different market dynamics, other than a trading glossary and many Frequently Asked Questions (FAQs). Despite the fact that the broker has a YouTube channel and a blog, you may be left unsatisfied.

Pricing

OctaFX generates revenue from the spread on the many asset types it offers, with no fixed fees or commissions. The spreads on currencies and many other assets are considered to be competitive, and are comparable to many online trading platforms. The Micro account offers swaps, while the Pro account charges a three-day fee for swaps, and the ECN account charges a weekend fee on trades done outside of normal trading hours.

The other account options, excluding the ECN account, all allow free rollovers. Apart from fees on trading, OctaFX stands out for the lack of fees associated with both its quick deposits and withdrawals.

User Experience

Users must first create an account before trading on the OctaFX platform. Signing up for a demo account is simple and only takes a few details.

You will need to provide your personal ID verification and other documents if you want to sign up for a real account. Your photo ID, and a trading verification process that determines your level of experience trading forex other assets, and a current utility bill as proof of residency are examples of documents you need to provide.

Your account's functionality will be limited until you complete this process. Once your OctaFX account is up, you’re able to start trading on the platform.

OctaFX users can fund their trading accounts using a variety of payment methods. Traditional methods such as bank transfer, credit card, or direct deposit are available in over 100 countries, and there’s also cryptocurrency and a variety of electronic payment methods.

Neteller, Skrill, and PerfectMoney are just a few of the payment options available. The broker provides non-EU users a 50 percent bonus on deposits, which is a big plus.

With OctaFX, withdrawing to a selected bank account or eWallet is a simple process that can be completed with a few clicks. One of OctaFX's biggest features is its quick deposit and withdrawal times, as well as the fact that there are no commissions on either of these transactions or currency conversion

Special Features

The swap-free trading system at OctaFX is one of the best special features they offer. One interesting fact is that trading incentives have paid out more than $6 million to date. The broker also has the Autochartist MT4 and MT5 plugin for users.

Bonuses and Promotions

OctaFX rewards active traders with a 50 percent deposit bonus and a 4-tier status program. It also runs a Trade & Win program, in which each lot counts as a prize lot that can be redeemed for cash. Not only that, but OctaFX also offers a referral program, as well as demo contests with actual money prizes.

We recommend that users read and understand the terms and conditions before engaging.

Is OctaFX a Good Broker and Safe To Use?

OctaFX is considered a higher than average risk. It is not a publicly-traded company or operates a bank. OctaFX is regulated by CySEC which is a lower-tier regulator. It is not regulated by top-class authorities.

Customers can be certain that they’re accessing optimal trading conditions with no requotes and 97.5 percent of all orders seeing no slippage, as well as quick execution of less than 0.1 second thanks to a non-dealing desk model centred on straight-through processing (STP) execution.

However, since OctaFX is only regulated in Cyprus, investing your money with this broker can contain a higher risk than brokers that are regulated in multiple tier-1 jurisdictions.

The broker holds regulatory licenses in Europe through its Octa Markets Cyprus Ltd, Cyprus-based entity, regulated by the Cyprus Securities and Exchange Commission (CySEC).

Octa Markets Incorporated, the broker's international entity, is based in St. Vincent and the Grenadines, where the regulator offers little to no protection. In terms of customer protection, the amount of security of your funds will be determined by which one of OctaFX’s entities holds your OctaFX account and any regulation that is relevant to customer protection.

It’s also worth mentioning that trading securities comes with a significant amount of risk. There is significant risk associated with off-exchange derivatives, margin-based foreign exchange trading, and cryptocurrencies, including creditworthiness, leverage, market volatility, and limited regulatory protection, all of which can have a significant impact on the price or liquidity of a currency or any related instrument.

OctaFX isn't a publicly traded company, and it doesn't run a bank. OctaFX is regulated by none of the tier-1 (high trust) authorities, one tier-2 (medium trust) regulator, and none of the tier-3 (low trust) regulators.

Customer Support

If users have any problems or inquiries, the OctaFX customer support team is available 24 hours a day, Monday to Sunday. They can be contacted via live chat, phone, email, regular mail, WhatsApp, and Telegram. The FAQ section is especially useful for people who are comfortable figuring things out on their own.

Final Verdict

OctaFX is great for investors looking for a low-cost option to get started trading a good range of assets, thanks to its narrow spreads and low opening balance requirements. While the platform is primarily focused on forex, the extra asset classes (such as UK, US, and Japanese equities) offer a good opportunity to diversify your investing portfolio.

On the other hand, if you worry about your money on OctaFX, you won’t be happy to hear it’s only regulated by tier-2 authority which has medium trust, so if you don’t mind taking the risk as 6 million traders have on OctaFX, go for it.

FAQ

To test a demo account, do I need to fund my OctaFX account and send compliance documentation?

No. However, genuine accounts require documentation. Simply enter your first and last names, email address, country of residence and address, and phone number to trade with a demo account. After your email has been confirmed, you can go to OctaFX's user dashboard and create a demo account.

Can citizens of the United States register for OctaFX?

At this time, the United States is not permitted to join the platform. While OctaFX accepts users from over 180 countries, it doesn’t yet have governmental approval to provide services to US residents.

Is it possible to deposit and withdraw cryptocurrencies from OctaFX?

Yes, OctaFX accepts Bitcoin for both deposits and withdrawals. Deposits are free of charge and can take 3-30 minutes. However, withdrawals take 1-3 hours to process and 30 minutes to send, both of which are free of charge.

Can I use automated trading strategies at OctaFX?

OctaFX supports a variety of strategies, such as Expert Advisor strategies (EAs). In addition to this compatibility, copy trading is offered to users with any OctaFX account type.

Is it possible to open a swap-free account with OctaFX?

Yes, OctaFX offers swap-free account options, but only for certain types of account. Accounts that are shariah-compliant are also available.

How can I open an Islamic account?

When creating a new trading account, simply select the Islamic option. Keep in mind that swap-free accounts have no advantages over regular accounts.The use of swap-free accounts is subject to fixed-fees. The commission is equal to the pip price multiplied by the currency pair's swap value. The fee isn’t an interest and is determined by the direction of the position (buyer or seller.)

Are there any fees associated with deposits and withdrawals?

OctaFX doesn’t charge any fees to users. It covers third-party deposit and withdrawal fees (such as Skrill, Neteller, and others). Note that in some cases, fees may be imposed.

What’s the maximum deposit/withdrawal amount?

The amount you can withdraw or put into your OctaFX account is unrestricted. The deposit amount is limitless, but the withdrawal amount cannot exceed the free margin.

Is it possible to deposit/withdraw many times each day?

No, OctaFX does not impose a daily limit on the number of deposits and withdrawals. To avoid processing delays, it’s recommended that you deposit and withdraw all of your funds in one transaction.

How do I use my account to log into MetaTrader 4?

Open MT4, then select “File” — “Login with trading account” from the drop-down menu. Write your account number, password, and choose “OctaFX-Real” for real accounts or “OctaFX-Demo” for demo accounts.