CMC Markets was founded in 1989 and is a forex and CFD trading platform. Their portfolio includes nearly 10,000 different CFDs. CMC covers various financial instruments such as stocks, indexes, bonds, and commodities. CMC Markets is regulated by top-tier authorities and listed on the stock exchange (LSE-CMCX).

Disclaimer: 70.5% of retail CFD accounts lose money. Make sure you understand CFD trading and the risks associated with it.

CMC was among the first trading platforms to introduce Contracts for Difference (CFDs) along with an even more innovative trading instrument know as spread betting.

Based on CMC latest reports, the platform has over 40,000 CFD-active clients and around 119,000 stockbroking clients.

The company is headquartered in London and has operations in two other tier-1 jurisdictions, Australia and Singapore.

The following is a list of CMC Markets' subsidiaries per each of the countries where they are currently established:

- UK: CMC Markets UK PLC & CMC Spreadbet PLC

- Singapore: CMC Markets Singapore Pte. Ltd.

- Australia: CMC Markets Stockbroking Limited & CMC Markets Asia Pacific Pty Ltd

Pros and Cons Of CMC Markets

| Pros | Cons |

| Low Fees For Forex | Stock CFD Fees are High |

| Great Product Offering | Account Verification is Fairly complicated |

| Great Mobile and Web Platform | Copy Trading not Available |

Why should you read this review?

Considering the fact that there are dozens of online brokers available nowadays, you may feel overwhelmed when it comes to picking the right one for your trading needs.

There are so many variables to watch for including the fees they charge, which are often difficult to understand, the quality of their customer service, the friendliness of their trading platform, and many other elements that you probably don't have the time to research and compare.

With that in mind, we wanted to come up with a comprehensive review that facilitates the job of comparing this broker with the wide range of alternatives available in the market so you can make an informed decision on whether CMC Markets is the right broker for you, or not.

The following topics will be covered by this review:

- Main pros

- How safe it is to trade with CMC Markets

- Opening an account

- Depositing and withdrawing money

- Financial products offered

- User experience and features of CMC Market's trading platform.

- Trading fees

- Research tools available

- Educational materials

- Customer service

- Risks associated with trading CFDs.

Is CMC Markets a Safe Trading Platform?

CMC Markets is a reliable online broker. Traders can safely use to conduct their transactions, considering the significant degree of regulatory oversight this company is subject to.

There are various elements that contribute to considering CMC Markets as a safe broker to trade CFDs.

These are:

- The company is regulated by three tier-1 regulatory bodies including the Financial Conduct Authority (FCA) in the United Kingdom, the Monetary Authority of Singapore (MAS), and the Australian Securities and Investment Commission (ASIC).

- CMC Markets (CMCX) is a publicly-traded company listed on the London Stock Exchange, which adds a high degree of transparency to their operations as they are required to file periodical financial statements and reports.

What's Best About CMC?

There are many positive characteristics of CMC Markets that make this broker an

appealing choice for traders.

First, the platform offers low trading fees for

forex trades and it also charges zero fees on withdrawals and requires no minimum

deposit.

Secondly, CMC Markets' trading platform – Next Generation – is among the best in the industry and it was awarded as Best Platform Features in 2019 by the Investment Trends UK Leverage Trading Report.

Moreover, both the research tools and the educational materials made available by CMC Markets are fairly advanced compared to what its rivals are currently offering.

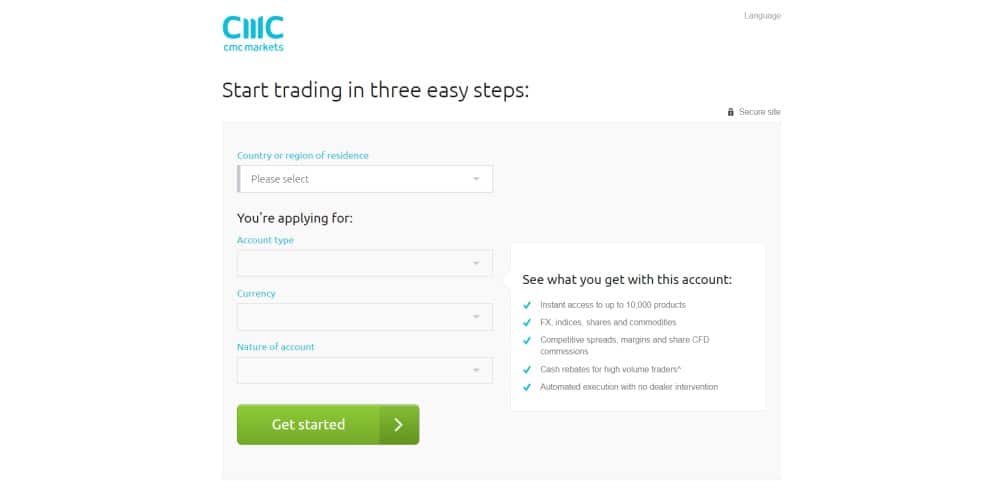

Account opening

Opening an account with CMC Markets has its ups and downs.

On the one hand, the process of signing up for the platform is fairly easy and can be completed within a few minutes through their 100% online registration.

Additionally, no minimum deposit is required to open an account with CMC Markets, which facilitates the process even more.

That said, the ID verification process takes longer and it is more complex than usual. On average, verifying the account will take at least 2 days.

CMC Markets offers two different types of accounts and each of them is available for a limited number of countries:

- CFD Account: this account offers 10 different base currencies and it is available for all countries where CMC Markets is allowed to operate. Capital gains for these accounts are taxable and it is possible to open a joint account and a corporate account.

- Spread betting account: this account is only available to UK and Ireland residents and only two base currencies are featured, GBP and EUR. Capital gains are not taxable for these accounts and corporate accounts are not available.

It is important to note that there's a not-so-small list of countries that are forbidden to open an account with CMC Markets including China, Syria, Cuba, Venezuela, Japan, South Africa, and the United States, among others. The reasons behind their bans vary from one country to the other.

Deposit

Depositing money on a CMC Markets account is easy and cheap.

Credit cards, debit cards, electronic wallets, and bank transfers are permitted and no deposit fees are charged by this broker.

Deposits made through electronic wallets, debit, and credit cards are credited instantly while bank transfers usually take 2 business days or more to be cleared. Additionally, bank transfers can only come from your own bank accounts, not from a third party.

Moreover, CMC Markets offers 10 different base currencies for its CFD accounts including GBP, EUR, USD, AUS, CAD, SGD and other smaller European currencies.

The importance of having this wide range of base currencies to fund your account is that you can save money on the deposits and withdrawals you make as you won't have to pay a conversion fee.

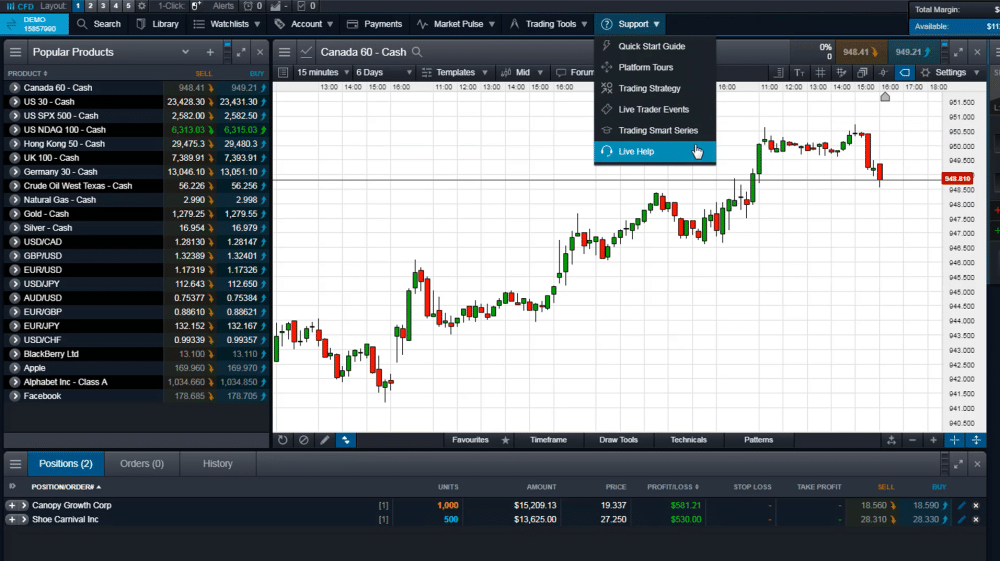

Trading Platform

CMC Markets' award-winning Next Generation trading platform provides a great trading experience that includes highly-customizable charts, many technical indicators, a solid search function, and a user-friendly design. Active day traders, looking to trade on the go, should read our guide on the best mobile trading platforms for day traders.

Web-based platform

The Next Generation web-based platform is proprietary, which means that it is owned by CMC, while it also supports Meta Trader 4 for more experienced traders.

At a first glance, the interface looks a bit complex, especially for traders that are just starting out, but CMC Markets has made available a good selection of educational materials to help new users in getting started.

Additionally, its great design facilitates the process of learning the ins and outs of its interface.

The web-based version of Next Generation features 9 different languages including Chinese, English, Norwegian, French, German, Italian, Spanish, Polish, and Swedish.

This review found that one downside of CMC's platform is that it does not feature a two-step CMC Markets login, which reduces security and leaves some room for potential unauthorized access.

Finally, the reports provided by Next Generation cover all the relevant information traders should know about their transactions including trading costs, gains & losses, cost basis, and market prices.

Desktop Platform

The Next Generation platform can be accessed via desktop as well, even though its design lacks in comparison with the web-based version.

The available features and customization alternatives are fairly similar to the web-based version.

Additionally, CMC Markets also supports Meta Trader 4 for desktops, which is a good alternative for more experienced traders that may enjoy a larger selection of technical indicators.

Mobile trading app

The CMC Markets mobile trading app is very user-friendly and provides a good deal of features compared to the other two versions, including a solid search function even though it is not as customizable as the web version.

Additionally, the same languages for the web-based platform are available on the mobile trading app.

Order Types

CMC Markets trading platform has made available five different types of trade orders:

- Market order – this order is executed at the current market price of the security.

- Limit order – a limit order sets a maximum price at which you are willing to buy the securities or a minimum price at which you are willing to sell the securities. The order will only be executed at the limit price or better.

- Stop order – a stop order limits losses in case the market price falls below the stop price. The order will become a market order once that price is reached.

- Trailing stop-loss order – a trailing-stop order allows traders to gain from any favorable price movement until the trend reverses and the price falls by a certain percentage or down to a certain price.

- Guaranteed stop-loss: this order allows the trader to close his position at the exact stop price but it comes with an additional cost.

Furthermore, CMC Markets also provides time frames for each trade order such as Good 'til cancelled (GTC) and Good 'til time (GTT).

All of these orders are available for the web-based and mobile trading app versions while trailing stop-loss and guaranteed stop-loss orders are not available for CMC Markets' desktop platform.

Finally, certain alerts and notifications can be set by using any of these three versions. The notifications can be sent via e-mail, push, or SMS.

Markets and Products Available

While CMC Markets offers a wide selection of CFD products that cover many financial assets, their portfolio of available financial products is fairly limited since they don't offer the possibility of trading options, futures, stocks, or bonds directly.

On the other hand, the number of available currency pairs makes it a good alternative for forex traders who want a wide range of options for their activities.

Here's an overview of what you can trade through CMC Markets:

- 338 currency pairs

- 92 stock index CFDs

- 8,000 stock CFDs

- 1,000 ETF CFDs

- 136 commodity CFDs

- 56 bond CFDs

- 15 cryptocurrencies

Fees

CMC Markets is not the cheapest broker platform for individual stocks, even though its Forex fees are on the low end.

CFD trading fees for individual stocks are fairly expensive compared to CMC's competitors, while the most popular CFDs – indexes for example – are very competitive.

This broker does not charge a flat fee as the cost per trade is embedded into the bid/ask spread, which is the gap between the bid price and the asking price.

Here are some average spreads paid for the most popular financial instruments offered by the platform:

- S&P500 Index CFD – 0.5 average spread

- Europe 50 CFD – 1.6 average spread

- EUR USD – 0.7 pips.

On the other hand, our review found that the cost of trading individual stocks by using the CMC Markets' platform can be best assessed by using a hypothetical $2,000 investment that is held for 1 week.

Based on that assumption, here's the cost of trading some popular individual stocks:

- Vodafone stock CFD: $23.4

- Apple stock CFD: $22.4

On the other hand, the cost of trading currency pairs can be estimated more accurately by using a hypothetical scenario for our review involving a $20,000 trade with a 30:1 leverage ratio held for 1 week.

In that scenario, the cost of trading some of the most popular pairs would be:

- GBP/USD: $12.1

- EUR/USD: $16.2

- AUD/USD: $10.9

The only other relevant fee charged by CMC Markets apart from its trading fees is an inactivity fee of £10 if the user fails to log into his account for more than 12 months.

Research Tools

The research tools available within the Next Generation trading platform are very good compared to what other brokers provide.

The platform has built-in Reuters and Morningstar news feeds, which are top-notch news services, along with an economic calendar covering a wide range of corporate and economic events.

Notifications and alarms can be set for each of these individual events and there's a meter that indicates the potential impact each event may have on the market.

Additionally, there's a section called ‘Insights' that shows relevant market information about each asset within the platform, providing traders with potential ideas for future positions.

On the other hand, the platform also provides an interesting social feed where traders can share their thoughts and analyses on the different financial instruments by using charting tools.

Fundamental data is available for individual stocks and it is fed by Morningstar, which means the information is very reliable and traders can find it easily. This is a very convenient and not frequently found feature in most trading platforms.

Finally, charting tools include dozens of different technical indicators, patterns, automatic drawing tools, and the possibility of saving various templates.

Education

Another great feature of the CMC Markets' Next Generation trading platform is its wide selection of educational materials that go beyond simple how-to tutorials to dive into more complex matters regarding technical analysis, fundamental analysis, and trading strategies.

This broker offers a demo account, which is advisable for those who have never seen a live trading platform and it is also a good way to get to know the interface before you deposit your money into it.

Educational materials include webinars, video content, blogs, glossary terms, and platform tutorial videos, which are particularly useful for those who have no prior experience with trading interfaces.

By taking advantage of this vast source of information traders can continuously improve and hopefully increase the profitability of their trades.

Customer Service

CMC Markets offer customer service via phone calls, live chat, and e-mails.

Their customer support feature is available in 9 languages, the same ones supported by the web-based and mobile trading app.

According to its users, the quality of customer support is very good, even though it is available only 5 days of the week. At this point, CMC only offers assistance from Monday to Friday but 24 hours a day during those 5 days, which is great.

All the customer service channels appear to be replied to within reasonable time frames. Live chat responses are instant and the same goes for phone calls. E-mails, on the other hand, are commonly responded in 24 hours or less.

Withdrawals

Withdrawals are a major topic for traders, especially those with limited capital.

Some platforms impose high withdrawal fees, which encourages retail investors with limited amounts, but not CMC.

CMC actually charges no withdrawal fees as long as the money is sent to a debit card, credit card, electronic wallet, or a domestic bank account.

On the other hand, international wire transfers pay a £15 charge. This charge applies to withdrawals made to a bank account that has a different currency than the base currency of the CMC Markets account.

Withdrawals usually take one business day to clear, except for bank transfers which may take a bit longer.

Conclusion

CMC Markets has been around for more than 30 years. This online trading platform offers more than 10,000 different CFDs and hundreds of currency pairs. The company is headquartered in London and has subsidiaries in Australia and Singapore. CMC Markets is also a publicly traded company listed on the London Stock Exchange (LSE). Currently, this online broker serves more than 40,000 active CFD traders and 100,000 stockbroking clients.

CMC is regulated by six different tier-1 authorities including: