Founded in 2012, BDSwiss is a well-renowned broker based in Zurich that grew quickly to become one of the biggest online trading companies in the world. BDSwiss's current client base includes 1.5+ million users from more than 186 countries, and more than 30 billion in average monthly Forex volume.

The Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Commission (FSC) regulate BDSwiss, allowing it to provide non-EU clients flexible leverage options.

By offering commission-free commodity and forex trading, as well as reasonable prices of commodities, indices, and equity CFDs, BDSwiss has grown to become a global trade company with headquarters in Cyprus, and offices in Kuala Lumpur, Malaysia; Berlin, Germany; Pristina, Kosovo; and Tirana, Albania.

BDSwiss has received not only positive feedback from traders globally, but also a slew of awards for the outstanding operations and convenient trading environment of the broker. It was praised and commended for its outstanding trading technology and service, owing to its app and trade execution, as well as confirming its long-term trading history.

But does BDSwiss really live up to its reputation? Find the in-depth answer here in our unbiased BDSwiss review, through which we’re going to tell you everything you need to know about BDSwiss in 2022.

BDSwiss Summary

When it comes to trading capabilities and high-quality features and offerings, BDSwiss reigns supreme over many other brokers. This award-winning service provides its clients with a fast, seamless account opening process that takes less than one minute. You get to choose from three major account types, as well as a demo account with virtual funds of $10,000. BDSwiss offers you a large selection of 250+ assets, including cryptocurrencies.

The broker excels when it comes to its trading platforms, with an excellent WebTrader, mobile app, and desktop platform to trade on. The research tools are of high quality and the education section is exstentive. They have great 24/5 customer support via live chat, phone, and email. BDSwiss is heavily-regulated by reputable regulators so your money should be safe on the broker.

On the other hand, BDSwiss does not accept clients from either the United States or Canada. Moreover, it does not offer a wide selection of cryptocurrencies.

Overview

| Trading Platform | BDSwiss |

|---|---|

| Founded | 2012 |

| Headquarters | Switzerland |

| Regulation | CySEC, FSC, FSA |

| Offering of Investments | Forex, Commodities, Indices, Shares, Cryptocurrencies, ETFs |

| Demo Account | Yes |

| Islamic Account | Yes |

| Minimum Deposit | $100 |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| Mobile App | Yes |

| Scalping | Yes |

| Hedging | Yes |

| U.S. Clients accepted | No |

| Inactivity Fee | No |

| Leverage | 1:30 | 1:500 |

| Payment Methods | Bank Transfers, Credit Cards Sofortüberweisung, Skrill, EPS, iDEal, Giropay, and more |

| Customer Service | Live chat, phone, and email |

| Our Score | 4.7/5 |

Pros and Cons

When we looked into what makes BDSwiss stand out among competitors, we found many good sides to like about this broker. On the other hand, there are very few drawbacks about BDSwiss that many traders can overlook.

| Pros | Cons |

|---|---|

|

|

|

BDSwiss Compared

BDSwiss is not the only online broker in the industry that offers attractive features and little drawbacks. In fact, there are many brokers out there that strongly compete with BDSwiss. So, in order to decide whether BDSwiss is the best in the market or not, you need to first have a basic understanding of what other competitors offer. We set a brief yet useful comparison below between the basic features of BDSwiss and its strongest competitors to help you pick your pick:

| Platform | BDSwiss | Exness | IC Markets | XM |

|---|---|---|---|---|

| Founded | 2012 | 2008 | 2009 | 2009 |

| Minimum Deposit | $100 | $10 | $200 | $5 |

| Inactivity fee | Yes | No | No | $5 per month |

| USA Accepted | No | No | No | No |

| Regulated | Yes | Yes | Yes | Yes |

Account Opening

New account openings are processed using a user-friendly online application that follows industry standards. The process, according to BDSwiss, takes less than 49 seconds. To complete the account opening process, you must send a copy of your ID and 1 proof of residency document, as well as 2 questionnaires.

Follow the steps below to create a new trading account with BDSwiss:

- Open the Sign In page. It’s also possible to sign up using your account on Google or Facebook.

- Provide some personal information like your name, phone number, email, etc

- Provide documents like utility bills or ID to verify your account.

- Complete questionnaire about your past experience in trading, as well as your trading expectations

- After the account gets activated, you’ll get to access the account area.

- Learn about all benefits and risks involved, after that, you can start funding and start trading instantly.

Account Types

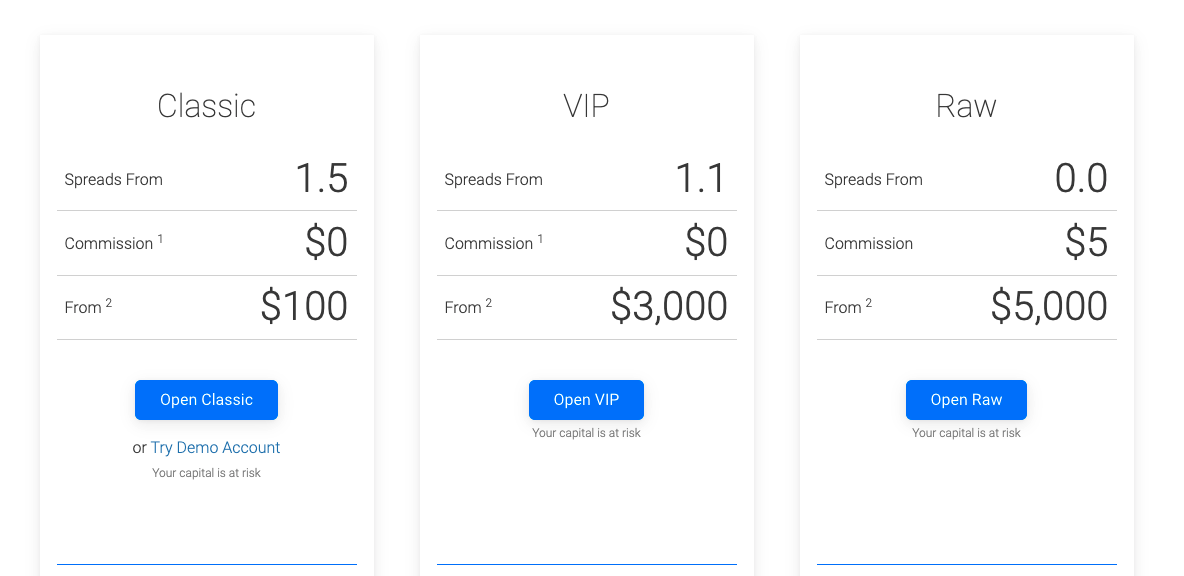

BDSwiss has three major account types to offer: the Classic account, the VIP account, and the Raw account, all of which were designed to meet the needs of different Forex traders by offering cheaper prices based on trade size. On request, BDSwiss provides Islamic accounts.

When you open your BDSwiss trading account, you get to choose between the US Dollar, the Euro, and the British Pound as your base currency, which is a fantastic feature as it means the account balance won't fall below 0 because of the negative balance protection. Plus, you won't be charged for currency conversion.

The Raw account includes interbank spreads as well as a per-lot commission charge. On the other hand, the Classic account and the VIP account are based on spreads only. The average spread on the Classic account is 1.5 pips, while it’s 1.1 pips on the VIP account.

BDSwiss also offers a Forex or CFD demo account that is risk-free and allows you to study and practice trading strategies as well as evaluate the trading circumstances before you open a genuine account with the broker.

The demo account is available with a $10,000 initial deposit after registering your BDSwiss account to test the WebTrader platform, MetaTrader4/MetaTrader5, or mobile app. Furthermore, the balance of your demo account can go back to its original number of $10,000 by resetting it.

Markets Offered

The asset selection at BDSwiss is extensive. BDSwiss offers 51 currency pairs, 7 commodity CFDs, 21 cryptocurrencies, 12 index, and 138 equity CFDs. The broker offers trading across a large selection of more than 250 assets, including CFDs on top Indices, Commodities, Forex, and Cryptocurrencies. With the ability to to access the most popular and liquid markets, you can select the most appropriate and understandable instrument for you from using the broker’s portal.

BDSwiss is a great broker to start trading Crypto. It offers competitive trading prices and a wide selection of features that include a strong portfolio function and the ability to trade Cryptocurrencies. You are able to trade Cryptocurrencies using CFDs with low fees.

BDSwiss provides high-quality product selections that can suit both novices and experienced traders.

Deposits and Withdrawals

BDSwiss offers a good selection of payment methods that may differ depending on country legislation and your location, so it's always a good idea to double-check this information. You can deposit on BDSwiss via bank transfers, credit cards Sofortüberweisung, Skrill, EPS, iDEal, giropay, and more.

BD Swiss Minimum Deposit

The minimum deposit for a Classic account at BDSwiss is 100 USD, which is a good amount for some traders and rather high for others. BDSwiss does not impose any fees for credit card or e-wallet deposits (albeit this varies by entity laws).

Withdrawals

BDSwiss offers a wide number of withdrawal methods, with a minimum withdrawal of $100 and withdrawals usually handled for free. However, if your withdrawal amount is less than the specified minimum, BDSwiss may charge a $10 fee.

Leverage

Leverage allows you to trade with a larger volume, potentially increasing your profits, but also increasing your losses. So, always use it wisely. For Forex instruments, Europe-based clients can employ a maximum leverage level of 1:30. But BDSwiss traders around the world may still be eligible for a larger range of up to 1:500. On all currency and gold pairs, the Raw account offers competitive spreads and a commission of $5 per traded lot.

We recommend you check the official platform of BDSwiss for the most up-to-date information and make sure to check each instrument because it differs depending on the asset.

Trading Platforms

MetaTrader4 and MetaTrader5 are offered in versions that are compatible with a variety of devices, including PCs, Macs, applications, and a web-based platform that does not require any installation.

We can see why a lot of traders like MT4 — the platform is excellent with its wide selection of tools and charting capabilities, all of which contribute to a pleasant trading experience. Because it’s a new version, MT5 has become popular among both novice and seasoned traders thanks to its advanced tools and thorough analysis choices.

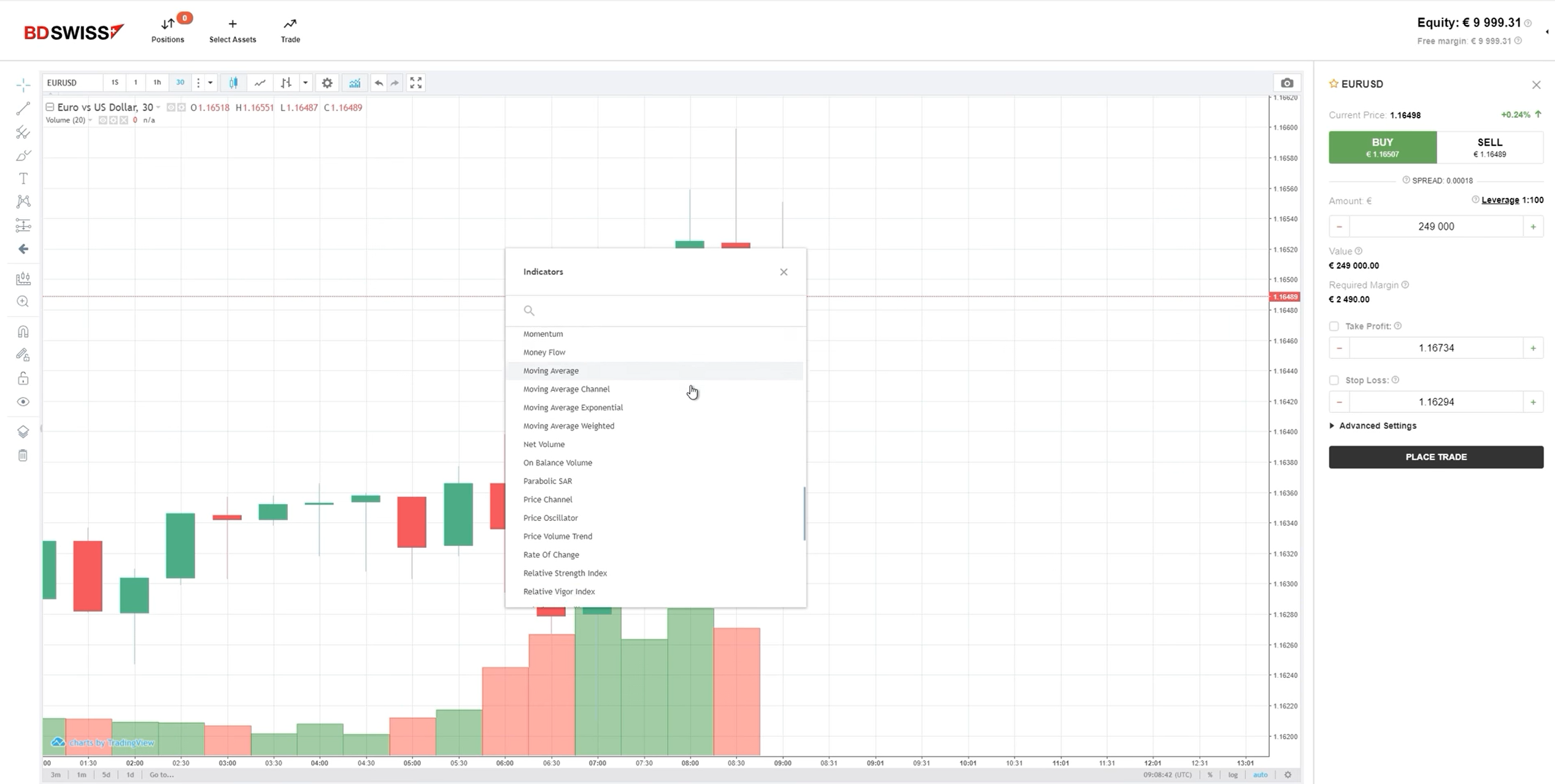

- Web Trading Experience

If you're looking for a MetaTrader alternative, the WebTrader that is completely synchronized with the MT4 downloaded versions may be the way to go. The WebTrader is a proprietary online trading platform that does not require any installations or downloads, allowing you to use your BDSwiss account directly from any browser.

The platform offers a clean, user-friendly design and a number of advanced analysis tools, such as risk management and technical analysis tools. You get access to WebTrader with over 20 different languages. The WebTrader platform offers almost all of what BDSwiss does, so you can get a full trading experience by only using your browser.

Although the WebTrader is touted as a feature-rich platform, it does not offer automated trading solutions. Thus, it's a less powerful version of the MT4 and MT5 web versions.

- Mobile Trading Experience

BDSwiss, like any other reputable broker, has its own mobile app, which is well-received by traders. The BDSwiss Mobile App is quite user-friendly and responsive. You can access all of the most significant functions from there, so you can do analysis and open your BDSwiss account management while on the go. You can also create an account, deposit, withdraw funds, and upload your KYC.

The mobile app provides traders with full trading and transactions history, 24/7 cryptocurrency pairs trading, real-time quotes, interactive charts, in-built user tutorials, and live chat and support.

- Desktop Platform

You can also get the desktop version to access MetaTrader4 and MetaTrader5 and enjoy all of its features, which more active or seasoned traders can find useful.

Research

BDSwiss provides excellent research tools via unique information to help you grow as a trader. Aside from common tools like Economic Calendars and excellent market analysis by the broker’s team, you’ll have access to Trading Alerts and Authochartist. Daily Market Analysis, which delivers market coverage 5 days a week, is another fantastic and useful service available in the BDSwiss Research Portal.

But not all clients can access the same level of research tools in terms of the depth, if you have a VIP or Raw account, for example, you’ll benefit from more in-depth research materials such as Exclusive Webinars, VIP Trading Alerts, and Performance Stats.

Education

Through its Academy, BDSwiss provides the best possible support and guidance to its clients Educational materials include strong courses and webinars that teach you how you can construct your trading strategy and operate in markets.

Furthermore, BDSwiss provides webinars on a daily basis, which are an excellent way for you to learn about forex. Through its Blog, you’ll also get access to essential information such as market alerts and analysis.

Awards

BDSwiss is a broker that has proudly received awards by some of the industry's most renowned awarding bodies for the high quality of their trade products and services:

- 2020 BEST FX & CEDs PROVIDER International Investor Awards

- 2020 BEST MARKET RESEARCH PROVIDER FxScouts Awards

- 2020 BEST PARTNERSHIP PROGRAM ASIA Global Banking & Finance Awards

- 2021 BEST FX RESEARCH & EDUCATION PROVIDER World Finance Awards

- 2021 BEST MOBILE TRADING PLATFORM EUROPE Global Banking & Finance Awards

Is BDSwiss Safe?

Yes, BDSwiss is safe to trade with, it’s regulated by authorities in Switzerland, Cyprus, and other countries and offers low-risk Forex and CFD trading. This broker is a trading name of BDSwiss Holdings Ltd., which is incorporated under the regulations of Cyprus, and is also licenced by the Cyprus Securities and Exchange Commission (CySEC) to provide legitimate financial and trading services.

Cyprus regulation complies with the European MiFID and MiFID II Directives in terms of the provision of trading services. These directives offer a secure trading environment for traders. As a result, the BDSwiss company is regulated and is able to work in the EEA.

Another operation office of BDSwiss is located in Mauritius and Seychelles, and it is registered with the Mauritius Financial Services Commission (FSC), allowing BDSwiss to serve a bigger number of clients globally.

According to the law, the funds’ security, as well as client protection, be delivered in a variety of ways to provide a secure trading environment. This means that you’re safe as long as BDSwiss follows the rules.

Customer Support

BDSwiss boasts excellent customer service in the industry. Their multilingual team is professional, sustainable, and available 24/5 for you to answer any questions via live chat, phone, or email.

When it comes to their phone number, BDSwiss uses local numbers in order to avoid any charge on you.

English phone number:+44 2036705890

German phone number: +49 3021446991

Italian phone number: +39 0689970124

French phone number: +33 184671942

Spanish phone number: +34 910756937

Portuguese phone number: +35 1308810611

Greek phone number: +30 2111984082

Email: [email protected].

Bottom Line

If you’re not a US-based or Canada-based trader, or if you don’t mind the modest selection of cryptocurrency, then yes, we recommend you invest your money with BDSwiss.

This award-winning broker meets the high expectations of traders by offering trading opportunities to both newbies and seasoned investors. Trades of any level can discover a suitable account type to match their specific trading needs. It provides clients with a variety of value-added products and services, from its own proprietary WebTrader and excellent mobile app to extensive educational content and daily webinars conducted by the company's experts.

Trade execution is always seamless thanks to the inclusion of minimal spreads and first-rate liquidity. If clients run into any issues, the exceptionally friendly and prompt support team is available in seven languages via local phone lines and email, as well as in 12 languages via live chat. Plus, BDSwiss is one of the most heavily-regulated brokers out there, which means that you won’t have to worry about losing your money on an online broker at any moment.

To sum up, it’s hard to hate a broker like BDSwiss. It’s a reputable broker that offers services any trader would hate to miss out on. So if you don’t mind any of its drawbacks mentioned in this review, go ahead and start trading with BDSwiss, as there’s a lot to benefit from doing that!

FAQ

How long does it take to withdraw money from BDSwiss?

As the broker states, it strives to provide withdrawal service that goes through within 24 hours. However, this only applies to business days, so withdrawal can take more time to proceed on weekends and holidays. Also, once your payment has been confirmed and made by the broker, you’re recommended to give extra days for your payment to proceed with the transaction.

Does BDSwiss charge an inactivity fee?

A monthly fee of 10% will be withdrawn from your account balance if no trading activity occurs for more than 90 days.

Why can't I withdraw my funds from BDSwiss?

If your withdrawal was denied, it could have been due to one of the

following reasons:

1. Insufficient balance in the account.

2.

There isn't enough free margin to cover all open positions.

3.

Withdrawal details are incorrect.

How can I deposit money into my BDSwiss trading account?

Follow the steps below in order to deposit money into your BDSwiss

trading account:

1. Choose the account you want to fund and

select Payments – Deposit.

2. Type the amount you want to

deposit.

3. Choose a deposit method and select ‘Proceed to

Pay'.

4. Confirm the details of your deposit on the next page.

How do I change my card details on BDSwiss?

On the BDSwiss dashboard, go to your Account, choose ‘Settings,' and then ‘Personal Profile.' BDSwiss will update your profile once the new proof of residence document is received and accepted.

Is it possible to transfer funds from one BDSwiss account to another?

If you want to transfer money between your BDSwiss accounts, send an email to [email protected] and specify which of your accounts you want to transfer money to and from, and don’t forget to include the account numbers. Within 24 hours, your request should be processed.

Are there any withdrawal fees on BDSwiss?

Withdrawals are usually processed without a fee. There are a few exceptions, though, like if you wish to withdraw a sum of less than $100, €100, or £100. Any bank wire withdrawals under €100 and any other types of withdrawals totaling €20 or less will be charged a fee of €10.