Binary Options in the USA are subject to regulation and are legal, but only on CFTC-regulated Binary Options Exchanges. I will go over the Best Binary Options Brokers in the USA below.

There are only two possible places if you don't want to trade through an offshore broker. We compiled a list of the Best Binary Options Brokers if you want to research it further.

Note that binary options trading isn’t available in all US states.

Moreover, the regulations regarding this type of investment can change. So, thoroughly check any broker’s rules and safety measures before investing.

Best Regulated Binary Options Brokers in the USA

There aren’t many binary options trading platforms regulated in the US.

Trusted US-regulated binary options brokers include Nadex, CBOE and NYSE Brokers, Cantor, TD Ameritrade, and ETRADE.

- NADEX – Best Binary Options Trading Platform USA

- Cantor – Best Binary Options Broker USA for Charting

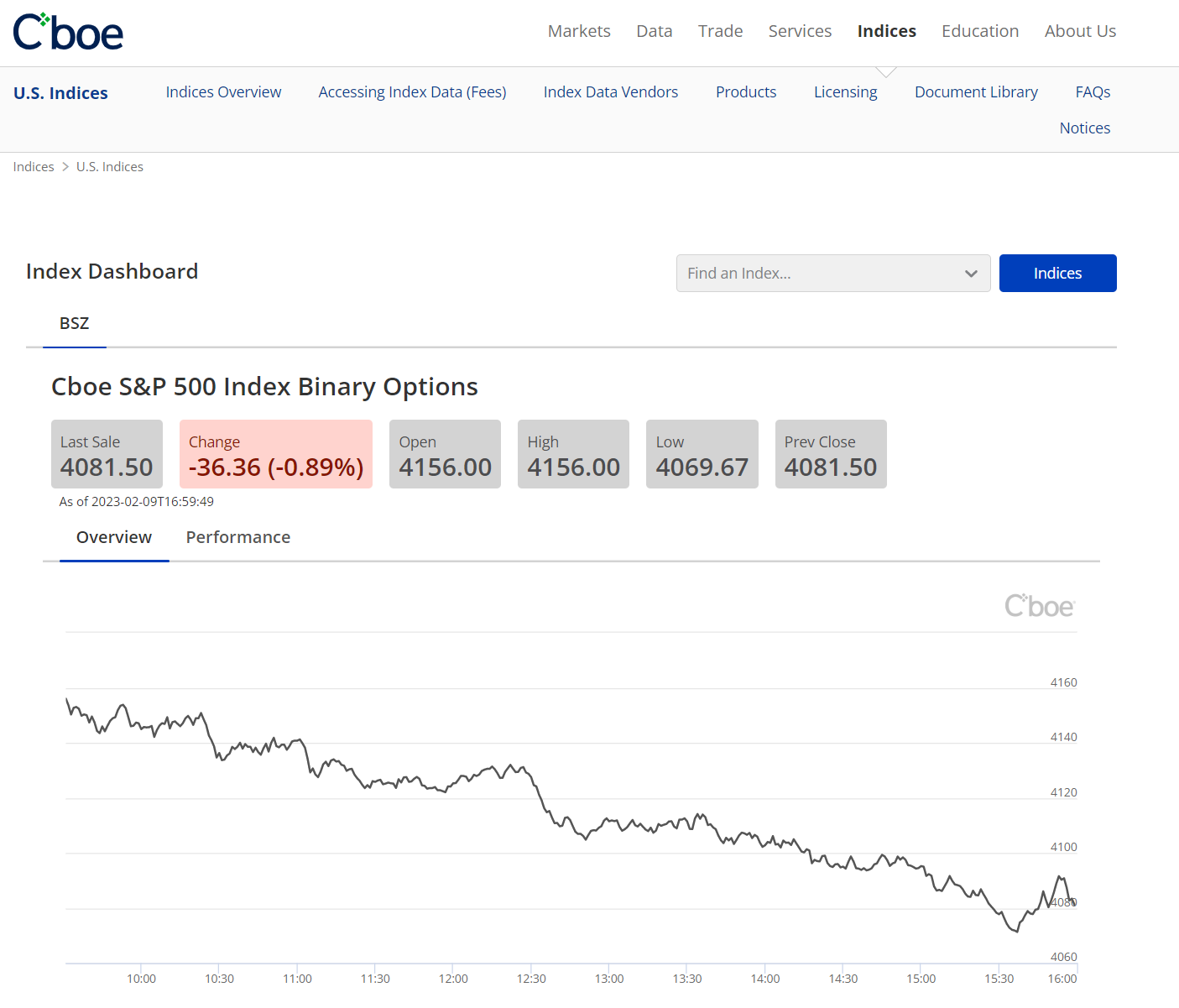

- CBOE – Working Through a Broker

- NYSE – Working Through a Broker

PFI Rating: 4.9/5

1. NADEX

Nadex is a regulated binary options exchange in the US, owned by IG Group.

It offers a secure trading environment with various trading instruments, including binary options and spreads.

Nadex was founded in 2004 and is headquartered in Chicago, Illinois. It operates as a Designated Contract Market (DCM) and is regulated by the Commodity Futures Trading Commission (CFTC).

The exchange offers a transparent and secure platform for trading financial derivatives. It has binary options on many markets, including forex, commodities, stock indices, and events, and provides a user-friendly trading platform with advanced features.

It also offers educational resources and a demo account for beginners.

PFI Rating: 4.8/5

2. Cantor

Cantor Exchange is a US-based financial exchange that offers binary options trading on six major currency pairs.

It was founded in 2010 and is headquartered in New York.

The exchange operates under the regulatory oversight of the US Commodity Futures Trading Commission (CFTC).

Cantor Exchange offers a wide range of products and services in the financial markets. Moreover, Cantor Exchange delivers futures and options contracts on various financial instruments, including interest rates, currencies, commodities, and stock indices.

It provides a fully electronic trading platform with advanced features, such as streaming market data, real-time quotes, and advanced order types.

PFI Rating: 4.8/5

3. CBOE

You can also trust the CBOE (Chicago Board Options Exchange) and NYSE (New York Stock Exchange). They’re leading securities exchanges in the United States.

CBOE is primarily known for its options trading, while NYSE is a stock exchange where public companies can list their shares and raise capital.

CBOE, the world’s largest options exchange, was founded in 1973. It’s known for trading options on the S&P 500 and VIX volatility indices. CBOE also trades ETFs and individual stocks.

PFI Rating: 4.8/5

4. NYSE

The NYSE, one of the oldest stock exchanges, was founded in 1792. It’s headquartered in New York City. Moreover, it’s the largest stock exchange worldwide by market capitalization.

It’s a big center for trading stocks of large corporations, such as many Fortune 500 companies. Both exchanges offer various financial products and services.

The brokers of CBOE and NYSE can participate in trading options and stocks, respectively, on those exchanges.

How to Choose the Right Binary Options Broker?

Choosing the right binary options broker in the US can be challenging, as the regulatory landscape for binary options trading is constantly changing.

Here’s a list of key factors to consider when choosing a binary options broker:

Regulation

Ensure that the broker is regulated by the CFTC or SEC. Also, check if they comply with all applicable laws and regulations.

Reputation

Research the broker’s reputation and history. Check for negative reviews or complaints from previous clients.

Trading Platform

Ensure the broker’s trading platform is user-friendly, reliable, and secure.

Mobile Trading App

Make sure the binary options trading app is well built and easy to use.

Asset Availability

Consider the assets available for trading, including stocks, currencies, commodities, and indices.

Ensure that the broker offers the assets that you are interested in trading.

Payouts and Returns

Consider the payout rates offered by the broker and compare them to other brokers.

Customer Support

Ensure that the broker offers adequate and responsive customer support.

Fees

Consider the charges associated with trading, including spreads, commissions, and overnight financing charges.

Advantages of Binary Options Brokers

Here’s a list of advantages of binary options brokers:

Convenience

Binary options brokers provide a platform for buying and selling binary options contracts easily.

A Wide Range of Assets

Binary options brokers provide many assets, including stocks, currencies, commodities, and indices.

Trading Tools and Resources

Binary options brokers often provide traders with trading tools and resources, such as charts, indicators, and analysis.

Easy to Use

Binary options trading is relatively straightforward, making it accessible to a wider range of traders.

Potential for High Returns

Binary options trading offers high returns in a short amount of time.

Risks Involved in Binary Options Trading

Here’s a list of some things to be aware of when trading binary options:

High Risk

Binary options trading is considered a high-risk investment, as traders can potentially lose their entire investment.

Limited Regulation

Binary options trading isn’t regulated in many countries, making it difficult to protect your investments.

Scams

There have been many instances of binary options brokers engaging in fraudulent activities and scams, which can result in significant losses for traders.

Short-Term Focus

Binary options trading is often focused on short-term trades, which may not be suitable for all traders.

Market Volatility

Binary options prices can be affected by sudden market movements, making it difficult to predict the outcome of a trade.

Limited Control

Binary options trading is a speculative investment. Also, traders have limited control over the outcome of their trades.

Lack of Transparency

Some binary options brokers may manipulate prices or create unrealistic trading conditions, leading to a lack of transparency in the market.

It is important to thoroughly research any broker before depositing funds and to carefully consider the risks involved with binary options trading before investing.

Choosing a reputable and regulated binary options broker is also crucial to help mitigate some of these risks.

Is Binary Options Legal in the USA?

Binary options trading is legal in the USA but with restrictions.

The CFTC ban applies only to off-exchange binary options trading, while on-exchange binary options trading is still allowed.

On-exchange binary options are traded through exchanges registered with the CFTC and subject to CFTC oversight, which provides a measure of consumer protection.

So, while binary options trading is legal in the USA, traders should be careful and only trade through CFTC-regulated exchanges.

Where Can I Trade Binary Options in the USA?

Binary options trading is largely banned in the US, with only a limited number of regulated binary options exchanges available to US traders.

Currently, the two major regulated binary options exchanges in the US are the North American Derivatives Exchange (Nadex) and the Chicago Board Options Exchange (CBOE).

They’re regulated by the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). Therefore, they’re considered safe for US traders.

How Can I Trade Binary Options Successfully?

Here’s a list of tips for trading binary options successfully:

Choose a Reputable and Regulated Broker

It’s important to choose a reputable and regulated binary options broker to ensure your investment and market transparency.

Understand the Market

Before trading binary options, you should thoroughly investigate the underlying market and the assets.

Develop a Trading Strategy

Successful traders have a well-defined strategy that they follow consistently; this may involve technical analysis, fundamental analysis, or a combination of both.

Manage Risk

Binary options trading involves a high level of risk, so it is important to manage your risk by setting stop-losses and limiting your investment per trade.

Stay Disciplined

Emotional trading decisions can lead to losses, so staying disciplined and sticking to your trading strategy is important.

Keep a Trading Journal

Keeping a record of your binary trading can help you identify and correct any mistakes and refine your trading strategy over time.

With a trading journal, you can examine any binary options trade or underlying asset in detail and make improvements.

Conclusion

To recap, you really only have two options for Trading Binary Options in the USA. Our top pick as the best Binary Options Trading Platform in the USA is NADEX. NADEX is CFTC regulated and offers the best trading experience and fees.

Please note that binary options trading is highly speculative and involves significant risk.

So, before choosing a US binary options trading platform, thoroughly research and compare safety measures, regulations, and overall reputation.