Trading platforms like eToro changed the face of online finance forever. eToro has captured the attention of millions of traders across the globe because of its advanced functions and simple layout.

One key feature that sets this program apart from others, is its Popular Investor Program. This allows experienced trades to share portfolios, data, and other trading tactics with others, who can then copy their trades.

In this guide, we will explore what it takes to become an eToro Popular Investor, the benefits and challenges of the program, and the strategies you can use with Popular Investor on eToro.

Popular Investor Program: Overview

This is a unique program offered by eToro to strengthen the connection between experienced traders & other new users on the platform looking for help and guidance along the trading pathways to navigate the financial markets. This program is split into two components; Copyrader and Popular Investors.

The first program, coffee traders, is a feature that allows users to automatically replicate the trades of other veteran investors and use the same strategies in their portfolios. Simply put, this will let you carry out financial trades without spending hours analyzing the market or testing strategies. You will have the expertise of a trader with a proven track record to back your trades.

The popular investor program on the other hand, is all about traders who have a proven track record of successful trading on this platform. They are then selected by eToro based on their trading performance, risk management skills, and engagement with the eToro community. Once selected, Popular Investors can share their trading strategies, market analysis, and performance metrics with other eToro users. These users can then copy their trades and benefit from their expertise.

Popular Investor Tiers Explained

Traders can now show off their expertise and receive prizes via the eToro Popular Investor program. As a trader, you can also set objectives & improve your performance by learning about the program's many tiers.

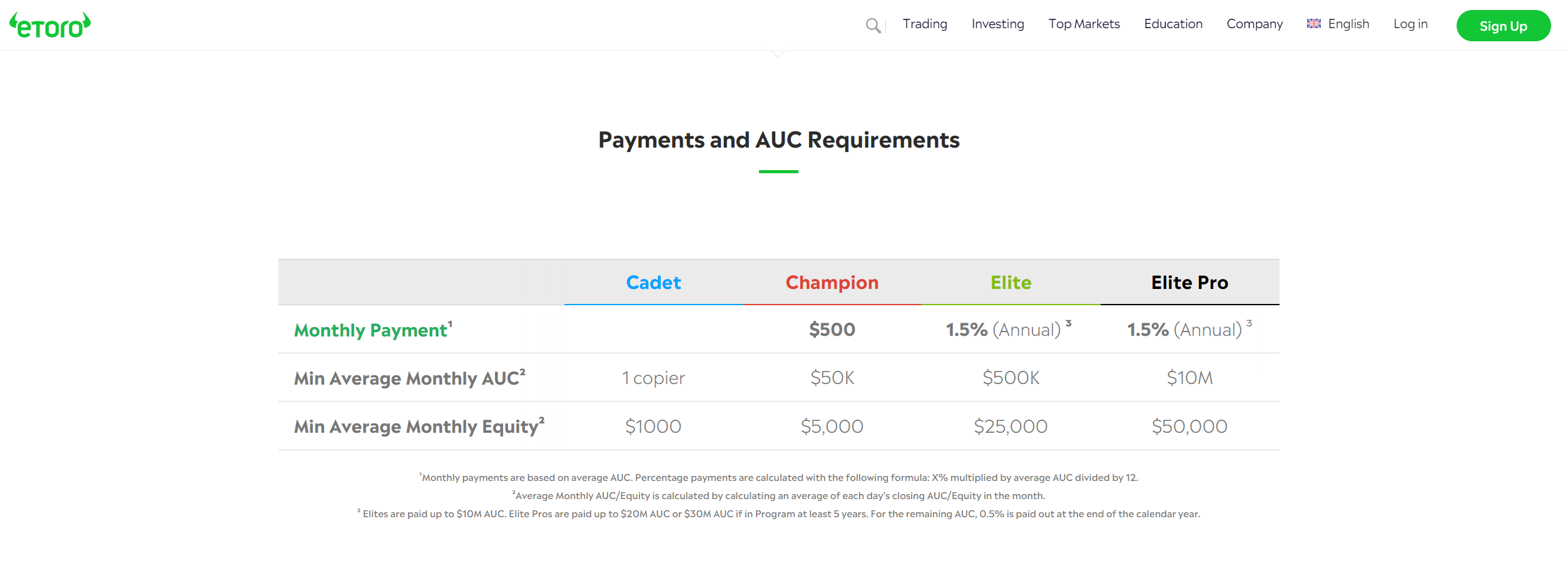

Not every popular investor is created equal. Traders often go through multiple stages of the program depending on their performance and participation. Here is an easy break down of different investor program tiers:

| Cadet | Champion | Elite | Elite Pro | |

|---|---|---|---|---|

| Monthly Payment | – | $500 | 1.5% (Annual) | 1.5% (Annual |

| Min average monthly AUC | 1 copier | $50K | $500K | $10M |

| Min average monthly equity | $1000 | $5000 | $25,000 | $50,000 |

| Minimum copiers | 1 | 5 | 10 | 10 |

| Minimum time on level | 2 months | 4 months | 2 months | – |

| Maximum daily risk score | 7 | 7 | 7 | 7 |

| Leverage restrictions | Present | Present | Present | Present |

| Educational requirements | – | – | Investment management qualification | Advanced investment management qualification |

| Fee-free withdrawals | No | Yes | Yes | Yes |

| Delta PRO App | No | Yes | Yes | Yes |

| Team-based CRM | No | No | Yes | Yes |

| Xperiti subscription | No | No | No | Yes |

- Cadet: This is the entry-level program for those who have just started with this system.

- Champion: Once you have been in the previous tier for a minimum of two months along with improving your record, you will have the option to become a champion. This is the stage where traders start earning money.

- Elite: The amount you earn is directly proportional to the amount of copiers you have in the elite level.

- Elite Pro: Elite pro is the highest tier and brings together all the benefits of different tiers with higher base earnings.

You need $1,000 in your eToro account and at least two months of trading experience to qualify for the Cadet level. At this time, you must have at least $500 in AUM and at least one trade copying client. In addition, you must have no open copy trades to be considered for the program.

A minimum of 10 copiers, totaling at least $50,000 in AUM and $5,000 in account equity is what’s required to reach the Champion level. The minimum time spent at the Champion level before moving up is 4 months.

To join the Elite rankers, your account equity must total $25,000. This should be accompanied by at least 10 copiers and a total of $500,000 in assets under management. If you want to go up a tier, you must wait at least two months. Next, the broker will likely provide you with a “Declaration of strategy and exclusivity agreement,” which you must sign.

Last but not least, the Elite Pro requires a minimum of $25,000 in equity in your account along with a minimum of ten copiers and an AUM of $500,000.

How Do eToro Traders Earn Money?

The amount of money an eToro trader can earn is dependent on the tier they belong to. Starting with the Cadet tier, they are not given any paid privileges, whereas the Champion tier pays up to $800 per month.

The Elite and Elite pro tier will pay you 1.5%-2% and 2%-2.5% of the AUM respectively per year. Along with this, traders also get other benefits associated with the account. For instance, cadet level traders can be featured on the “copy people” page which helps them maximize reach and get more copiers.

Champion level traders enjoy benefits like invites to exclusive events, free withdrawals and a subscription to the Financial Times.

Elite tier traders also get all the Champion and Cadet benefits along with access to free educational content and a weekly video call with the popular investor team.

Finally, at the Elite Pro level, you can expect all the above benefits and an augmented AUM income.

Bonus Tip

When starting out on eToro, making an effort to make yourself known can help you get more clients. For this, it is highly recommended that you use your feed the right way to attract more traffic. You can post helpful insights, tips or other useful information that can be useful to traders. Other examples include posting links to good blogs, social media and educational resources.

You will benefit even more if you have your own website and blogs which add value. Avoid spamming else that might get you banned from posting temporarily.

Similar to any other freelance platform, you need to be highly responsive here and try to build good engagement through your feed to increase your chances of getting your first copier. Make sure you stick to a strategy and are not tempted by any short-term benefits that may compromise your long-term goals.

Copy People Section

If you've fulfilled the prerequisites to enter the cadet level of the program, you'll be included in the copy people section. Several well-known financiers are profiled here. The “Editors Choice” sub-section can be found here as well. Only the best traders will be listed here and selected only by eToro.

This section is subdivided even further. This includes the most copied people, the most profitable investors, and those with low to medium-risk ratings. Popular investors may be sorted in many different ways, such as by nation, markets traded, performance, or risk rating.

Lastly, eToro also has a section called CopyPortfolios to help clients improve their profits and simplify the diversification process. The higher the number of copiers you have, the more frequently you will be appearing on this list. If any trader clicks on your Popular Investor page, they will then be automatically redirected to your feed, which is why it is good to keep posting regularly.

Getting a Popular Investment Account

Here are the steps to open a Popular Investor account on eToro:

Step 1: Create an eToro Account

If you don't have an eToro account already, you will need to sign up for one. Go to the eToro website and click on the “Join Now” button. You will need to provide some personal information and create a username and password to create your account.

Step 2: Complete the eToro Profile

Once you have created your account, you will need to complete your eToro profile. This includes providing information such as your name, address, and phone number, as well as verifying your identity by uploading a government-issued ID.

Step 3: Start Trading on eToro

To become a Popular Investor, you will need to demonstrate a track record of successful trading on eToro. So, start trading on the platform and focus on building a successful trading record by making informed investment decisions and managing your risk effectively.

Step 4: Apply to Become a Popular Investor

Once you meet the program requirements, you can apply to become a Popular Investor. Go to the “Popular Investor” tab on the eToro platform and click on “Apply Now.” You will need to provide information about your trading strategy, your risk management approach, and your goals as a Popular Investor.

Step 5: Wait for eToro to Review Your Application

After you submit your application, eToro will review it to ensure that you meet the program requirements and that you have a successful trading record. If your application is accepted, you will be notified by eToro and can start attracting followers to your portfolio.

Qualities You Should Have As a Popular Investor

An eToro Popular Investor should possess several qualities to become successful and attract followers on the platform. Here are some of the key qualities:

- Market Knowledge: A Popular Investor should have a strong understanding of the financial markets and be able to make informed decisions when investing. This includes knowledge of financial instruments, such as stocks, cryptocurrencies, and commodities.

- Risk Management Skills: A Popular Investor should have strong risk management skills and be able to manage their portfolio effectively. This includes setting stop-loss orders and diversifying their investments to minimize risk.

- Consistency: A Popular Investor should be consistent in trading strategies and not make impulsive or emotional decisions. This helps build trust with their followers and demonstrates their expertise.

- Communication Skills: A Popular Investor should be able to effectively communicate with their followers and provide regular updates on their portfolio and trading activities. This includes explaining their investment decisions and providing insights into the market.

- Transparency: A Popular Investor should be transparent about their performance and provide regular updates on their portfolio's performance. This helps build trust with their followers and encourages them to invest in the Popular Investor's portfolio.

- Discipline: A Popular Investor should be disciplined to stick to their investment strategy and not deviate from it. This helps build trust with their followers and demonstrates their ability to manage risk effectively.

- Patience: A Popular Investor should be patient to wait for the right opportunities to invest in and not be tempted to make impulsive decisions. This helps ensure the long-term success of their portfolio and builds trust with their followers.

FAQ

What is AUC and Equity in eToro?

In eToro, AUC stands for “Assets under copy,” which represents the portion of a trader's funds that have been allocated to open trades but have not yet been settled. This means the funds are temporarily unavailable for other trades or withdrawals until the trades are closed or settled.

Equity, on the other hand, represents the current value of a trader's account, including the balance, the value of any open trades, and the profits or losses from closed trades. In other words, it is the sum of a trader's AUC and realized profits or losses.

Is an eToro Trading Account Mandatory to be a Popular Investor?

Yes, to be eligible for the eToro Popular Investor Program, you must have an active eToro trading account. The program is designed to recognize and reward successful traders who attract and retain copiers on the eToro platform. Therefore, to be considered for the program, you need to have an active trading account on eToro, and you must meet the program's requirements.

How do Popular Investors Get Paid?

All payments are sent to the eToro account, automatically withdrawn and sent to their preferred payment method. Popular Investors on eToro receive several types of payments, including fixed monthly payments, performance-based fees, and bonuses for attracting new copiers.

Fixed monthly payments are based on the level of the Popular Investor program, with higher-level investors receiving higher monthly payments. Performance-based fees are paid to Popular Investors based on the amount of assets under management (AUM) in their portfolio.

If I Move Down a tier, Can I Move Back Up?

Yes. As long as you satisfy the conditions, you can return to the previous tier as a Popular Investor. It's important to remember that even though you were demoted to a lower tier, you still have to complete the necessary amount of time there.