The forex market is massive, so transactions continually occur during market hours. But how can this statement be true if every region has a trading window based on its financial institutions’ operational hours?

Let’s take a closer look at forex market hours, how they come to be, various trading sessions, and what a forex trader can do with this information to find better deals for their order books.

Forex market hours are the periods that forex exchanges operate and accept trades. These hours work like a bank or credit union, where transactions happen so long as the doors are open and accountants can accept the buy and sell orders.

However, the forex market covers more clients than one bank. With the different time zones, how does the market know when to open and close?

The truth is that most forex trading occurs in four regions: the United States, the United Kingdom, Japan, and Australia. Each region has a financial entity that engages in most forex trading for the day.

What Time Does Forex Open?

Every nation has a different starting time for its forex market hours, depending on when the relevant financial institutions open the market for the day. Here is a list of those start times:

- United States: 8 AM local time (8 AM EST)

- United Kingdom: 8 AM local time (3 AM EST)

- Japan: 9 AM local time (7 PM EST)

- Australia: 7 AM local time (5 PM EST)

When Is Forex Market Closed?

Forex markets also have a designated closing time when the market closes trades for the day. Those closing times for each region are:

- United States: 5 PM local time (5 PM EST)

- United Kingdom: 4 PM local time (12 AM EST)

- Japan: 6 PM local time (4 AM EST)

- Australia: 4 PM local time (2 AM EST)

The Truth About Forex Market Hours

The opening and closing times for the different forex markets reveal something interesting: the forex market never really closes.

Because forex occurs at almost any time of day somewhere in the world, forex traders can access the market at almost any time. This fact contrasts with other markets like stocks or real estate, where traders and investors must wait for their market to open first.

Still, this continuous market begs the question: how do traders engage in forex at any time of day? The answer is in decentralized trading tools.

Many forex platforms offer a website, desktop, or mobile application that allows traders to plug into their order books. Once orders go into the virtual books, the platform can start processing them once its associated market opens up. All the while, pricing data from other regions goes live, giving traders new info and a chance to edit orders before they process.

Thus, a forex trader can interact with the market at any time. While it may take extra time for their orders to process, traders can use data from across the globe to see where their preferred currency pairs are going and adjust plans if needed.

Understanding Forex Trading Sessions for Each Region

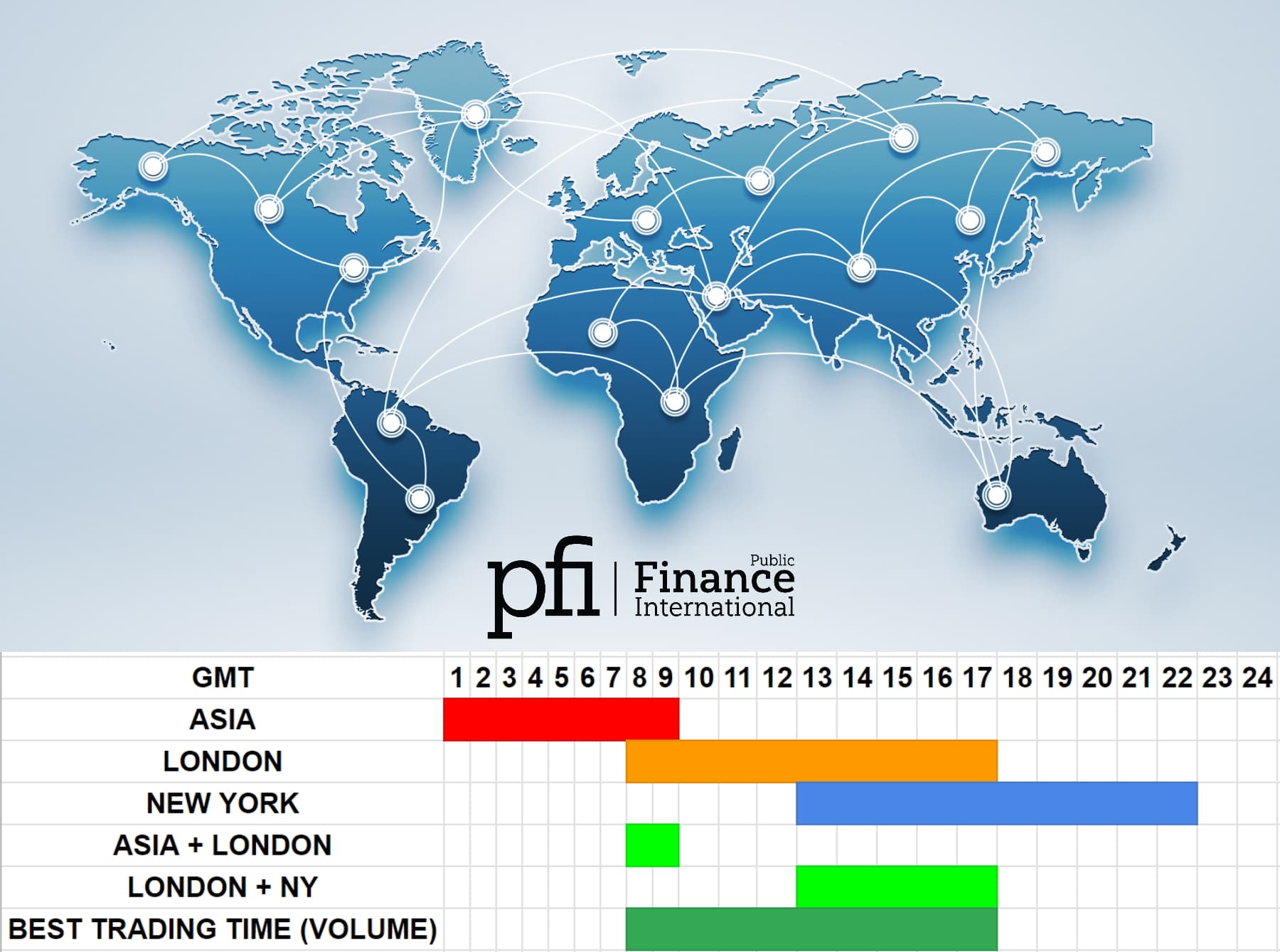

The truth is that while forex is a 24/7 ordeal thanks to decentralized tools and electronic order books, there are nuances to the market that tend to line up with the trading hours of the main forex market makers.

Let’s look at what trading tends to look like for each of these markets to better understand the general flow of one day’s forex:

The Japanese and Australian Trading Sessions

For North Americans and Europeans, a new forex week starts on Sunday evening when the Tokyo and Syndey capital markets open. While many other institutions open up during these hours, these two cities make up a sizeable amount of the money following through forex in these regions.

In addition to Japan and Australia, the rest of Asia starts their markets around this time, as well. China and Singapore are notable nations that come into the market over the next two hours.

Liquidity tends to be low during this trading period. Part of this comes from the limited currencies traded during this period. Japan and Australia don’t have the same level of dealing as larger regions like the United States or Europe. Thus, much money gets tied up in settling orders and paying buyers.

The United Kingdom Trading Session

While the entirety of Europe comes into the market as the Asian markets reach their zenith, the London exchanges represent the largest piece of the forex market.

Part of London’s position in the forex market comes from its location. The London markets open during the Asian markets' last few hours and stay open until the United State exchanges open. This position allows London to act as a forex broker between the nations of Asia and the Americas.

The increase in trades and holdings means more liquidity for the market. Traders can use this to their advantage by lining up orders with better spreads, reducing the money lost on fees and exchange rates.

London’s position as an international broker also means this period has higher volatility than other trade periods. This position presents an interesting opportunity for traders to exchange along the ups and downs of this market to earn extra money from this volatility.

The United States Trading Session

Finally, the American exchanges, mainly in New York, represent the last trading session of the day. Other nations, like Canada, Mexico, and other nations in South America, begin their trading sessions with the deals and trades offered by the London institutions.

Because the United States represents a large population and a great demand for foreign currency, this period has the highest trade volume of any forex period. This demand increases liquidity and volatility, allowing traders another chance to score deals.

As the American nations close their days, there is a brief period of rest before the Asian and Australian markets reopen, starting the cycle over again.

Advantages and Disadvantages of a 24-Hour Forex Market

Making something available at any time of day is the best course of action. Many stock traders would love to trade paper assets at any time but cannot do so because the tools to settle those orders are not as developed as they are in forex.

So, with forex effectively acting as an always-on market, there are several advantages the forex has over other asset markets:

- Decentralized programs allow traders to buy and sell orders any time of day, expanding the trading opportunities for traders

- Fewer gaps in the trading volume and liquidity, unlike other asset markets like the stock market

- Higher liquidity counts than other asset classes that cannot maintain a constant order book

However, there are some downfalls to an always-on market, too:

- Access to the market at all hours can leave traders glued to their charts for longer rather than taking a needed break.

- The accessibility of the tools can make trading creep into other parts of life, adding extra stress and worry to a trader that cannot break away.

Good discipline can offset the above downsides. Traders need to recognize the difference between waiting for an opportunity and reflexively checking the markets with no higher goal.

How To Do Well With Forex Trading

With the knowledge of how the trading sessions work globally, forex traders have one less thing to worry about when entering the market. However, there are some other tips to consider before heading into the forex market:

Define Your Goals and Trading Style

Trading forex doesn’t have to look like the day trading many traders romanticize in blog posts or news articles. It is possible to invest in forex for long-term outcomes instead, leading to purchases made with months or years in mind rather than hours.

Forex traders should define their financial goals and trading style when entering the market. Deviating from this plan, or not having one at all, tends to have poor outcomes for traders over time.

Find the Right Platform

While there are dozens of choices in forex platforms, not all will suit all traders' needs. Access to the right features, including analysis tools and software integrations, can make the job of forex trading easier.

Also, traders should ensure they pick the best forex brokers from a safety and security standpoint. A reputable exchange that follows the regulations of its governing nation will always be the best choice compared to something unknown and loose with the rules.

Be Consistent

Forex traders need to know what their trading plan is before entering the market. Once a trader has that plan, they need to stick with it for as long as possible.

Many losses in trading come from traders getting emotional and not following their plans. With the ready access most traders have to the markets, it is easy for traders to make a snap decision and take a loss rather than thinking things through.

Calculate Your Entry and Exit Points

In addition to a strategy, good traders know when to enter and exit a position with goals often determined by desired profit or time frame.

Having an entry and exit point for a trader ensures that you know what your goals and strategy are. It shows that the trader looked at the data and determined where they needed to go to make money off the market that day.

Utilize Stop-Loss Orders

Finally, one of the most important tools a trader can learn is the stop-loss order. These orders allow a trader to prevent too much loss from accruing from a bad position, allowing the trader to exit the position.

Ideally, these orders should be automatic on the platform you choose. Manual stop-losses rely on human intervention to enact, something that is tough to do if your position tanks during the middle of the night.

Final Thoughts

The forex market hours are defined trading periods based on what area of the world is awake and the region’s active trading hours. However, combining all these sessions reveals that somewhere in the world is trading forex.

Thus, traders need to learn how this constant market cycle affects these assets and how they can take advantage of them. By understanding how the trading sessions tend to go and pairing that info with good trading practices, forex traders can increase their chances of finding success on the market.