PFI Rating: 4.9/5

Fusion Markets, based in Melbourne, was launched by veterans of the Australian FX sector in 2017. Its objective is straightforward — to provide a high-quality trading platform at low costs compared to its competitors.

Fusion Markets has earned a place in the low-cost niche thanks to key advantages such as low commissions and quick and friendly support. The Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC) both regulate Fusion Markets.

On Fusion Markets' Official Website

Gleneagle Asset Management (GAML), which is a subsidiary of Gleneagle Securities, owns the Fusion Markets brand. Gleneagle is an institutional financial market participant that provides services like corporate consulting and asset management. Fusion Markets traders take advantage of Gleneagle to trade with low commissions thanks to their connections with liquidity providers.

But is it as high-quality and cost-effective as it claims to be? That’s what we are going to verify today in our full Fusion Markets review. So, here’s everything you need to know about Fusion Markets in 2022…

Summary

Fusion Markets is a fantastic well-regulated forex broker with an affordable trading and non-trading fee structure. Account creation is quick and simple, and customer support representatives respond quickly and accurately. On the other hand, they offer inadequate educational content and no protection for investors. Finally, the product offering is primarily focused on forex pairs and a few CFDs.

Overview

| Trading Platform | Fusion Markets |

|---|---|

| Founded | 2017 |

| Headquarters | 17 Gwynne St, Cremorne VIC 3121, Australia |

| Regulation | ASIC and VFSC |

| Demo Account | Yes |

| Islamic Account | No |

| Minimum Trade | 0.01 Lots |

| Minimum Deposit | $0 |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| Copy Trading | Yes |

| Inactivity Fee | No |

| Account Currency | USD, EUR, JPY, GBP, AUD, SGD, and THB |

| Spread | From 0.8 pips on Classic accounts, and 0 pips on Zero accounts |

| Payment Methods | Mastercard, Visa, Dragonpay, Neteller, PayPal, Skrill |

| Mobile Apps | Android and iOS |

| US- accepted | No |

| Our Score | 4.6/5 |

Pros and Cons

Whatever the broker you’re considering, you can’t start trading with it before being fully informed about its pros and cons. Here are the advantages and disadvantages that you NEED to know before investing your money with Fusion Markets:

| Pros | Cons |

|---|---|

| Relatively low trading and non-trading fees | Limited selection of products |

| No minimum deposit | There are no adequate educational content |

| No withdrawal fees | No price alerts except on the desktop trading version |

| No inactivity fees | Not listed on stock exchange |

| Transparent fee report | No investor protection under VFSC |

| Demo account | Outdated web platform design |

| Hassle-free account opening process | Outdated charting design |

| Customizability for workspace and charts | No two-step login process |

| Good-quality news flow | No face/ touch ID login on the mobile app |

| Great search function | No 24/7 customer support |

| Prompt customer support | |

| Negative balance protection (for users under ASIC | |

| Well-regulated by top-tier authority |

Fusion Markets Compared To Similar Trading Platforms

Fusion Markets has a lot of strong competitors in the industry, including IC Markets, FP markets, and Pepperstone. We set a brief comparison below to help you see how Fusion Markets compares to these competitors.

| Trading Platform | Fusion Markets | Pepperstone | FP Markets | IC Markets |

|---|---|---|---|---|

| Founded | 2017 | 2010 | 2005 | 2007 |

| Minimum Deposit | $0 | $0 | $0 | $200 |

| Inactivity Fee | No | No | No | No |

| US-Accepted | No | No | No | No |

| Regulated | Yes | Yes | Yes | Yes |

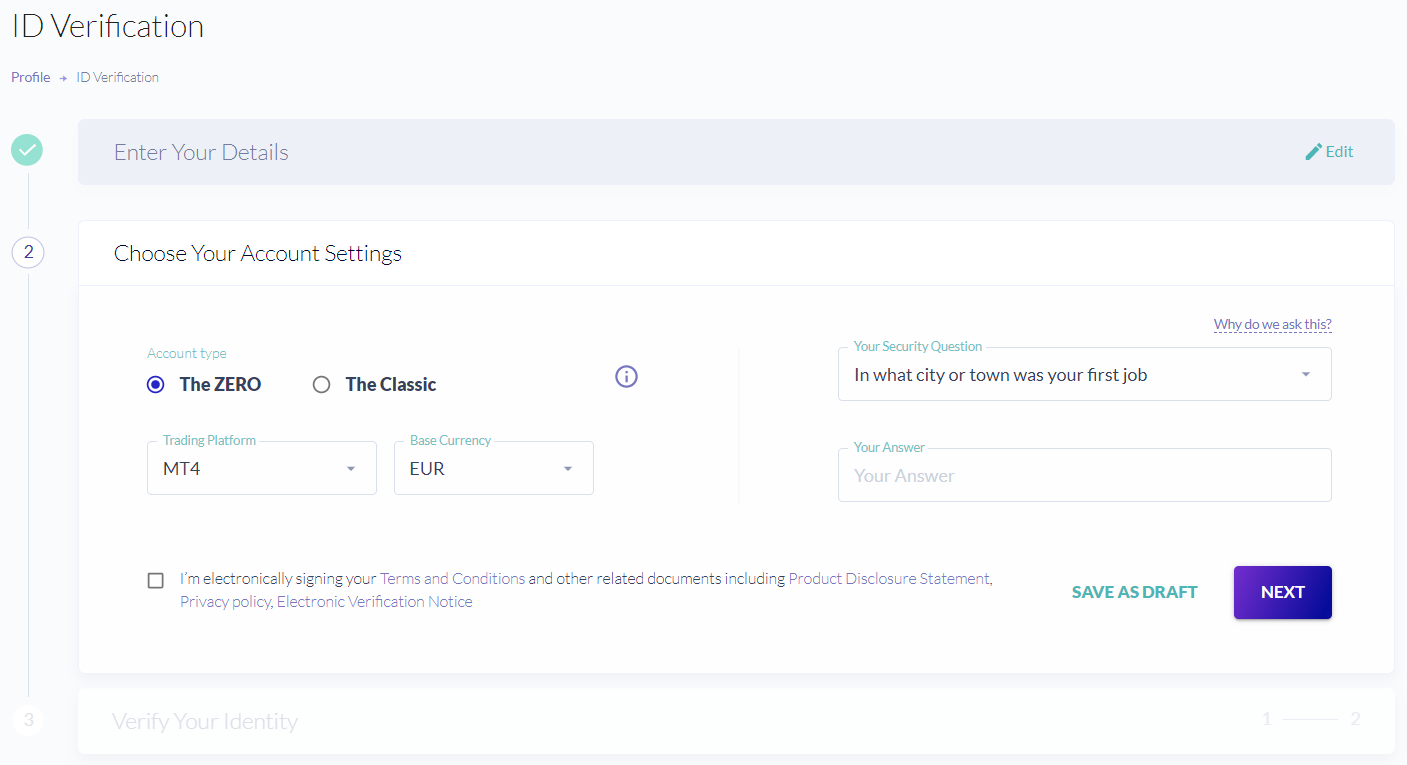

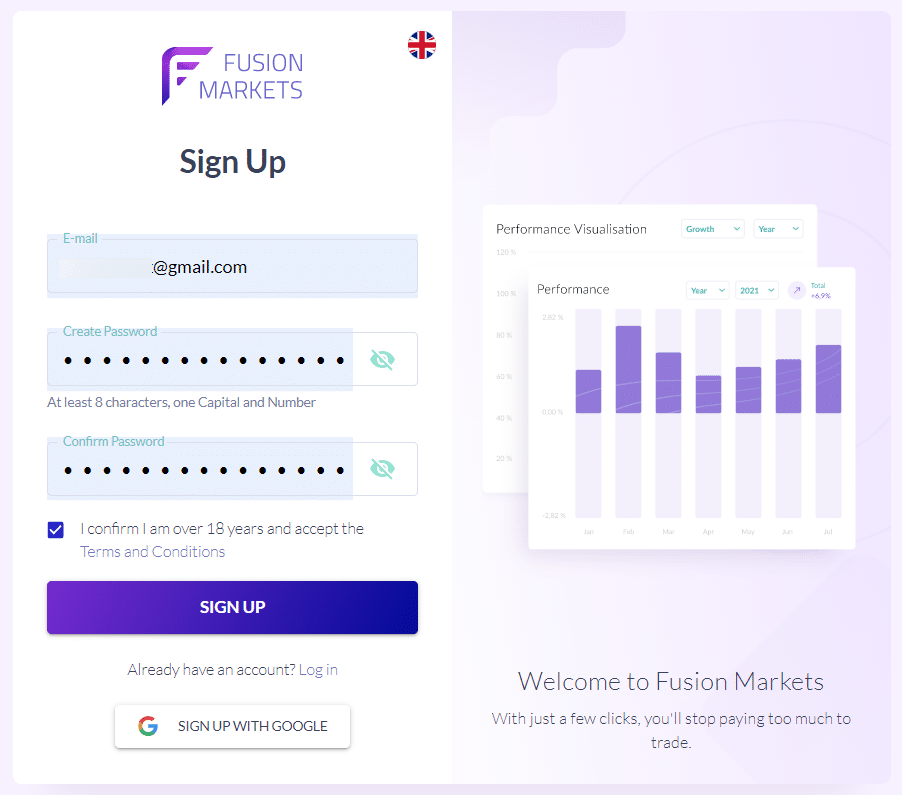

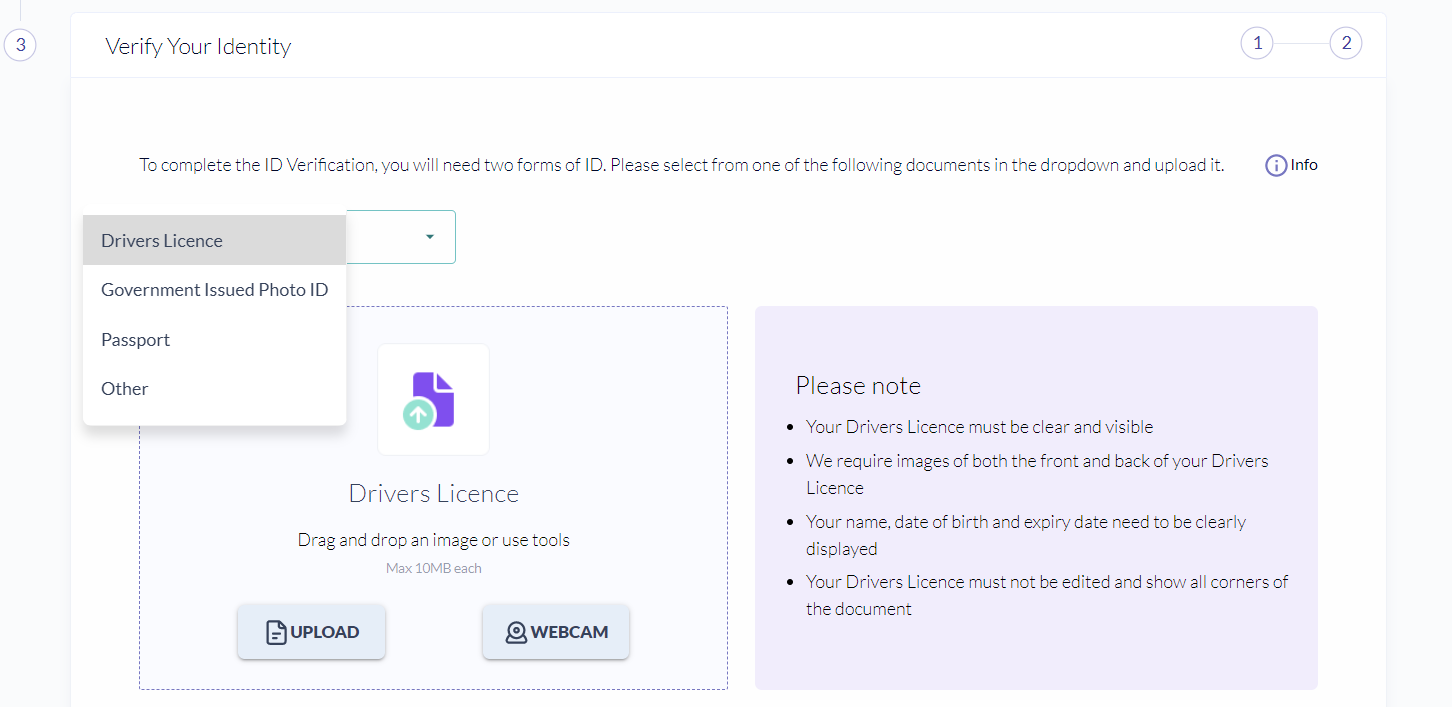

Account Opening

Opening a Fusion Markets account is simple and completely digital. To open a Fusion Markets account, follow steps below:

- Put in your email address and make a password.

- Log in to the client portal interface select ‘Profile'.

- Provide your personal information (such as address and date of birth).

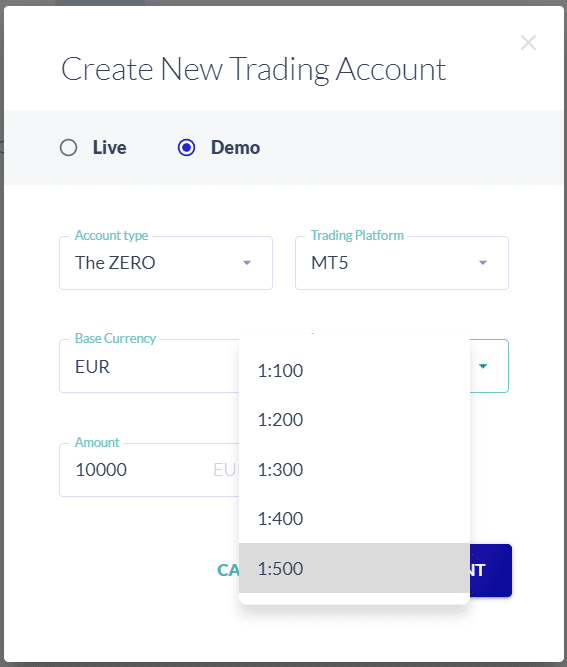

- Choose the account type and leverage size, then create your security question.

- The last step is verifying your identity by providing a copy of your passport or ID or driver's license and a utility bill or bank statement.

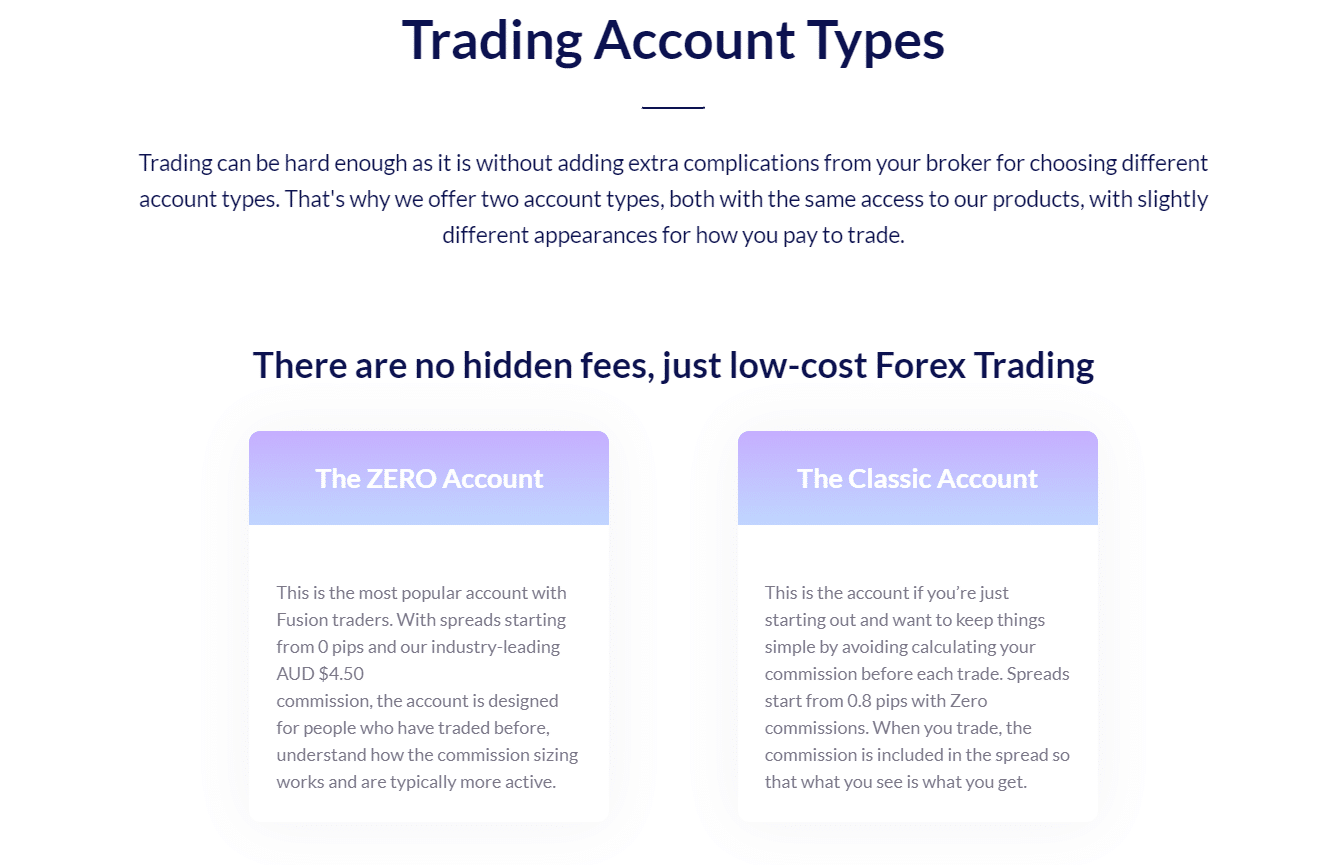

Account Types

Fusion Markets makes the clients choose from 2 types of accounts, which are the Classic account and Zero account, both of which differ in terms of pricing.

Since spreads start at 0 and the commission is $4.50 per round, the Zero account offers better terms. The Zero account will be ideal if you’re adopting an active trading style. With Classic Accounts They include the commission in the spread, and spreads begin at 0.8 pips.

There are also corporate accounts offered by Fusion Markets.

Demo Account

Fusion Markets, like most well-known brokers, offers a demo account for new users to try out their services. Again, the broker's website provides little details about this, making it difficult for potential clients to figure out what they are getting without first creating an account.

But generally, this gives potential traders a great chance to know what Fusion Markets has to offer, so you won't have to take any risk before being fully aware of the quality of their service.

Offering of Investments

While Fusion Markets is a forex broker, it still offers some CFDs as well. The broker has a large currency pair selection. In fact, they are one of the largest among forex brokers. Stock index CFDs, commodity CFDs, stock CFDs, and crypto are all available to trade. ETF and bond CFDs, on the other hand, are not offered by Fusion Markets. Stock CFDs are provided only on the MT5 platform.

Fusion Markets allows you to modify your leverage levels, which is truly fantastic. If you want to reduce the risk of your trade, changing your leverage is a very handy function. You need to be aware when trading forex and CFDs because the leverage levels are set high.

Check the following list that shows the product selection of Fusion Markets:

| Stock CFDs | 52 |

|---|---|

| Stock index CFDs | 18 |

| Commodity CFDs | 15 |

| Currency pairs | 89 |

| Cryptos | 12 |

| Bond CFDs | N/A |

| ETF CFDs | N/A |

Fees – Commissions and Spreads

Fusion Markets claims to be the lowest-cost trader in the industry, and a quick check of its commissions and spreads appears to support this claim. On a number of prominent currency pairs, including AUD/CHF, AUD/CAD, AUD/JPY, AUD/USD, and AUD/NZD, Fusion Markets offers minimum spreads of 0.00. And if we look at the average spreads of the broker, we see numbers like 0.22, 0.48, 0.65, 0.92, and 1.01. Plus, their commission charges are extremely low. We have a full list of low spread trading platforms here.

So, Fusion Markets can be an ideal broker if you've been looking for a low-cost alternative compared to most other brokers in the industry.

Deposit and Withdrawal

Fusion Markets offers seven different base currencies, which are USD, EUR, JPY, GBP, AUD, SGD, and THB. Fusion Markets X is no longer in business, so CAD has been removed.

There are no deposit fees at Fusion Markets. You can deposit funds using credit/debit cards, as well as electronic wallets such as PayPal, Neteller, or PerfectMoney. Of course, bank transfers are also available. Bank transfers can take up to several days, whereas a credit/debit card payment is almost instant.

Only money from trading accounts in your name can be deposited.

What is The Minimum Deposit at Fusion Markets?

The minimum deposit at Fusion Markets is $0.

What is The Minimum Withdrawal?

The minimum withdrawal amount at Fusion Markets is $35. And the amount you withdraw via credit/debit cards cannot exceed the amount deposited, meaning that you can only withdraw cash from your trading activity via bank transfer.

Withdrawing money from Fusion Markets using a debit card can take more than 3 business days.

You won't pay any conversion fee if you fund your Fusion Markets account in the same currency as your bank account or trade assets in the same currency as your Fusion Markets account base currency. Opening a multi-currency bank account with a digital bank is a convenient approach to avoid paying any conversion fees. It only takes a few minutes to create an account. These banks typically provide multiple currency bank accounts with excellent currency exchange rates, as well as none-to-low fees on international bank transfers.

Leverage

Fusion Markets leverage available is up to 500:1 as part of Fusion Market’s commitment to offer a flexible service.

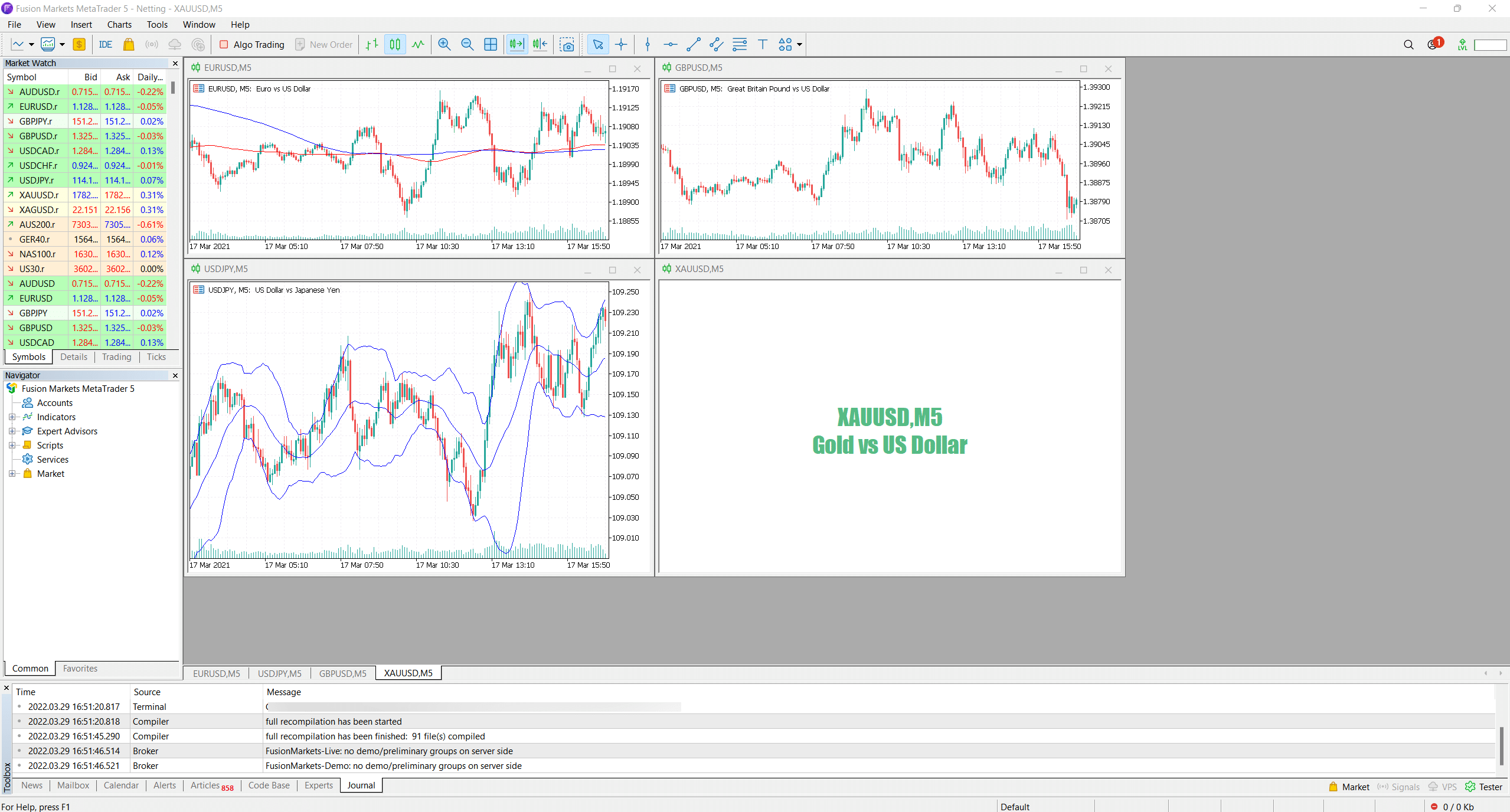

Trading Platform

Fusion Markets doesn’t have its own trading platform; instead, it uses MetaTrader 4, which is a third-party platform.

Fusion Markets has a one-step login process. It would be more secure to use two-step authentication, so it’s not really in their favor. The search functions are average, and the assets are organised into categories.

The web-based trading platform allows for a lot of customization. And the position and the size of the tabs can be changed with ease. However, the platform has an outdated design and several features are not easy to find.

On the Fusion Markets web-based trading platform, you cannot configure alerts or notifications. However, you can do this on the desktop trading platform.

Fusion Markets provides easy-to-understand fee structure. Under the ‘History' tab, you can easily check the commissions you paid as well as your profit-loss balance.

Basic order types are available, but more complex ones, such as ‘one-cancels-the-other,' are not. There are several order types to choose from, such as market, limit, and stop.

MetaTrader 4 is accessible in many languages, which include Arabic, Bulgarian, Croatian, Chinese, Czech, Dutch, Danish, Estonian, English, Finnish, French, Greek, German, Hindi, Hungarian, Hebrew, Italian, Indonesian, Japanese, Korean,Lithuanian, Latvian, Malay, Mongolian, Polish, Portuguese, Persian, Romanian, Russian, Slovak, Serbian Slovenian, Swedish, Spanish, Thai, Traditional Chinese, Tajik, Turkish, Uzbek, Ukrainian, and Vietnamese.

Mobile App

Fusion Markets offers MetaTrader4 as a mobile trading platform, just like the web-based trading platform. Both the iOS and the Android versions of MetaTrader4 are available to traders. You should have access to the FusionMarkets – Live server after downloading the MT4 mobile trading platform.

Fusion Markets provides a fantastic mobile trading platform that has a great design and is easy to use. All of the features are conveniently accessible.

The mobile app, like the web trading platform, only has a one-step login process. Fingerprint and Face ID authentication are not available, which is bad news for many traders.

On the mobile trading interface, you get to select from a variety of languages. But on Android devices, changing the language is not that easy, as you must change your phone's default language first.

Fusion Market's search functions are excellent. You can look for products by putting their names into the search box or by browsing the category folders.

You can place orders using the order types and time limits featured on the web-based version. Only the desktop trading platform allows types available on the web-based platform. The fee structure is also well-organized.

The main distinction is that you get to use set alerts and notifications. Just go to the ‘Tools' menu and then ‘Options' to enter your email and your mobile MetaQuotes ID.

Social/Copy Trading

Social trading (also known as copy trading) is offered by Fusion Markets. Fusion+ is the name of the company’s copy trading platform. Provided that you and your follower account get to trade a minimum of 2.5 lots of FX/Metals every month, this service is free. Otherwise, the follower will be charged a monthly fee of $10 if they make fewer trades.

If you’re a Fusion+ Master, you can charge your clients as high as 30%.

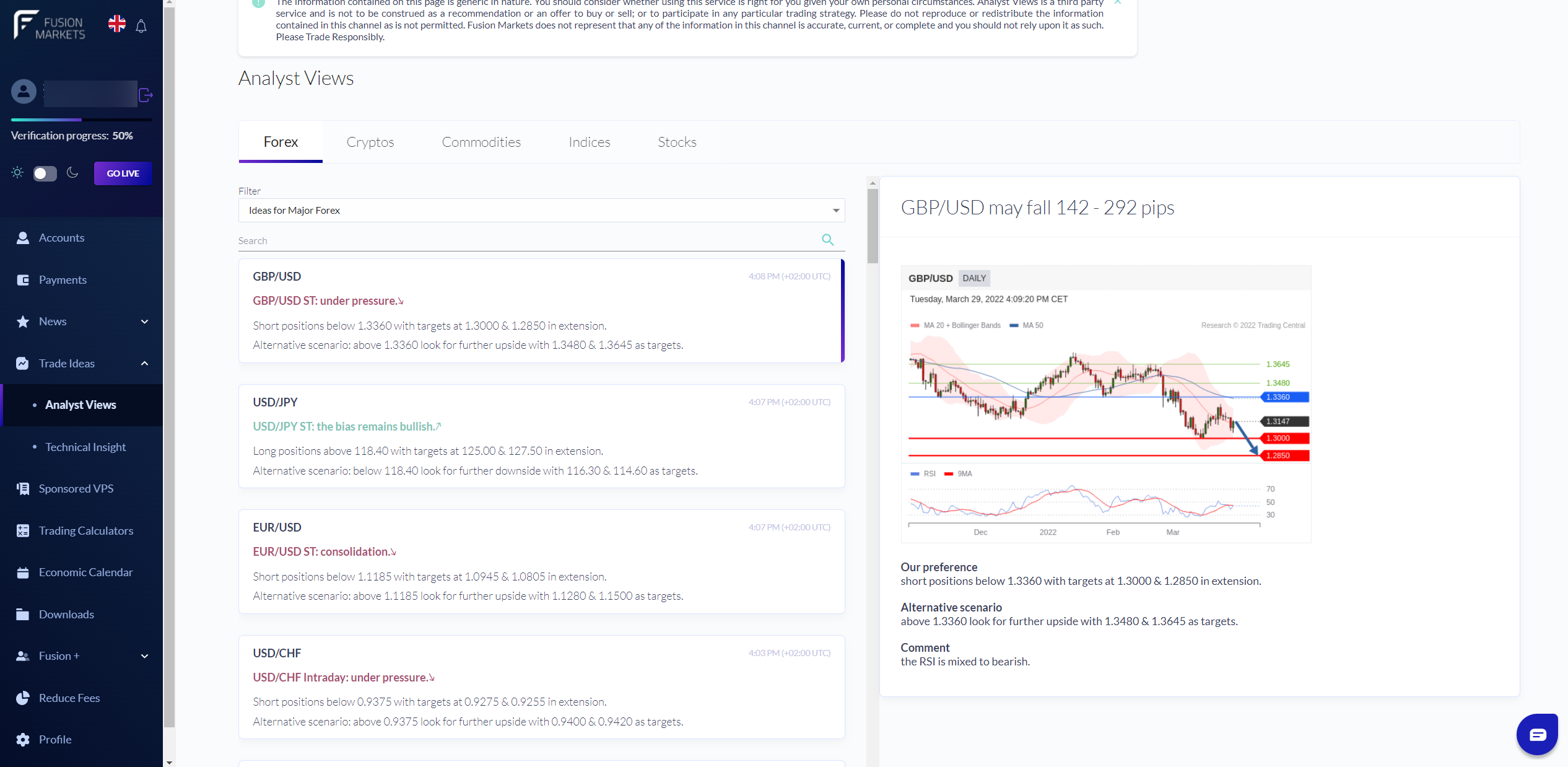

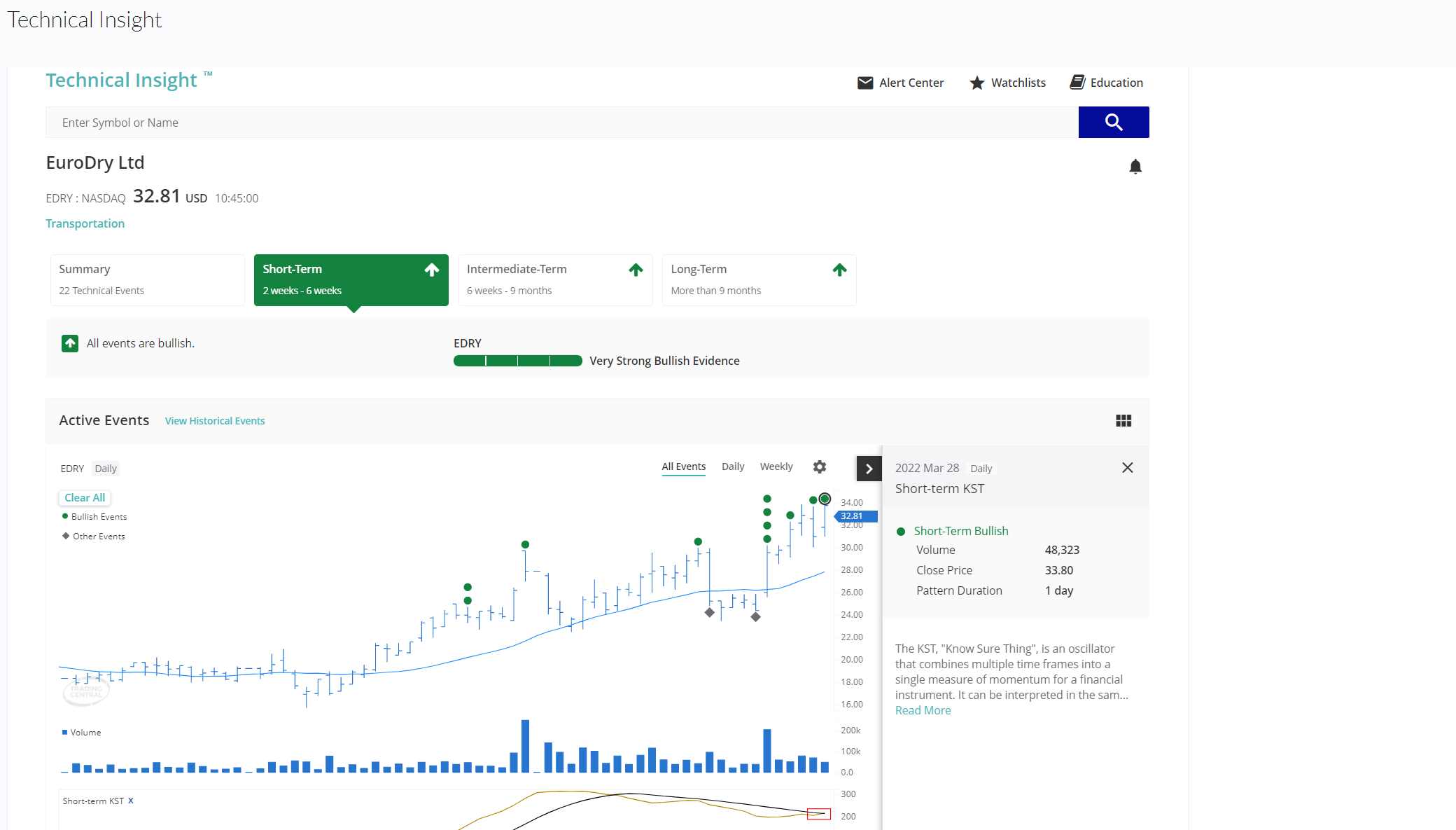

Research

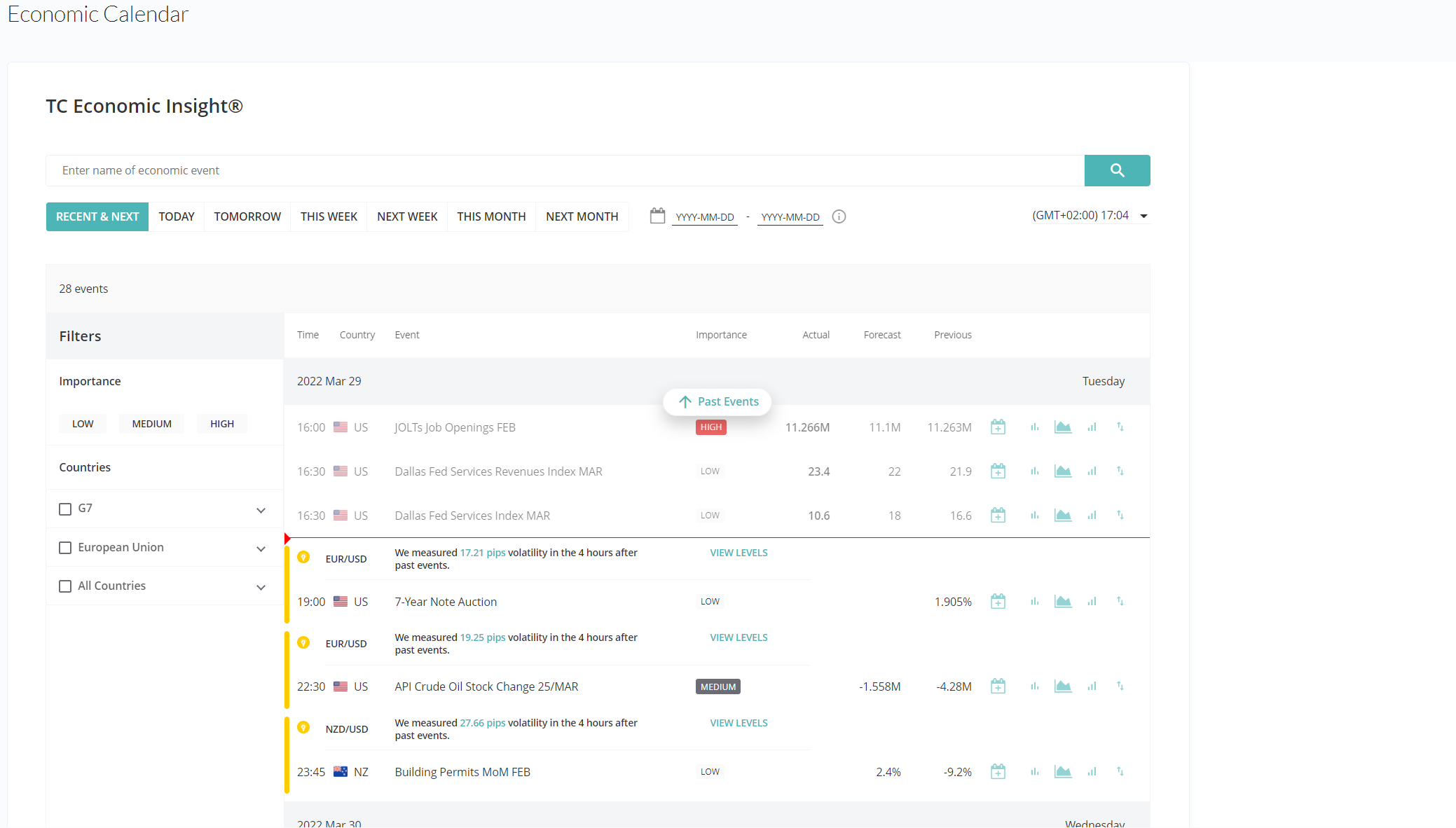

After logging in to Client Portal, you'll see all the research tools offered by Fusion Markets (but not the charting tools). Charting tools can be found on the MetaTrader trading platform.

Fusion Markets offers clients trading ideas that are based on advanced indicators such as indicator movements or chart patterns. You can see target prices as well as determining if you should go short or long.

This broker's economic calendar is excellent. You’ll like how you can look for events by country and importance.

So, let’s say that you notice that an HSBC interest rate decision is approaching, you can use the ‘impact' option to check how the GBP/USD price has changed in response to these decisions.

You’ll most probably like their news feed, which can be found in the ‘News' area. You get to filter the latest news for a single asset. The ‘My Feeds' function is also great; it lets you choose which news sources you wish to follow.

Education

Unfortunately, Fusion Markets has no educational material or training resources. However, it does have an informative source of educational content on its Youtube channel.

Referrals

Fusion Markets has a number of affiliate programs aimed at various types of potential partners.

Youtube channels, arbitrageurs, bloggers, trading sites, email marketers, media, and individuals with a large social media fan base will like the idea of the Fusion Affiliates program. The Fusion Affiliates program works on the basis that the partner gets a reward for every person they refer. Fusion Markets helps by providing many marketing materials and by tracking the sources of new clients. This program requires you to apply first by filling out a form.

Traders who want to recommend the broker to a friend or other interested parties should use the ‘Invite a friend’ referrals. Once they join and begin trading, the broker will transfer $50 into the account of all members of the program, including both the referral and the partner.

The Introducing Broker (IB) option is geared towards companies that wish to get recurring commissions from Fusion Markets for clients they refer. To take part, you must first get the approval of the broker. The partner will begin earning once the referral places their first trade.

Is Fusion Markets a Safe Broker?

Fusion Markets is an Australian company that is regulated by both the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC).

Fusion Markets operates through two legal entities, both of which are also regulated by ASIC and the VFSC. The broker provides negative balance protection for its clients under ASIC, although there is no investor protection.

That said, Fusion Markets should be a safe broker to trade with.

Customer Support

Fusion Markets offers a prompt live chat service. Within minutes, you’ll receive meaningful responses to your inquiries from friendly and helpful operators that are well-prepared. They give excellent customer service. It shouldn’t take a few minutes to be connected to an agent and receive helpful responses.

The email service is also great, you’ll receive relevant responses to your emails within a few hours or even minutes.

Support is only available five days a week, thus there is no 24/7 assistance on Fusion Markets.

Phone number: +61 3 8376 2706

Email: [email protected]

Accepted Countries

Fusion Markets allows practically anyone from most parts of the world to open an account. Residents of countries that have unstable political and economic conditions are the few exceptions.

Australia, China, Canada, Germany, Hong Kong, Ireland, India, Malaysia, Netherlands, South Africa, Singapore, United Kingdom, and the United Arab Emirates, are among the countries accepted by Fusion Markets. It does not, however, accept clients from the United States, Palestine, Afghanistan, Iraq, Congo, Iran, Myanmar, Somalia, Sudan, Syria, New Zealand, North Korea, or Yemen.

Final Verdict

Fusion Markets is a low-cost broker that has tons to offer — it has relatively low trading and non-trading fees, transparent fee reports, a hassle-free account opening process, customizability for charts, good-quality news flow, great search function, prompt and friendly customer support, and it’s regulated by tier-1 authority, making it safe.

While it might sound like the best broker ever, it really isn’t; it doesn’t have adequate educational content, price alerts (except on the desktop trading version), investor protection, a two-step login process, face/ touch ID login on the mobile app, or 24/7 customer support. Also, it has a limited selection of products and is not listed on the stock exchange.

However, that doesn’t mean that Fusion Markets is a terrible broker. In fact, it’s a great option for traders seeking a more affordable option without being worried about fees pouring over them.

You might also want to read:

- Is eToro a Safe Trading Platform?

- Everything you need to know about Plus500

- What are the best investment platforms for Singapore Traders?

- Day Trading with an Mobile App

- Top Share Trading Platforms in South Africa

FAQ

How to withdraw your money from Fusion Markets?

To Withdraw your profits from Fusion Markets, follow the steps

below:

– Log in to the client portal

– Select

‘Payments'

– Click ‘Withdrawal'

–

Write the amount you wish to withdraw and choose the withdrawal

method

– Make the withdrawal

Does Fusion Markets allow scalping?

Yes, Fusion Markets allows scalping. You can open and close positions as quickly as you wish, with no constraints on where the stop loss and take profit are set or hold time.

Does Fusion Markets offer binary options?

Fusion Markets doesn't offer binary options. Fusion Markets claims that it will not offer binary options to its clients due to their high risk.