Stock exchanges don’t actually own shares. Instead, they act like a stock market where buyers establish a connection with sellers. Stocks can be traded on various exchanges including the Nasdaq and the New York Stock Exchange, two of the most popular stock exchanges around the world. Most stocks change hands through a broker but it’s still important to know details about the connection between the exchanges and companies that trade.

Below, I will discuss the stock exchange in detail and provide a list of stock exchanges with a detailed description, so let’s begin.

How Does The Stock Exchange Work?

Stock exchanges represent trading many financial materials including equities, bonds, and commodities. They bring governments and corporations together with investors.

They also help provide liquidity in the market. Meaning, there isn’t a shortage of buyers and sellers, and trades can be completed successfully and without delays.

Exchanges also ensure fair and orderly trading, so crucial financial data can be shared between financial professionals and investors.

Stocks first become present on exchanges after a business handles its initial public offering. The business sells shares to initial sets of public shareholders in initial public offerings or the primary market.

After the initial public offerings give shares to public shareholders, these shares can be sold and bought on exchanges or secondary markets. After a firm’s initial public offering, the general public can purchase and sell shares on the secondary market.

Exchanges keep track of the flow of orders for each stock. What establishes the stock’s price is the flow of supply and demand. And depending on the type of brokerage account, you can see this flow of prices.

For instance, if a stock’s bid price is $30, this means one investor is informing the exchange that they’re willing to buy the stock for $30. Simultaneously, you can notice a required price of $31, meaning they’re willing to sell the stock for $31. The difference between the two represents the bid-ask spread.

Largest Stock Exchanges: Top 10

The stock market represents the single largest wealth-making tool.

The top global stock exchanges have MCap (market capitalizations) up to multiple trillions of dollars.

Below, I will discuss some of the world’s greatest stock exchanges. The top spots take place in developed parts of the world. However, China and South Asia also make the list of best stock exchanges.

It appears that most parts of the world have a good appetite for shares, stocks, and other financial tools.

However, remember that good analytics and data are crucial in successful stock market investing. Now, let’s review some of the world’s biggest stock exchanges.

NYSE (New York Stock Exchange), USA

With a market capitalization of about $24.5 trillion, the New York Stock Exchange in the United States is one of the largest stock exchanges in the world.

Established in 1792, this well-known stock exchange dominates the rest of the stock exchanges over the world.

Meaning, the activity of the New York Stock Exchange always has a big influence over the trading at other stock exchanges on the following day.

This stock exchange lists about 2,400 companies including American Express, JPMorgan Chase, Walmart, McDonald’s, Nike, IBM, ExxonMobil, and so on.

The exchange’s benchmark index is DJIA (Dow Jones Industrial Average), a 30-stock price-weighted index of 30 stocks.

Other well-reasoned indexes include the S&P 500, which tracks 500 of the greatest firms in the USA, and the NYSE Composite Index.

NASDAQ (National Association Of Securities Dealers Automated Quotations), USA

NASDAQ was the first electronically traded stock market in the world. It has a market capitalization of $19.34 trillion with over 3,000 firms including Microsoft, Intel, Tesla, Google (FAANG), Amazon, Apple, and Facebook, among many other prominent businesses.

NASDAQ was established in 1971 and trades about $1.26 trillion monthly in futures, options, and stocks. The stock exchange hasn’t listed “old economy” stalwarts like gas and oil companies.

The benchmark index of NASDAQ is the NASDAQ Composite which mostly consists of the stocks listed on the stock exchange. And for a stock to be listed on the NASDAQ Composite, it should be a common stock instead of exchange-traded or preferred funds.

Another prominent index is the NASDAQ 100, which only consists of 100 greatest and non-financial firms listed on the stock exchange. And they make over 90% of the NASDAQ Composite.

SSE (Shanghai Stock Exchange), China

The SSE (Shanghai Stock Exchange) is the biggest, most recognized stock market in Asia with a market capitalization of &6.98 trillion.

The stock exchange was established in 1990 and represents a non-profit entity under the purview of the CSRC (China Securities Regulatory Commission). And since the Chinese government has control over the capital accounts, the SSE isn’t completely open to foreign investors. The stock exchange trades derivatives, bonds, stocks, and funds.

You can find two types of stocks on SSE including “A” shares in the local renminbi yuan and “B” shares in US dollars. In 2002, carefully checked investors were allowed to invest in these two types of shares with a USD 80 billion quota as of 2012.

The benchmark index of SSE is the SEE Composite, which includes all the stocks on the exchange. Other indexes include the SSE 180 Index and SSE 50 Index.

EURONEXT (European New Exchange Technology), pan-Europe

With headquarters in Amsterdam, EURONEXT represents a pan-European stock exchange network with a market capitalization of $6.65 trillion. The well-known network operates exchanges in London, Milan, Paris, Amsterdam, Dublin, Lisbon, and Oslo.

The offerings of EURONEXT include derivatives and equity with items such as ETFs, stocks, options, bonds, futures, and forex trading. Investors might want to look at the most reputable European trading platforms for trading EURONEXT. It lists more funds and debt than any other stock exchange worldwide and has many benchmark indexes.

Some of those indexes include the blue-chip EURONEXT 100, which consists of the 100 largest stocks on the stock exchange. Interestingly, French businesses make up about 65% of this index.

Prominent companies include Phillips, Michelin, Peugeot, Aegon, L’Oreal, Royal Dutch Shell, Alstom, BNP Paribas, Unilever, ArcelorMittal, Schneider, Electric, etc.

Other indexes include BEL 20, AEX, OBX 25, and FTSE MIB. CSDs (Central Securities Depositories) in Italy, Denmark, Portugal, and Norway provide the stock exchange’s settlement and custody services.

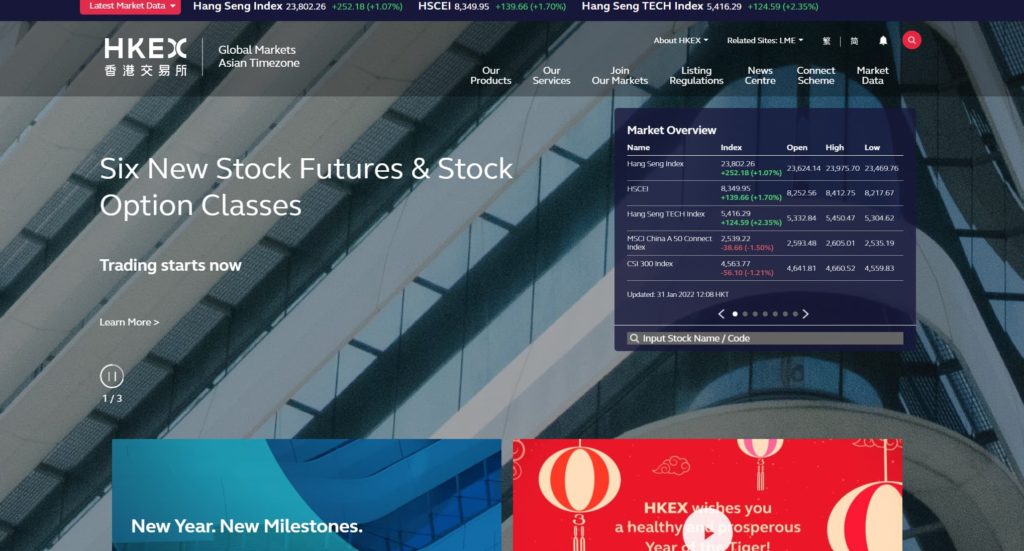

HKEX (Hong Kong Stock Exchange), Hong Kong

Hong Kong represents one of the biggest financial hubs in the world. Therefore, the HKEX unsurprisingly earned a spot on this list.

Established in 1891, this exchange has over 2,500 companies with a market capitalization of 6.48 trillion. The benchmark index of HKEX is Hang Seng Index.

It’s a well-adjusted market capitalization-weighted and free-float index consisting of 50 important stocks that make about 58% of the overall HKEX’s market capitalization.

HKEX includes some of the world’s largest companies including China Mobile, PetroChina, Bank of China, HSBC Holdings, Agriculture Bank of China, China National Offshore Oil Corporation, AIA, etc.

The stock exchange has gone through multiple important mergers like those with the Hong Kong Futures Exchange Ltd and Hong Kong Securities Clearing Company Ltd.

Even large businesses can trade normally on the stock exchange lower than HK$4 per share.

TSE (Tokyo Stock Exchange), Japan

The Tokyo Stock Exchange in Japan was established in 1878 and has over 3,700 businesses with a market capitalization of about $5.67 trillion.

Popular companies listed on this stock exchange include Toyota, Mitsubishi, Honda, Sony, etc. The 2 key indexes include the Nikkei 225 and Tokyo Price Index. The ladder ranks businesses using a capitalization-weighted free-float metric.

The Nikkei 225, on the other hand, ranks the best 225 stocks by their cost. The exchange has 2 sections, including the 1ST section which consists of large businesses, and the 2nd section which includes mid-sized businesses.

The trading items include global equities, stocks, index futures, index funds, etc. What people like about this stock exchange are the compliance and market surveillance systems.

However, stock price and real estate inflation in Japan caused issues in the 1990s, leading to the serious economic decline and crashing of TSE.

This period is known as Japan’s Lost Decade.

SZSE (Shenzhen Stock Exchange), China

The SZSE was established in 1990 with a market capitalization of about $3.9 trillion. It lists around 1,900 companies, mostly based in China.

The stock exchange is a trading platform for both A and B shares. A-shares trade in local currency, while B shares trade in US dollars for foreign investors. It trades other common tools as well including futures, options, ETFs, and mutual funds.

The benchmark indexes of SZSE include the SZSE 100 which lists the top 100 businesses on the exchange and the SZSE Component Index consisting of 500 stocks.

This stock exchange is a self-regulatory legal entity. However, it’s still closely monitored by the CSRC (the China Securities Regulatory Commission).

LSE (London Stock Exchange), United Kingdom

The LSE is one of the oldest stock exchanges around the world which was established around the 1800s. It has over 3,000 companies with a market capitalization of $3.71 trillion.

The London Stock Exchange placed the initial benchmark market, price, and equity-market liquidity data in Europe. The benchmark index is the London Stock Exchange 100 Index, Financial Times, FTSE 250, etc.

The LSE has 2 markets for trading including the Main Market and the Alternative Investment Market.

The first one has over 1,300 large companies around the world, while the ladder has smaller companies and includes tools like derivatives, bonds, debt securities, ETFs, exchange-traded commodities, gilt-edge securities, global depository receipts, etc.

TSX (Toronto Stock Exchange), Canada

Established in 1861, the TSX in Canada is a wholly-owned subsidiary of financial services company TMX Group. This stock exchange has about 2,200 listed businesses as of 2019 with a market capitalization of $3.1 trillion.

The financial tools traded on this stock exchange include futures, options, bonds, equities, commodities, investment trusts, etc. This exchange has a soft spot for gas and oil as well as mining companies. In 2010 and 2011, the Toronto Stock Exchange was looking to join forces with the London Stock Exchange (LSE).

However, the partnership was never made official because of the lack of approval from the shareholders at TSX. The benchmark index of TSX includes the Standard and Poor (S and P)/TSX 60, mostly consisting of energy businesses.

NSE (National Stock Exchange)/BSE (Bombay Stock Exchange), India

Last but certainly not least, I want to mention the National Stock Exchange, which was founded in May 2021 in Mumbai, which makes it the youngest stock exchange.

NSE lists over 1,950 businesses. The benchmark index of this stock exchange is the NIFTY 50 consisting of the top 50 stocks on the stock exchange.

However, the position of this stock exchange is under constant threat from the BSE (Bombay Stock Exchange) which lists over 5,000 businesses.

The benchmark index of BSE includes the Sensex index consisting of 30 prominent stocks. It enables the trading of equities in South Africa, Brazil, Russia, and China and has a market capitalization of $3 trillion. BSE was established in 1875 as Asia’s first stock market.

BONUS: Digital Exchanges (Coinbase, Binance, And Kraken)

Cryptocurrencies have taken over the world and encouraged digital exchanges. The best cryptocurrency exchanges include Coinbase, Binance, and Kraken.

Coinbase comes with a very advanced trading platform that ensures easy and safe cryptocurrency trades for retail investors and custodial accounts for institutions. It’s a licensed cryptocurrency exchange in 42 US states.

And at the moment, Bitcoin dominates the market. However, you can also find popular cryptocurrencies such as Litecoin and Ethereum among many others.

Binance, on the other hand, is a global cryptocurrency exchange with a trading volume of 2 million daily. However, this platform has a small downside.

The well-known platform allows for deposits in different currencies, including euros but not US dollars at the moment. Still, it allows a few cryptocurrencies to be transferred through a debit or credit card.

Lastly, Kraken enables investors to purchase and sell cryptocurrencies utilizing different fiat currencies, including US dollars, Canadian dollars, euros, and the Japanese yen.

It’s a San-Francisco-based exchange where you can trade many different currencies, including Monero, EOS, Etherium, and of course, Bitcoin.

Investors first need to open and fund a digital wallet, then link it to the trading account.

Summary

As you can notice, everyone wants a piece of the stock exchange pie! Although digital exchanges aren’t veterans on the market, they’re still grabbing people's attention by the minute.