When browsing through popular online trading platforms in the UK, the name City Index has likely popped up more than once. It's not a surprise. City Index is one of the most renowned online brokers in the industry. But is their reputation well-deserved? Having tested the platform myself, I have to say… yes.

City Index is an excellent online trading app, especially if you're interested in Forex and CFD trading. It offers an impressive range of financial markets, relatively low trading fees, a comprehensive research section, and easy deposits and withdrawals. Also, as a regulated broker, City Index is 100% safe to trade at.

But, of course, it's not a perfect platform. It has several annoying features that did disrupt my trading experience. Today, I want to show you what City Index is all about. First, I want to talk about its key features. Once done with that, I'll share my personal experience using the City Index platform and answer several frequently asked questions about the platform.

Is City Index worth your time and money? Let's find out.

City Index Overview & Key Highlights

| Founded | 1983 |

| Countries of regulation | UK, Australia, Singapore |

| Regulation | FCA, ESMA, FSCS, ASIC, MAC |

| Trading desk | Market Maker |

| Demo account | Yes |

| Islamic account | Yes |

| Minimum deposit | $0 |

| Withdrawal fee amount | $0 |

| Inactivity fee | Yes |

| Supported currencies | USD, GBP, EUR, AUD |

| Copy trading | Yes |

| Available markets | 13,500+ |

| Financial products | Forex, CFD, Crypto |

| Deposit and withdrawal methods | Visa, MasterCard, Maestro, PayPal, Bank Transfers |

| My score | 4.5/5 |

City Index Pros and Cons

| Pros | Cons |

|---|---|

| + Impressive range of available markets + Low Forex trading fees + Trusted and regulated + Numerous research tools + No deposit and withdrawal fees + No minimum deposit amount |

- Limited number of instruments - Slow withdrawals - Surprisingly high CFD trading fees - Very limited demo account - Inactivity fee |

About City Index

City Index was initially founded in 1983, making it one of the oldest online brokers currently available for UK traders. City Index currently unites over 1 million traders globally, who value the broker for its transparency and a jaw-dropping number of over 13,500 available markets.

The platform is licensed and regulated by numerous authoritative bodies, including the Financial Services Compensation Scheme (FSCF) and Financial Conduct Authority (FCA). This ensures it's a safe and fair space for British traders. As for the trading instruments, City Index traders can take advantage of CFD and Forex trading.

As one of the most renowned brokers globally, City Index has won numerous prestigious awards, including the 2022 Best CFD Provider, Best 2022 Spread Betting Provider, and Best 2021 Platform for the Active Trader.

Is City Index Safe?

The first question I'd like to address is whether City Index is a safe platform. I'm glad to say it is. As mentioned, City Index is regulated by renowned authorities, ensuring it's a fair and secure platform for British and global traders.

Among many, City Index is licensed by the Financial Conduct Authority (FCA). It's also compliant with European Securities and Markets Authority (ESMA), which enforces that limit leverage and provides negative balance protection, ensuring traders don't lose more money than they put on the platform.

On top of that, City Index users are under the UK Financial Services Compensation Scheme (FSCS) protection. Essentially, the FSCS will compensate traders up to $85,000 in the event of liquidation.

Based on that, I have nothing else to do but confirm you are more than safe when trading with City Index. The trading is fair and regulated, and there's a negative balance protection in place in case you start losing money rapidly and your risk, while existing, is minimised.

Markets and Trading Instruments

While City Index doesn't offer the most impressive number of available trading instruments I've ever seen, it was enough to keep me invested. Currently, you can trade CFDs, Forex, and cryptos (only available for UK's professional accounts). That alone might not look overly impressive, but as I mentioned previously, what makes City Index stand out from the crowd is the 13,500 global financial markets to take advantage of.

Overall, City Index investors can access:

| Financial Instruments | Markets |

| FX currency pairs | 84 |

| Stock CFDs | 4700 |

| Commodities | 25 |

| Bonds | 11 |

| Indices | 40 |

| Metals | 5 |

| Crypto | 8 |

| Interest rates | 3 |

| Options | 40 |

- Forex Trading: Forex traders can take advantage of over 84 Forex pairs, including minors, majors and exotics.

- Trading CFDs: City Index offers over 4700 share CFDs, including the leading tech companies and energy companies from all over the world.

- Commodities: There are currently 25 commodities you can trade with, including coffee, sugar, oil, wheat, and natural gas.

- Bonds: The City Index selection of bonds includes UK Gilts, Euro Bunds, and US T-Bonds, with a total of 11 available bonds you can trade with.

- Indices: If you're interested in trading spot and futures contracts, City Index offers over 21 international indices, such as the UK1000 or NASDAQ.

- Metals: With only silver, metal, gold, copper, and palladium, the City Index collection of available metals doesn't really stand out from the competition.

- Crypto: Professional account traders can take advantage of crypto trading, with City Index offering cryptocurrencies like Bitcoin, Ethereum, and Litecoin. However, be mindful that crypto trading isn't available for retail investor accounts.

- Interest rates: City Index users can speculate on Eurodollar, Euribor, and Short Sterling interest rates. Nothing fancy, really.

- Options: With over 40 options available, City Index doesn't fall far behind some other brokers, but I have to say I've seen better offers than that.

Trading Methods

There are two ways to trade at City Index. You can either try spread betting or CFD trading, with both options coming with their individual pros and cons. I'm not going to explain what spread betting or CFD trading is. If you're reading my review, I assume you're already well aware of the primary differences.

Therefore, here's just a short summary of key differences between spread betting and trading CFDs at City Index:

| Spread Betting | Trading CFDs | |

| Best for | UK tax-free trading | Trading in the specific market currency |

| Trade type | £ per point | Number of CFDs |

| Min trade size | Depends on the market | Fractional CFDs |

| Tax | UK Capital Gains Tax and Stamp Duty free | Stamp Duty free |

| Commission | No commission | No commission except for CFD shares |

Which one to choose, then? Whichever you feel more comfortable trading in. In general, I find CFD trading more suitable for more experienced traders, as it very much resembles traditional trading. Spread betting could be better for beginners as it's slightly less complicated.

However, before you start trading CFDs, be aware that it comes with an increased risk. CFDs are very complex instruments that involve a higher risk of losing money rapidly due to leverage. Approximately 75% of retail investor accounts lose money when trading CFDs with this broker.

This percentage might look high, but it's not the case only for City Index. According to ESMA, the European average of investor accounts that lose money when CFD trading is 73%. That's because CFDs are generally considered high-risk instruments, so be sure you understand how they work before you start trading them.

City Index Trading Fees & Non-Trading Fees

Forex Fees

I have to say that City Index fees are very competitive, especially when trading Forex and stock index CFDs. Furthermore, the fee structure is very transparent, and I was able to conveniently check live, minimum, and average spreads via the City Index's website and app.

For example, the minimum and average spreads for the pair EUR/USD are 0.5 pips and 0.69 pips, respectively, which is very competitive indeed. Let's use this pair as a benchmark. Imagine you want to trade 100,000 USD on the EUR/USD. With a minimum spread of 0.5 pips and no commission on spread betting guaranteed by City Index, your estimated trading fee would be $5. Not bad compared to some other brokers.

Of course, trading fees vary on spreads, and they aren't always as low as 0.5 pips. The exact fee will also vary depending on your trading platform (I'll talk about it later). However, as said, Forex fees are typically low at City Index. That can't always be said about stock CFD fees, though.

Stock CFDs Fees

While Forex trading is 100% commission-free, City Index charges commission fees on stock CFD trading. These will vary between markets. For instance, for UK and European equities, the commission on shares is 0.08% of the trade value. For US shares, the charge is 1.8% of the trade value.

| CFD Market | Commission Rate | Minimum Fee Charged |

| UK Stocks | 0.08% | £10 |

| EU Stocks | 0.08% | €10 |

| US Stocks | 1.80% | $10 |

Swap Fees

Financing is the fee traders pay to hold their trading position overnight. It applies to most spread bets and CFD trades. In other words, it's an interest payment to cover the cost of your leverage used overnight. It's important to note here that swap fees apply to positions with no set expiry date. Finance fees aren't charged on futures.

Financing is usually applied after 10 PM (GMT) for most markets. When it comes to the costs of swap fees at City Index, these are based on the interest rate benchmark plus the financing rate of +2.5% on long positions and -2.5% on short positions. Unfortunately, what I personally find annoying, is that City Index doesn't publish the swap fees on their website. Instead, I had to look for the market information sheet available on the platform.

Non-Trading Fees

The good news is that City Index doesn't charge too many or too high non-trading fees. You won't have to pay for your trading account maintenance, and there are no withdrawal or deposit fees. One thing I dislike is that the broker does charge an inactivity fee, especially since they didn't do that at first. Now, if your account remains inactive for a year, City Index will charge a monthly fee of £12.

Regarding taxes, spread betting is entirely exempt from the UK Gain Capital Tax and stamp duty. When trading CFDs, you will only be free of the UK stamp duty.

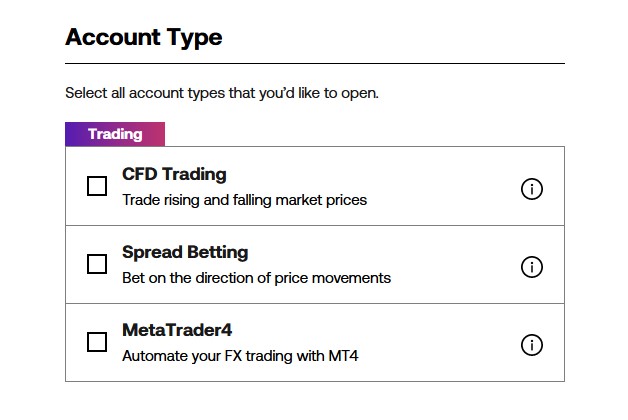

City Index Account Types

Most brokers I've traded with typically offer multiple trading accounts. City Index breaks out from that pattern, offering its users basically two trading account types – standard and professional.

The first doesn't come with any real requirements. The latter, on the other hand, comes with some comprehensive conditions for you to set it up, such as having a history of working in the finance sector for more than a year, a portfolio of a minimum of £500,000, and proof of at least 40 significant trades performed the previous year.

Here’s how the two compare in terms of basic features:

| Trading Account | Minimum Deposit | Maximum Leverage | Minimum Spread | Additional Services |

| Standard | £0 | 30:1 | 0.5 | None |

| Professional | £0 | 400:1 | 0.5 | Relationship Manager |

There's also a dedicated account for Meta Trader 4, City Index's proprietary trading platform for Forex trading. I'll talk more about available trading platforms in the next section.

The good news is that City Index offers a free demo account. The bad news is that it's only available for 12 weeks, which I have to say is unusual for such a large online broker. The starting amount is £10,000 of virtual money, which you can use as you please to perform your trades.

The demo account has all the features of City Index's standard trading account, allowing you to fully experience what the broker offers. The MT4 account also comes with a demo version and all the features of its usual account.

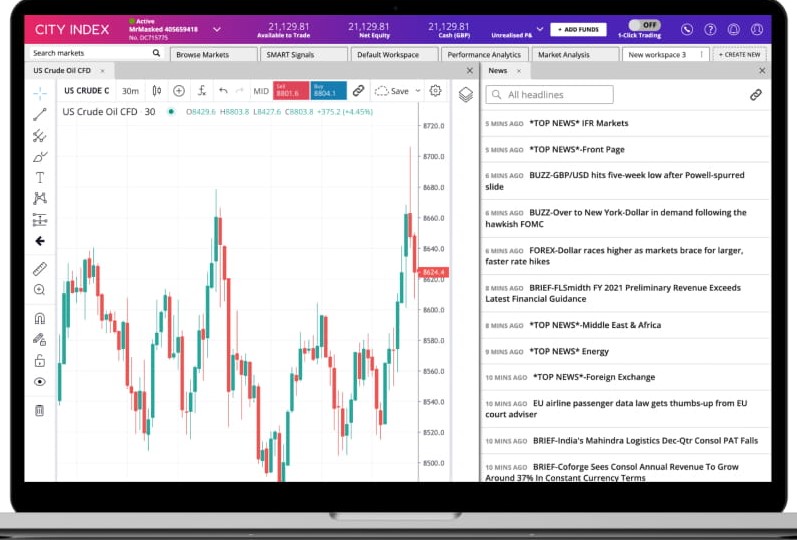

City Index Trading Platforms

When trading at City Index, you can choose between the two primary trading platforms. There's a browser-based Web Trader platform and the downloadable Meta Trader 4, which is the City Index's proprietary platform. City Index also has a mobile trading app.

Web Trader

Web Trader is your go-to trading platform if you're interested in trading CFDs or spread betting. This platform will give you access to all 13,500 financial markets offered by City Index, allowing you to trade shares, indices, Forex, metals, and commodities.

The key features include:

- Access to over 13,500 City Index markets

- Can be used by CFD and spread betting accounts

- Available in the web, desktop, and mobile versions

- Customisable workspace

- Over 10 chart types

- Wide range of drawing tools

- Custom watchlists

- Range of order types

- Hedging capabilities

- Over 80 technical indicators

- Access to a comprehensive knowledge base, market news, and economic calendar

Meta Trader 4

MT4 trading platform is a third-party platform that specialises in Forex trading. Available in both demo and standard versions, Meta Trader 4 offers a much different trading experience compared to the standard Web Trader, although both platforms share several similarities.

The key features of Meta Trader 4 include:

- Access to the MetaTrader market

- Available via the standard MT4 trading account

- Can be used to trade Forex, indices, metals, and commodities

- Over 2,000 technical indicators

- 24 analytical objects

- Custom watchlist

- Allows hedging, scalping, and copy trading

- Range of order types

- Allows users to create, modify, and customise their automated trading strategy

Mobile Trading Platform

The City Index app is available for both iOS and Android devices. It comes with all the features of a standard desktop version. The app itself is very well optimised, allowing you to trade on your mobile device without having to worry about the loss of performance. What's great is that both the Web Trader and MT4 are available in their mobile versions, although you will need to download them separately.

Trading Tools

City Index users can take advantage of a wide range of research tools to aid their trading strategies. For me, it's a great thing, as comprehensive research and trading tools can really help make the right calls and improve your trading skills in the long run.

The key trading tools available at City Index include technical analysis from Trading Central, advanced charting tools from Trading View, the latest market news courtesy of Reuters News, and a comprehensive data monitor algorithm – SMART Signals. Let's uncover what these tools offer City Index account users.

Trading Central

Trading Central is a third-party tool available to all City Index users with standard live accounts. It's a professional technical analysis tool, one of the most advanced in the industry, which provides traders with comprehensive and accurate trading information. Essentially, Trading Central will prove itself useful if you lack technical trading knowledge.

TradingView

Any experienced trader knows how useful charts can be. With TradingView, you will be able to research, chart, and screen any instrument, allowing you to pinpoint the essential information for your trading strategy. The tool is 100% free and is available via your standard trading account. It includes over 65 technical indicators, a synchronised layout feature, and over 100,000 user-built scripts and indicators.

Reuters News

Reuters News provides all City Index users with real-time financial news, data, and the latest market reports. Most importantly, Reuters News is the best source of verified financial data, which is crucial for any trader to make the correct decisions. For me, Reuters News is always the first choice whenever I want to check the current market situation.

SMART Signals

And last but not least, there's the SMART Signals engine, which uses a selection algorithm to automatically monitor 36 global financial markets across thousands of trade data points. It then highlights the best potential trading opportunities and shows them via the SMART Signals dashboard.

Each SMART signal represents a potential short-term trade in either 4, 6, 8, or 12-hour timeframes. It also comes with a complete auto-populated trade ticket that shows suggested take profit and stop-loss levels.

Deposits and Withdrawals

As I already covered, City Index doesn't charge any deposit and withdrawal fees. However, I find the number of available banking methods slightly limited compared to some other brokers I've reviewed. Essentially, you will be able to deposit or withdraw your money through a standard bank transfer, using any of the major credit card services (MasterCard, Visa, Maestro), or using PayPal.

| Banking Method | Deposit Fees | Withdrawal Fees | Processing Times |

| Bank Transfer | £0 | £0 | 1-2 days for deposits and withdrawals |

| Visa | £0 | £0 | Deposits are immediate; withdrawals take 3-5 days |

| MasterCard | £0 | £0 | Deposits are immediate; withdrawals take 3-5 days |

| Maestro | £0 | £0 | Deposits are immediate; withdrawals take 3-5 days |

| PayPal | £0 | £0 | Deposits and withdrawals are processed within 48 hours |

There's no minimum deposit required. The minimum and maximum withdrawal are, respectively, £100 and £20,000 for all payment methods.

So, all in all, while your deposit and withdrawal options are limited, they don't include any fees. Therefore, in that matter, I think City Index is one of the best brokers around. However, where City Index falls behind is the number of base currencies. Essentially, users can choose only between USD, GBP, and AUD.

That might not be an issue for British or Australian brokers, but for those who don't have UK, US, or Australian bank accounts, it likely means paying currency conversion fees. They might not be significant, but they can become annoying, especially if you trade a lot and they start to add up.

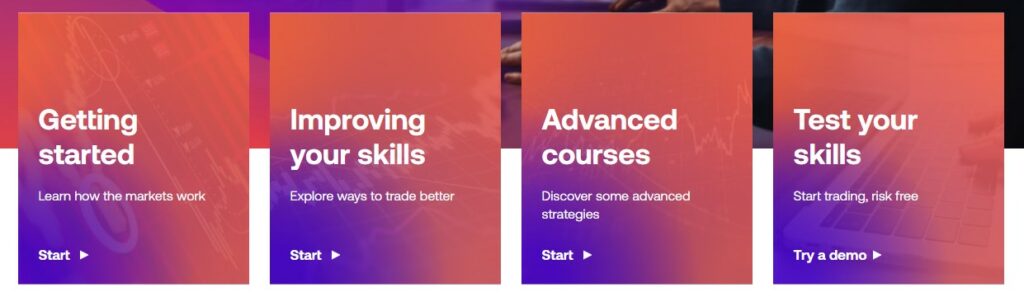

Education Materials

If you're new to trading or simply want to improve your trading skills, City Index is a great source of trading knowledge. I was practically overwhelmed by the number of educational materials offered. In fact, there's an entire dedicated training section where beginners can read and learn all they need about trading.

To help its users improve their skills, City Index provides them with:

- Demo account

- Trading educational videos

- Platform tutorial videos

- Webinars

- Research and educational materials

- Research and trading tools

The platform itself is also incredibly straightforward to use and comes with a helpful tutorial. Furthermore, what I find very cool is that the training section is divided into different subsections for improved navigation. Therefore, you will be able to only learn about what you are interested in instead of scrolling through numerous materials to find what you want.

Using educational materials provided by City Index, you will be able to learn more about different trading strategies, improve your general trading skills, and learn more comprehensive trading techniques, all provided in an interesting and clear way.

Customer Support

I'd also like to talk briefly about City Index's customer support. My verdict here is that it's not the best I've experienced, but it's also not the worst. The good thing is that when I called their customer service, they picked up immediately and provided me with a clear and helpful answer.

The live chat feature is also a great addition, especially for less complex problems. The City Index's website also comes with a comprehensive FAQ section, which I found impressive and helpful.

Now to the downsides. First, email support. I had to wait several days for my answer, which, fortunately, was relevant and helpful. The support is also not 24/7, which some might find annoying. You will be able to reach City Index 24/5 (from 5 PM Sunday to 5 PM Friday), though, so I guess it's not that bad.

My Experience with City Index

Okay, I'm done with the features. Now I want to discuss how City Index actually works. Is it the account to set up? How about the trading experience? To figure such queries out, I decided to have a go at the City Index myself. For the purpose of this review, I used the Web Trader demo account on my browser and smartphone.

Setting Up an Account

While I performed all trades using my demo account, I had to create an actual trading account to review the entire process of setting it up. The good news is that the account opening process is really straightforward, and it took me only a few minutes to have my live trading account up and running.

Let's go through it step by step:

- Click on the ‘Open Account' button at the top-right of the City Index's website.

- You will be redirected to the registration page, where you will need to provide your email address, full name, physical address, phone number, and personal information (birth date, nationality, etc.). City Index will also ask you to choose your username and password.

- Next, you will be asked to provide information about your employment status, financial details, and any previous trading experience.

- To finalise your registration, you will need to agree to City Index's Terms &

Conditions and verify your identity. The latter can be done by providing City

Index with two documents:

- Proof of address: bank statement, credit card statement, or utility bills (gas, water, cable, etc.);

- Proof of identity: driver's license, national ID, or machine-readable passport.

The broker's customer support will then verify your documents. If everything is correct, you will be notified via email. You will then be able to log into your account. The only thing left is depositing your funds and making your first trade.

As for the demo account, all it takes to set it up is your email address and phone number. The broker will provide you with the password you need to use to log into it the first time, which you can change at any point during your 12-week trial.

Trading at City Index

Now let's get to the most important part of this City Index review – the trading platform experience. In simple terms, very good.

The first thing I noticed when I opened the demo account was how clear and user-friendly the interface was. The platform looks great, and it's highly customisable. I could easily change my themes, pick the charts I want to see, and create and switch between the tabs.

I also really liked the search feature, which allowed me to quickly find any instrument or market. Using it, you will be able to quickly narrow down what you want to trade with.

And speaking of trading, I found it very intuitive and straightforward. Essentially, you can choose between several types of orders, both standard and more sophisticated ones (e.g., market, limit, stop, trailing stop, or OCO). All it takes to place a trade or order is to click on the instrument's buy or sell value. It will trigger the pop-up window with the trade/order details to fill out.

Here's what a standard trade or order window looks like:

Another feature I like is that City Index allows you to set alerts or notifications when your asset reaches the desired price or your order is fulfilled. I know it's a standard feature for most trading platforms, but it's always good to see that one of the leading brokers cares for such details and user experience.

I was also able to freely use the trading and research tools, such as SMART Signals and TradingView. You'll love these features if you're a trader who always looks for new trading ideas and ways to improve their skills.

Desktop vs Mobile Experience

Typically, desktop versions of trading platforms are much more comprehensive than mobile ones, coming with more features and trading tools. The story is no different for the City Index platform. I didn't use the mobile version for too long, but from what I have experienced, it's a pretty good app.

The design is sleek, and the app itself is easy to use. It's less customisable and doesn't come with as many features as web or desktop versions, but there are several options I really enjoyed. One is the embedded economic calendar, which comes with some advanced filter options. Another is the ‘Platform tips' option, which provides information about the platform's functions.

As said, it's a solid app, and all of you who like trading on your mobile devices should be satisfied with its performance. However, while I'm at it, the performance was sometimes slower, especially when loading specific features.

My Verdict on City Index

Overall, City Index is a great CFD and Forex broker. It ticks all the boxes a reliable online trading platform should have, being fully regulated by independent governing bodies, using top-level security features, and having the funds-loss protection features in place.

On top of that, there are no withdrawal or deposit fees, trading fees are relatively low, and there are numerous education and research tools for traders to take advantage of. As I found, the platform itself is very straightforward to use and highly user-friendly.

Are there any downsides? Oh yes. First, there's the limited product portfolio, which falls behind compared to other leading brokers. I also don't like how limited the number of banking methods is. These might be small things for some, but they can significantly impact the overall experience you have with the broker.So, what is my rating for City Index? A solid 4.5/5. Still, I have to say that City Index ranks very highly in my personal online brokers' ranking. It's definitely a broker I can sincerely recommend. But don't just trust my word. Create your demo City Index account today and see for yourself!

City Index Review: FAQs

Still hungry for more City Index information? I've compiled a list of some of the most frequently asked questions to satisfy your knowledge cravings. You'll find it below.

Is City Index legitimate?

Yes, City Index is regulated by the leading finance authorities, such as the UK's FCA, the Australian Securities and Investment Commission, and the Monetary Authority of Singapore. The broker also offers negative balance protection, providing retail investor accounts with a compensation of $85,000 per trader through the FSCS scheme.

Can I trade at City Index for free?

Yes, City Index offers a 100% demo account which allows users to trade with virtual money. The platform will provide you with virtual £10,000, which you can use to practice your trading skills, try new trading strategies, or learn how to perform trades and orders with City Index. A downside is that the demo account has a 12-week expiration date.

What instruments does City Index offer?

City Index's product portfolio is a bit limited compared to other brokers. For some, it might not be enough, but I'm sure less experienced traders will find the number of trading instruments more than satisfactory.

Essentially, City Index users can trade:

– Forex

–

Stock CFDs

– Commodities

– Bonds

–

Indices

– Metals

– Crypto

– Interest

rates

– Options

Can I make real money when trading at City Index?

Of course, that's the whole idea behind trading platforms. Once you create a live trading account and deposit your funds, you will be able to start trading for real money. The good thing about City Index is that there's no minimum deposit, meaning you freely decide how much money you're willing to use to trade with. Many other brokers don't give online traders that freedom.

Can I use City Index on my mobile device?

Yes, you can easily download the City Index app to your iOS or Android device. As covered, the app doesn't support all the platform's features, such as the desktop one, but it performs well. I also found it very user-friendly, especially when it comes to its design. It makes navigating through the app very straightforward. I have experienced some minor performance issues, though, but they didn't ruin the app for me.

Do I need any trading experience to trade at City Index?

Although it's always recommended to have at least some experience when trading for real money, City Index is a great platform to learn your online trading ropes. There's a comprehensive research and education section, the platform includes numerous trading tools, and there's a demo account where you can trade without the risk of losing your own money. Therefore, if there's an online broker I'd recommend for less experienced traders, it is City Index.