Central Depository Account are accounts held with the Central Depository of the Singapore Stock Exchange (or SGX), hence why they are otherwise known as SGX CDP accounts. CDP Singapore is the most internationally-recognized and diverse stock markets in Asia.

These accounts were designed to safe-keep any shares (including IPO shares), stocks, and/or bonds (such as SSBs, or Singapore Savings Bonds) that an investor has purchased through the SGX stock market. Once you purchase stocks on the SGX, they are deposited into your personal CDP account. You should also read our guide on online trading in Singapore.

Check out the video below

Here are the steps to create a CDP account:

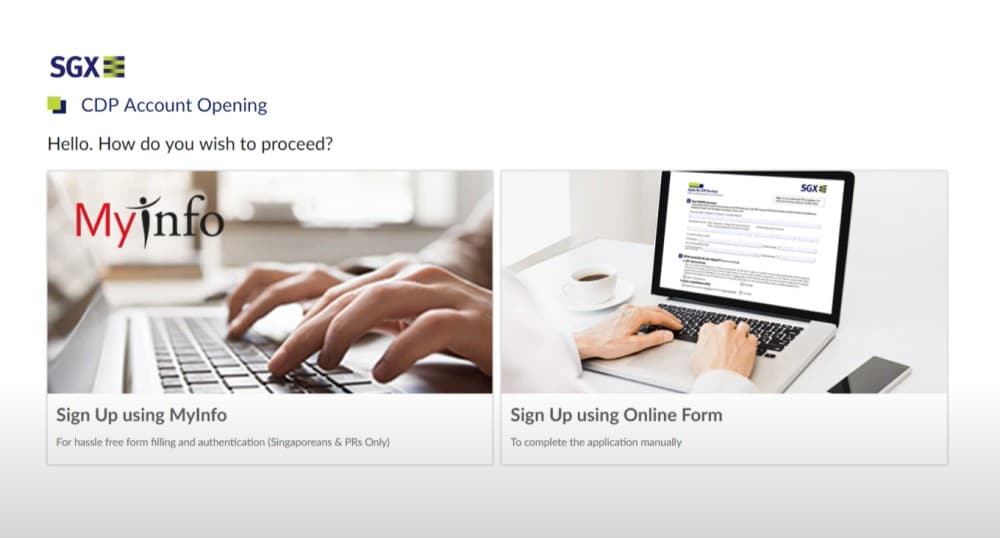

There are two ways of opening a CDP account. You can either apply for an account online through your online broker or SGX directly or by mail. Online Brokerage Reviews goes into details below about how to apply for an account.

How do I apply for a CDP account online?

Since November 2019, the SGX has offered investors the ability to apply online, saving time, and postage/travel! It only takes most people an average of around 15 minutes to set up their account online, making it easier and more convenient than ever to take control of your investments.

Residents of Singapore can complete the form even more quickly using the MyInfo authentication system! With more than one way to login, CDP accounts are easier than ever to use!

To use the online form to apply, you can click here. If you already have a bank account with any of the Singaporean banks, you can use this online form.

You can also apply through a online broker – you can read our analysis about the best trading platforms in Singapore.

Traditional way

Step 1: Open a Singapore Bank Account

To open your account, you will need to be 18 years old or over, and already have a (non-bankrupt) bank account with one of the following banks:

- Standard Chartered Bank

- CitiBank

- UOB

- DBS/POSB

- HSBC

- Maybank

- OCBC

Step 2: Fill Out the Application Form

Once you have the required bank account, you will need to print out and sign a CDP application form. You can also fill out an application form online (which we will cover later on in this article).

To fill out the application form, you will need the following supporting documents to hand in order to provide the required information:

- Your bank account details

- Your NRIC / Singapore Police Force Identity Card / Singapore Armed Forced Identity Card / Malaysia Identification Card / Passport

- Any of the following (dated within the last 3 months): a bank statement from any Monetary Authority of Singapore (MAS) licensed bank, Central Provident Fund (CPF) statement, latest Notice of Assessment for income tax

- A photographed or scanned copy of your personal signature

- Your Tax Identification Number (TIN) for your tax residency status

- Any of the following (only if you apply through a broker): a photocopy of NRIC / Singapore Police Force Identity Card / Singapore Armed Forced Identity Card / Malaysia Identification Card / Passport

If you choose to apply for your CDP account by mail, you will need to send the signed application form, along with the supporting documents, to the following address:

The Central Depository (Pte) Limited

11 North Buona Vista

Drive

#06-07

The Metropolis Tower 2

Singapore 138589

You can also choose to deliver your application form to the SGX Customer Service at this address by hand. Their opening hours are as follows:

Mondays to Fridays – 8.30 am to 5.00 pm

Saturdays – 8.30 am to 12.00 pm

Closed

on Sundays and Public Holidays

SGX Customer Service is usually busiest from 11.00 am until 2.00 pm, and most hours on Saturdays, so you may wish to avoid these times if possible!

You can also choose to apply via a brokerage firm. Most firms will be able to assist their customers with applying for a CDP account, and these firms are listed below:

- DBS Vickers Securities

- iFAST Singapore

- KGI Securities

- Lim & Tan Securities

- CIMB Securities

- Maybank Kim Eng

- OCBC Securities

- RHB Securities Singapore

- Phillip Capital

- UOB Kay Hian

Once you have carried out these steps, you will be able to purchase securities to keep in your CDP account.

How can a foreigner open a CDP account?

You don't have to live in Singapore to benefit from a CDP account! If for one reason or another you do not have a Singpass (the government e-services system) account, you can still start your account using the online form. The only difference is that you will not be able to automatically fill in each field using MyInfo, and will have to fill in each field separately and manually.

First, you will need to click “Sign Up using Online Form”. Once you have done this, you will need to make sure you have the supporting documents to hand that were mentioned earlier in this article. If you are not a resident of Singapore, you will also need a Passport or Malaysia ID card, the country/region of your tax residency alongside your TIN number, and one completed Form-W9. Once you have all of these required documents, you can click “Proceed”.

After this, the method of filling out the form will be the same as that of any resident or investor without a Singpass account or access to MyInfo.

We hope that this article has been helpful to you if you are curious about opening a CDP account!

Securities (such as stocks) are purchased with cash, via a personal bank account that the investor links to their CDP account. If and when these securities are sold by the investor, they are removed from the CDP account and the cash total that they were sold for is deposited into the bank account that is linked.

Investing via a brokerage may also give investors the extra option of trading with a nominee account, where the broker takes care of investments on behalf of the account holder. However, most investors opt to open and manage their own CDP account due to the reduced expense and increased level of control that they can give you.