Oanda (short for Olsen & Associates) is Forex and CFD broker. The company was founded by Dr. Stumm and Dr. Olsen in 1996. This US-based forex broker has global operations in over 196 countries. It provides the clients with all types of “currency-related” and online brokerage services. As a leading multi-asset broker, Oanda offers services in over 100 financial instruments. It specializes in a range of FX and CFD products like currency pairs, commodities, indices, bonds, and metals.

Summary

OANDA is an excellent trading platform with powerful research and trading tools. It is a high-quality forex and CFD broker, offering great technical indicators and an API offer. Opening an account is easy and straightforward, while the product portfolio is limited to CFDs and forex.

| Feature | OANDA |

|---|---|

| Website | www.oanda.com |

| Founded | 1996 |

| Headquarters | New York, USA |

| Bank | No |

| Regulation | Commodity Futures

Trading Commission (CFTC) and National Futures Association

(NFA) Europe: Financial Conduct Authority (FCA) Japan: Financial Services Agency (FSA) Asia (excluding Japan): Monetary Authority of Singapore (MAS) Australia: Australian Securities and Investment Commission (ASIC) Canada: Investment Industry Regulatory Organization of Canada (IIROC) Malta: Malta Financial Services Agency (MFSA) |

| Demo Account | Yes |

| Instruments Available | Forex, CFD, Cryptocurrency, Spreadbetting |

| Minimum Deposit | $0.00 (Standard

Account) $20,000 (Premium Account) |

| Minimum Trade | $0.00 |

| Trading Platform (fxTrade): | MT4, Desktop, Web, Mobile (Android/iOS) |

| Copy Trading | Yes |

| Base Currencies | 9 |

| Payments Methods | Debit Cards, Bank Transfer, Cheque, Swift, Payoneer |

| Islamic Account | Yes |

| Our Score | 4.5/5 |

Pros and Cons of Oanda

The best thing about Oanda is its user-friendly trading platform and advanced research tools to guide investment decisions. It operates globally and abides by regional regulations such as CFTC, FCA, FSA, IIROC, ASIC, and MAS. These regulations add to the credibility and trustworthiness of Oanda. Its fxTrade platform comes with an impressive range of data visualization and analytical features, which is a rare thing in any retail trading platform.

One downside is that OANDA does not offer “negative balance protection” for its US traders. Even though it boasts to trade in over 100 instruments, those are limited to FX and CFD. Oanda is a private company and not listed on a stock exchange and has no banking background.

| Pros | Cons |

|---|---|

| User-friendly trading platform | Limited product portfolio (FX and CFDs) |

| Advanced research and analytical tools | No “negative balance protection” for US Traders |

| Licensed by trustworthy regulatory bodies (CFTC, FCA, FSA, ASIC, IIROC, MAS) | No banking background |

| Easy to get started with | Customer service |

| Offers over 100 trading instruments | |

| Available in desktop, web, and mobile version | |

| Accepts US Traders |

Comparing Oanda to Similar Brokers

As an intelligent investor, you should consider different brokers before settling with the best one that matches your investment needs. As specified above, there are pros and cons to every broker. Each of them varies in terms of their cost structure, trading platform, data analytics, customer service, and other aspects. In this context, we conducted a detail research regarding the best alternatives to Oanda. You will find the following comparison table useful.

| Broker | Oanda | XTB | eToro | Plus500 |

|---|---|---|---|---|

| Founded | 1996 | 2002 | 2007 | 2008 |

| Headquarters | New York | Poland | Tel Aviv, Israel | Tel Aviv, Israel |

| Regulation | CFTC/NFA, FCA, FSA, MAS, ASIC, IIROC, MFSA | FCA, Cyprus Securities and Exchange Commission (CySEC), Belize International Financial Services Commission (IFSC), Dubai Financial Services Authority (DFSA), Dubai International Financial Center (DIFC),Financial Sector Conduct Authority (FSCA) | FCA, CySEC, ASIC | ASIC, FMA, FSCA,FCA, CySEC, MAS |

| Minimum Deposit | $0 | $0 | $50 | $100 |

| Withdrawal Fees | Yes (varies with withdrawal method) | Yes (varies with withdrawal method) | $5 withdrawal fee | No |

| Negative Balance Protection | No | Yes | Yes | Yes |

| Inactivity Fees | No | Yes | Yes | Yes |

| Instruments Available | 100+ (FX and CFDs) | 4000+ (FX, Commodity CFDs, Indices, Stocks, Cryptocurrency) | ||

| 2000+ | 2500+ |

Regulation

You should always conduct a background check of the broker company regarding their regulatory status before entrusting them with your hard-earned money. Since Oanda operates globally in more than 196 countries, it is authorized and licensed by a number of international regulatory bodies.

Oanda and its subsidiaries around the world hold a strong legitimate status based on their compliance with the following regulatory standards:

- Oanda Corporation is registered with the U.S. Commodity Futures Trading Commission (CFTC) as Retail Foreign Exchange Dealer (RFED) and the National Futures Association (NFA #0325821) as Forex Dealer Member (FDM).

- Oanda Asia Pacific Pte. Ltd. is authorized and regulated by the Monetary Authority of Singapore (CMS License No: CMS100122-4) for its legitimacy in that region, except for Japan. It is also licensed by the International Enterprise Singapore (Commodity Brokers License No: OAP/CBL/2012) to deal in commodity CFDs.

- Oanda Japan Inc. is authorized and licensed by the Japanese Financial Services Agency (FSA), registered with Kanto Local Finance Bureau #2137, to trade in Type 1 Financial Instruments. It is also a member of the Financial Futures Association of Japan #1571.

- Oanda (Canada) Corporation ULC is authorized and licensed by the Investment Industry Regulatory Organization of Canada (IIROC).

- Oanda Europe Ltd. is regulated and licensed by the Financial Conduct Authority in the UK, No: 542574.

- Oanda Australia Pty. Ltd. is authorized by the Australian Securities and Investment Commission (ASIC) ABN 26 152 088 349, AFSL No. 412981.

Trading Platform

A trading platform is a gateway to forex and CFDs markets. Oanda provides the clients with fxTrade, its proprietary, award-winning trading platform suite, which can be safely accessed from anywhere on any device at any time. The clients can take advantage of its advanced charting interface and trade directly from there in real-time. It also offers MetaTrader 4(MT4) platform, which is taken as a de facto standard in forex trading platforms.

Desktop Platform

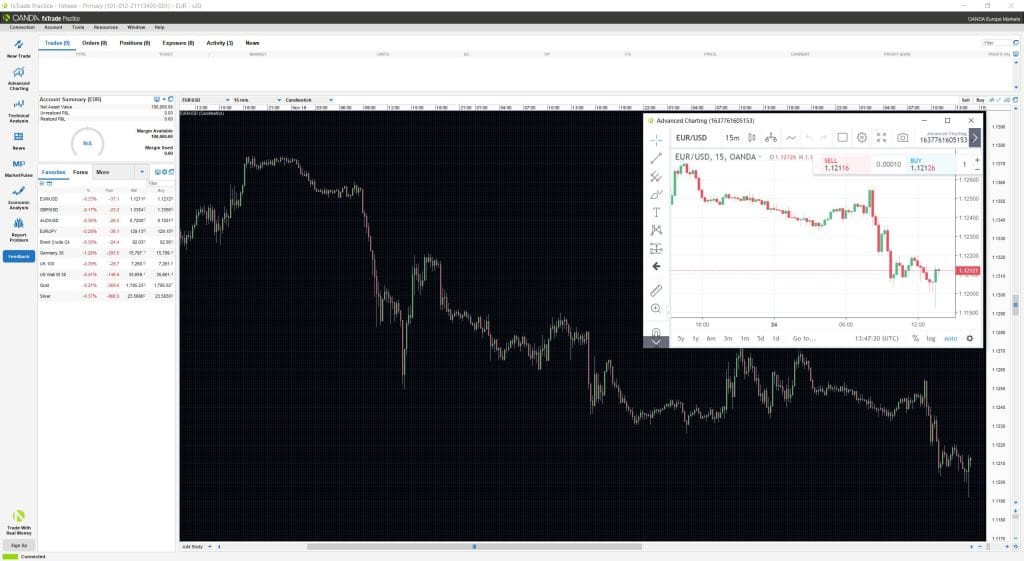

Oanda’s fxTrade desktop platform is probably the most powerful tool any aspiring forex trader could wish for. Besides its powerful charting tool, the traders can take advantage of Tradingview where they can compare multiple currency pairs at once. With over 50 drawing tools and more than 10 chart types, they can trade directly from the chart in real-time. Personalization is at the core of this platform to enhance the overall trading experience, guided by up-to-date market news and insight to manage risk.

Web Platform

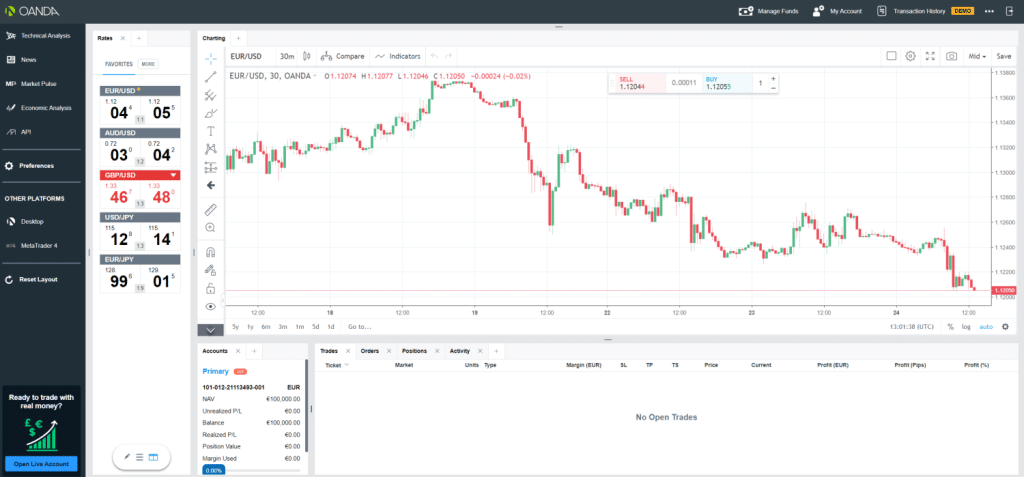

Most of the traders prefer to trade via a fast and intuitive web platform that offers similar functionality as a desktop. It provides advanced charting tools to analyze market trends and make direct trading decisions. Traders can identify potential trading opportunities with their advanced technical analysis tools.

Mobile App

The Oanda fxTrade mobile trading platform is available for both Android and iOS. Its developers have done a great job of integrating most of the features of the platform into an efficient and portable package to provide a seamless trading experience. You get access to the full range of Forex and CFD markets with a customizable interface, and charting tools. Real-time alerts and price signal notifications for live trading accounts. The trading experience is similar to the desktop version.

MetaTrader 4 (MT4) Platform

Oanda takes the trading experience one step forward with MT4 platform, which is taken as industry-standard in forex and CFD trading. You benefit from its advanced charting features, analytical tools, watch lists, and Expert Advisors. While MT4 is quite impressive in terms of its functionality, but it looks rather outdated. Oanda is not compatible with MT5 and cTrader that support automated trading.

| Broker | Oanda |

|---|---|

| Proprietary Trading Platform | Yes (fxTrade) |

| Desktop Platform | Yes |

| Web Platform | Yes |

| Mobile App | Yes |

| Charting | Yes (Proprietary/Tradingview) |

| Demo | Yes |

| Social Trading/Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | No |

| cTrader | No |

| Order Types | Market Order, Limit Order, Take Profit Order, Stop Loss Order, Trailing Stop Order |

| Alerts | Yes |

| Watch lists | Yes (7) |

Markets Available

The range of markets available may vary according to the regional regulatory standards in effect. Oanda offers over 100 market instruments such as forex, bonds, precious metals, indices, and commodities.

Following is the list of instruments offered by Oanda:

- 71 Forex/Currency Pairs (including major, minor and exotic pairs)

- 16 Stock Index CFDs

- 31 Commodity CFDs

- 6 Bond CFDs

- 3 Cryptocurrencies

It should be noted that the trading of Bitcoin is subject to regulatory restrictions. For example, the FCA has prohibited UK-based traders from dealing with cryptocurrencies from 6 January 2021. The US clients can’t trade in CFDs. However, Australia allows the trade of Bitcoin as CFD.

Fee and Commission Structure

Oanda charges a few different fees. There are no deposits fees. Clients get one free credit or debit card withdrawal per month, while bank transfers incur a fee. Other fees include inactivity and currency conversion fees.

Spread-Only Pricing

In the spread-only pricing option, the broker’s commission is included in the spread. There is no explicit commission for trading. As a result, spread rates are calculated slightly above the market average.

Core Pricing Plus Commission

As the name suggests, the spread rate is lower than the market average. But the trader has to pay a fixed rate of commission to the broker for each trade.

Other Fees

Oando has a relatively straightforward and competitive fee structure. Besides the abovementioned trading fees, there are a few non-trading fees, such as withdrawal and inactivity fees.

There is no minimum deposit at Oanda for a standard account. The withdrawal fees depend on the method of withdrawal payment and currency conversion. This is because each payment service provider charges differently to the brokers for processing the payment. For example, Oanda charges its clients for requesting a wire transfer, but there is no withdrawal fee for debit cards.

Previously, Oanda didn’t use to charge inactivity fees. But now, it charges 10 units of currency (for example, $10 in the US) per month until the trader terminates the account or resumes trading again. The inactivity fee is charged if the account has no open trades for at least 12 months.

Research And Education

Oanda has a dedicated education portal with a range of educational resources, such as e-books, videos, webinars, and events. For beginners, Oanda provides a demo trading account where they can gain a better understanding of market variables.

Forex and CFDs trading is a risky venture where a majority of retail investors (73.5%) end up losing their money. It is the responsibility of both the broker and the clients to manage the risks.

Oanda is a goldmine for a research-oriented trader. Its proprietary platform is equipped with a range of real-time market news and updates, advanced charting tools, and data analytics features.

Is OANDA Safe?

OANDA is considered safe and secure. OANDA is regulated by top-tier authorities: ASIC, MAS, FCA, CFTC, IIROC which makes it a reliable broker. OANDA is not a publicly-traded company and does not operate a bank. It is considered low-risk.

Customer Support

Customer support is a major concern in trading. Every second matters. Money can be made or lost in those few precious seconds. Therefore, the broker should have a responsive customer support system to take care of technical glitches and account issues.

Oanda has a dedicated team of customer service 24/7 in various languages, including English, German, French, Spanish, Russian, Chinese, Japanese, and Korean.

Final Thoughts

Oanda is a great choice for traders interested in Forex and CFDs. It is easy to get started with and its fxTrade trading platform offers a great trading experience for traders.

The company is built on the trust and confidence of its clients, which is evident from its experience of 25 years. Its regulatory status is authorized by some top-tiers financial regulatory bodies around the globe.

The trading market is full of risks and the selection of a reliable broker is of great importance. It is worth investing your time and effort in comparing the brokers before you invest with your real money.

Start Trading at OANDA

- Award Winning Online Trading Platform

- Regulated Worldwide

- Transparent Pricing

- Fast Execution

- Education

- Great Charting Tools